When you hear about a new crypto coin promising an AI assistant that runs on blockchain, it’s easy to get excited. But when you dig into Nexa (NXA), things get messy fast. The project claims to build a decentralized AI ecosystem that rewards users with real-time insights - but the data tells a different story. As of July 2025, NXA trades at around $0.64, down from its all-time high of $1.10 just weeks earlier. Its 24-hour trading volume is barely over $26,000, and its market cap is less than $10 million. That’s tiny compared to real AI crypto projects like Fetch.ai or SingularityNET, which together hold over $12 billion in value. So what’s really going on with Nexa?

What Is Nexa (NXA) Actually Built On?

Nexa isn’t its own blockchain. It’s an ERC-20 token built on Base, which is Ethereum’s Layer-2 network. That means it uses Ethereum’s security but with lower fees and faster transactions. The contract address is0xbe1518af2419b8ead1fbca138a676d559fedb51d, and it’s verified on multiple platforms like CoinMarketCap and LiveCoinWatch. This isn’t a red flag by itself - many tokens operate this way. But here’s the problem: Nexa doesn’t have a working product. There’s no public AI assistant. No API. No demo. Just a website (nexaagent.xyz) with vague promises about "autonomous self-enhancing systems" and "community-driven rewards."

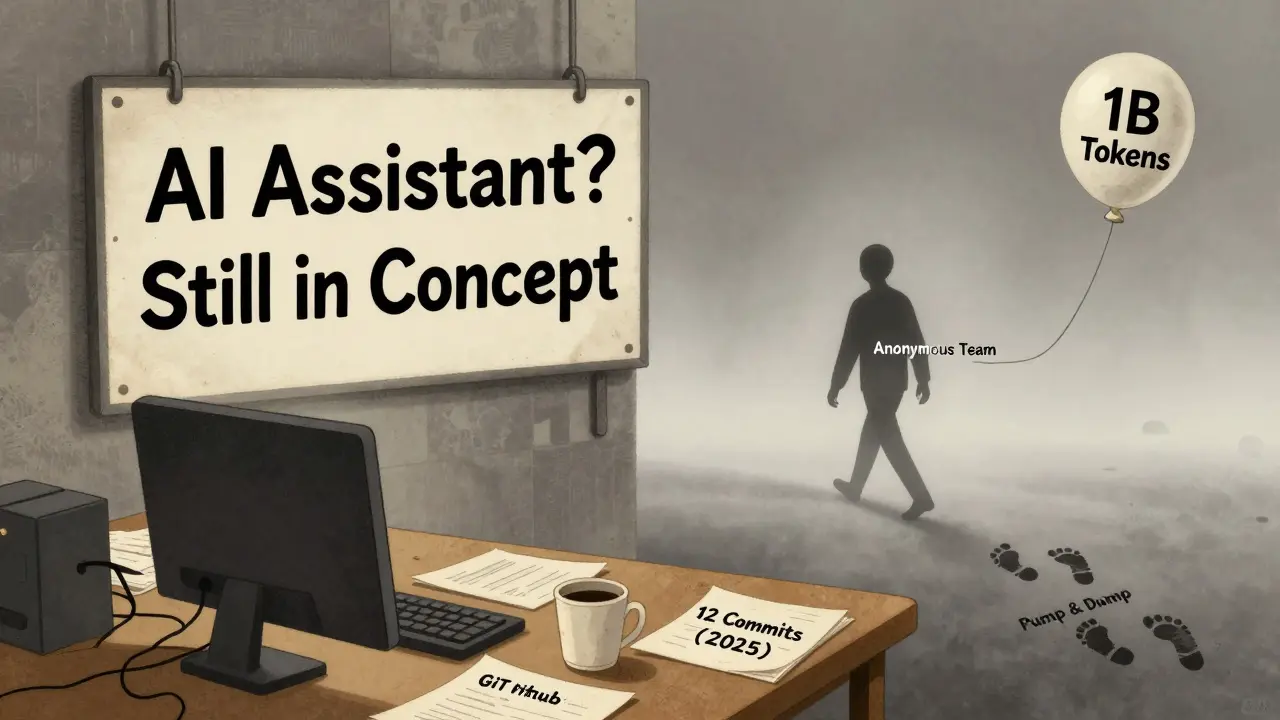

The project claims its token powers an AI assistant that learns from user behavior and gives trading tips. But if that assistant existed, you’d see it in action. You’d see logs. You’d see users sharing results. Instead, GitHub shows only 12 commits across three repositories - all from early 2025. No updates since then. No code improvements. No bug fixes. That’s not how real AI projects operate.

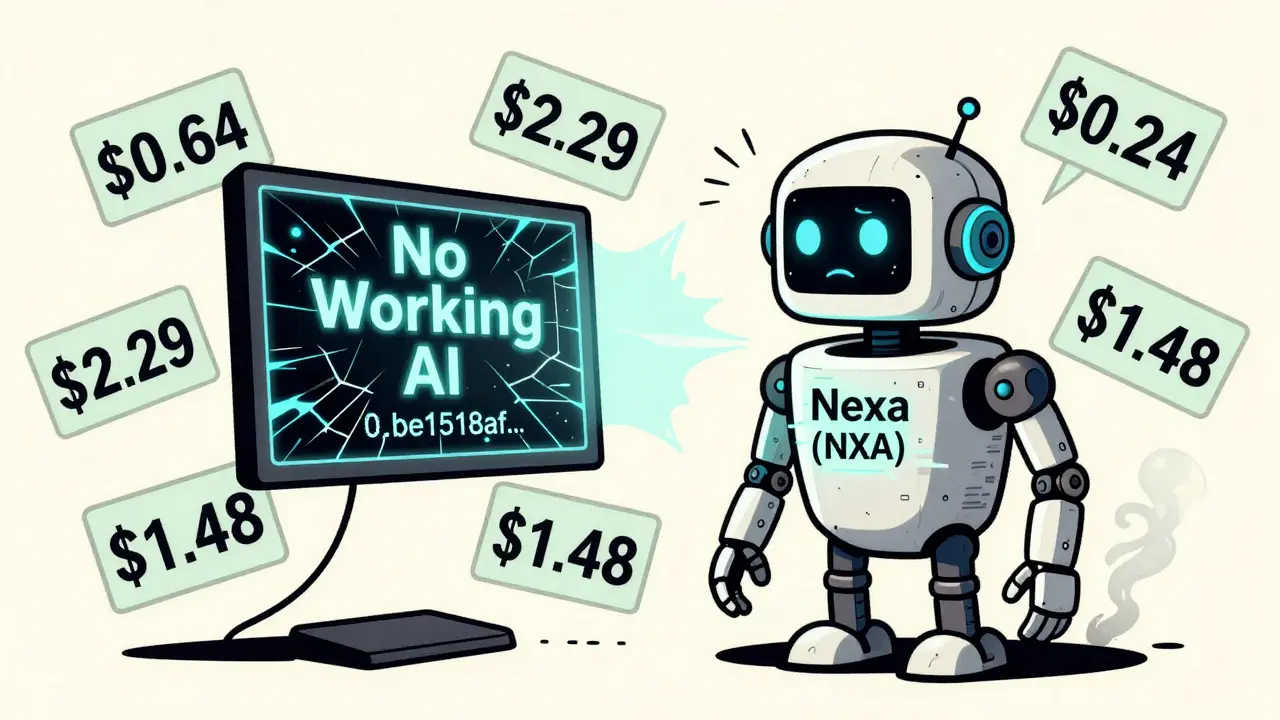

Price Chaos: Why Does NXA Cost $0.64 on One Site and $2.29 on Another?

This is where Nexa gets suspicious. Different exchanges report wildly different prices:- CoinGecko: $0.6427

- CoinMarketCap: $0.8212

- Lbank: $1.76

- Coinpedia: $2.29

- LiveCoinWatch: $1.48

Supply and Circulation: Where Are All the Tokens?

Nexa has a fixed total supply of 1 billion NXA tokens. No more will ever be created. That’s good - no inflation risk. But here’s the catch: only 10 million tokens are in circulation, according to CoinMarketCap. That’s just 1% of the total supply. Where are the other 990 million? No one knows. The project doesn’t disclose vesting schedules, team allocations, or treasury details. That’s unusual. Most legitimate projects reveal at least basic tokenomics upfront. Some sites call NXA "deflationary," but there’s no proof of burning mechanisms, buybacks, or fee structures that reduce supply. Without clear rules, "deflationary" is just marketing noise.

Where Can You Buy NXA? And Should You?

You can buy NXA on two places:- XT.COM - This is the main exchange, handling over 100% of the 24-hour volume (yes, over 100% - meaning some volume is likely duplicated or inflated).

- Uniswap v3 on Base - You can trade it directly using a wallet like MetaMask, but only if you’ve switched your network to Base.

- Install MetaMask or a similar wallet.

- Switch your network to Base.

- Deposit ETH or USDC on Base.

- Connect to Uniswap and search for NXA using the contract address.

Who’s Behind Nexa? And Why Does It Matter?

Anonymous teams aren’t always bad. But when a project makes bold claims - "AI-powered crypto assistant," "self-enhancing ecosystem" - you expect proof. Nexa gives none. No founders. No developers. No advisors listed. No past projects. No interviews. No GitHub commits beyond 2025. That’s not anonymity - it’s secrecy. Compare that to Fetch.ai, which has a team of PhDs from Cambridge and MIT, published research papers, and partnerships with Bosch and Samsung. Or SingularityNET, which has been around since 2017 and has real AI agents running on its network. Nexa has none of that. It’s a concept on a website. Not a company. Not a product. Not even a prototype.

The Bigger Picture: Is Nexa Part of a Bigger Trend?

AI crypto projects exploded in 2025. The sector grew 347% in market cap. But out of hundreds of new coins, only a handful survived. Most were abandoned within months. Nexa is one of them. It’s not that the idea is bad. A personal AI assistant that analyzes crypto markets could be useful. But building that requires:- Real machine learning models

- Access to live market data

- Security audits

- Testing with real users

- Transparent team

Is Nexa a Scam?

Not necessarily. It might be an abandoned project. Or a poorly executed one. But it’s definitely high-risk. Here’s why:- Price inconsistencies across exchanges suggest manipulation.

- No development activity since early 2025.

- Zero transparency about team or token allocation.

- No real product, just promises.

- Minimal user base - only 9,210 holders total.

- Trading volume is tiny - $26,000 per day.

What Should You Do?

If you’re curious:- Don’t invest money you can’t afford to lose.

- Don’t trust price charts - they’re unreliable.

- Don’t believe marketing claims without code, demos, or team info.

- Don’t follow hype. Follow progress.

- Fetch.ai (FET) - Real AI agents trading on-chain.

- SingularityNET (AGIX) - Decentralized AI marketplace with real users.

- Render Token (RNDR) - GPU power for AI rendering, used by studios.

Is Nexa (NXA) a real cryptocurrency or just a meme coin?

Nexa is technically a real cryptocurrency because it has a token contract, a blockchain address, and trades on exchanges. But it lacks the core features of a legitimate project: a working product, transparent team, or verifiable development. It behaves more like a meme coin - driven by speculation, price manipulation, and hype - rather than utility or innovation.

Can I mine or stake NXA tokens?

No, you cannot mine or stake NXA. It’s an ERC-20 token on Base, which means it doesn’t have its own consensus mechanism. There are no staking programs, yield farms, or mining rewards tied to the token. Any site claiming to offer staking for NXA is likely a scam.

Why do different exchanges show different prices for NXA?

The price differences come from inconsistent reporting, fake volume, and possibly pump-and-dump schemes. Some exchanges may list inflated prices to attract buyers, while others report accurate data. CoinGecko and RootData’s numbers are closer to reality - around $0.64. The higher prices on Lbank or Coinpedia are likely artificial and not backed by real trading activity.

Is Nexa listed on major exchanges like Binance or Coinbase?

No, Nexa is not listed on Binance, Coinbase, Kraken, or any other major exchange. It only trades on smaller platforms like XT.COM and Uniswap v3 on Base. This limits liquidity and makes it harder to buy or sell large amounts without moving the price.

Does Nexa have a working AI assistant?

No, there is no working AI assistant. The project’s website and marketing materials describe one, but there’s no demo, no app, no API, and no user testimonials proving it exists. GitHub shows no code related to AI functionality. Without a product, the AI claim is just a marketing tactic.

What’s the safest way to buy NXA if I still want to try?

If you insist on buying NXA, use Uniswap v3 on Base network with a trusted wallet like MetaMask. Never send funds to a website claiming to sell NXA directly. Only use the official contract address: 0xbe1518af2419b8ead1fbca138a676d559fedb51d. Buy the smallest amount possible - treat it as a gamble, not an investment.

Is Nexa regulated or approved by any financial authority?

No, Nexa is not regulated or approved by any financial authority like the SEC, FCA, or MAS. As an ERC-20 token on Base, it falls under the same regulatory gray area as most utility tokens. There’s no legal oversight, no investor protection, and no compliance reporting. You’re on your own.