Futures Trading: Strategies, Risks & Market Insights

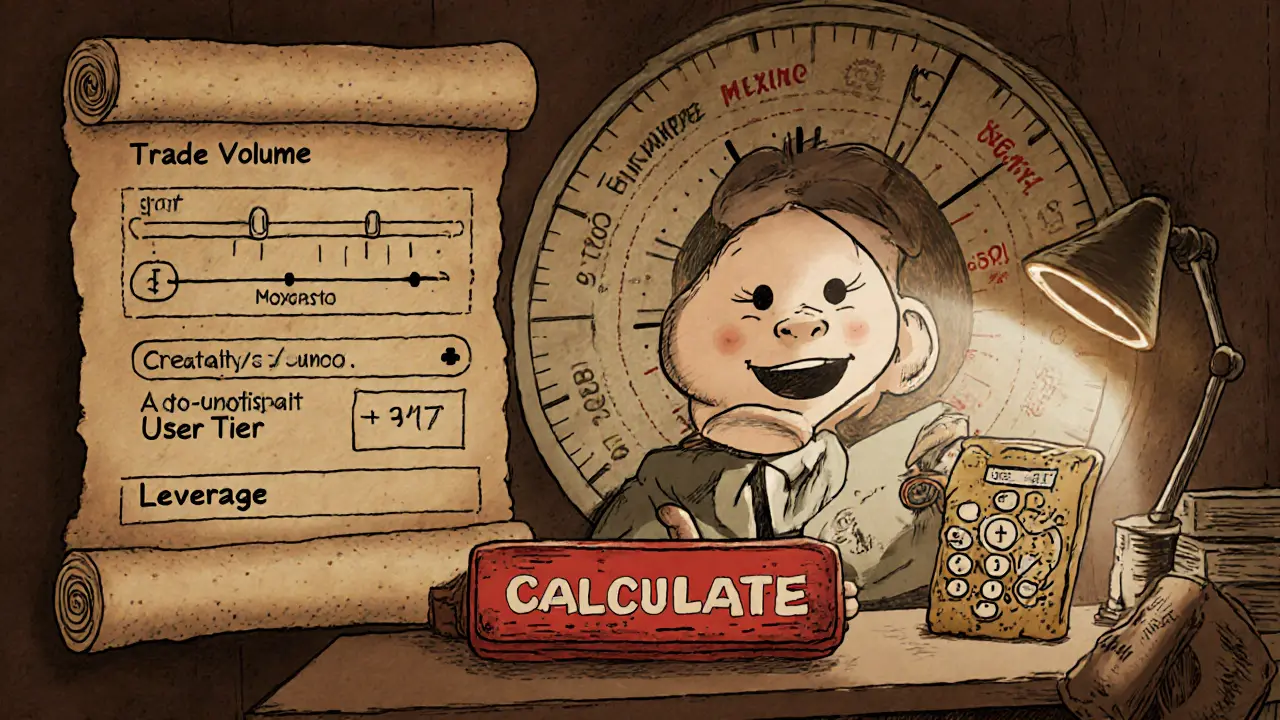

When talking about futures trading, the practice of buying and selling contracts that lock in the price of an asset for delivery at a future date. Also known as future contracts, it lets traders speculate on price moves without owning the underlying asset. Cryptocurrency futures bring this concept to digital tokens, while DeFi platforms offer decentralized ways to trade them. Managing risk often means understanding the liquidation engine that automatically closes positions when margin falls short, and many traders also hold governance tokens to influence protocol rules.

Futures trading encompasses three core steps: (1) selecting a contract that matches your market view, (2) posting margin to back the position, and (3) monitoring the liquidation engine to avoid forced closure. The process requires a solid grasp of market volatility, especially in crypto markets where price swings can be extreme. That’s why traders often combine futures with other tools—like hash algorithm analysis for mining‑related assets or regulatory updates from jurisdictions such as Malta—to fine‑tune their strategies.

Key Concepts in Futures Trading

One semantic link you’ll see often is that futures trading relies on liquidity providers to keep contracts tradable. Without deep liquidity, slippage can erode profits in seconds. Another link is that the design of a liquidation engine directly influences risk exposure; smarter engines use auto‑deleveraging to protect both traders and the platform. Governance tokens add a third layer: holders vote on fee structures, margin requirements, and even the introduction of new contract types, meaning the ecosystem evolves with its participants.

The article collection below mirrors these connections. You’ll find a clear guide to Malta’s crypto regulation that helps you navigate compliance when trading crypto futures, a step‑by‑step NFT airdrop tutorial that shows how token incentives can affect market sentiment, and a deep dive into hash algorithms that explains why mining difficulty matters for futures on proof‑of‑work assets. There are also pieces on DeFi governance tokens, liquidation engine mechanics, and DAO treasury management—each shedding light on how the broader blockchain world shapes futures trading.

Ready to explore the specific guides? Below you’ll discover practical insights, real‑world examples, and actionable tips that together build a well‑rounded view of futures trading in the crypto era.