MTO Value Calculator

Calculate the current value of your MTO tokens or how many tokens you can purchase with your funds. Note: Current price is based on December 2025 market data.

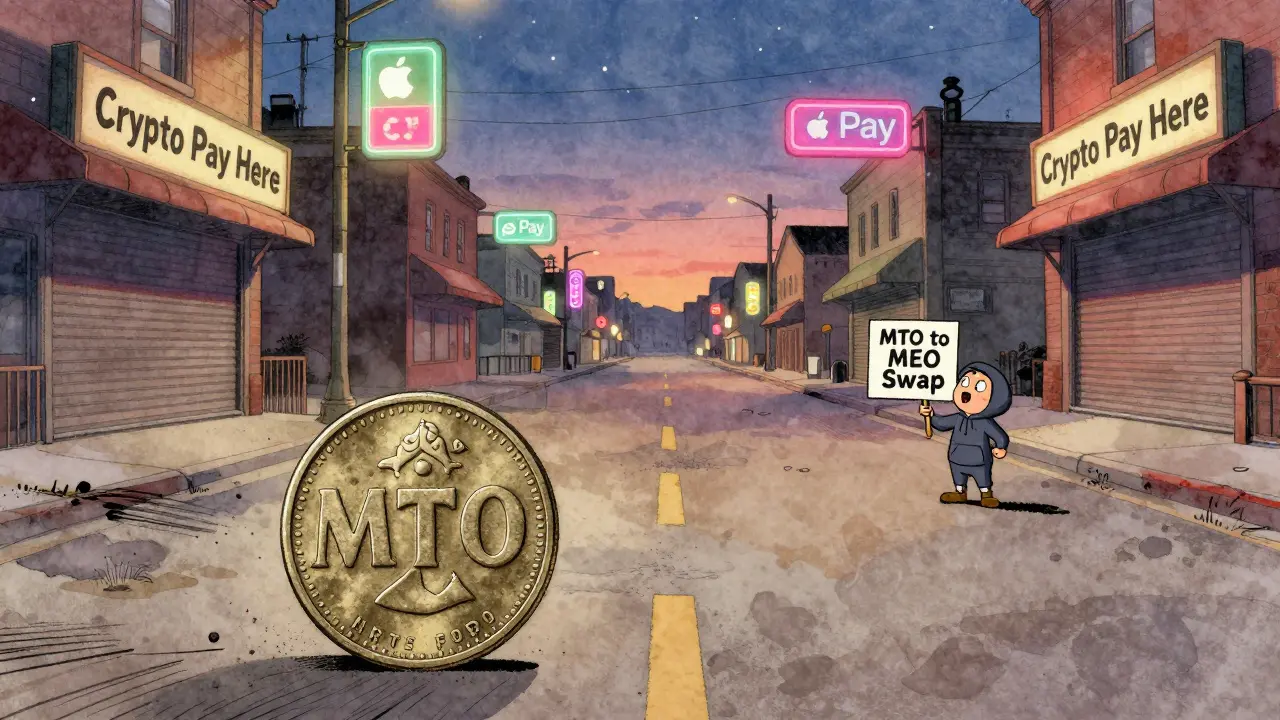

Merchant Token (MTO) isn’t just another crypto coin. It was built to solve a real problem most people don’t even know exists: how do you make crypto payments safe at a physical store? If you’ve ever bought something with Bitcoin and then had a dispute over a defective product, you know there’s no way to get your money back. Credit cards have chargebacks. PayPal has buyer protection. Crypto? Nothing. MTO tries to fix that.

What Exactly Is Merchant Token (MTO)?

MTO is a utility token created by the HIPS Merchant Protocol (HMP) team. It runs on the Ethereum blockchain as an ERC-20 token, meaning you can store it in any wallet that supports Ethereum, like MetaMask or Trust Wallet. But its purpose isn’t to be a store of value or a speculative asset. It’s designed to power a payment system that lets merchants accept crypto on regular point-of-sale (POS) terminals - the same ones you see in grocery stores and gas stations.

The core idea is simple: use blockchain to bring consumer protections like chargebacks and dispute resolution to crypto payments. That’s unusual. Most crypto projects celebrate irreversibility. MTO says, "Wait, what if customers need to return items?" And that’s where it stands out.

How Does MTO Work in Real Life?

Imagine walking into a small shop. The cashier swipes your card. Instead of pulling money from your bank, they’re pulling it from your crypto wallet. Behind the scenes, MTO triggers a smart contract that locks the payment until the transaction is confirmed. If you’re unhappy with the product, you can open a dispute through the merchant’s app. A decentralized panel of validators reviews the case. If it’s valid, your money gets returned - just like a credit card chargeback.

This system runs on the HIPS Merchant Blockchain (MEO), which is still in testnet. Right now, MTO is a bridge token. Once the MEO mainnet launches, MTO will be replaced by MEO coins, the native token of the new blockchain. MEO is built to speak the same language as old-school payment systems like ISO8583, so it can plug right into existing terminals without needing new hardware.

Current Price and Market Data (December 2025)

As of December 2025, MTO’s price is around $0.04. That’s down over 94% from its all-time high of $0.841 in November 2023. Across exchanges, prices vary slightly:

- Cryptorank.io: $0.0486

- Blockspot.io: $0.0395

- Livecoinwatch: $0.0392

The market cap hovers between $2.1 million and $2.9 million. That’s tiny compared to Bitcoin’s $1.2 trillion or even smaller payment coins like Litecoin ($7 billion). Trading volume is even worse - often under $2,500 in 24 hours. Some platforms report $0 volume. That means almost no one is buying or selling MTO right now.

There are about 56 million MTO tokens in circulation out of a max supply of 100 million. Only around 53,000 wallets hold MTO. For comparison, Bitcoin has over 100 million holders.

Why Is MTO So Low in Value?

There are two big reasons: lack of adoption and lack of trust.

First, no major retailer uses MTO. You won’t find it at Walmart, Target, or even small independent shops. Without real-world use, the token has no utility beyond speculation. And when speculation dies, so does the price.

Second, the crypto community is split on consumer protection. Purists believe transactions should be final - that’s the whole point of blockchain. MTO’s chargeback system feels like trying to bring Visa rules to Bitcoin. Critics say it undermines decentralization. Supporters say it’s the only way regular people will ever use crypto to buy coffee.

There’s also no strong community. No Reddit threads. No big influencers talking about it. No case studies. Just a website and a whitepaper.

How Is MTO Different from Other Crypto Payment Coins?

Most crypto payment coins focus on speed, low fees, or scalability. Bitcoin is slow. Litecoin is faster. Ripple targets banks. Solana and Stellar aim for global payments. But none of them offer chargebacks.

MTO is the only one trying to solve the consumer protection gap. That’s its niche. But it’s also its weakness. If you’re a merchant, why switch to a system that requires extra steps for refunds? If you’re a buyer, why use crypto if you still have to file a dispute? It adds complexity.

Compare that to Apple Pay or Google Pay. They already have chargebacks built in. They’re fast. They’re trusted. MTO has to beat that - and right now, it’s not even close.

Is MTO a Good Investment?

If you’re looking for a safe bet, no. The price drop from $0.84 to $0.04 is brutal. The trading volume is too low to exit easily. You could buy MTO, but selling it later might take days - or you might not find a buyer at all.

If you believe in the idea - that crypto needs consumer protection to go mainstream - then maybe. But belief alone doesn’t pay bills. The project has been in development since 2022. It’s still on testnet. The mainnet launch has been delayed multiple times. There’s no timeline.

And remember: MTO will be replaced by MEO. So even if you hold MTO now, it may become worthless once the new chain goes live. You’ll need to swap it manually. No one guarantees that process will be smooth.

Who Is Behind Merchant Token?

The team behind MTO is anonymous. There’s no LinkedIn profiles. No public founders. The project is led by the HIPS Merchant Protocol team, which publishes updates on merchanttoken.org. That’s not uncommon in crypto, but it doesn’t inspire confidence either. When a project has no team identity, it’s hard to know who to hold accountable if things go wrong.

The roadmap shows stages: Pre-MVP, MVP, Alpha (Heimdall), Beta, Testnet (MEO), and planned Mainnet. They’ve hit most of these, but the pace is slow. No major partnerships have been announced. No integrations with payment processors like Stripe or Square.

Should You Use MTO?

For consumers: Only if you’re experimenting. Don’t use it to pay for groceries or rent. The risk of being stuck with a bad transaction is real.

For merchants: Only if you’re testing new tech and have technical resources. Integrating MTO means dealing with smart contracts, wallet setups, and dispute panels. It’s not plug-and-play like PayPal.

For investors: High risk, low reward. The token has no liquidity. The project is unproven. The market doesn’t care. If you’re betting on a bull market comeback, you’re betting on hope - not data.

What’s Next for MTO?

The only real path forward is the MEO mainnet launch. If it works, and if merchants actually adopt it, MTO could become valuable as a bridge token. But if the mainnet fails, or if no one uses it, MTO will fade into obscurity - just like thousands of other crypto tokens.

The big question isn’t whether MTO can work. It’s whether anyone will ever care enough to make it work.

Kathy Wood

December 11, 2025 AT 20:43MTO is a scam dressed up as innovation-chargebacks on blockchain? LOL. You might as well put a PayPal button on a Bitcoin ATM.

Sarah Luttrell

December 11, 2025 AT 22:43Of course it’s low. America doesn’t need another crypto project that tries to fix problems that don’t exist. We’ve got Apple Pay. We’ve got Venmo. We don’t need blockchain to refund our overpriced lattes. 🤡

Patricia Whitaker

December 12, 2025 AT 09:37Someone actually wrote a 2000-word essay on this? Bro. It’s a dead coin with zero liquidity. The fact that you’re still talking about it means you’re either a dev trying to pump it… or you’re just bored.

Ian Norton

December 13, 2025 AT 10:55The real issue isn’t chargebacks-it’s that no one trusts anonymous teams to manage them. If the HIPS team can’t even put a face to their name, why should I believe their smart contracts won’t vanish next week?

Steven Ellis

December 14, 2025 AT 04:19I appreciate the attempt to solve a real problem-crypto’s lack of consumer protection-but MTO’s execution is a mess. Low volume, no adoption, no roadmap clarity. It’s like building a luxury car with no engine. The design looks good, but you can’t drive it. And now? The battery’s dead.

Jeremy Eugene

December 15, 2025 AT 21:34While I respect the theoretical framework behind MTO, the practical implementation remains deeply flawed. The absence of institutional partnerships, combined with negligible trading volume, renders the token functionally inert. Until real-world merchant integration occurs, it remains a thought experiment.

amar zeid

December 16, 2025 AT 18:36Let’s be real: crypto needs consumer protections, but MTO isn’t the answer. Why not integrate with existing systems like Stripe’s crypto payments? They already handle chargebacks. Why reinvent the wheel with a broken axle?

Alex Warren

December 18, 2025 AT 15:57Market cap under $3M with 56M tokens in circulation? That’s not a coin. That’s a spreadsheet with delusions of grandeur.

Taylor Fallon

December 19, 2025 AT 19:01It’s funny how people say blockchain is about trustless systems… then cry when there’s no chargeback. You can’t have your cake and eat it too. MTO is trying to make crypto safe for people who don’t understand crypto. That’s not innovation-that’s compromise.

Taylor Farano

December 21, 2025 AT 01:46Oh wow, a crypto project that’s *actually* trying to make things worse? Groundbreaking. Next they’ll add a 3-day waiting period for refunds and call it "decentralized due diligence." 😂

Scot Sorenson

December 21, 2025 AT 03:13So the team’s anonymous, the token’s worthless, and the mainnet’s been delayed for three years… but you’re still holding? You’re not an investor-you’re a martyr for a cause that died in 2023.

Claire Zapanta

December 22, 2025 AT 09:32Did you know the HIPS team is linked to a shell company registered in the Caymans? And the whitepaper’s written in the same style as the 2017 ICO scams? This isn’t innovation-it’s a rebrand of a failed Ponzi. The US government is already watching.

Kurt Chambers

December 24, 2025 AT 02:03Think about it… blockchain was supposed to remove middlemen… but MTO adds a whole new layer: dispute panels, validators, smart contracts… it’s like putting a GPS on a horse. You don’t need it. You just need to ride.

Kelly Burn

December 25, 2025 AT 02:08Y’all are missing the point 😔 MTO is the bridge… the *emotional* bridge… between crypto purists and grandma who just wants to buy groceries without getting scammed. It’s not about tech-it’s about humanity 💙

Jessica Petry

December 26, 2025 AT 14:39Only a person who believes in fairy tales would think a token with $2k daily volume and zero real-world use cases has any future. This isn’t investing. This is volunteering for financial suicide.

Hari Sarasan

December 27, 2025 AT 13:35Let’s dissect the architectural paradigm: MTO’s ERC-20 foundation introduces latency in settlement velocity, while the dispute resolution mechanism via decentralized validators creates a Byzantine fault tolerance overhead that’s antithetical to the atomic settlement ethos of blockchain. Moreover, the liquidity vacuum-coupled with negligible wallet distribution-indicates a structural collapse in network effects. The MEO transition is not an upgrade-it’s a funeral procession.

Lloyd Cooke

December 29, 2025 AT 03:29Is MTO a solution… or a symptom? We live in a world where we demand both absolute freedom and absolute safety. We want crypto’s decentralization… but Visa’s safety net. MTO is the tragic compromise of a generation that doesn’t know what it wants. Maybe the real question isn’t whether MTO works… but whether we’re ready to live with the consequences of our contradictions.

Sue Gallaher

December 29, 2025 AT 12:22Why are we even talking about this? It’s dead. Move on. There’s 10k other coins trying to do the same thing and at least 5 of them have actual merchants using them. This is just crypto graveyard bait

Taylor Fallon

December 31, 2025 AT 10:30You know what’s more ironic than MTO’s chargeback system? The fact that the people who hate it the most are the same ones who say "crypto is money"… but then panic when they can’t get their money back. So… is it money or is it a gamble?

Steven Ellis

January 2, 2026 AT 09:12Exactly. That’s the core contradiction. Crypto purists want finality, but consumers want recourse. MTO is trying to bridge that gap, but it’s like trying to make a sailboat into a speedboat by adding a jet engine. It doesn’t work unless the hull was built for it. And right now, the hull is rotting.

Jeremy Eugene

January 3, 2026 AT 22:33It’s worth noting that even traditional payment processors are beginning to explore blockchain-based dispute resolution. The market may not be ready for MTO today, but the demand for transparent, auditable consumer protections in digital transactions is growing. The timing may be wrong, but the need is real.