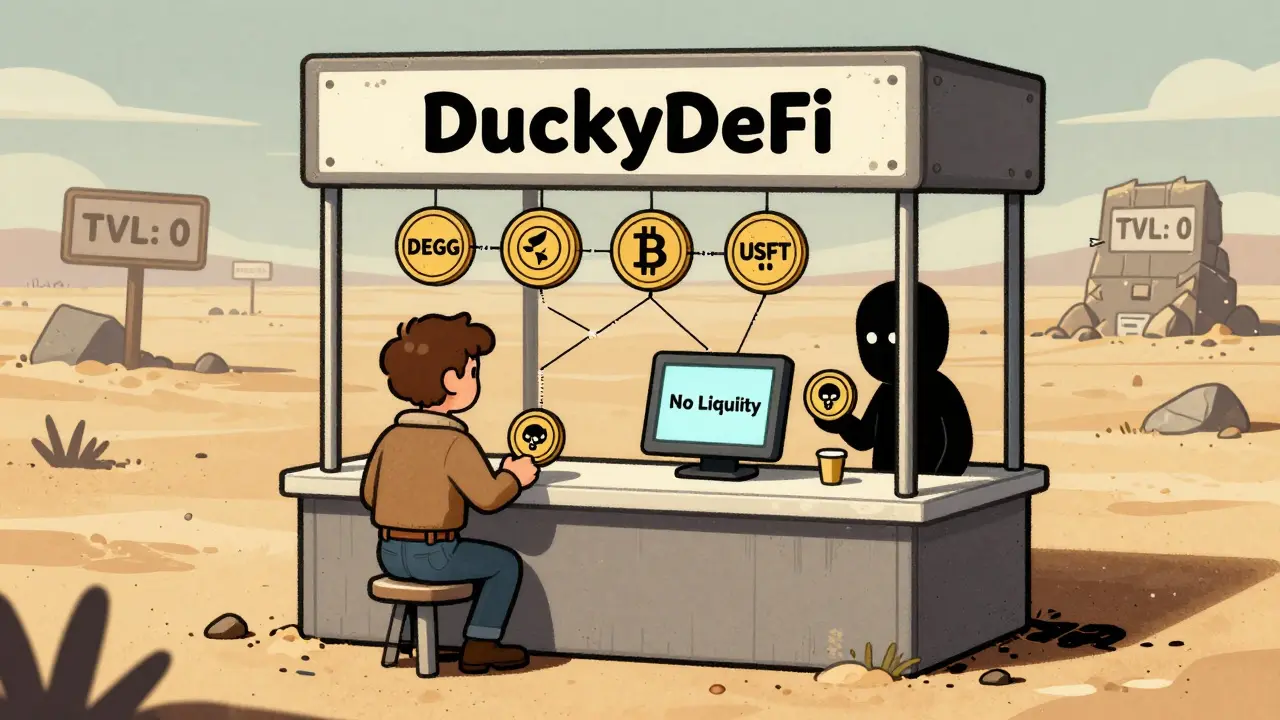

If you're looking for a reliable decentralized crypto exchange in 2025, DuckyDeFi isn't one you should consider unless you're specifically trading its native DEGG token. This platform, launched in 2022, operates as a tiny, isolated corner of the DeFi world-with only 4 cryptocurrencies and 5 trading pairs available. That’s not a feature. It’s a red flag.

What Is DuckyDeFi, Really?

DuckyDeFi is a decentralized exchange (DEX), meaning it lets you trade crypto directly from your wallet without a middleman. Unlike centralized exchanges like Binance or Crypto.com, there’s no account to sign up for. You connect your MetaMask or Trust Wallet, approve tokens, and trade on-chain. Sounds simple, right? But here’s the catch: DuckyDeFi doesn’t offer anything beyond the bare minimum.

The entire platform revolves around one token: DEGG. Every trading pair involves DEGG. You can trade DEGG/ETH, DEGG/BTC, DEGG/USDT, and two others-but that’s it. No Solana. No Polygon. No altcoins with real volume or community backing. If you’re not already holding DEGG, there’s almost no reason to use this exchange.

No Liquidity, No Trust

Liquidity is the lifeblood of any exchange. Without it, your trades get slippage, your orders fail, and you end up paying more than you planned. Major DEXs like Uniswap have over $4.9 billion locked in liquidity. PancakeSwap sits at $2.5 billion. Even Curve Finance, focused on stablecoins, holds $200 million.

DuckyDeFi? There’s no publicly verified Total Value Locked (TVL) data. No charts. No live metrics. CoinGecko lists the exchange, but it doesn’t show any meaningful volume. That’s not because it’s private-it’s because there’s nothing to report. If a DEX can’t attract even $50 million in TVL, according to Messari’s 2025 DeFi report, it’s not sustainable. DuckyDeFi doesn’t come close.

Security Risks You Can’t Ignore

Every decentralized exchange carries risk. But with DuckyDeFi, the risks are amplified. There’s no public record of smart contract audits. No security firm has reviewed its code. No bug bounty program exists. And because it’s so obscure, there’s zero community oversight.

Here’s what happens when you trade on a tiny DEX: anyone can create a token that looks like DEGG. A scammer can deploy a fake version with the same name, logo, and contract address. If you approve the wrong token, your wallet gets drained. That’s not theory-it’s standard practice on low-traffic DEXs. Koinly’s December 2025 review warned: “Anyone can create a token on chain. That means there are many scam versions of tokens that can drain your wallet.”

With no verified token listings, no official documentation, and no community alerts, you’re flying blind. You’re trusting a platform that doesn’t even bother to prove it’s trustworthy.

Zero User Support, Zero Tutorials

Most beginner-friendly DEXs-like PancakeSwap-have YouTube tutorials, multilingual help pages, and responsive Discord channels. DuckyDeFi has none of that.

There’s no FAQ section. No live chat. No email support. No guides on how to connect your wallet or approve tokens. If you’re new to DeFi, you’ll be stuck. You’ll need to understand gas fees, token approvals, blockchain confirmations, and slippage tolerance-all without any hand-holding.

Even the tax reporting process, which Crypto Tax Calculator documents as a simple three-step procedure, has no user feedback. No one’s posted about it on Reddit. No one’s written a Medium post. No one’s complained. That’s not because everything’s perfect. It’s because almost no one uses it.

How It Compares to Real DEXs

Let’s put DuckyDeFi next to the real players:

| Feature | DuckyDeFi | Uniswap | PancakeSwap | Curve Finance |

|---|---|---|---|---|

| Cryptocurrencies Supported | 4 | Over 10,000 | Over 5,000 | Over 1,000 |

| Trading Pairs | 5 | 10,000+ | 5,000+ | 200+ |

| Total Value Locked (TVL) | Unknown / Near Zero | $4.9 Billion | $2.5 Billion | $200 Million |

| Multi-Chain Support | No | Yes (Ethereum) | Yes (9 chains) | Yes (27 chains) |

| Smart Contract Audits | Not Public | Yes (Multiple) | Yes (Multiple) | Yes (Multiple) |

| User Reviews / Community | None | Massive | Massive | Large |

| Beginner-Friendly | No | Yes | Yes | Yes (for stablecoins) |

Uniswap, PancakeSwap, and Curve aren’t just bigger-they’re better built, better secured, and better supported. They’ve spent years refining their interfaces, reducing fees, and adding features like concentrated liquidity and yield farming. DuckyDeFi hasn’t changed since 2022.

Why Experts Ignore It

Not a single professional crypto analyst included DuckyDeFi in their 2025 DEX reviews. Koinly’s “Top 5 DEXs in 2025” list? No DuckyDeFi. Traders Union’s exchange ratings? Not mentioned. Even niche DeFi blogs skip it.

Why? Because it doesn’t matter. It doesn’t move markets. It doesn’t attract developers. It doesn’t innovate. It’s a ghost town with a website.

Meanwhile, platforms like Balancer and SushiSwap are rolling out new AMM models, cross-chain bridges, and institutional-grade tools. DuckyDeFi sits still. And in crypto, standing still means falling behind-fast.

Who Should Use DuckyDeFi?

Only one group: people who already hold DEGG and have no other way to trade it.

If you bought DEGG on a centralized exchange, and now you want to move it to a wallet and trade it peer-to-peer, DuckyDeFi might be your only option. But even then, you’re taking a risk. There’s no guarantee the token has long-term value. No one’s tracking its utility. No one’s building products around it.

For everyone else-traders looking for liquidity, security, or choice-this exchange is a dead end.

The Bottom Line

DuckyDeFi isn’t a crypto exchange you should use. It’s a test case in what happens when a project lacks ambition, transparency, and community.

It doesn’t offer better fees. It doesn’t have better tools. It doesn’t even have enough users to generate meaningful trading volume. It’s a niche experiment that never scaled-and likely never will.

If you’re serious about decentralized trading, go where the liquidity is. Use Uniswap. Use PancakeSwap. Use Curve. They’re safe, proven, and built for real users-not just token promoters.

DuckyDeFi? Save your time. Save your gas fees. Save your wallet.

Is DuckyDeFi safe to use?

No, DuckyDeFi is not considered safe for most users. There are no public smart contract audits, no verified token listings, and no community oversight. The platform’s lack of transparency makes it vulnerable to scams, including fake DEGG tokens designed to drain wallets. Without audits or security disclosures, you’re trading on an unverified system with no safety net.

Can I trade other cryptocurrencies on DuckyDeFi besides DEGG?

Technically, yes-but only 4 cryptocurrencies are listed, and every single trading pair involves DEGG. You can’t trade ETH for BTC, SOL for USDT, or any other combination. The entire platform is built around promoting its own token. If you’re looking to trade a variety of crypto assets, DuckyDeFi won’t help you.

Does DuckyDeFi have mobile apps or a good user interface?

No, DuckyDeFi has no dedicated mobile app. The interface is basic, with no tutorials, tooltips, or guidance for new users. Unlike PancakeSwap or Uniswap, which offer intuitive designs and step-by-step onboarding, DuckyDeFi assumes you already know how to interact with blockchain wallets and approve transactions. Beginners will find it confusing and risky.

What are the trading fees on DuckyDeFi?

The platform does not publicly disclose its fee structure. Major DEXs like Uniswap (0.05%-1%) and PancakeSwap (0.01%-1%) clearly state their fees. DuckyDeFi offers no transparency here, making it impossible to calculate trading costs or compare it to alternatives. This lack of information is another red flag for serious traders.

Is DuckyDeFi listed on major crypto data sites?

Yes, it’s listed on CoinGecko, but only as a basic exchange profile with no user ratings, volume charts, or liquidity data. It’s not mentioned in any major industry reports, rankings, or analyses from Traders Union, Messari, or Koinly. Its presence on CoinGecko doesn’t mean it’s reputable-it just means it’s been added to a public database.

Should I invest in the DEGG token?

Investing in DEGG is extremely high risk. There’s no evidence of real utility, development activity, or community growth. The token exists solely to fuel a platform with no users, no liquidity, and no future roadmap. Most tokens like this fail within months. Unless you’re speculating with money you can afford to lose-and understand the risks-you should avoid DEGG entirely.

Helen Pieracacos

December 20, 2025 AT 15:13Dustin Bright

December 21, 2025 AT 22:42Melissa Black

December 22, 2025 AT 10:34Sophia Wade

December 22, 2025 AT 15:13Brian Martitsch

December 24, 2025 AT 00:31Rebecca F

December 24, 2025 AT 15:13Rachel McDonald

December 26, 2025 AT 10:01Vijay n

December 27, 2025 AT 00:05Alison Fenske

December 27, 2025 AT 23:01Amit Kumar

December 29, 2025 AT 05:17chris yusunas

December 30, 2025 AT 09:22Naman Modi

December 30, 2025 AT 22:16Tyler Porter

January 1, 2026 AT 12:21Rishav Ranjan

January 3, 2026 AT 06:51Steve B

January 3, 2026 AT 18:15Dusty Rogers

January 4, 2026 AT 22:58Kevin Karpiak

January 6, 2026 AT 17:45Mmathapelo Ndlovu

January 6, 2026 AT 19:46Grace Simmons

January 8, 2026 AT 08:32