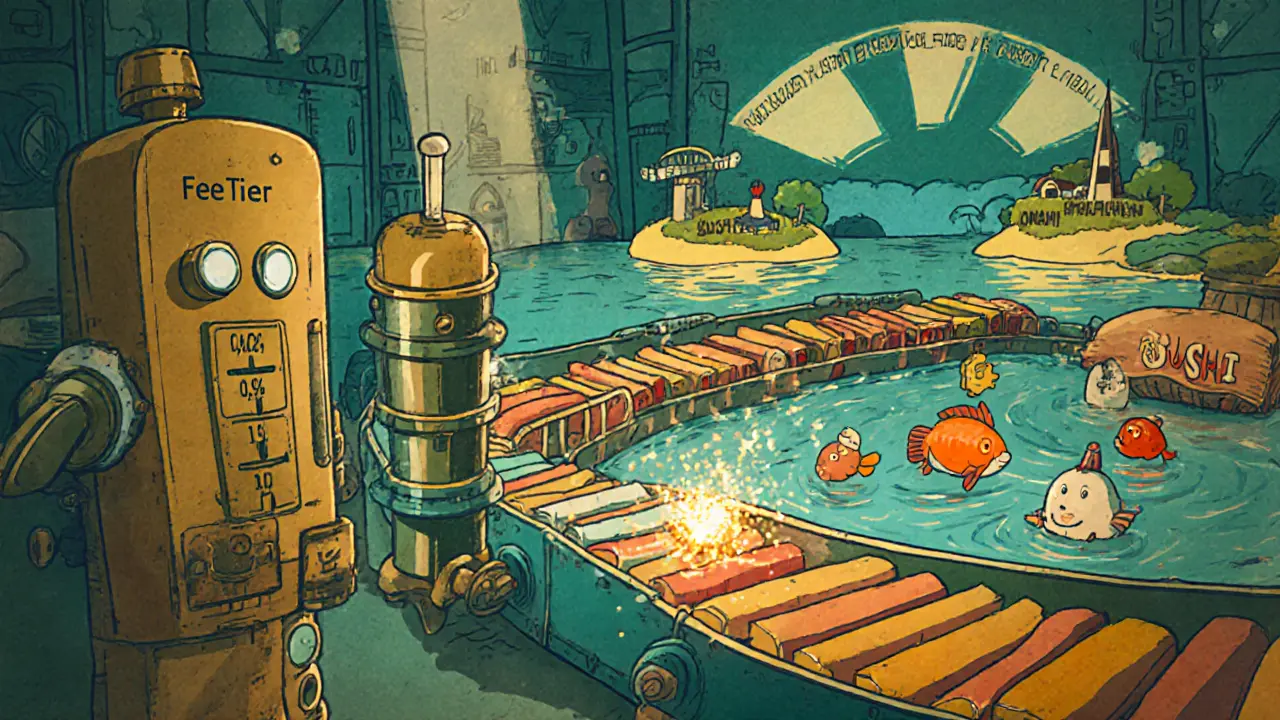

Uniswap vs SushiSwap Comparison Tool

Uniswap

Ethereum-based DEX with concentrated liquidity

- Liquidity $4B TVL

- Fees 0.05% - 1% selectable

- Chain Ethereum, Polygon, Arbitrum, Optimism, Base, BNB Chain

- Governance UNI token

SushiSwap

Multi-chain DEX with reward incentives

- Liquidity $400M TVL

- Fees 0.3% fixed

- Chain 14+ chains including Avalanche, Fantom, Harmony

- Governance SUSHI/xSUSHI token

Key Comparison Metrics

| Metric | Uniswap | SushiSwap |

|---|---|---|

| Total Value Locked (TVL) | $4B | $400M |

| Trading Fee | 0.05% - 1% (selectable) | 0.30% (fixed) |

| LP Fee Share | 100% of selected tier | 0.25% |

| Revenue Sharing | No (UNI governance only) | Yes (xSUSHI stakers get 0.05%) |

| Chain Support | Ethereum, L2s | 14+ chains |

When to Choose Uniswap

- Deep liquidity for large trades

- Simple, beginner-friendly interface

- Stable performance on Ethereum/L2s

- Focus on governance without rewards

When to Choose SushiSwap

- Active liquidity farming

- Cross-chain trading capability

- Reward incentives via Onsen program

- Revenue-sharing token (SUSHI/xSUSHI)

Quick Summary

Uniswap excels in liquidity and simplicity, making it ideal for large trades and beginners. SushiSwap offers rich incentives and multi-chain support for advanced users seeking yield.

When it comes to swapping tokens without a middleman, Uniswap is an Ethereum‑based decentralized exchange that pioneered the automated market maker (AMM) model. SushiSwap is a fork of Uniswap that adds token‑reward incentives and multi‑chain support. Both platforms dominate the DeFi landscape in 2025, but they cater to different types of traders, liquidity providers, and token‑holders. This guide breaks down the most relevant factors - liquidity, fees, incentives, chain coverage, governance, and user experience - so you can decide which DEX fits your strategy.

TL;DR - Quick Takeaways

- Uniswap leads on liquidity ($4B TVL) and daily volume (>$1B), making it the go‑to for large swaps and low slippage.

- SushiSwap offers higher yields through the Onsen liquidity mining program and a revenue‑sharing model for xSUSHI stakers.

- If you value simplicity, single‑chain stability, and a clean UI, start with Uniswap.

- If you chase extra token rewards, need cross‑chain access, or enjoy advanced DeFi tools, SushiSwap is worth the extra learning curve.

- Both are secure, audited, and have active communities; the choice boils down to your priority: raw liquidity vs. incentive richness.

Core Architecture & Technical Specs

Both DEXs use the AMM formula x·y=k, but Uniswap V3 added concentrated liquidity - LPs can allocate capital to narrow price ranges, increasing capital efficiency. Uniswap offers three fee tiers (0.05%, 0.3%, 1%) that let providers choose risk‑adjusted returns.

SushiSwap kept the classic constant‑product model with a uniform 0.3% fee (0.25% to LPs, 0.05% to xSUSHI stakers). The platform compensates the lower fee flexibility with a robust Onsen rewards program that continuously distributes SUSHI tokens to liquidity providers of newly listed pairs.

In terms of chain support, Uniswap runs on Ethereum, Polygon, Arbitrum, Optimism, Base, and BNB Chain - a focused set of high‑throughput networks. SushiSwap spreads across 14+ chains, including Avalanche, Fantom, Harmony, and Cosmos‑based ecosystems, positioning it as a true multi‑chain hub.

Liquidity, Volume & Market Impact

Liquidity is the lifeblood of any AMM. As of October2025:

- Uniswap holds roughly $4billion in Total Value Locked (TVL).

- SushiSwap holds about $400million TVL.

Daily trading volume mirrors this gap - Uniswap typically processes $1‑2billion, while SushiSwap sees $50‑150million. For traders who need deep order books and minimal price impact, Uniswap’s scale is hard to beat. However, SushiSwap’s lower volume can translate into higher relative yields for LPs, especially on newly launched tokens where Onsen rewards are generous.

Fee Structure & Yield Potential

| Metric | Uniswap | SushiSwap |

|---|---|---|

| Base Trading Fee | 0.05% / 0.3% / 1% (selectable) | 0.30% (fixed) |

| LP Share of Fee | 100% of chosen tier | 0.25% |

| Protocol/Reward Share | None (UNI holds governance only) | 0.05% to xSUSHI stakers + Onsen token rewards |

| Average APY for LPs (stable pairs) | ~5‑12% (depends on tier) | ~10‑30% (boosted by SUSHI incentives) |

For pure fee‑only earnings, Uniswap’s higher volume often yields comparable or better returns than SushiSwap’s lower‑fee environment. But if you actively participate in Onsen farms or stake xSUSHI, the additional 0.05% fee share can push total returns well above 20% annualized on many pairs.

Governance & Token Economics

Uniswap’s native token, UNI, is strictly a governance token. Holders can vote on protocol upgrades, fee tier adjustments, and treasury allocations, but there is no direct revenue‑sharing mechanism. UNI’s max supply is 1billion tokens, with a large portion already distributed to early users and the community treasury.

SushiSwap’s SUSHI serves a dual role: governance and revenue sharing. By staking SUSHI you receive xSUSHI, which entitles you to a slice of every trading fee (the 0.05% mentioned above). The token’s capped supply is 250million, creating scarcity that can boost price appreciation alongside the steady fee income stream.

For investors who want a token that pays dividends (in crypto), SUSHI’s model is more attractive. If you prefer a pure governance stake without the extra complexity of staking contracts, UNI may be a cleaner choice.

User Experience & Accessibility

Uniswap’s UI is intentionally minimalist: connect your wallet, select a pair, set slippage, and hit “Swap”. The platform works seamlessly on the web and via a mobile app (iOS/Android), making it ideal for beginners.

SushiSwap’s dashboard bundles additional tabs - “Farm”, “Lend”, “Kashi” (leverage), and “Onsen” - under one roof. The richer feature set means a steeper learning curve, especially for users unfamiliar with concepts like impermanent loss or cross‑chain bridging. That said, the platform has refined its layout over the years, and many power users appreciate having all tools in one place.

Both sites offer extensive documentation, but Uniswap’s guidebooks are shorter and more visual, while SushiSwap’s docs delve deeper into yield‑farming strategies and multi‑chain bridging steps.

When to Choose Uniswap

- You need the deepest liquidity for large trades or low‑slippage swaps.

- You prefer a simple, single‑click experience without navigating farms or stakes.

- Your primary chain is Ethereum or a layer‑2 (Polygon, Arbitrum, Optimism) and you value stability over cross‑chain experimentation.

- You hold UNI for governance influence rather than direct income.

When to Choose SushiSwap

- You actively seek token rewards and are comfortable managing staking or farming positions.

- You want to trade or provide liquidity on non‑Ethereum networks like Avalanche, Fantom, or Harmony.

- You enjoy using integrated DeFi primitives (lending, limit orders, leveraged positions) without leaving the platform.

- You hold SUSHI/xSUSHI for both governance and a passive fee‑share income stream.

Risk Considerations

Both DEXs are open‑source and have undergone multiple audits, yet users remain exposed to smart‑contract risk, impermanent loss, and market volatility. Uniswap’s larger liquidity pool reduces price impact risk, but the lack of fee rebates means LP earnings rely purely on trading volume. SushiSwap’s incentive programs can mask the underlying impermanent loss; a sudden drop in token price can erode rewards quickly.

Cross‑chain bridges used by SushiSwap also add an extra layer of risk. Always verify bridge contracts and consider using reputable aggregators when moving assets between chains.

Future Outlook (2025‑2026)

Uniswap is doubling down on concentrated liquidity, launching NFT marketplace integrations, and polishing its UI for mobile‑first traders. Its focus on a tight set of high‑throughput networks suggests it will remain the go‑to DEX for institutional and high‑frequency traders.

SushiSwap is expanding its DeFi suite: lending, limit orders, and an ever‑growing list of supported blockchains. The platform’s roadmap emphasizes cross‑chain composability, which aligns with the broader DeFi movement toward multi‑chain liquidity aggregation.

Both exchanges face increasing competition from newer AMMs that tout lower fees or innovative order‑book hybrids. However, their entrenched liquidity and active communities give them a solid moat for the near future.

Frequently Asked Questions

Which DEX has lower transaction fees?

Uniswap lets you pick a fee tier - the 0.05% tier is the cheapest for stable‑coin pairs, while SushiSwap has a flat 0.30% fee. So, for low‑volatility swaps Uniswap can be cheaper, but overall trading costs also depend on slippage and gas fees.

Can I earn passive income on Uniswap?

Yes. Liquidity providers earn the full trading fee from the pool they deposit into. There is no extra token reward, but the high volume can still generate meaningful APY, especially on concentrated‑liquidity positions.

What is the Onsen program?

Onsen is SushiSwap’s liquidity‑mining initiative. It allocates additional SUSHI tokens to LPs who provide liquidity to new or promoted token pairs, boosting their overall yield.

Is SushiSwap safe for cross‑chain swaps?

SushiSwap uses audited bridge contracts and third‑party bridge aggregators. While the platform itself has been audited, any cross‑chain operation carries extra risk, so double‑check contract addresses and consider using a hardware wallet.

Which token offers revenue sharing?

SUSHI provides revenue sharing through xSUSHI staking, which captures 0.05% of every trade. UNI does not share fees with holders.

Rachel Kasdin

May 15, 2025 AT 07:16Yo, if you're an American trader and you ain’t stuck on Uniswap, you’re basically missing out on the biggest liquidity pool in the world. The US market loves deep order books and we don’t need some foreign fork trying to be cute with rewards.

Nilesh Parghi

May 17, 2025 AT 15:37Thinking about the trade‑off between raw depth and extra incentives feels like a classic balancing act-like choosing between a sturdy canoe and a flashy speedboat. Both have their place, and understanding your own risk appetite can guide you to the right vessel.

karsten wall

May 19, 2025 AT 23:58From a protocol‑level perspective, Uniswap’s concentrated liquidity model optimizes capital efficiency via price‑range orders, whereas SushiSwap’s ON‑chain reward distribution introduces an additional layer of yield‑enhancing vectors. When you synthesize these vectors with cross‑chain bridge latency, you get a multidimensional risk‑return matrix that demands rigorous quantitative modeling.

Keith Cotterill

May 22, 2025 AT 08:19Uniswap’s massive TVL fundamentally reshapes the slippage landscape for any sizeable trade.

The ability to select fee tiers gives LPs a lever to calibrate risk versus reward.

Meanwhile, SushiSwap’s fixed 0.3% fee simplifies the user experience at the cost of flexibility.

The Onsen program injects token emissions that can dramatically boost nominal yields.

However, those emissions are not free; they dilute token value and can be short‑lived.

The revenue‑sharing mechanism on SushiSwap, via xSUSHI, creates a modest passive income stream for stakers.

In contrast, UNI holders receive pure governance rights without direct fee redistribution.

For a trader focused on minimal price impact, the deep liquidity on Uniswap is unrivaled.

For a liquidity provider chasing higher APY, SushiSwap’s multi‑chain farms may be more alluring.

The cross‑chain architecture of SushiSwap, while versatile, introduces additional bridge risk.

Audits have covered the core contracts, yet bridge exploits remain a systemic hazard.

If you prioritize security and simplicity, the Ethereum‑centric approach of Uniswap is prudent.

If you enjoy navigating multiple ecosystems and harvesting extra tokens, SushiSwap offers a richer playground.

Both platforms have active communities, which helps in rapid response to emergent threats.

Ultimately, the decision hinges on whether you value raw liquidity depth or incentive diversity.

Align your strategy with your risk tolerance, and the optimal DEX will reveal itself.

Lana Idalia

May 24, 2025 AT 16:40Let me break it down: Uniswap is the OG, so you get stability; SushiSwap is the younger sibling that’s trying to outshine with rewards, but the fundamentals stay the same.

Henry Mitchell IV

May 27, 2025 AT 01:01Both platforms have their perks 😏, just pick the vibe that matches your trading style.

Kamva Ndamase

May 29, 2025 AT 09:21Listen up! If you’re sick of boring low‑yield swaps, dive into SushiSwap’s Onsen farms and watch those juicy SUSHI drip straight into your wallet.

bhavin thakkar

May 31, 2025 AT 17:42The drama of DeFi isn’t complete without the clash of Titans-Uniswap’s colossal pools versus SushiSwap’s seductive token rain. One offers sheer power; the other tempts you with glittering promises.

Mangal Chauhan

June 3, 2025 AT 02:03Excellent analysis, Keith. Your breakdown of fee structures and tokenomics really clarifies the trade‑offs. 🌟 For newcomers, I’d emphasize that the APY numbers on SushiSwap can be volatile, so pairing them with a risk‑adjusted portfolio is wise. 📊 Additionally, monitoring the governance proposals on UNI can provide early insight into protocol upgrades.

Enya Van der most

June 5, 2025 AT 10:24Bottom line: If you crave depth and low slippage, Uniswap is your go‑to. If you’re chasing extra token drops and love hopping chains, SushiSwap is the playground you need.

Eugene Myazin

June 7, 2025 AT 18:45Don’t stress-both DEXs are solid, just pick the one that matches your vibe and start swapping!

Latoya Jackman

June 10, 2025 AT 03:06Uniswap provides higher liquidity, while SushiSwap offers additional token incentives; each serves distinct user goals.

karyn brown

June 12, 2025 AT 11:27Honestly, if you’re still debating after reading the numbers, you’re missing the point 🤦♀️. SushiSwap’s reward model is clearly superior for yield hunters.

Megan King

June 14, 2025 AT 19:47hey guys, just wanted 2 say both are legit options – uniswap for easy trades and sushi for extra rewards. pick what feels right for u.

C Brown

June 17, 2025 AT 04:08Oh sure, let’s all throw our life savings into the “biggest” DEX because size equals safety. Newsflash: more users mean more front‑running bots, and the fees you think are “cheap” can still eat your profit.

Noel Lees

June 19, 2025 AT 12:29Totally agree, the sheer volume on Uniswap actually creates a fertile ground for MEV extraction – it's not the utopia it pretends to be 😤.

Adeoye Emmanuel

June 21, 2025 AT 20:50In the grand tapestry of decentralized finance, each protocol contributes a unique thread; the harmony arises when we interweave liquidity with incentive mechanisms responsibly.

Raphael Tomasetti

June 24, 2025 AT 05:11Both DEXs have solid code audits.

Jenny Simpson

June 26, 2025 AT 13:32Everyone’s blinded by the shiny token rewards while ignoring the silent erosion of capital that plagues over‑leveraged farms.

Sabrina Qureshi

June 28, 2025 AT 21:53Uniswap’s simplicity!!!... SushiSwap’s rewards!!!... Choose wisely!!!

Rahul Dixit

July 1, 2025 AT 06:14They don’t tell you that the bridges SushiSwap uses are backed by shadowy entities; one wrong hop and your funds are vanished into the abyss.

CJ Williams

July 3, 2025 AT 14:34Crypto is an adventure!!! 🚀💥🪙

mukund gakhreja

July 5, 2025 AT 22:55Sure why not trust a system that needs emojis to feel legit

Michael Ross

July 8, 2025 AT 07:16Both platforms have their merits; consider your personal risk tolerance when deciding.