Standard (STND) isn't another meme coin or a copycat token. It’s a protocol built to fix real problems in decentralized finance - specifically, how stablecoins behave when markets crash. If you’ve ever wondered why some stablecoins lose their peg or why DeFi platforms feel fragile, STND was designed to answer those questions. But here’s the thing: most people still don’t understand what it actually does. Let’s cut through the noise.

What Standard (STND) Actually Is

Standard (STND) is the governance token of Standard Protocol, a decentralized finance (DeFi) protocol built on Polkadot that uses a rebaseable, collateralized system to create stable digital assets. Unlike Bitcoin or Ethereum, STND doesn’t aim to be money. It’s not meant to be spent at coffee shops or traded for NFTs. Its job is to power the engine behind another token called Meter (MTR), which is the actual stablecoin users interact with.

Think of STND like the voting rights and fuel for a car. You don’t drive the key - you use it to start the engine. STND lets holders vote on protocol changes, earn fees from users borrowing stablecoins, and stake their tokens to help secure the system. It’s not a currency. It’s infrastructure.

The Three Tokens Behind Standard Protocol

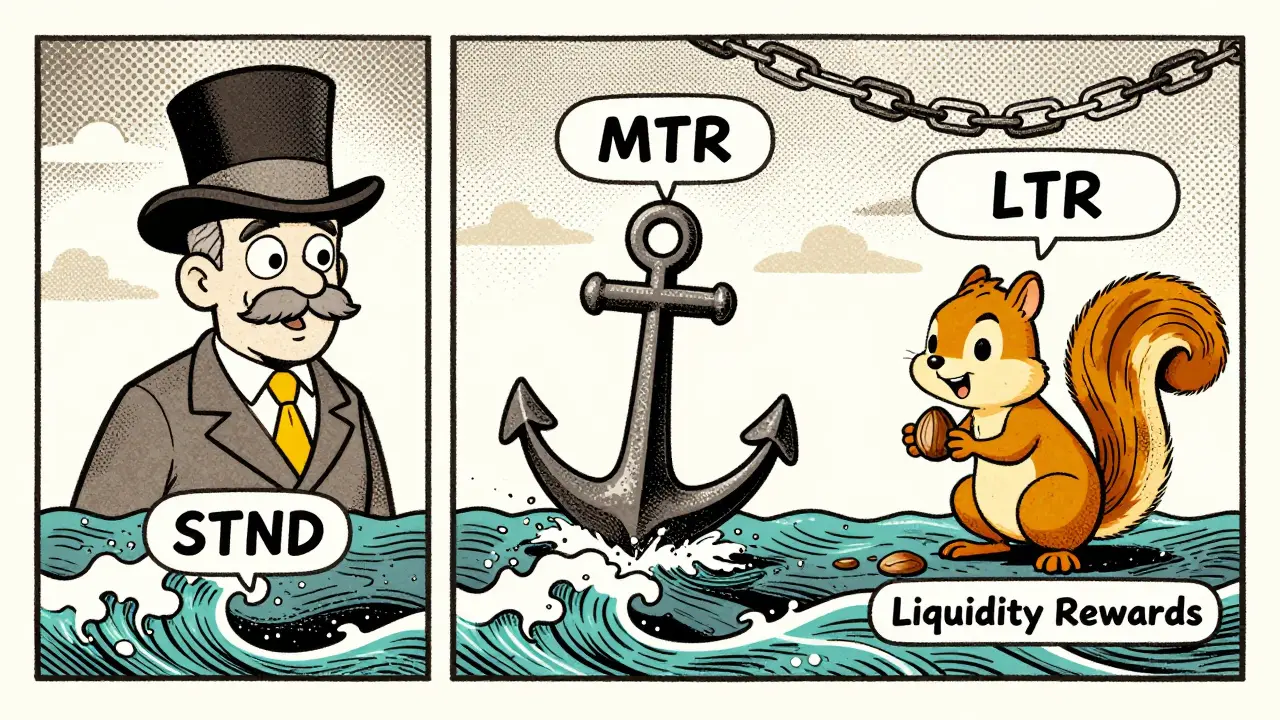

Standard Protocol doesn’t run on one coin. It runs on three. Each has a specific job:

- STND - The governance token. Used for voting, staking, and collecting protocol fees.

- Meter (MTR) - The stablecoin. Designed to stay pegged to $1 USD, generated when users lock up collateral like ETH or BTC in a vault.

- Liter (LTR) - The liquidity token. Earned when users provide trading pairs on the protocol’s AMM (automated market maker). Used for farming rewards.

This three-token structure is rare. Most DeFi projects use one or two tokens. Standard’s design tries to separate power (STND), value (MTR), and liquidity (LTR). That’s intentional. It’s meant to reduce risk and increase transparency.

How the Rebase Mechanism Works

Here’s where Standard gets weird - and interesting. Most stablecoins like USDT or USDC are backed by cash or reserves. If those reserves shrink, the peg breaks. Standard doesn’t work that way.

Instead, it uses a rebaseable supply, a system where the total number of tokens automatically expands or contracts based on price. If MTR trades above $1, the system increases supply to bring the price down. If it drops below $1, supply shrinks to push the price back up. No centralized reserve. No bank. Just code.

This isn’t new - projects like Ampleforth used rebase too. But Standard adds collateral. Users must lock up assets like Ethereum or Bitcoin to mint MTR. That collateral must always be worth more than the MTR created. If the value of the collateral drops too low, the system automatically liquidates it. It’s like a crypto mortgage with built-in insurance.

Why Polkadot? And Why Not Just Ethereum?

Standard Protocol launched on Polkadot, a blockchain designed for cross-chain communication and scalability. That’s not random. Polkadot lets Standard connect with other chains - Ethereum, Bitcoin, even Solana - without needing a bridge that can be hacked.

Most DeFi projects are stuck on Ethereum. High fees, slow transactions, and congestion make it hard for small users to participate. Standard’s goal is to be chain-agnostic. It doesn’t just support Ethereum and Bitcoin - it’s built to integrate with them natively. That’s ambitious. Most protocols talk about cross-chain. Standard is trying to build it from the ground up.

Tokenomics: Supply, Price, and Market Reality

As of February 18, 2026:

- Total supply: 100,000,000 STND

- Circulating supply: 85,574,950 STND

- Current price: ~$0.0054-$0.014 (varies by exchange)

- Market cap: ~$465K (Coinbase) to $392K (Investing.com)

- All-time high: $3.06 (May 14, 2021)

- 24-hour trading volume: ~$149K

The drop from $3.06 to under $0.01 is brutal. That’s a 99.8% decline. But here’s what most people miss: the token’s value isn’t tied to speculation. It’s tied to usage. If no one is minting MTR, locking collateral, or staking STND, then the token doesn’t matter.

Right now, usage is low. Trading volume is tiny. The protocol hasn’t cracked mainstream adoption. But it’s still alive. That’s more than most projects from 2021 can say.

Who Built It? And Is It Still Active?

Standard Protocol was launched in Q1 2021 by a small team: Hyungsuk Kang (Head of Technology), Dixon Wong (Product Owner), and Beli Hong (Administrator). They raised $3.58M in funding through an ICO and private rounds. That’s solid backing for a DeFi startup.

Since then, updates have been slow. There’s no flashy marketing. No celebrity endorsements. No viral Twitter threads. But the code is still running. The vaults are still accepting collateral. The governance votes still happen. The team hasn’t vanished. They’re quiet, but they’re not gone.

Is STND Worth Anything?

Here’s the honest answer: as a speculative investment? Probably not. If you bought STND at $3, you’re underwater. If you bought it at $0.01, you’re still betting on a long shot.

But if you care about DeFi innovation - about building stablecoins that don’t rely on centralized banks or auditors - then STND matters. It’s one of the few protocols trying to solve the core problem: how do you make a decentralized stablecoin that survives a crash without a central authority?

It’s not the answer. But it’s asking the right questions. And in crypto, that’s rare.

What’s Next for Standard Protocol?

The roadmap isn’t public. There’s no flashy whitepaper update. But the fact that it’s still live after five years suggests something important: it’s not dead. It’s waiting.

Its real test will come when Bitcoin or Ethereum sees another major crash. Will MTR stay pegged? Will the collateral system hold? Will STND holders still be incentivized to keep the system running? No one knows. But if it works, Standard could become a blueprint for the next generation of DeFi.

For now, it’s a quiet experiment. Not a boom. Not a bubble. Just code trying to do something hard.

Is Standard (STND) a stablecoin?

No. STND is the governance token of the Standard Protocol. The actual stablecoin is called Meter (MTR), which is designed to stay pegged to $1 USD. STND is used for voting, staking, and earning fees - not for spending or trading as money.

Can I stake STND to earn rewards?

Yes. Holders of STND can stake their tokens to earn a portion of the stability fees collected from users who open vaults to mint Meter (MTR). Staking also gives you voting power in protocol decisions.

Why is STND’s price so low compared to its all-time high?

STND hit $3.06 in May 2021 during a crypto bull run. Since then, the market has corrected, and the protocol hasn’t gained widespread adoption. Its value is tied to usage, not hype. Low trading volume and minimal DeFi activity mean demand is low. The price reflects that.

Is Standard Protocol safe to use?

It’s as safe as the code it runs on. The protocol is open-source and lives on Polkadot, which has a strong security track record. However, like all DeFi projects, it carries smart contract risk. If a bug is found in the vault system, funds could be lost. Always do your own research before locking up assets.

Can I use STND on Ethereum or Bitcoin?

You can’t use STND directly on Ethereum or Bitcoin. But Standard Protocol allows users to lock up ETH or BTC as collateral to mint MTR, the stablecoin. The protocol is built on Polkadot, but it’s designed to interact with those chains. Cross-chain functionality is still limited and not fully live yet.

Where can I buy STND?

STND is available on a few decentralized exchanges like PancakeSwap and SushiSwap. It’s not listed on major platforms like Coinbase or Binance. You’ll need a wallet like MetaMask and some ETH or BNB to trade for it. Be cautious - low liquidity means large price swings on small trades.

Sasha Wynnters

February 18, 2026 AT 07:33STND isn't a coin. It's a governance wrench in a machine nobody's sure still works. I love that. Most projects chase hype, but this? It's the quiet guy in the back who fixed the server at 3am while everyone else was posting memes. No splash, no influencer collabs, just code holding the line. That's art in crypto.

Remember when Ampleforth tried to rebase and everyone screamed "it's a rug pull"? STND learned from that. It didn't just copy the mechanism-it layered in collateral. That’s not innovation. That’s engineering.

People keep asking why the price is trash. Bro, it’s not supposed to be a trading pair. It’s the voting rights to a system that’s still alive after five bear markets. That’s like finding a diesel engine from 1987 that still runs on rainwater. You don’t sell the bolt. You protect the whole damn thing.

I’ve staked my STND. Not for profit. For principle. If this protocol dies, it dies because no one believed in the idea. Not because the code failed. And that’s sadder than any 99.8% drop.

They’re not hiding. They’re waiting. For the next crash. When every stablecoin tied to a bank account melts down, and the world realizes: maybe the answer wasn’t in a vault in Delaware. Maybe it was in a smart contract on Polkadot, quietly minting MTR while the rest of crypto screamed into the void.