Hummingbird Finance (Old) - known by its ticker HMNG - wasn’t just another crypto coin. It was a mirror of a broken promise. Launched on April 12, 2021, it promised holders automatic USDT rewards just for owning the token. No staking. No locking. No effort. Just hold, and get paid. But behind that simple pitch was a design doomed to fail. Today, HMNG is nearly worthless, abandoned by its creators, and remembered as a cautionary tale in crypto.

How HMNG Was Supposed to Work

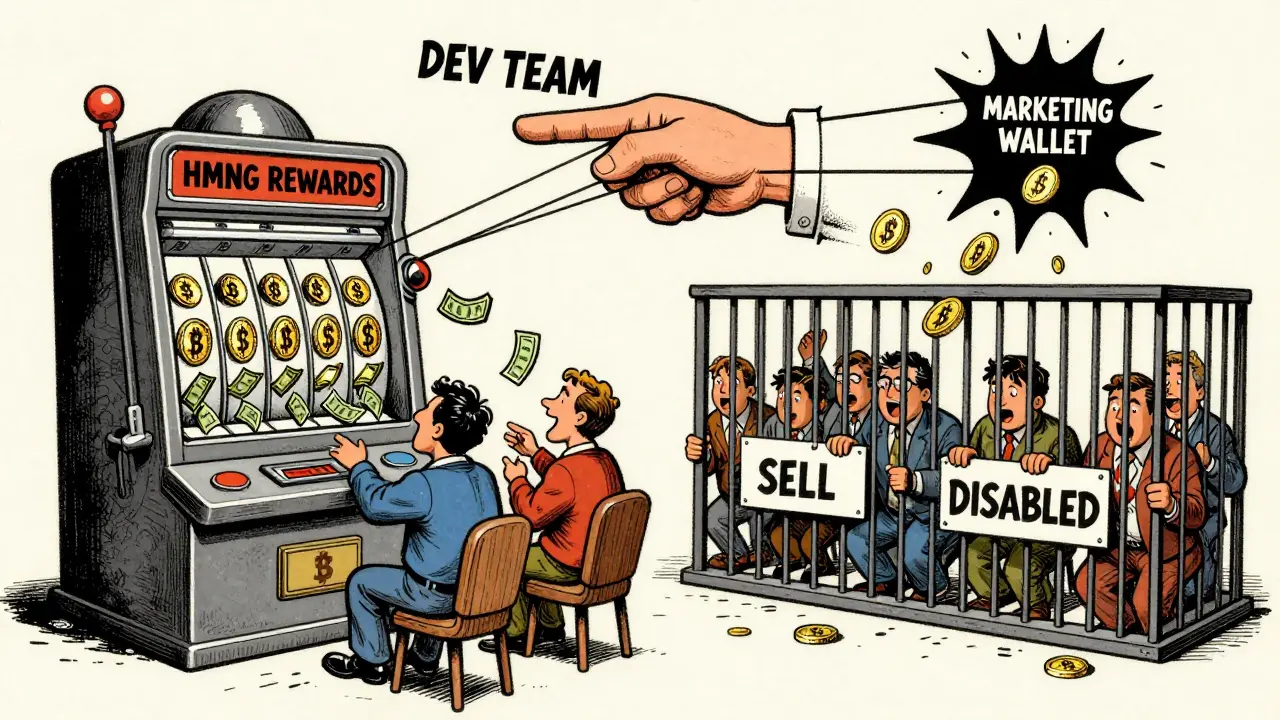

Hummingbird Finance (Old) ran on the Binance Smart Chain as a BEP-20 token. Its core idea was built on the same model as SafeMoon and RFI: take a small cut from every trade and redistribute it to holders. HMNG’s fee structure was 3% total - split into three parts:

- 1% went to USDT rewards for all holders

- 1% went to marketing (paid to a wallet controlled by the team)

- 1% went to a liquidity pool to supposedly stabilize the price

That sounds fair. But here’s the catch: the 1% USDT reward didn’t come from profits. It came from your fellow traders. Every time someone sold HMNG, a tiny slice of their sale was split among everyone holding the coin. The more people traded, the more rewards you got. But if trading dropped? Your rewards vanished.

The token had a fixed supply of 100 trillion HMNG. That’s a huge number - designed to make the price look tiny and encourage buying. But it also meant every single transaction, no matter how small, had to generate enough volume to keep the reward system alive. And that’s where it fell apart.

The Hidden Flaws in the Code

On paper, HMNG looked like an upgrade over SafeMoon’s 10% fee. But the real danger wasn’t the fee - it was what the developers could do behind the scenes.

According to security audits from GoPlus, the contract allowed the original team to:

- Disable selling for any wallet

- Change transaction fees at will

- Mint new tokens anytime

- Transfer ownership of the marketing wallet

In plain terms: the team had full control. And they used it.

In August 2021, after the initial hype faded, the developers disabled selling for retail holders. Suddenly, people who bought HMNG during the pump couldn’t sell. Their coins were trapped. Meanwhile, early investors and insiders had already cashed out. This wasn’t an accident - it was a honeypot.

Another red flag: the marketing wallet received 100% of the 1% marketing fee with no public tracking. No reports. No receipts. No transparency. CryptoSherlock’s 2021 analysis called it a “black hole” - money went in, but no one ever saw where it went.

Why the Rewards Never Materialized

Users were promised USDT rewards. But many never received them. On Reddit, users like u/DeFi_Disaster reported holding over 27 quadrillion HMNG tokens - and getting $0 in USDT for months. Why?

The smart contract didn’t automatically send USDT to wallets. It recorded rewards as a balance inside the token. To claim them, you had to trigger a transaction - which cost gas fees. By late 2021, gas fees on BSC were around $0.35 per transaction. At that point, HMNG was worth less than $0.00000002 per token. To claim $1 in USDT rewards, you’d need to sell or trade over 50 million HMNG just to cover the gas cost. It was mathematically impossible.

Plus, when holders did receive USDT, most sold it immediately. That created more selling pressure. And more selling meant less volume. Less volume meant fewer rewards. It was a death spiral.

What Happened to the Price?

At its peak in April 2021, HMNG hit a $1.2 million market cap. By December 2024, it briefly climbed to $0.0847 - a 68.6% drop from that high. But by February 2026, the price hovered around $0.0814. Sounds stable? Think again.

On CoinPaprika, HMNG was listed at $0.00000000. That’s because its value had collapsed so far that exchanges stopped tracking it. CoinMarketCap still listed it at #7326 with a $92,800 market cap - but that’s based on a circulating supply of 70 trillion tokens. KuCoin, however, reported 37.81 quadrillion tokens in circulation. The numbers don’t match. Why? Because no one knows how many tokens are really out there. The contract could have minted more at any time.

The fully diluted valuation (FDV) was around $132,570 - meaning if all 100 trillion tokens were traded, the total value would barely reach $133k. That’s less than the market cap of a single decently sized NFT collection.

The Community Faded - Fast

At launch, HMNG had an active Telegram group with 12,000 members. By October 2021, it was dead. The official website, hummingbirdbsc.org, stopped updating. Its support page returned 404 errors. The whitepaper? Three pages of vague promises with zero technical details. CoinCodex gave it a 1.2/10 for documentation.

Trustpilot had 42 one-star reviews. Reddit threads filled with users asking, “Where are my USDT rewards?” The most-upvoted comment on CoinGecko said: “HMNG V1 was a classic honeypot - early buyers could sell, but retail got trapped.” It got over 1,200 upvotes.

There were no real developers. No roadmap. No updates. Just silence.

Why HMNG Failed - The Bigger Picture

Hummingbird Finance wasn’t unique. In 2021, over 2,000 reflection tokens launched on BSC. They all shared the same fatal flaw: they relied on new buyers to pay rewards to old holders. It’s a Ponzi structure dressed up as DeFi.

Dr. Evelyn Torres from Delphi Digital put it simply: “Reflection tokens face an impossible trilemma - sustainable rewards need either endless growth, constant buying pressure, or central control. None are possible long-term.”

When the crypto market turned bearish in 2022, HMNG had no utility, no product, no community, and no trust. Its only “feature” - automatic rewards - became its downfall. No one wanted to buy a coin that only paid you in a currency you couldn’t claim without losing money.

Even worse, the SEC began cracking down on reflection tokens in mid-2021. Chair Gary Gensler called them “likely unregistered securities.” That sent shockwaves through the entire sector. Trading volume for HMNG dropped from $2,150 a day to near zero within 18 months.

What’s Left of HMNG Today?

As of February 2026, the original HMNG token is dead. No one is developing it. No one is marketing it. No one is even talking about it.

There’s a “Hummingbird Finance (New)” on CoinMarketCap - but it’s a completely different token with a new contract, new team, and new tokenomics. The old one? It’s a ghost.

If you still hold HMNG, you’re holding a token with almost no value. You can’t sell it easily. You can’t claim rewards. And there’s no hope of recovery.

Hummingbird Finance (Old) didn’t fail because it was poorly marketed. It failed because its entire economic model was mathematically unsound. It promised something it could never deliver - and when the hype faded, the truth came out: you weren’t earning rewards. You were funding the team.

Lessons from HMNG

HMNG teaches three hard truths:

- Never trust a token that pays rewards without utility. If the only value is “buy and get paid,” it’s a trap.

- Check the contract. If the team can disable sells, change fees, or mint tokens - walk away.

- Gas fees matter. If claiming your reward costs more than the reward itself, you’re being played.

HMNG didn’t just vanish. It was designed to vanish. And it did - exactly as planned.