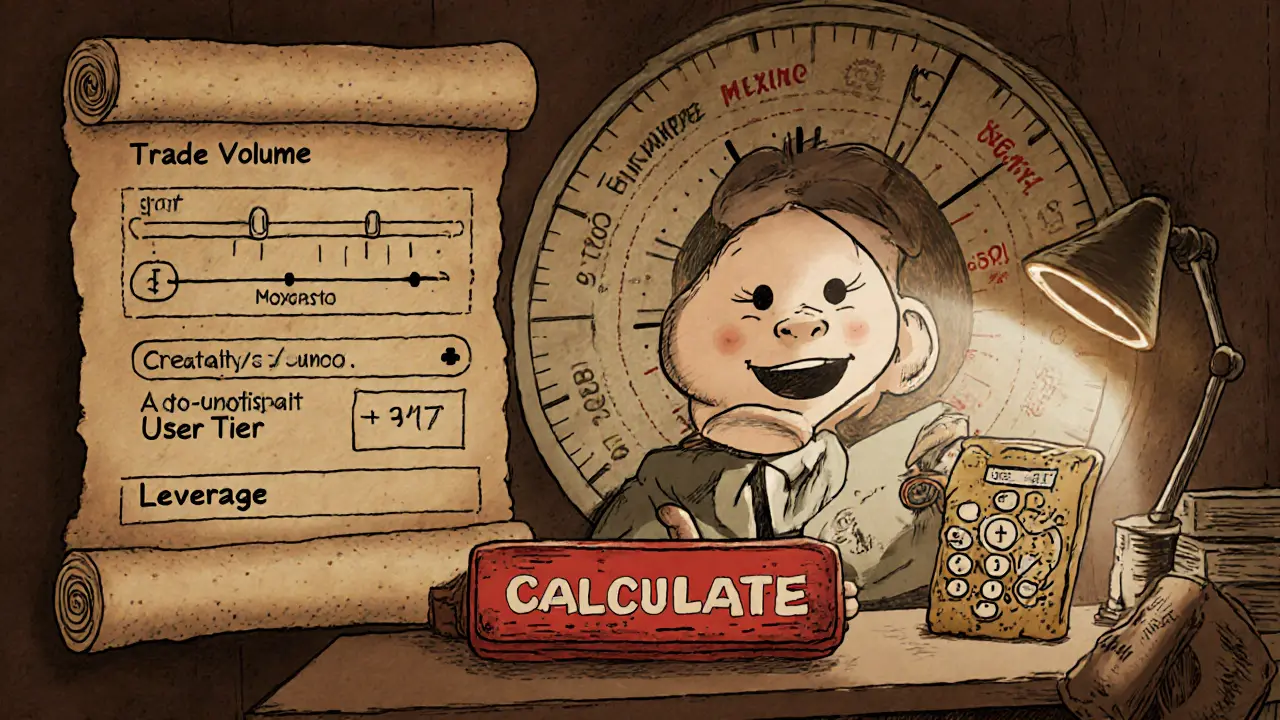

MEXC Fee Calculator

Estimated Fees

Spot Trading

0% Maker | 0.05% Taker (Standard)

0.01% Taker (Basic)

0.009% Taker (MX Holder)

Futures Trading

0% Maker | 0.02% Taker

Leverage up to 125x

MX Token Benefits

Reduced fees

Exclusive airdrops

Early access to projects

MEXC is a centralized crypto exchange launched in 2018 and registered in Victoria, Seychelles. It has climbed into the top‑10 by 24‑hour trading volume, handling roughly $124billion daily as of March2025. The platform markets itself around the MEXC approach - Most trending tokens, Everyday airdrops, Xtremely low fees, and Comprehensive liquidity. This MEXC crypto exchange review looks at fees, token variety, futures options, security, and real‑world user experiences to help you decide whether it’s a fit.

TL;DR

- Zero maker fees, 0.05% taker on spot, 0.02% taker on futures.

- Over 2,800 crypto assets and 3,100+ trading pairs - great for altcoin fans.

- MX token holders enjoy fee discounts and occasional airdrops.

- Strong security (cold storage, 2FA, insurance fund) but limited fiat gateways.

- Mixed customer service; no U.S. access, some account restrictions.

Why traders pick MEXC

The biggest draw is sheer variety. If you chase the next meme coin or DeFi token before it lands on the big exchanges, MEXC often lists it first. That early‑access edge aligns with the platform’s "Most trending tokens" promise.

Day traders also love the fee structure. With zero maker fees on both spot and futures, you only pay the taker tier - 0.05% for regular spot trades and a razor‑thin 0.02% for futures contracts. High‑frequency traders can shave off a noticeable chunk of cost compared to rivals that charge 0.1% or more.

For those holding the native MX token, the platform offers additional perks like reduced taker fees (down to 0.009%) and occasional airdrops of new projects.

Fee structure in detail

Below is a quick snapshot of the main fee tiers:

- Spot trading - 0% maker, 0.05% taker for standard users.

- Spot trading - 0% maker, 0.01% taker for “basic” users (often promotional).

- Futures - 0% maker, 0.02% taker across most contracts.

- MX‑token holders - 0% maker, 0.009% taker on spot; same 0.02% futures taker.

There’s no hidden withdrawal fee for crypto; network fees apply as usual. For fiat, the minimum deposit is $10, and the only supported fiat currencies are EUR and BRL, which limits users outside Europe and Brazil.

Token selection & early access

MEXC lists more than 2,800 cryptocurrencies, giving traders around 3,100 trading pairs. That breadth is a clear advantage over platforms like Binance (which caps at ~1,800) and Coinbase (around 750). The exchange’s rapid onboarding process means many projects debut on MEXC weeks before hitting larger venues.

For altcoin hunters, this translates to two practical benefits:

- First‑mover profit potential - early price spikes can be sizable.

- Access to niche DeFi tokens that might never make it onto mainstream exchanges.

However, this variety also brings risk. Some newly listed tokens have low liquidity and higher volatility, so it’s wise to size positions carefully.

Futures trading and leverage

The platform’s futures suite covers perpetual contracts on major coins (BTC, ETH, BNB, etc.) and a handful of alt‑futures. Taker fees sit at 0.02%, one of the lowest in the market, and leverage reaches up to 125x on select pairs.

New traders should note that high leverage magnifies both gains and losses. MEXC offers a demo‑trading mode where you can practice strategies without risking real capital - a rare feature among centralized exchanges.

Security, regulation, and compliance

Security measures are pretty solid:

- Cold storage holds the majority of user funds.

- Two‑factor authentication (2FA) is mandatory for withdrawals.

- An insurance fund buffers against unexpected losses.

Regulatory compliance is mixed. MEXC holds registrations with bodies such as AUSTRAC (Australia), FINMA (Switzerland), and the FCA (UK). It also lists registrations under FinCEN (US) and the MAS (Singapore), but the exchange is blocked for U.S. residents due to licensing gaps.

For traders in regulated markets like Europe or Australia, the exchange’s compliance stamps are reassuring, though the lack of a full banking partnership means fiat deposits rely on SEPA (for EUR) and limited local methods.

User experience, support, and mobile apps

The desktop UI is clean, with customizable charts and a quick‑order panel. Mobile apps (iOS and Android) mirror most desktop functions, though some advanced order types are only on the web version.

Customer support receives mixed reviews. While the platform offers a chatbot, email, and live‑chat, users report slow response times and occasional account freezes that require manual review. The FAQ page is extensive, but finding specific answers can be a chore.

On the plus side, MEXC provides multilingual support covering over 15 languages, which helps its global user base of more than 40million across 170countries.

Pros and cons at a glance

| Pros | Cons |

|---|---|

| Zero maker fees - big cost saver for active traders. | Limited fiat options (only EUR & BRL). |

| Over 2,800 crypto assets - unmatched token variety. | No U.S. access; regulatory restrictions for some regions. |

| Low futures taker fee (0.02%) and high leverage. | Customer service can be slow; occasional account restrictions. |

| MX token offers extra fee discounts and airdrops. | Liquidity on very new tokens can be thin. |

| Demo‑trading mode for risk‑free strategy testing. | Some users report KYC delays when upgrading accounts. |

How MEXC stacks up against Binance and Coinbase

| Feature | Binance | Coinbase | MEXC |

|---|---|---|---|

| Trading volume (24h) | $210B | $18B | $124B |

| Number of crypto assets | ~1,800 | ~750 | ~2,800 |

| Maker fee | 0.02% (spot) | 0% (USD pairs) | 0% (spot & futures) |

| Taker fee (spot) | 0.04% | 0.50% | 0.05% (standard) |

| Futures taker fee | 0.02% | N/A | 0.02% |

| Fiat deposit options | USD, EUR, GBP, many others | USD, EUR, GBP | EUR, BRL only |

| U.S. availability | Yes (with compliance) | Yes | No |

| Demo trading | No | No | Yes |

If you value the widest token list and the lowest maker fees, MEXC wins. If you need robust fiat on‑ramps or U.S. access, Binance or Coinbase will feel more comfortable.

Who should consider MEXC?

- Altcoin enthusiasts - you’ll find new projects here first.

- Day traders and scalpers - zero maker fees keep costs down.

- Futures traders - low taker fees and high leverage options.

- Privacy‑conscious users - basic trading works without mandatory KYC.

Conversely, if you need a broad fiat gateway, are based in the U.S., or prioritize premium customer support, you might look at other exchanges.

Getting started on MEXC

- Visit the official MEXC website and click “Register”.

- Enter your email, set a strong password, and verify the email link.

- Enable 2FA (Google Authenticator or Authy) for added security.

- Deposit crypto or use SEPA/EUR to fund your account. No KYC required for basic spot trading.

- If you plan to trade futures or withdraw large amounts, complete the KYC wizard (photo ID, proof of address).

- Navigate to the ‘Spot’ or ‘Futures’ tab, select your pair, and place an order.

Remember to start small on brand‑new tokens-liquidity can be thin and price swings extreme.

Final thoughts

MEXC positions itself as the go‑to spot for traders who chase variety, speed, and low fees. Its token breadth and zero maker fees are hard to beat, especially for those who love jumping on the next hype coin. Security is respectable, and the demo‑trading feature adds a safety net for newcomers.

The main downsides are the limited fiat options, no U.S. service, and a reputation for slower support. If those aren’t deal‑breakers, MEXC can be a powerful addition to your trading toolbox.

Frequently Asked Questions

Is KYC mandatory on MEXC?

No. You can create a basic account, deposit crypto, and trade spot without any identity verification. KYC becomes required if you want to trade futures, withdraw large sums, or use fiat deposits.

What are the main fee advantages over Binance?

MEXC charges 0% maker fees on both spot and futures, while Binance’s maker fee starts at 0.02% for spot. Taker fees are also lower on MEXC for spot (0.05% vs 0.04% on Binance) and match Binance’s 0.02% on futures.

Can I withdraw to my bank account?

Only EUR and BRL fiat withdrawals are supported via SEPA (for EUR) and local methods for BRL. If you need USD or other currencies, you’ll need to convert to crypto first and then move it to a platform with broader fiat support.

Is MEXC safe for large balances?

The exchange stores the bulk of funds in cold wallets, requires 2FA for withdrawals, and maintains an insurance fund. While no platform is 100% risk‑free, MEXC’s security measures meet industry standards.

How does the MX token affect my fees?

Holding MX reduces spot taker fees to 0.009% and keeps maker fees at 0%. It also unlocks occasional airdrops and promotions for token holders.

Marie Salcedo

September 6, 2025 AT 04:48Great overview, thanks for sharing!

Latoya Jackman

September 8, 2025 AT 12:48The fee breakdown is clear and helpful. I appreciate the focus on zero maker fees for both spot and futures. The summary of token variety also gives a good picture of why traders might choose MEXC.

Megan King

September 10, 2025 AT 20:48Nice write‑up! really love how you laid out the MX token benefits-those airdrops can be a sweet bonus. Also, the low taker fees are a big plus for day traders. If you’re just starting, the demo‑trading mode is a solid way to practice without risk. Keep the posts coming, they’re super useful.

Rachel Kasdin

September 13, 2025 AT 04:48Finally, a review that actually gets the importance of low fees across the board. MEXC’s approach feels patriotic for the crypto community.

Keith Cotterill

September 15, 2025 AT 12:48One must note, with the current market dynamics, the zero‑maker‑fee paradigm represents a pivotal shift in exchange economics; however, an over‑reliance on sub‑percent taker fees might obscure hidden costs elsewhere-such as spread widening on illiquid pairs. Moreover, the platform’s compliance matrix, while extensive, remains a labyrinthine construct for regulators to decipher; this could potentially engender future operational frictions. It is also worth contemplating the psychological impact of ultra‑high leverage options, which can precipitate margin calls in volatile episodes. In essence, MEXC offers an alluring mix of features, yet the discerning trader must remain vigilant to the nuanced risk vectors embedded within its architecture.

Noel Lees

September 15, 2025 AT 14:12Totally agree with the points on leverage-great insight! 😊 The demo mode is especially handy for testing strategies before going live. Also, the MX token discounts really sweeten the deal for frequent traders.

Raphael Tomasetti

September 17, 2025 AT 20:48Low taker fees = higher net returns. TL;DR: MEXC is fee‑friendly for scalpers.

Jenny Simpson

September 20, 2025 AT 04:48Surprisingly, despite the hype, the platform’s security measures may not be as rock‑solid as advertised. The limited fiat options also raise eyebrows, especially for newcomers who expect seamless onboarding.

Sabrina Qureshi

September 22, 2025 AT 12:48Wow!!! The entire review is just a massive information dump!!! It totally blew my mind!!!

CJ Williams

September 24, 2025 AT 20:48Hey folks! 🌟 Loved the deep dive-especially the part about cold storage and insurance funds. Those details reassure me about safety. Also, the MX token airdrops are a fun perk. Keep the guides coming! 🚀

mukund gakhreja

September 27, 2025 AT 04:48The fee structure is decent, but the article glosses over the real pain points-like account freezes. Still, the high leverage is tempting, albeit risky.

Michael Ross

September 27, 2025 AT 06:12I think the overview is balanced and presents both pros and cons without bias. The clarity on fiat limitations helps set realistic expectations.

Lana Idalia

September 29, 2025 AT 14:12From a philosophical standpoint, MEXC embodies the paradox of democratized finance-offering unprecedented access while simultaneously imposing subtle barriers through KYC thresholds. The platform’s token diversity reflects the chaotic nature of the crypto ecosystem, where novelty reigns supreme. Yet, we must question whether such breadth dilutes liquidity, ultimately affecting market efficiency. In any case, the fee structure is a tangible metric of value proposition, serving as a litmus test for trader loyalty.

WILMAR MURIEL

October 1, 2025 AT 22:12Reading through this review, I’m struck by how many facets MEXC packs into a single platform. First, the sheer number of listed assets-over 2,800-means traders can chase the latest trends without hopping between exchanges. Second, the zero‑maker‑fee model directly boosts profitability for high‑frequency strategies, which is a game‑changer for scalpers. Third, the MX token benefits, such as the 0.009% taker fee, reward loyal holders with tangible savings. Fourth, the availability of a demo‑trading environment provides a risk‑free sandbox, allowing newcomers to practice without capital exposure. Fifth, the platform’s security infrastructure, featuring cold storage and mandatory 2FA, aligns with industry best practices, instilling confidence among users. Sixth, the insurance fund acts as a safety net, potentially covering unforeseen losses. Seventh, the leveraged futures offering up to 125× opens doors for amplified gains-though it equally magnifies potential losses, demanding disciplined risk management. Eighth, the limited fiat on‑ramps (EUR and BRL) could frustrate traders seeking seamless deposits, yet the SEPA integration for EUR is robust for European users. Ninth, MEXC’s global regulatory registrations, spanning AUSTRAC, FINMA, and FCA, suggest a proactive stance toward compliance, even though U.S. residents remain excluded. Tenth, the mixed customer support experiences highlight a need for operational improvements, especially regarding response times and account freezes. Eleventh, the mobile app mirrors most desktop functionalities, making on‑the‑go trading viable. Twelfth, the exchange’s emphasis on early token listings gives early‑adopter advantage but introduces volatility risks on low‑liquidity assets. Thirteenth, the community‑driven airdrops and promotions foster engagement, creating an ecosystem where users feel rewarded. Fourteenth, the transparent fee calculator embedded in the site demystifies cost structures for traders. Fifteenth, the overall user experience-clean UI, customizable charts, and quick‑order panels-makes navigation intuitive. Sixteenth, the platform’s expansion strategy, focusing on emerging markets, could drive future growth. Seventeenth, the absence of mandatory KYC for basic spot trading respects privacy preferences. Eighteenth, the mandatory KYC for higher‑value withdrawals ensures regulatory alignment while still offering flexibility. Nineteenth, the platform’s demo mode is a rare offering among centralized exchanges, distinguishing MEXC in the competitive landscape. Twentieth, the diversity of supported languages lowers entry barriers worldwide. Twenty‑first, the combination of low fees, extensive token lists, and robust security craft a compelling proposition for a broad spectrum of traders. Finally, despite its shortcomings-limited fiat options, occasional support delays, and U.S. inaccessibility-MEXC stands as a formidable contender in the crypto exchange arena, especially for those prioritizing variety and cost efficiency.

carol williams

October 1, 2025 AT 23:35While the article praises MEXC’s token variety, one must also consider the inherent risks of low‑liquidity assets. Nonetheless, the fee advantages are undeniable, and the platform’s UI is quite polished.

jit salcedo

October 4, 2025 AT 04:48The review is solid, but I’m not convinced the low fees compensate for the occasional account hiccups. Still, the diversity of listings is a nice perk.

Fionnbharr Davies

October 6, 2025 AT 12:48I appreciate the balanced perspective, especially the clear delineation of pros and cons. The emphasis on security measures gives me confidence, and the multilingual support is a definite plus for global users.

Narender Kumar

October 8, 2025 AT 20:48In the grand tapestry of cryptocurrency exchanges, MEXC occupies a niche defined by its expansive token catalogue and attractive fee regime. Yet, the absence of comprehensive fiat gateways remains a notable shortcoming.

Anurag Sinha

October 11, 2025 AT 04:48One could argue that the platform’s rapid token onboarding is driven by opaque partnerships, which may hide ulterior motives. Nevertheless, the low fee structure does provide a competitive edge, assuming the security claims hold true under scrutiny.

Lisa Strauss

October 13, 2025 AT 12:48Loving the detailed breakdown! The zero‑maker‑fee model is perfect for my day‑trading hustle. Can’t wait to try the demo mode.

Darrin Budzak

October 15, 2025 AT 20:48Solid review, helps me decide if I should switch.

karsten wall

October 18, 2025 AT 04:48The juxtaposition of low fees and extensive token lists makes MEXC a compelling case study in exchange design. Its API latency is also commendable for algorithmic traders.