Ecuador Remittance Cost Calculator

The article reveals Ecuador's unique crypto landscape: while crypto trading is legal and unregulated, traditional remittance services charge high fees. Using crypto can save you up to 90% on international transfers.

Traditional Remittance

Crypto Remittance

Savings

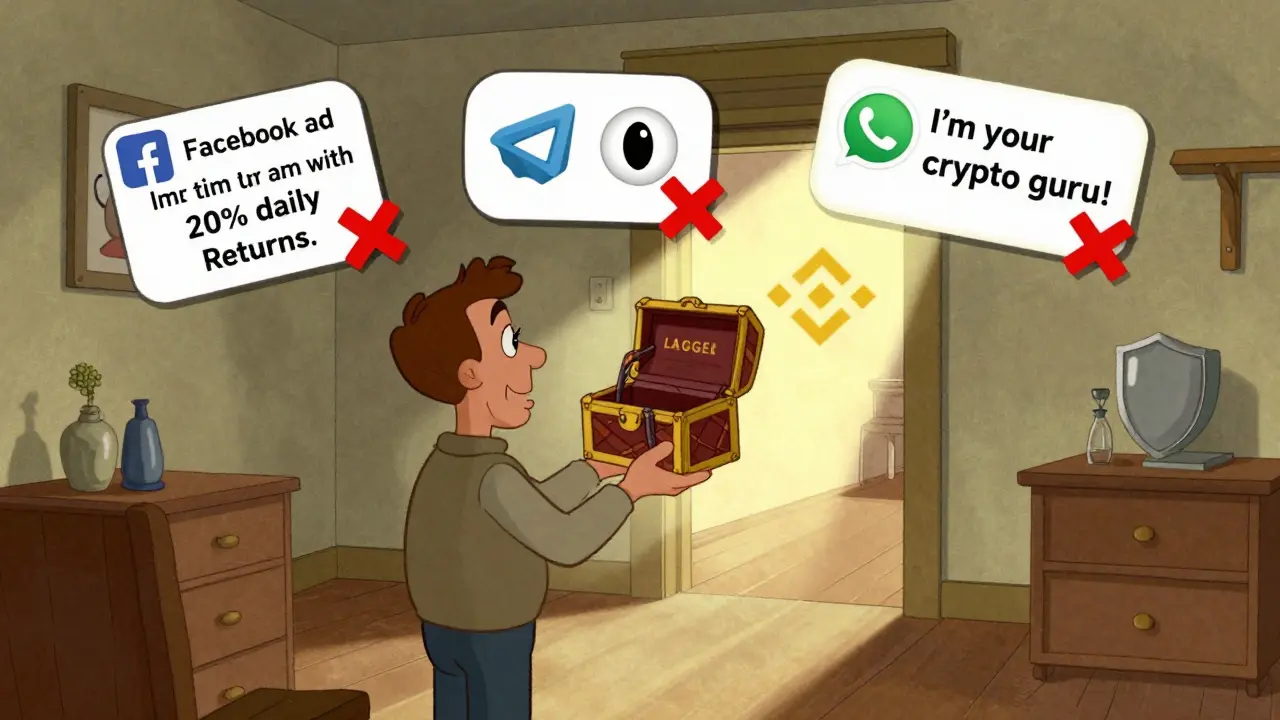

1 in 7 Ecuadorians lose money to crypto scams. Always use verified platforms like Binance P2P, enable 2FA, and never send crypto directly to unknown addresses. Scams are the real risk—not the law.

When you hear the words underground crypto market, you might picture shadowy deals in back alleys, cash-for-Bitcoin handoffs, or secret Telegram groups trading in silence. But in Ecuador, the reality is far more ordinary-and far more telling.

Ecuador doesn’t have an underground crypto market in the way most people imagine. There’s no black market network, no known crackdowns on illegal crypto traders, no leaked police raids on hidden crypto farms. Instead, what exists is a quiet, legal, and growing crypto economy that operates right under the government’s nose-because the government, for now, has chosen to look away.

Why There’s No Official Underground Market

In 2018, Ecuador banned private cryptocurrencies, hoping to push people toward its own failed state-backed digital currency, the DCE. That project vanished within months. But instead of doubling down on control, the government quietly reversed course. By 2023, officials confirmed: buying, selling, and holding Bitcoin or Ethereum is not illegal. You won’t go to jail for owning crypto. You won’t be fined for trading it. The law doesn’t protect you-but it also doesn’t punish you.

This legal gray zone is the real story. It’s not about crime. It’s about indifference. The Central Bank of Ecuador doesn’t regulate crypto. The tax office doesn’t track it. The financial watchdogs don’t monitor wallets. And because of that, thousands of Ecuadorians trade without fear-using platforms that are fully legal, but operate in a space where no one is watching closely enough to enforce rules.

How People Actually Trade Crypto in Ecuador

Most Ecuadorians don’t use underground methods. They use Binance P2P, Bit2Me, and LocalCoinSwap. These are global platforms, but they’ve adapted to Ecuador’s reality. On Binance P2P, you can buy USDT with a bank transfer from Banco del Pacífico or a mobile wallet top-up from Movistar Money. The price? Around $50.80 for 50 USDT, with a small $0.80 fee. No middleman. No cash. No risk.

LocalCoinSwap lets users trade with over 300 payment methods-from prepaid cards bought at corner stores to utility bill payments. People pay for crypto using the same systems they use to pay for water or electricity. It’s not underground. It’s just… normal.

And it works. Ecuadorians are among the top 10 countries in Latin America for crypto adoption, according to Chainalysis. Why? Because inflation hit 12% in 2024, the national currency (the U.S. dollar) lost purchasing power, and banks made it harder to send money abroad. Crypto became a tool-not a rebellion.

What Makes a Crypto Platform Legal in Ecuador?

There’s no official licensing system for crypto exchanges in Ecuador. But the ones that thrive follow international rules. CEX.IO, Gemini, and Bit2Me all require KYC: your ID, selfie, and proof of address. They use two-factor authentication. They store 95% of assets in cold wallets. They’re certified under ISO 27001 and SOC 2 Type 2-standards used by banks and governments worldwide.

These platforms don’t need Ecuadorian approval to operate. They don’t need to register locally. They just need to be trustworthy enough that users feel safe. And users vote with their wallets. Gemini supports USD, EUR, CAD, AUD, and GBP for Ecuadorians. That’s not a coincidence. It’s a signal: the global market sees Ecuador as a viable, low-risk user base.

The Real Risk: Not the Law, But the Scams

If there’s an underground side to crypto in Ecuador, it’s not in trading. It’s in scams.

Facebook groups promise “guaranteed 20% daily returns” on Bitcoin investments. Telegram channels sell fake mining rigs. WhatsApp “crypto advisors” take your money and disappear. These aren’t illegal crypto markets-they’re fraud operations. And because crypto isn’t regulated, victims have no recourse. No police unit handles crypto fraud. No consumer protection agency steps in.

That’s the real danger. Not the lack of laws, but the lack of help when things go wrong. A 2024 survey by the Ecuadorian Consumer Association found that 1 in 7 people who tried to invest in crypto lost money to scams. Most didn’t report it. Why? Because they knew no one would care.

Who’s Using Crypto-and Why

It’s not just tech-savvy youth. It’s teachers, nurses, small business owners. A 52-year-old woman in Cuenca uses Binance P2P to send money to her daughter in Spain. She pays $1 in fees instead of $25 through Western Union. A mechanic in Guayaquil buys USDT every payday and holds it as a hedge against inflation. He doesn’t call it crypto. He calls it “dollar backup.”

These aren’t revolutionaries. They’re practical people using the tools available. No one’s breaking the law. No one’s hiding. They’re just using crypto because it’s faster, cheaper, and more reliable than the system they’ve been given.

What Could Change Everything

Right now, Ecuador’s crypto scene is stable because it’s ignored. But if inflation spikes again-or if the government decides to crack down on dollarization-everything could shift.

Imagine if the Central Bank suddenly demanded all crypto transactions be reported. Or if banks started blocking transfers to Binance. Or if a new law required exchanges to freeze accounts without court orders. That’s not fantasy. It’s happened in Argentina, Venezuela, and Nigeria. Ecuador could follow.

Until then, the market stays quiet. Not because it’s illegal. But because it doesn’t need to be loud.

How to Trade Crypto in Ecuador-Safely

If you’re in Ecuador and want to trade crypto, here’s how to stay safe:

- Use only major platforms: Binance P2P, CEX.IO, Bit2Me, Gemini. Avoid unknown apps or Telegram bots.

- Always enable two-factor authentication (2FA). Use an authenticator app, not SMS.

- Never send crypto to someone you don’t know. Even if they’re “verified.”

- Use P2P trades with escrow. Never do direct bank transfers without platform protection.

- Keep your private keys offline. If you don’t know what that means, use a hardware wallet like Ledger or Trezor.

- Track your transactions. Even if the government doesn’t care, you should.

There’s no need to go underground. The legal path is wide open. Just don’t get fooled by the noise.

Why This Matters Beyond Ecuador

Ecuador’s crypto story isn’t unique. It’s a blueprint for dozens of countries where the official financial system has failed-but people still need to move money. Nigeria, Argentina, Lebanon, and even parts of the U.S. are seeing the same pattern: crypto grows not because of ideology, but because it works when nothing else does.

The lesson? You don’t need a revolution to change finance. You just need a system that’s broken enough that people are willing to try something new.

In Ecuador, crypto isn’t underground. It’s just… alive.

Is it legal to buy Bitcoin in Ecuador?

Yes, it is legal to buy, sell, and hold Bitcoin and other cryptocurrencies in Ecuador. The government does not consider crypto trading illegal, though it is not recognized as legal tender. You can use it for investment or peer-to-peer transfers without legal risk.

Can I use crypto to pay for groceries or gas in Ecuador?

No. While owning crypto is legal, you cannot use it to pay for goods or services in most places. Businesses do not accept Bitcoin or Ethereum as payment for bread, fuel, or rent. The U.S. dollar remains the only widely accepted currency for daily transactions.

Are there any crypto exchanges based in Ecuador?

There are no Ecuadorian-based crypto exchanges. All platforms used by Ecuadorians-like Binance, CEX.IO, and Bit2Me-are international. They operate legally because they follow global AML and KYC rules, not because they’re registered in Ecuador.

Do I need to pay taxes on crypto gains in Ecuador?

As of 2025, Ecuador does not have a tax law that applies to cryptocurrency profits. There is no official requirement to report crypto gains or losses to tax authorities. However, this could change if the government introduces new financial regulations.

Is Binance P2P safe to use in Ecuador?

Yes, Binance P2P is widely used and considered safe in Ecuador. The platform holds funds in escrow until the buyer confirms payment. Always use only verified sellers with high ratings and avoid direct bank transfers outside the platform. Never bypass the P2P escrow system.

What’s the biggest risk of using crypto in Ecuador?

The biggest risk isn’t the law-it’s scams. Fake investment schemes, phishing apps, and fraudulent “crypto advisors” are common. Many people lose money because they trust strangers online. Always verify platforms, enable 2FA, and never invest more than you can afford to lose.

Can I withdraw crypto to a local bank account in Ecuador?

You cannot directly withdraw crypto to a bank account. But you can sell crypto via P2P platforms like Binance or Bit2Me and receive U.S. dollars via bank transfer. This is how most Ecuadorians cash out. The money lands in their dollar-denominated accounts as fiat, not crypto.

Are there any limits on how much crypto I can buy in Ecuador?

There are no government-imposed limits. However, individual exchanges set their own limits based on your KYC level. For example, unverified users on Binance may have a daily limit of $100, while verified users can trade up to $10,000 or more per day.

ashi chopra

December 2, 2025 AT 10:46Wow. This is the most honest thing I’ve read about crypto in a long time. No drama, no hype-just people using what works. I’m from India, and I see the same thing here with UPI and crypto. It’s not rebellion. It’s survival. 🙏

Darlene Johnson

December 4, 2025 AT 02:29Of course the government looks away. They’re in bed with the Fed. This is all a psyop to normalize decentralized money so they can phase out cash later. You think they don’t track every transaction? They’re just waiting for the right moment to freeze everything. 🕵️♀️

Ivanna Faith

December 4, 2025 AT 13:41Ugh I’m so tired of people acting like crypto is just ‘normal’ now. It’s not. It’s a financial Trojan horse. You think Binance gives a damn about Ecuadorians? They’re mining data, not empathy. 💅

Akash Kumar Yadav

December 6, 2025 AT 02:58India does this better. We don’t wait for permission. We just use it. Ecuadorians are lucky they have P2P. Here, we use WhatsApp, UPI, and crypto together-no banks needed. You think the system works? It doesn’t. We just outsmarted it. 🇮🇳

Vidyut Arcot

December 6, 2025 AT 08:24This is exactly why I love crypto. Not because it’s revolutionary. But because it’s practical. A nurse in Cuenca sending money to her daughter? That’s the real win. No politicians. No fees. Just human connection. Keep going. You’re doing it right.

Jay Weldy

December 7, 2025 AT 10:58It’s beautiful how people adapt. No fanfare. No protest. Just quietly building a better system. I’ve seen this in rural Mexico too. When institutions fail, people don’t riot-they innovate. This is hope in action. 🌱

Melinda Kiss

December 9, 2025 AT 06:20Thank you for writing this with such clarity. So many articles make crypto sound like a cult or a crime. But this? This is real life. People are just trying to get by. And they’re doing it with dignity. 💛

Christy Whitaker

December 9, 2025 AT 16:35You’re all naive. The government is letting this happen so they can later seize every wallet. They’re not ignoring it-they’re collecting metadata. Every trade. Every IP. Every phone number. You’re being groomed for control. Wake up.

Nancy Sunshine

December 10, 2025 AT 21:58While I appreciate the anecdotal evidence presented, one must consider the macroeconomic implications of unregulated digital asset adoption in a dollarized economy. The potential for capital flight, coupled with the absence of AML/KYC enforcement mechanisms, presents a systemic risk that may eventually necessitate intervention. One must ask: Is this sustainability-or precarity dressed as autonomy?

Alan Brandon Rivera León

December 11, 2025 AT 16:37As someone who’s lived in both the US and Ecuador, I can say this: the quietness is the power. No one’s screaming. No one’s protesting. They’re just… using it. That’s how real change happens. Not with banners. With bank transfers.

Ann Ellsworth

December 12, 2025 AT 22:28Let’s be real-this isn’t adoption, it’s desperation. Binance P2P isn’t innovation-it’s arbitrage on institutional collapse. And don’t get me started on the KYC theater. You think your ID selfie is private? Honey, it’s already in a Bloomberg terminal.

Ankit Varshney

December 14, 2025 AT 20:19My cousin in Quito uses Binance every week. He says it’s cheaper than Western Union. That’s it. No ideology. Just numbers. That’s the whole story right there.

Ziv Kruger

December 15, 2025 AT 21:08Is the system broken? Yes. But is crypto the answer? Or just the symptom? We treat the fever without curing the disease. The real question isn’t how people trade crypto-it’s why they had to.

Heather Hartman

December 16, 2025 AT 16:36This made me cry a little. Not because it’s sad-but because it’s so quietly powerful. People aren’t waiting for permission to survive. They’re just doing it. And that? That’s beautiful. ❤️

Catherine Williams

December 18, 2025 AT 11:05I’ve seen this in my work with microbusinesses in Central America. Crypto isn’t tech-it’s trust. When banks won’t move your money, you find another way. And you don’t need a degree to do it. Just grit and a phone. Keep going, Ecuador.

Paul McNair

December 19, 2025 AT 22:37It’s not about legality. It’s about dignity. People aren’t breaking rules-they’re bypassing a system that broke them first. That’s not underground. That’s just human.

Mohamed Haybe

December 21, 2025 AT 18:18Don’t flatter yourselves. This isn’t innovation. It’s failure. The US dollar is a crutch. Binance is a Band-Aid. Ecuador’s economy is a rotting house and you’re all just rearranging the furniture while it burns

Marsha Enright

December 22, 2025 AT 09:50So many people are scared of crypto because they don’t understand it. But this post? This is the guide everyone needs. Use P2P. Use 2FA. Don’t trust strangers. You don’t need to be a genius-just careful. You got this.

Andrew Brady

December 23, 2025 AT 08:26Mark my words: this ‘indifference’ is temporary. The US Treasury is watching. The IMF is drafting sanctions. This isn’t freedom-it’s a countdown. And when the crackdown comes, you’ll be begging for the dollar you gave up.

Steve Savage

December 23, 2025 AT 08:29I’ve lived in 7 countries. This is the most honest economic story I’ve seen in years. No heroes. No villains. Just people making the best choice they can with the tools they have. That’s all. And that’s enough.

Reggie Herbert

December 24, 2025 AT 17:56Everyone’s acting like this is some genius move. Nah. It’s just chaos with better UX. You think Binance gives a shit about your ‘dollar backup’? They’re charging you 0.80% to exploit your desperation. Welcome to capitalism 2.0.

Philip Mirchin

December 24, 2025 AT 21:23My uncle in Ecuador just sent me $200 via Binance P2P. Took 12 minutes. Cost $1.50. If I’d used Wise? $25 and 3 days. He didn’t need a lecture on blockchain. He just needed to feed his family. That’s all.

Britney Power

December 26, 2025 AT 18:09Let’s not romanticize economic collapse. What you’re describing is not a ‘quiet crypto economy’-it’s the slow-motion implosion of a national financial system, with retail users acting as de facto liquidity providers for offshore exchanges. The lack of regulation isn’t freedom-it’s institutional abandonment. And it will end badly.

Maggie Harrison

December 28, 2025 AT 03:54It’s not crypto. It’s hope. 🌟 And hope doesn’t need a license. It just needs a phone, a Wi-Fi signal, and someone who refuses to give up. Ecuadorians are teaching the world how to survive with grace. I’m in awe.

Lawal Ayomide

December 28, 2025 AT 17:42Same thing in Lagos. People use crypto to pay for fuel, school fees, even bribes. No one talks about it. Everyone does it. The system’s broken. We just moved on.

Vidyut Arcot

December 29, 2025 AT 07:58And that’s why I love this. It’s not about Bitcoin. It’s about dignity. My cousin in Cuenca doesn’t call it crypto. She calls it ‘dollar backup.’ That’s the real win. No ideology. Just survival. And that’s enough.