The Ravana (RAVANA) crypto coin isn't another Bitcoin or Ethereum. It's a niche, high-risk token built on blockchain technology with a bold mission: to reshape decentralized finance by putting power back into the hands of everyday users. But here's the reality - if you're looking for a stable, widely traded cryptocurrency with strong market backing, Ravana isn't it. What you'll find instead is a project caught between ambition and obscurity, with wild price swings, almost no trading volume, and conflicting data across platforms.

What Ravana Actually Is

Ravana (RAVANA) is a DeFi-focused token, meaning it's designed to power decentralized financial tools like lending, staking, and governance - not just serve as a speculative asset. It launched sometime between 2021 and 2024, depending on which source you trust. The team behind it remains anonymous, which isn't unusual in crypto, but it does raise questions about accountability. The project operates under the RavanaX.org platform, which claims to connect users with real financial services, not just trading charts. Unlike many tokens that exist only to be bought and sold, Ravana was meant to be used. Holders can vote on future upgrades, earn rewards by staking their tokens, and use them to pay for services within the ecosystem. It’s built to work on both Ethereum and BNB Smart Chain (BEP20), giving it flexibility in how users interact with it.How Ravana Works - The Tech Behind It

Ravana uses a consensus mechanism called Proof of Authority (PoA). This means instead of miners solving complex math problems (like Bitcoin), a small group of pre-approved validators confirms transactions. It’s faster and cheaper than Proof of Work, but it’s also more centralized - which contradicts the whole idea of decentralization. Still, for a small project with limited resources, PoA makes sense. It also uses sharding - a technique that splits the blockchain into smaller parts to handle more transactions at once. This is smart. Most small tokens don’t even try to scale. Ravana’s developers clearly wanted to build something that could grow, not just survive. Smart contracts handle everything: staking rewards, governance votes, and even NFT integrations. These are self-executing codes on the blockchain that automatically trigger actions when conditions are met. For example, if you stake 10,000 RAVANA tokens, the contract will automatically send you rewards every week without a middleman.The Wild Price Discrepancies

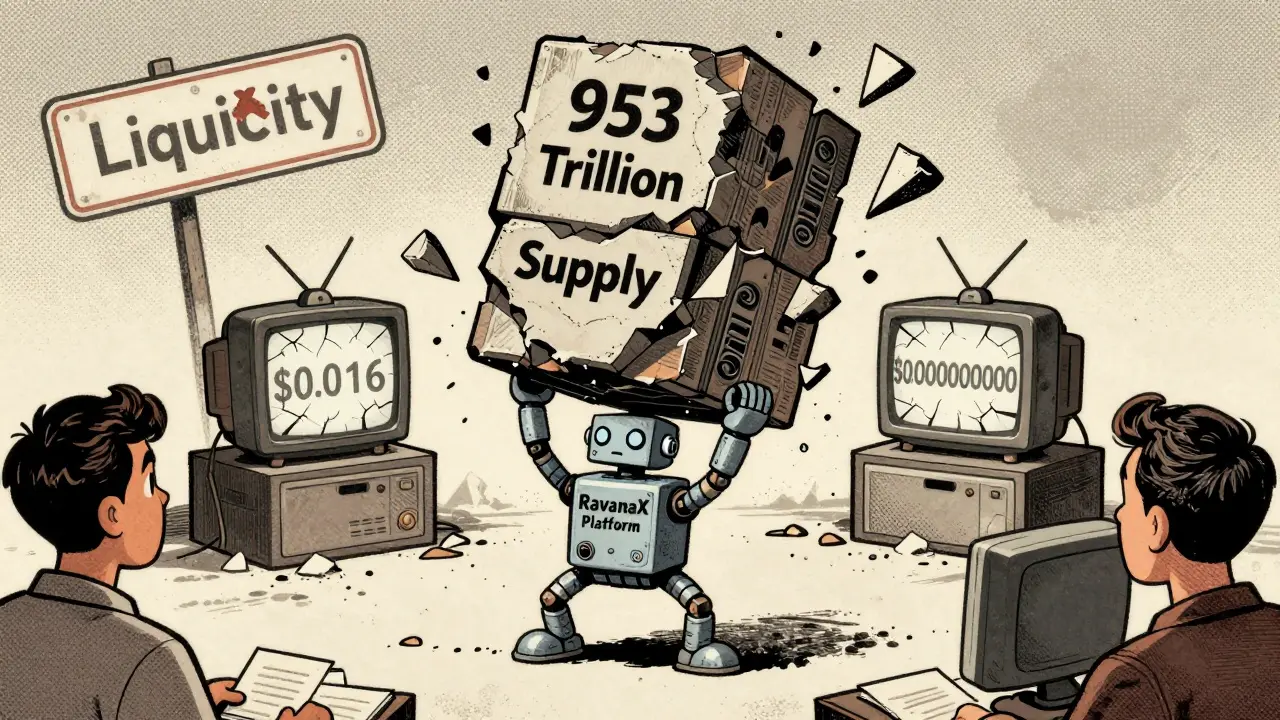

This is where things get confusing - and risky. On CoinPaprika, Ravana trades at around $0.016242. On Binance, it’s listed at less than $0.000001. Coinbase shows $0.0000000000. Crypto.com says it’s worth $0.00000000000000002495 - that’s 24 quintillionths of a dollar. These aren’t typos. They’re real numbers from major platforms. Why? Because Ravana isn’t listed on major exchanges like Binance or Coinbase in any meaningful way. Most of these price quotes come from tiny, obscure trading pairs on low-traffic exchanges. Some platforms may be showing outdated or fake data. Others might be listing tokens that aren’t even tradable. Trading volume tells the real story. CoinPaprika reports $13 to $42 in 24-hour volume. Binance says $0. Coinbase says $0. Crypto.com says no trading is available. That’s not a glitch - that’s a dead market. If you bought Ravana today, you’d likely have no way to sell it later. Liquidity is almost nonexistent.Supply Numbers That Don’t Add Up

Ravana’s token supply is one of the most bizarre parts of the project. CoinPaprika says the maximum supply is over 3.8 quadrillion tokens. Binance says the total supply is 953 trillion. That’s not a typo - it’s quadrillions and trillions. For comparison, Bitcoin has a max supply of 21 million. Ethereum’s supply is around 120 million. Ravana’s supply is so massive it’s practically meaningless. The circulating supply - the number actually in use - is listed as 953.65 billion tokens on CoinMarketCap. But Binance shows a circulating supply of zero. Again, conflicting data. This kind of inconsistency is a red flag. Either the project’s data is poorly maintained, or it’s not being audited at all.

What Can You Do With Ravana?

Despite the chaos, Ravana has three real use cases:- Governance: Holders can vote on proposals to change how the RavanaX platform works - like adding new features or adjusting staking rewards.

- Staking: Lock your RAVANA tokens to earn more. It’s not a guaranteed return, but it’s one of the few ways to get passive income from this token.

- Payments: The RavanaX platform claims to let users pay for services using RAVANA, though there’s no public list of merchants accepting it.

Is Ravana Still Active?

The project claims to be in “ongoing development.” The website RavanaX.org is live. It has a blog, a roadmap, and a Discord channel. But updates are rare. The last major announcement was in mid-2025. Community engagement is minimal. There are no verified developers posting on GitHub. No recent audits. No partnerships with other projects. It’s not dead - but it’s not thriving either. It’s in a holding pattern. The team hasn’t abandoned it, but they’re clearly not pushing it forward with urgency.How Ravana Compares to Other DeFi Tokens

Let’s put this in perspective. | Feature | Ravana (RAVANA) | Uniswap (UNI) | Aave (AAVE) | |--------|-----------------|---------------|-------------| | Launch Year | 2021-2024 | 2020 | 2020 | | Market Cap | $0-$39K | $4.1B | $1.9B | | 24-Hr Volume | $0-$42 | $210M | $180M | | Exchanges Listed | 2-3 minor | 50+ | 40+ | | Liquidity | Extremely low | High | High | | Active Development | Unclear | Yes | Yes | | Governance | Yes | Yes | Yes | Ravana sits in a completely different league. Uniswap and Aave are giants. They have teams of engineers, millions in funding, and millions of users. Ravana has a website and a handful of token holders.

Should You Buy Ravana?

If you’re looking for a long-term investment, the answer is no. The risks far outweigh any potential reward. You’re not investing in a company or a product. You’re betting on a token with no liquidity, no clear roadmap, and conflicting data. But if you’re a crypto hobbyist who likes to explore obscure projects, Ravana might be worth a tiny stake - say, $5 or $10 - purely as an experiment. Treat it like a lottery ticket. Don’t expect to cash out. Don’t assume it will grow. Just see what happens. There’s a chance - slim as it is - that the team wakes up, secures funding, lists on major exchanges, and rebuilds the ecosystem. But that’s not a strategy. That’s a prayer.Where to Track Ravana

If you still want to follow it, here are the only reliable places:- RavanaX.org - The official site. Check for updates.

- BSCScan - Look up the RAVANA contract on the BNB Smart Chain. See transaction history.

- CoinPaprika - The only platform showing any consistent price and volume.

Final Reality Check

Ravana (RAVANA) isn’t a scam. It doesn’t have a white paper full of buzzwords and empty promises. It has a real blockchain, real smart contracts, and a real mission: to build a community-driven DeFi platform. But it also has no users, no liquidity, no traction, and no clear path forward. It’s a project stuck in limbo - ambitious in theory, invisible in practice. If you’re curious, explore it. But don’t invest. Don’t expect returns. Don’t believe the hype. This isn’t the next big thing. It’s a quiet experiment - one that might never wake up.Is Ravana (RAVANA) a real cryptocurrency?

Yes, Ravana is a real token built on blockchain networks like Ethereum and BNB Smart Chain. It has a smart contract, a website, and a listed supply. But it lacks liquidity, exchange listings, and user adoption - making it functionally inactive in most practical senses.

Can I buy Ravana on Coinbase or Binance?

No, Ravana is not listed on Coinbase or Binance as a tradable asset. Some platforms may show fake or outdated price data, but you cannot buy or sell Ravana on these major exchanges. It only trades on a few tiny, obscure platforms with almost no volume.

Why do prices for Ravana vary so much?

The extreme price differences - from $0.016 to $0.00000000000000002495 - happen because Ravana is traded on unverified, low-traffic exchanges. Some platforms may be pulling data from inactive pairs or using manipulated feeds. There’s no centralized pricing mechanism, and with almost no trading, prices are meaningless.

Is Ravana a good investment?

No, Ravana is not a good investment. It has near-zero liquidity, no trading volume, and no clear development roadmap. The chances of it gaining value are extremely low. If you buy it, treat it as a speculative experiment - not a financial decision.

What is the RavanaX platform?

RavanaX.org is the official platform associated with the RAVANA token. It claims to offer DeFi services like staking, governance, and payments. However, there’s no public evidence of active users or functioning services beyond the website and token contract.