When you're looking for a crypto exchange that doesn’t hold your keys, doesn’t charge gas fees, and executes trades in under a second, Helix Markets sounds like a dream. But is it safe? Is it real? And does it actually work for everyday traders? This review cuts through the hype and shows you exactly what Helix Markets offers - and what it hides.

What Is Helix Markets?

Helix Markets is a decentralized crypto exchange built on the Injective Protocol. It used to be called Injective Pro before rebranding in late 2023. Unlike centralized exchanges like Binance or Coinbase, Helix doesn’t store your funds. You connect your wallet - like MetaMask or Keplr - and trade directly from it. That means no withdrawal delays, no account freezes, and no third party holding your Bitcoin or Ethereum. The platform runs on Injective’s blockchain, which processes blocks in less than a second. That’s 15 times faster than Ethereum-based DEXs like Uniswap. Trade orders fill instantly. No waiting 10 seconds for confirmation. No slippage from slow blocks. For active traders, especially those doing perpetual futures, this speed matters. Helix supports 37 cryptocurrencies across 48 trading pairs. You can trade major coins like BTC, ETH, and SOL, plus native tokens like INJ (Injective’s token) and ATOM. It offers both spot trading and perpetual futures with up to 100x leverage. That’s a lot of flexibility for someone who wants to go long or short without leaving the ecosystem.Zero Gas Fees - But Why?

One of Helix’s biggest selling points is zero gas fees. On Ethereum-based DEXs, you pay anywhere from $5 to $50 per trade just to get your transaction confirmed. On Helix? Nothing. That’s because Injective uses a unique consensus mechanism called Tendermint BFT, which is optimized for trading. The protocol covers transaction costs through its own tokenomics, rewarding liquidity providers and traders with INJ tokens instead of charging users. This makes Helix attractive for high-frequency traders or those who do dozens of trades a day. But here’s the catch: you still need INJ to pay for transaction fees on the Injective chain if you’re doing anything outside of trading - like staking or swapping tokens via the bridge. So while trading is free, the ecosystem isn’t entirely fee-free.Trading Volume vs. Real User Activity

Helix claims over $13 billion in cumulative trading volume since launch. That sounds impressive - until you look at current traffic. According to independent analytics, the site gets only 449 monthly visits. That’s less than a small Shopify store. Meanwhile, top DEXs like Uniswap get millions of visits per month. The platform also reports a 0% bounce rate and 25 pages per visit. That’s mathematically impossible for a real user base. No human clicks 25 pages in one session unless they’re testing the site. This suggests either data manipulation or flawed tracking. Either way, it’s a red flag. High volume claims with low traffic usually mean one thing: bots or wash trading. CoinGecko lists Helix as a legitimate exchange with basic stats, but it doesn’t endorse it. There are no credible third-party audits of its orderbook integrity. No public proof-of-reserves. No transparency reports. If you’re trading large amounts, you’re flying blind.Regulation? There Isn’t Any

This is the biggest risk. Helix Markets is not regulated by any financial authority - not the SEC, not the FCA, not ASIC. BrokerChooser explicitly warns users: "We wouldn’t trust HELIX with our own money as it is not regulated by a financial authority with strict standards." That means:- No investor protection if funds disappear

- No legal recourse if the platform shuts down

- No KYC or AML checks - which sounds good for privacy, but raises serious red flags for compliance

How Does It Compare to Other DEXs?

Here’s how Helix stacks up against other decentralized exchanges:| Feature | Helix Markets | Uniswap (v3) | dYdX | SushiSwap |

|---|---|---|---|---|

| Blockchain | Injective | Ethereum | StarkEx (L2) | Ethereum |

| Block Time | <1 second | 12-15 seconds | ~2 seconds | 12-15 seconds |

| Gas Fees | Zero for trading | $5-$50 per trade | Low (L2) | $5-$50 per trade |

| Perpetuals | Yes, up to 100x | No | Yes, up to 20x | No |

| Regulated | No | No | No | No |

| Monthly Traffic (est.) | 449 | 5,000,000+ | 800,000+ | 300,000+ |

| Native Token | INJ | UNI | DYDX | SUSHI |

Helix wins on speed and zero trading fees. But it loses on user base, liquidity, and trust. Uniswap and dYdX have millions of users. They’ve survived bear markets. They’ve been audited. They have community governance. Helix? It’s a niche product for Injective believers.

Who Is Helix Markets For?

Helix isn’t for beginners. It’s not for people who want to buy Bitcoin and hold it. It’s not for anyone who values regulatory safety. It’s for:- Traders already using Injective Protocol and holding INJ

- High-frequency traders who need sub-second execution

- Users who prioritize non-custodial control over regulatory protection

- Speculators betting on Injective’s ecosystem growing

Mobile App? Desktop? What’s Available?

There’s no official mobile app. No downloadable desktop client. You access Helix through your browser - Chrome, Brave, or Firefox with a Web3 wallet extension. That’s fine if you’re trading from a laptop. But if you want to monitor positions on the go, you’re out of luck. The interface is clean, minimal, and fast. But it’s barebones. No educational content. No customer support chat. No help center. If you get stuck, you’re on your own. Reddit threads and Telegram groups are your only resources.Is Helix Markets a Scam?

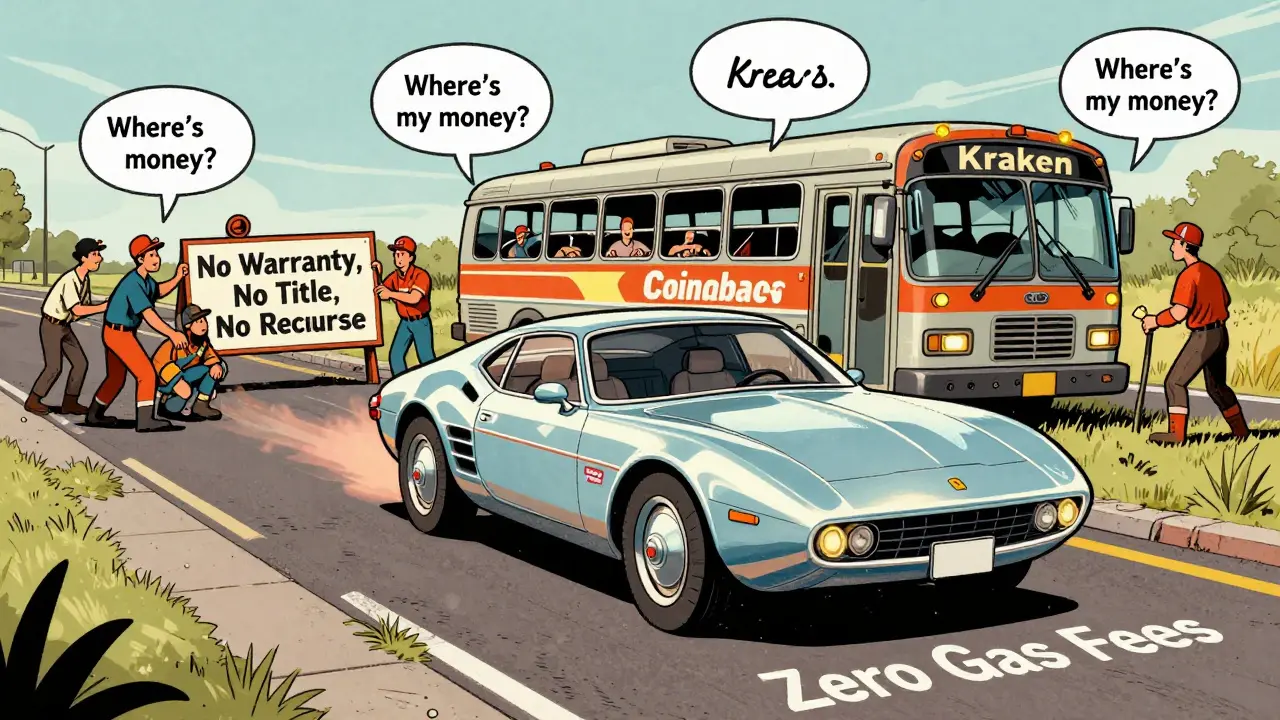

It’s not a scam in the classic sense - the code is open, the blockchain works, and trades execute as promised. But it’s dangerously opaque. There’s no accountability. No team transparency. No clear roadmap beyond vague promises of "cross-chain expansion." The lack of regulation, the suspicious traffic numbers, and the absence of any public audits make it a high-risk platform. If you deposit $10,000 and the site vanishes tomorrow, there’s no one to call. No bank to reverse it. No lawyer to sue. Think of it like buying a car with no title, no VIN, and no warranty. It runs fine today. But if it breaks down, you’re stuck.Final Verdict

Helix Markets is a technically impressive exchange - fast, fee-free, and built for traders who know what they’re doing. But it’s not safe. Not for most people. Not for long-term holding. Not for anyone who doesn’t fully understand the risks of unregulated DeFi. If you’re an experienced DeFi trader already invested in Injective, and you’re comfortable with the risks, Helix can be a powerful tool. But if you’re looking for a reliable, trustworthy place to trade crypto - stick with regulated platforms like Kraken, Bybit, or Coinbase. They may charge gas fees and hold your keys, but at least you have a chance to recover your money if something goes wrong. Don’t be lured by zero fees and fast trades. In crypto, the cheapest option is often the most expensive in the end.Is Helix Markets regulated?

No, Helix Markets is not regulated by any financial authority. It operates as a fully decentralized exchange with no oversight from agencies like the SEC, FCA, or ASIC. This means there is no legal protection for users if funds are lost, the platform shuts down, or if there’s a security breach.

Does Helix Markets have a mobile app?

No, Helix Markets does not have an official mobile app. The platform is only accessible via a web browser using a Web3 wallet like MetaMask or Keplr. There is no downloadable iOS or Android application, making it inconvenient for traders who want to manage positions on the go.

Can I trade Bitcoin and Ethereum on Helix Markets?

Yes, you can trade Bitcoin (BTC) and Ethereum (ETH) on Helix Markets. The platform supports 37 cryptocurrencies across 48 trading pairs, including major assets like BTC, ETH, SOL, and INJ. All trades are executed through the Injective blockchain using cross-chain bridges.

Are there any fees on Helix Markets?

Trading on Helix Markets has zero gas fees - meaning you don’t pay network fees to execute trades. However, the platform rewards users with INJ tokens for trading activity, and you may need INJ for other actions like bridging assets or interacting with Injective’s ecosystem. Withdrawals and non-trading actions may still involve costs.

Why does Helix Markets have such low traffic?

Helix Markets reports only 449 monthly visits despite claiming over $13 billion in trading volume. This discrepancy suggests either heavy bot activity, wash trading, or unreliable traffic tracking. The low user base indicates limited mainstream adoption and raises questions about the authenticity of its volume claims.

Is Helix Markets safer than centralized exchanges?

Helix Markets is safer from exchange hacks because you control your own keys. But it’s riskier overall due to the lack of regulation, no customer support, and no legal recourse. Centralized exchanges like Kraken or Coinbase may be hacked, but they offer insurance, recovery options, and compliance protections. Helix offers none of that.

Should I use Helix Markets if I’m in Australia?

If you’re in Australia, using Helix Markets could violate AUSTRAC regulations, as the platform is not registered. Australian law requires crypto exchanges to be licensed, and Helix is not. While you can technically access it, you do so at your own legal and financial risk. Regulated alternatives like CoinSpot or Independent Reserve are safer and compliant.

Jess Bothun-Berg

December 5, 2025 AT 10:43Joe B.

December 5, 2025 AT 22:02Rod Filoteo

December 6, 2025 AT 18:51Layla Hu

December 8, 2025 AT 18:32Nora Colombie

December 9, 2025 AT 10:38Bhoomika Agarwal

December 10, 2025 AT 18:11alex bolduin

December 12, 2025 AT 16:47Vidyut Arcot

December 14, 2025 AT 06:01Ankit Varshney

December 14, 2025 AT 17:12Ziv Kruger

December 14, 2025 AT 22:44Heather Hartman

December 16, 2025 AT 01:31Catherine Williams

December 16, 2025 AT 16:28Paul McNair

December 17, 2025 AT 00:44Mohamed Haybe

December 17, 2025 AT 01:33Marsha Enright

December 17, 2025 AT 06:54Andrew Brady

December 18, 2025 AT 13:51Sharmishtha Sohoni

December 19, 2025 AT 07:11