Most people think crypto exchanges mean Coinbase, Kraken, or Binance. But if you’re trading on-chain, especially on Arbitrum, you might’ve stumbled across CrescentSwap. It’s not a household name. You won’t find it on Reddit’s top crypto threads or on YouTube’s "Best Exchanges 2025" lists. But if you’re deep into DeFi, know how to connect a wallet, and want to trade tokens that aren’t on centralized platforms yet - CrescentSwap might be worth a look.

What Exactly Is CrescentSwap?

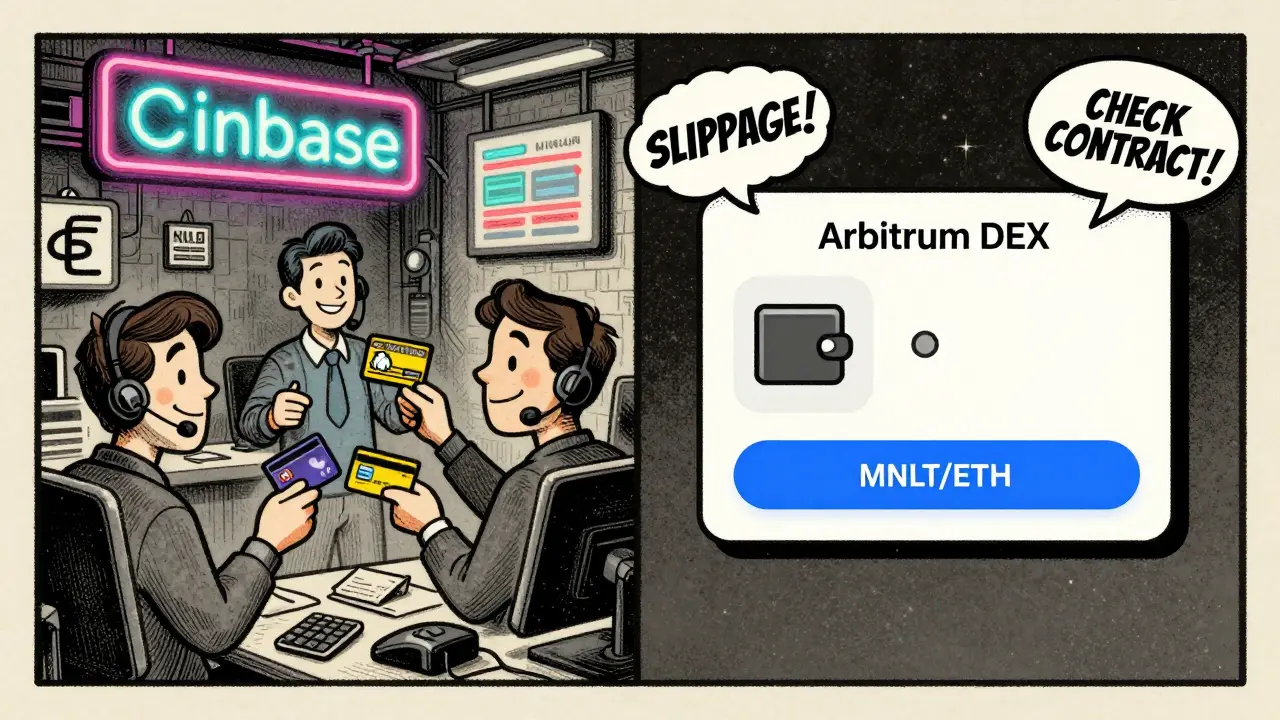

CrescentSwap is a decentralized exchange (DEX) built entirely on the Arbitrum network. That means it runs on Ethereum’s Layer 2, keeping transaction fees low - usually between $0.03 and $0.15 per trade - while still benefiting from Ethereum’s security. Unlike Coinbase or Crypto.com, you don’t sign up, don’t do KYC, and don’t hand over your keys. You connect your MetaMask or WalletConnect wallet and trade directly from it. No middlemen. No account recovery. No customer support. It follows the Uniswap v3 model, which lets liquidity providers put their funds in specific price ranges instead of across the whole curve. This makes capital way more efficient. In theory, you can get up to 4,000x better use of your liquidity than with older DEX models. But in practice, CrescentSwap doesn’t have the depth to make that matter for most users. Its main token is Moonlight (MNLT). And honestly? That’s where most of the action is. Over 73% of its total trading volume in November 2025 came from the MNLT/ETH pair, according to Dune Analytics. If you’re not trading that pair, you’re likely dealing with thin liquidity and high slippage.How Does It Compare to Other DEXs?

Let’s put CrescentSwap next to the big players. Uniswap, for example, handles over $1.2 trillion in total volume since launch. It’s on Ethereum, Polygon, BNB Chain - you name it. CrescentSwap? Only Arbitrum. And its 30-day trading volume? Around $8.7 million. That’s less than 0.001% of Uniswap’s monthly volume. PancakeSwap? Curve? They dominate the DEX space. Messari’s Q4 2025 report says those three plus Uniswap control 68% of all DEX volume. CrescentSwap? It’s in the long tail. The niche. The 18.7% of DEX volume that Arbitrum captured in Q3 2025 - and even then, most of that is still going to Uniswap v3 forks, not smaller ones like CrescentSwap. Fees? CrescentSwap charges the standard 0.30% trading fee, like Uniswap v3. That fee goes to liquidity providers, not to a company. Centralized exchanges like Coinbase charge 0.50% on maker/taker trades - and they keep it all. So if you’re just looking for lower fees, CrescentSwap wins. But if you care about price impact? That’s another story.What You Can and Can’t Do on CrescentSwap

You can swap tokens. That’s it. No fiat on-ramps. No Visa card cashback. No staking. No yield farming. No referral programs. No mobile app. Just a simple interface at app.crescent.network/swap. You pick a token, pick an amount, set your slippage, and click swap. Done. But here’s the catch: you can only trade tokens that exist on Arbitrum. As of late 2025, that’s about 1,200 tokens. That sounds like a lot - until you realize that most of them are low-cap, low-volume, or outright scams. And because CrescentSwap doesn’t list tokens, anyone can deploy a token on Arbitrum and add it to the DEX. No curation. No review. That’s where the risk comes in. Chainalysis found that 22% of new DeFi users lose money because they trade fake tokens or set slippage too high. On CrescentSwap, you’re on your own. No warnings. No alerts. No support team to call if you accidentally send ETH to a dead contract.

Who Is This For?

If you’re new to crypto? Skip it. You’ll get lost. You’ll get scammed. You’ll lose money. If you’ve used Uniswap before? You’ll feel right at home. The interface is clean, minimal, and fast. No clutter. No ads. Just the trade screen. If you’re holding Moonlight MNLT? Then yes - this is your place. It’s the only DEX where you can reliably trade it. And if you’re a liquidity provider on Arbitrum looking to earn fees from a niche token pair? CrescentSwap might be worth testing. But don’t expect big returns. The volume is too low. If you’re chasing the next big DeFi project? Maybe. But don’t believe the hype. CrescentSwap has had no major updates since September 2025. Its GitHub repo shows just a handful of commits. Compare that to Uniswap’s 142 commits in the same period. This isn’t a platform on fire. It’s a quiet, steady, small-scale experiment.Security and Regulation

CrescentSwap doesn’t claim to be regulated. Its disclaimer is clear: "We don’t recommend you buy, sell, or hold any cryptocurrency." That’s standard for DEXs. But it also means no legal recourse if something goes wrong. The SEC has been cracking down on centralized exchanges. Coinbase got sued. Kraken settled. But DEXs? They’re in gray territory. The SEC’s July 2025 guidance says it’s watching for "substantially centralized" DEXs - meaning if CrescentSwap’s team starts controlling liquidity pools or manipulating token prices, they could be in trouble. But right now? It’s just code on Arbitrum. No one owns it. No one controls it. That’s the promise of DeFi. Your security? It’s all on you. Keep your private keys safe. Use a hardware wallet if you’re moving large amounts. Double-check token addresses. Never click random links. And always set your slippage tolerance wisely - 1% is safe for major pairs. 5% or higher? That’s how scams get your money.The Bottom Line: Is CrescentSwap Worth It?

CrescentSwap isn’t for everyone. It’s not even for most people. But if you’re an experienced DeFi user who:- Uses Arbitrum regularly

- Trades niche tokens like Moonlight MNLT

- Understands slippage, liquidity, and token risks

- Doesn’t need fiat on-ramps or customer support

How to Get Started (If You Decide To)

1. Install MetaMask - Make sure it’s version 12.4.1 or later. Older versions may not support Arbitrum properly. 2. Add the Arbitrum network - Go to Settings > Networks > Add Network. Use these settings: Network Name: Arbitrum One, New RPC URL: https://arb1.arbitrum.io/rpc, Chain ID: 42161, Currency Symbol: ETH, Block Explorer URL: https://arbiscan.io 3. Get some ETH for gas - You need ETH to pay for transactions. Use a bridge like Arbitrum Bridge to move ETH from Ethereum mainnet to Arbitrum. 4. Go to app.crescent.network/swap - Connect your wallet. Don’t trust any other site claiming to be CrescentSwap. 5. Check the token address - Always verify the contract address of any token you trade. Search for "CrescentSwap Moonlight MNLT contract" on Arbiscan to confirm you’re trading the real one. 6. Set slippage to 1% or less - For MNLT/ETH, 1% is fine. For other pairs? 2-3% might be needed, but never go above 5%. 7. Confirm the trade - Read the details. Once you sign, it’s final.What Could Go Wrong?

- You trade a fake MNLT token. There are dozens of copycats. Always check the contract address. - Your slippage is too high. You think you’re getting 100 MNLT, but you get 85 because the pool is shallow. - You send ETH to a token contract by accident. That’s a common mistake. Once sent, it’s gone. - The platform goes offline. No one owns it. No one’s responsible. If the devs disappear, the site might vanish. - Arbitrum gets congested. Rare, but possible. Fees could spike.Final Thoughts

CrescentSwap isn’t the future of crypto. It’s a small experiment in a crowded, noisy space. It doesn’t have the funding, the team, or the traffic to compete with Uniswap or PancakeSwap. But it doesn’t need to. It serves one purpose: letting people trade Moonlight MNLT and a few other Arbitrum-native tokens without a middleman. If you’re in that niche? It’s useful. If you’re not? You’ll be better off sticking to bigger, safer platforms. DeFi is about freedom. But freedom without knowledge is dangerous. CrescentSwap gives you freedom. It doesn’t give you hand-holding. That’s on you.Is CrescentSwap safe to use?

CrescentSwap is as safe as your own wallet. Since it’s a decentralized exchange, there’s no central company holding your funds. But that also means there’s no recovery option if you lose your keys or send funds to the wrong address. Always verify token contracts, set low slippage, and never trade tokens you don’t fully understand. The biggest risk isn’t the platform - it’s scams and user error.

Can I buy crypto with fiat on CrescentSwap?

No. CrescentSwap is a pure DEX. You can’t deposit USD, EUR, or any fiat currency. You need to already own ETH or other tokens on the Arbitrum network. Use a centralized exchange like Coinbase to buy crypto with fiat, then bridge it to Arbitrum before using CrescentSwap.

What’s the trading fee on CrescentSwap?

CrescentSwap charges a standard 0.30% fee on every trade, which goes directly to liquidity providers - not to the platform. This is the same fee structure as Uniswap v3. There are no hidden fees or maker/taker differences. Gas fees on Arbitrum are separate and typically cost between $0.03 and $0.15 per transaction.

Why is CrescentSwap so low in volume compared to Uniswap?

CrescentSwap is limited to the Arbitrum network and focuses almost entirely on its native token, Moonlight MNLT. Most users don’t need a separate DEX just for one token - they use Uniswap, which supports hundreds of chains and thousands of tokens. CrescentSwap’s volume is concentrated in one pair, and it hasn’t attracted enough liquidity or users to scale beyond that niche. Uniswap has years of brand trust, multi-chain support, and institutional backing. CrescentSwap doesn’t.

Can I stake or earn rewards on CrescentSwap?

No. CrescentSwap only offers token swapping. There’s no staking, yield farming, liquidity mining, or reward programs. If you see anyone claiming to offer rewards through CrescentSwap, it’s likely a scam. The platform is designed for simple, direct trades only.

Is CrescentSwap available on mobile?

There is no official CrescentSwap mobile app. You can access it through your mobile browser using MetaMask or WalletConnect, but the experience is the same as on desktop - no optimization for small screens. For mobile DeFi trading, apps like Uniswap or PancakeSwap have better mobile interfaces.

What happens if CrescentSwap shuts down?

The platform itself can shut down - the website might go offline. But your funds aren’t stored there. They’re in your wallet on the Arbitrum blockchain. As long as you have your private keys or seed phrase, you can still access your tokens using any other Arbitrum-compatible DEX, like Uniswap or SushiSwap. The only thing you lose is the convenience of the CrescentSwap interface.

Daniel Verreault

January 1, 2026 AT 02:24Emily L

January 2, 2026 AT 01:02Ryan Husain

January 2, 2026 AT 16:15Bianca Martins

January 4, 2026 AT 16:09alvin mislang

January 5, 2026 AT 04:24surendra meena

January 6, 2026 AT 20:21Jacky Baltes

January 7, 2026 AT 18:29Mandy McDonald Hodge

January 9, 2026 AT 01:21Alexandra Wright

January 10, 2026 AT 00:01Monty Burn

January 10, 2026 AT 15:47Willis Shane

January 12, 2026 AT 15:18Jack and Christine Smith

January 13, 2026 AT 23:25NIKHIL CHHOKAR

January 15, 2026 AT 05:14Johnny Delirious

January 16, 2026 AT 22:13Kenneth Mclaren

January 18, 2026 AT 12:38