Decentralized Exchange (DEX) Explained

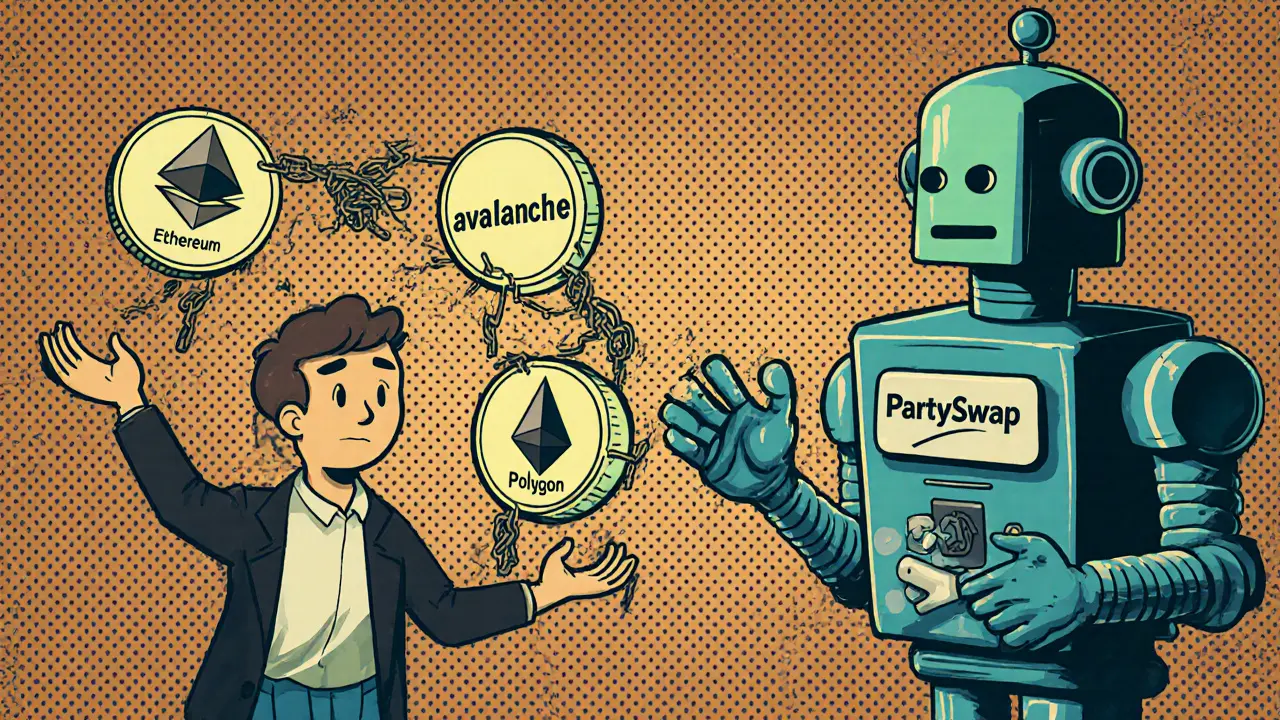

When exploring decentralized exchange, a platform that enables peer‑to‑peer crypto trading without a central custodian. Also known as DEX, it relies on smart contracts to settle trades, manage order books, or run automated market makers, the decentralized exchange has become a core pillar of modern finance. It encompasses liquidity pools, shared reserves of tokens that power instant swaps and price discovery, which in turn enable users to trade 24/7 without needing a matching order. This structure supports low‑fee, permissionless swaps and opens doors for anyone to provide capital and earn fees.

Key Components that Power a DEX

The engine behind most DEXs is the automated market maker, a formula‑based system that sets prices based on the ratio of assets in a pool. Unlike traditional order‑book exchanges, an AMM does not require a counterparty; the smart contract automatically adjusts prices as traders add or remove liquidity. This mechanism, often expressed as the constant product formula (x·y=k), creates predictable slippage and allows for seamless token swaps. AMMs also interact closely with governance tokens, native assets that grant holders voting rights over protocol upgrades and fee structures. By staking these tokens, users can influence future developments and earn a share of the platform’s revenue, turning the DEX into a community‑run financial hub.

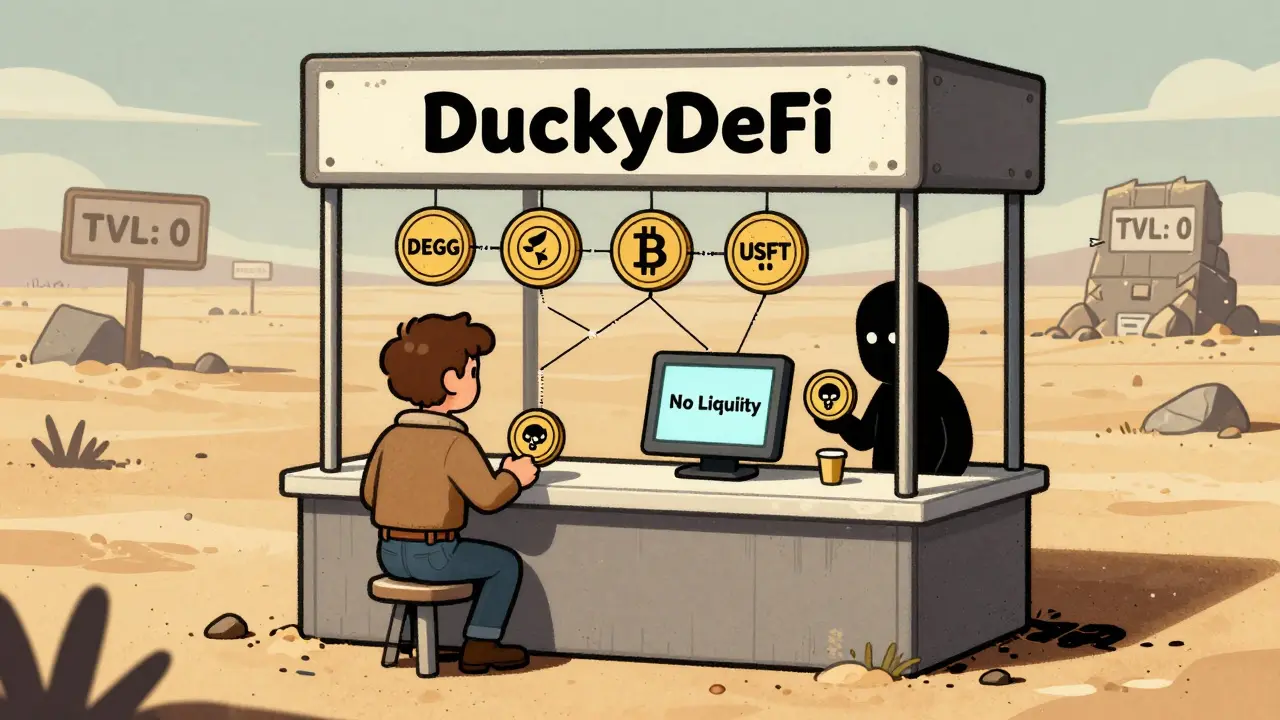

Beyond the core swapping function, decentralized exchanges sit inside the broader DeFi, a suite of open‑source financial services that run on blockchain networks. DeFi leverages composability, meaning a DEX can be combined with lending platforms, yield farms, or synthetic asset issuers to create richer user experiences. For example, a trader might provide liquidity on a DEX, earn LP tokens, and then deposit those tokens into a yield optimizer to earn extra returns. This layered approach amplifies capital efficiency and showcases how DEXs act as building blocks for complex financial products.

Below you’ll find a curated collection of articles that dive deeper into each of these topics—from a hands‑on review of the ApertureSwap DEX to guides on governance token mechanics and liquidity pool strategies. Whether you’re just starting out or looking to fine‑tune your DeFi portfolio, the pieces ahead will give you practical insights and actionable steps to navigate the decentralized exchange landscape.

- 1

- 2