BlasterSwap Risk Assessment Calculator

Risk Assessment Result

Comparison Metrics

| Metric | BlasterSwap | Uniswap V3 | SushiSwap |

|---|---|---|---|

| Daily Volume | $350K | $2.3B | $1.1B |

| Trading Pairs | 7 | +4,000 | +3,200 |

| TVL | $12.9K | $13.6B | $6.8B |

| Order-book Depth | 7th Percentile | 92nd Percentile | 85th Percentile |

| Average Spread | 0.65% | ~0.03% | ~0.04% |

| Fee Transparency | Undisclosed | 0.05-1% (varies) | 0.25-0.30% |

| Security Audits | None Public | Multiple Audits | Audited by PeckShield |

TL;DR

- BlasterSwap launched in 2024, supports only 6 coins and 7 pairs.

- 24‑hour volume hovers around $350k, but the numbers are volatile and may be exaggerated.

- Liquidity is thin - order‑book depth sits in the 7th percentile versus major DEXs.

- No public security audit, TVL is just $12.9k, and user feedback is virtually non‑existent.

- For casual swaps on a tiny niche market it might work, but most traders should stick with established platforms.

What Is BlasterSwap?

When you hear the name BlasterSwap is a decentralized cryptocurrency exchange (DEX) that went live in early 2024. It runs on a single blockchain, offers a handful of trading pairs and promises a low‑fee, permission‑less swapping experience. Unlike centralized services, you keep control of your private keys, and every trade settles directly on‑chain.

Getting Started: How to Trade on BlasterSwap

- Install a Web3‑compatible wallet (MetaMask, Trust Wallet, or any wallet that supports the target blockchain).

- Connect the wallet to the BlasterSwap interface by clicking the "Connect Wallet" button on the homepage.

- Select one of the six supported assets - currently WETH, USDB, and four smaller tokens.

- Enter the amount you want to swap, review the quoted price and the estimated slippage, then confirm the transaction.

- Wait for the on‑chain confirmation (usually a few seconds on a healthy network) and your new tokens appear in the wallet.

The UI is minimalist, but you won’t find detailed tutorials, video guides, or a community‑run help desk. If you’re comfortable navigating raw blockchain transactions, the steps above are all you need.

Liquidity, Volume, and Trading Costs

BlasterSwap reports a 24‑hour volume of roughly $347,000. That sounds decent until you realize the platform only offers seven pairs. The most active pair, WETH/USDB, alone accounts for virtually the entire reported volume, suggesting the other pairs see almost no activity.

Average bid‑ask spreads sit at about 0.65%. For a DEX with shallow order‑book depth, that spread can widen dramatically on larger orders, leading to higher slippage than you’d expect on a platform like Uniswap where depth is in the billions.

Fee‑structure details are missing from public docs, so you’re left guessing whether you’ll pay a flat 0.3% like many competitors or a hidden fee baked into the price. The lack of transparency is a red flag for anyone who wants predictable costs.

Security, Audits, and Trust Signals

One of the first things seasoned traders check is whether the smart contracts have undergone an independent security audit. BlasterSwap provides no audit report, no bug‑bounty program, and no third‑party verification. In contrast, platforms like Uniswap and SushiSwap publish audit findings from firms such as ConsenSys Diligence.

The total value locked (TVL) is a tiny $12,880 across a single chain. That amount is negligible compared to the $40‑80billion that the broader DeFi ecosystem locks, meaning there’s essentially no institutional backing or insurance fund to cover a potential exploit.

Community sentiment is also a concern. Review sites list a 0‑star rating based on zero reviews, Reddit mentions are scant, and the claimed 335k Twitter followers show little engagement (few likes, retweets, or genuine conversations). When you combine opaque audit status, minuscule TVL, and an almost non‑existent user base, risk management leans heavily toward “stay away unless you’re testing with a few dollars.”

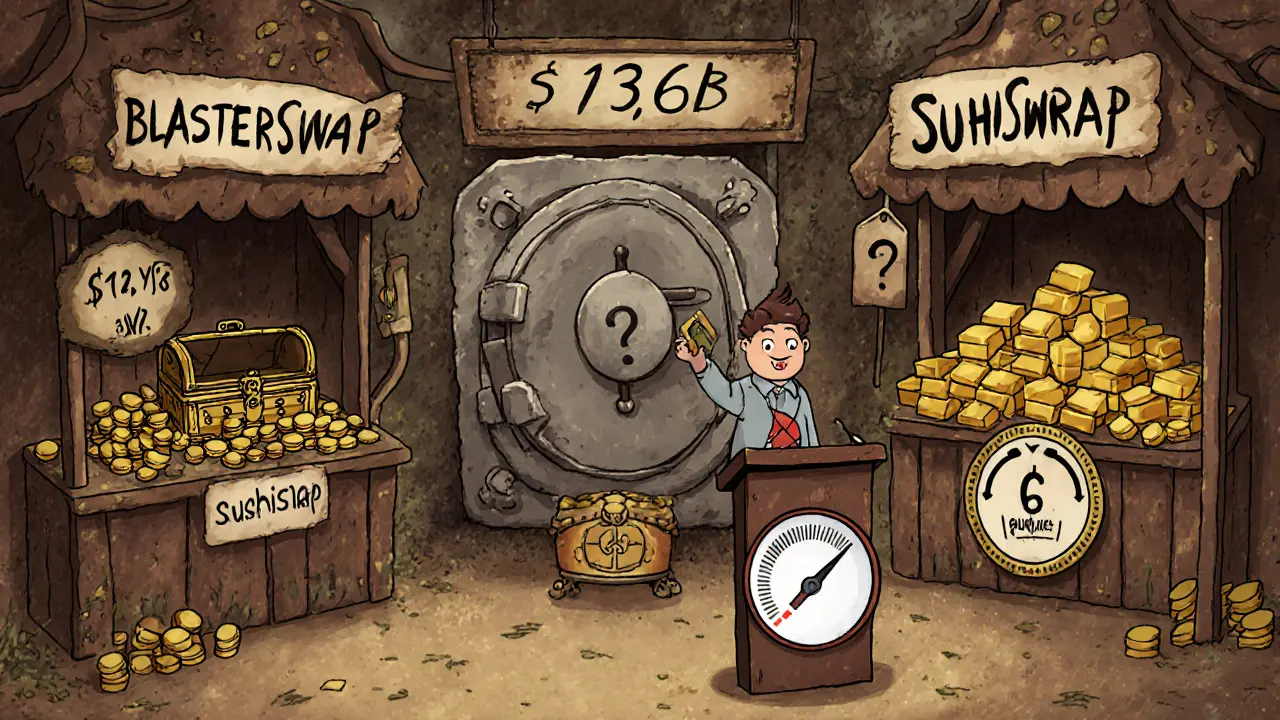

How Does BlasterSwap Stack Up Against the Big Guys?

| Metric | BlasterSwap | Uniswap V3 | SushiSwap |

|---|---|---|---|

| Daily Volume | $0.35M | $2.3B | $1.1B |

| Trading Pairs | 7 | +4,000 | +3,200 |

| TVL | $12.9K | $13.6B | $6.8B |

| Order‑book Depth (percentile) | 7th | 92nd | 85th |

| Average Spread | 0.65% | ~0.03% | ~0.04% |

| Fee Transparency | Undisclosed | 0.05‑1% (varies by pool) | 0.25‑0.30% |

| Security Audits | None public | Multiple audits (ConsenSys, Trail of Bits) | Audited by PeckShield, others |

Numbers speak for themselves. BlasterSwap’s volume and liquidity are fractions of a percent of what Uniswap or SushiSwap process every day. The lack of fee clarity and audit reports adds another layer of uncertainty. If you need deep liquidity, predictable costs, and a proven security track record, the established DEXs win hands‑down.

Who Might Still Use BlasterSwap?

There are a few niche scenarios where a tiny DEX could make sense:

- Experimentation: Developers testing new token contracts might appreciate a low‑traffic environment where front‑running is less likely.

- Region‑specific swaps: If the platform later adds on‑ramps for local fiat or specific regional tokens, users without better options could benefit.

- Defi hobbyists: People who enjoy trying every new protocol with a few dollars (and are fine with higher risk) might find the novelty appealing.

For anyone looking to trade significant sums, earn yield, or rely on a platform for regular swapping, the cons outweigh any novelty factor.

Final Verdict

BlasterSwap is a fledgling DEX that offers the bare minimum-six assets, seven pairs, and a simple swap UI. Its reported volume looks impressive only on paper; beneath the surface, liquidity is shallow, fee structures are hidden, and security assurances are absent. The platform’s TVL of $12.9k and a near‑zero community presence suggest you’re not dealing with a mature ecosystem.

If you’re comfortable running on a test wallet and want to explore a brand‑new protocol, go ahead. Otherwise, stick with the big players that provide audited contracts, deep order books, and transparent fees. In short, the BlasterSwap review leads to a cautious “no, not yet” for most traders.

Frequently Asked Questions

Is BlasterSwap safe to use?

Safety is hard to verify because the platform has not published any independent security audit. Its TVL is only about $13k, which means an exploit would likely drain the entire pool. Until an audit is released, treat it as high‑risk.

What wallets work with BlasterSwap?

Any Web3 wallet that supports the underlying blockchain (e.g., MetaMask, Trust Wallet, Coinbase Wallet) can connect to the DEX via the "Connect Wallet" button.

How do fees on BlasterSwap compare to other DEXs?

BlasterSwap does not disclose its fee schedule publicly, whereas Uniswap V3 charges 0.05‑1% depending on the pool and SushiSwap typically takes 0.25‑0.30%. The lack of clarity makes it hard to estimate actual costs.

What is the liquidity like on the platform?

Order‑book depth ranks in the 7th percentile among DEXs, meaning large trades will likely suffer noticeable slippage. The primary pair WETH/USDB carries almost all the volume, while the other six pairs see almost no activity.

Does BlasterSwap have a roadmap or future plans?

Public information about a roadmap is scarce. The development team has not posted detailed updates, so any future feature releases remain speculative.

Iva Djukić

June 9, 2025 AT 09:47When one contemplates the epistemic foundations of decentralized finance, the emergent discourse surrounding nascent DEXes such as BlasterSwap invites a rigorous ontological inquiry wherein both systemic risk and the phenomenology of trust converge. The platform's ostensible novelty is subsumed by a paucity of liquid assets, as evidenced by a daily volume of merely $350 k, which is a statistical outlier when juxtaposed against the multi‑billion‑dollar throughput of established counterparts. In the lexicon of financial engineering, liquidity depth functions as a buffer against slippage; placing a substantive order on a 7th‑percentile order book inevitably precipitates adverse price impact, a reality that aligns with the concept of market microstructure inefficiency. Moreover, the opacity of fee structures tantalizes a hidden cost function, contravening the principle of price discovery that undergirds efficient markets. The absence of publicly disclosed security audits further entrenches an asymmetry of information, effectively violating the informational parity requisite for rational agent behavior. From a risk‑adjusted return perspective, the platform's total value locked (TVL) of approximately $12.9 k is negligible, suggesting a lack of institutional endorsement and augmenting systemic vulnerability. Conceptually, the scarcity of community governance mechanisms exacerbates the moral hazard, as participants cannot collectively enforce corrective protocols. When viewed through the prism of game theory, participants are incentivized to defect from cooperative norms, thereby eroding the Nash equilibrium that sustains platform stability. The pragmatic implications for traders are manifest: exposure to elevated execution risk, potential for hidden fee extraction, and the specter of an unmitigated smart‑contract exploit. Philosophically, the endeavor epitomizes a tension between the libertarian ideal of borderless exchange and the pragmatic exigencies of risk mitigation. Consequently, a prudent actor would calibrate exposure commensurately with their risk tolerance, perhaps reserving BlasterSwap for minuscule, exploratory trades rather than capital‑intensive strategies. In summation, while the platform embodies an experimental frontier within the DeFi ecosystem, its current macro‑economic parameters and governance deficits implore a cautious, perhaps even skeptical, stance.

Darius Needham

June 15, 2025 AT 04:40From a macro perspective, the limited token repertoire and shallow liquidity pools render BlazorSwap suboptimal for any serious arbitrage or yield‑farming operation, especially when seasoned platforms provide both depth and auditable security assurances.

Maggie Ruland

June 20, 2025 AT 23:34Oh great, another DEX that pretends it’s the next big thing while barely moving the needle.

Joyce Welu Johnson

June 26, 2025 AT 18:27Listen, if you’re just dipping your toes in the DeFi ocean, BlasterSwap might give you a quick splash, but the waves are rough – the spreads can swell, the fees are a mystery, and without an audit you’re basically sailing blind. For a smoother ride, stick with the big players.

Raj Dixit

July 2, 2025 AT 13:20Yo, this so‑called "swap" is a joke – no audit, no legit volume, just hype. Don’t waste your crypto on this flimsy platform.

C Brown

July 8, 2025 AT 08:14Oh, look at BlasterSwap trying to be the underdog hero – nice try, but with zero transparency and that pathetic TVL, it’s just a drama with no plot.

Noel Lees

July 14, 2025 AT 03:07Hey folks, if you’re feeling brave 😎, you can test tiny trades here, but keep it under $10 and don’t forget to smile when the slippage bites! 💪

Adeoye Emmanuel

July 19, 2025 AT 22:00Reflecting on the strategic landscape, a newcomer like BlasterSwap may serve as a sandbox for developers; however, without robust liquidity and audited contracts, the risk‑reward calculus skews heavily toward caution.

Raphael Tomasetti

July 25, 2025 AT 16:54From a protocol integration standpoint, the limited pair set constrains composability, making it an unattractive candidate for high‑throughput DeFi pipelines.

Rahul Dixit

July 31, 2025 AT 11:47Honestly, it feels like they’re hiding something – no audits, tiny TVL, and the community is ghost town level. Keep your assets elsewhere.

Deepak Chauhan

August 6, 2025 AT 06:40Esteemed colleagues, one must ponder whether engaging with a platform devoid of verifiable security audits constitutes due diligence or naive folly; I urge prudence.

Aman Wasade

August 12, 2025 AT 01:34Sure, BlasterSwap sounds cool, but in reality it’s just a tiny pond trying to act like an ocean.

Ron Hunsberger

August 17, 2025 AT 20:27For anyone experimenting with small amounts, BlasterSwap can be a low‑risk sandbox; just remember to never allocate more than you can afford to lose.