Crypto Token Classifier

Use this tool to evaluate whether your digital token qualifies as a security or utility token under the new 2025 framework. Answer the following questions based on your token's characteristics:

Classification Result

Enter your token details and click "Classify Token" to see the classification result.

About This Tool

This tool applies the principles of Project Crypto and the updated Howey test framework introduced in 2025. It evaluates tokens based on key factors like investment of money, common enterprise, profit expectation, and utility purpose. The score determines if the token is classified as a security or utility token.

When we talk about the crypto securities law is the evolving body of U.S. rules that decides whether a digital token is treated like a traditional security and how it can be offered, traded, and custodied, the conversation has finally moved from speculation to concrete policy. 2025 has been a turning point: three federal bills, a sweeping SEC reform called Project Crypto, and an active state regulator coalition are all shaping a clearer future. If you’re an investor, founder, or compliance officer, you need to know what’s on the table, how it will affect day‑to‑day operations, and what steps you can take right now to stay ahead.

Key Takeaways

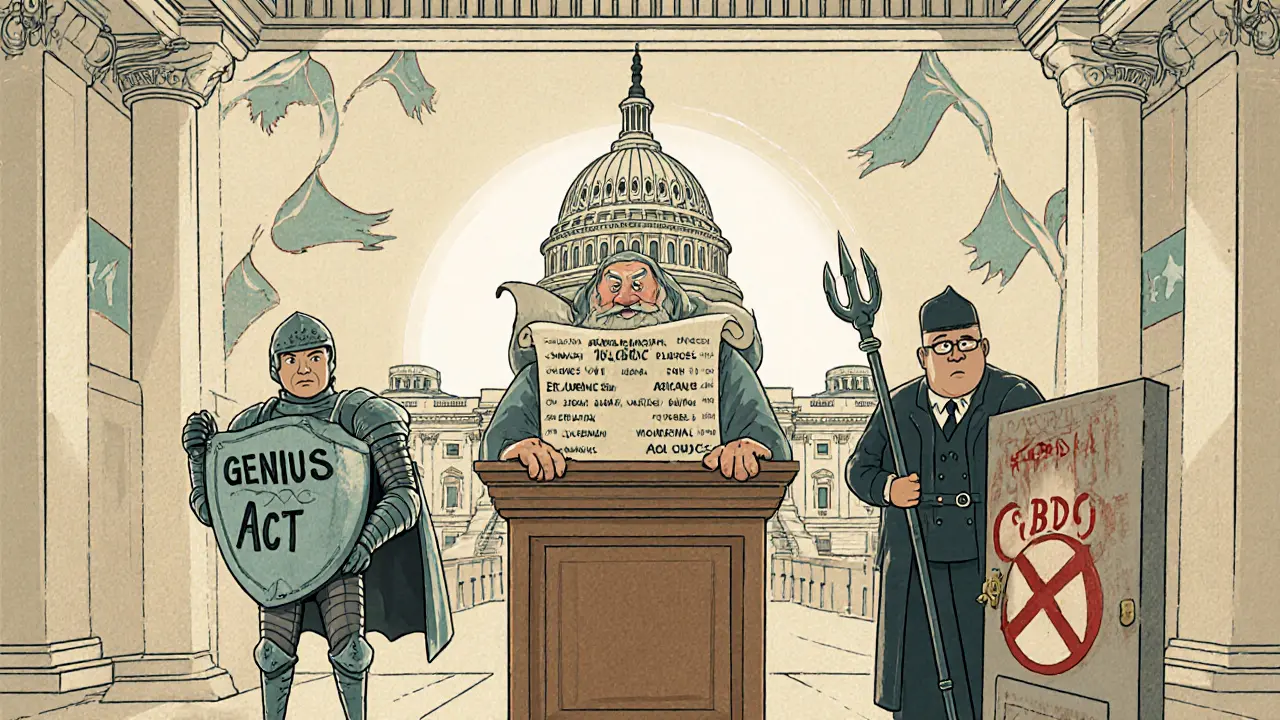

- The GENIUS Act, signed July182025, creates the first comprehensive federal framework for stablecoins and other digital assets.

- The CLARITY Act clears the path for broader market‑structure reforms, though it still needs Senate approval.

- SEC Chair Paul Atkins’ Project Crypto declares that most crypto assets are not securities and promises simple, on‑chain‑friendly rules.

- State groups like NASAA are pushing for strong antifraud powers and a narrow definition of the Howey test.

- Businesses should start building internal compliance checklists now-self‑custody policies, disclosure templates, and token‑classification workflows will become mandatory soon.

Legislative Landscape in 2025

During what legislators dubbed “Crypto Week,” Congress hammered out three major proposals that together aim to end years of regulatory ambiguity.

GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins Act) was signed into law on July182025. It defines a stablecoin as a digital asset backed 1:1 by a reserve of fiat or government‑guaranteed securities, imposes a cap‑on‑risk ratio of 150%, and requires real‑time reporting to a new Federal Stablecoin Registry.

The CLARITY Act (Digital Asset Market Clarity Act of 2025) passed the House on the same day but still awaits Senate consent. Its headline provision is a “safe‑harbor” exemption for token sales that meet a three‑prong test: (1) no expectation of profit from the efforts of others, (2) a fully disclosed token‑utility purpose, and (3) a limited‑duration lock‑up of less than 90 days.

The Anti‑CBDC Surveillance State Act bans the Federal Reserve from issuing a central‑bank digital currency without explicit congressional approval, echoing President Trump’s Executive Order14067 that prioritized private‑sector innovation over government‑issued tokens.

| Bill | Status | Core Provisions |

|---|---|---|

| GENIUS Act | Signed into law | Defines stablecoins, creates Federal Registry, sets reserve‑backing ratios. |

| CLARITY Act | House passed, pending Senate | Safe‑harbor for utility tokens, three‑prong test, 90‑day lock‑up limit. |

| Anti‑CBDC Act | House passed | Prohibits Fed‑issued CBDC without Congress, reinforces private‑sector focus. |

SEC’s Project Crypto - A Paradigm Shift

On July312025, SEC Chair Paul Atkins unveiled Project Crypto at the America First Policy Institute. The initiative flips the agency’s historic stance: instead of treating “most digital assets as securities,” the SEC will issue a series of interpretive releases that carve out clear exemptions for utility tokens, airdrops, and network‑reward distributions.

Project Crypto’s roadmap includes three concrete deliverables by early 2026:

- A Token Classification Guide that walks issuers through a decision‑tree based on the Howey test, economic function, and governance rights.

- Model Disclosure Templates for security‑like offerings, covering financial statements, risk factors, and token‑specific metrics such as “burn rate” and “staking yield”.

- Regulatory “safe harbors” for custodians that allow self‑custody, provided users retain control of private keys and the custodian offers transparent audit trails.

These moves are designed to “enable America’s financial markets to move on‑chain,” a nod to the growing appetite for tokenized equities and debt instruments. The SEC has already opened a notice‑and‑comment period, inviting industry participants to submit real‑world use cases.

State Regulators and the NASAA Push

The NASAA (North American Securities Administrators Association) represents 58 state securities regulators. In 2025 their priority has been two‑fold: preserve strong antifraud enforcement and ensure any federal definition of “investment contract” does not erode state‑level powers.

NASAA’s comments on the CLARITY Act warn that a rigid federal “investment‑of‑money + common‑enterprise + profit‑expectation + effort‑of‑others” formula could narrow the traditional breadth of securities law, making it harder for states to pursue cross‑border fraud.

Practically, this means that even after federal safe‑harbors are enacted, firms will still need to comply with state‑level registration or exemption requirements, especially when tokens are sold to retail investors in multiple states.

The Howey Test Re‑engineered for Tokens

Since the 1946 SEC v. W.J. Howey Co. case, the “Howey test” has been the litmus paper for securities classification. Project Crypto proposes a “purpose‑fit” adaptation: instead of a binary yes/no, issuers will score tokens across four dimensions-economic reliance, governance rights, resale market, and expectation of profit. A cumulative score above a threshold triggers full securities registration; a lower score lands the token in the newly defined “utility‑token” bucket.

This approach aims to eliminate the current “grey‑area” where a token can be both utility and security depending on who you ask. Early pilots with the blockchain platform ChainGuard and the token SGT have shown that a structured scoring model reduces legal fees by up to 40%.

Impact on Market Participants

Founders and token issuers will need to run a formal classification before any token sale. The new guidance encourages a “pre‑sale compliance audit” that includes:

- Mapping token economics against the Howey‑score matrix.

- Drafting the required disclosure using the SEC’s template.

- Checking state registration requirements via the NASAA portal.

Custodians and exchanges must upgrade their AML/KYC pipelines to capture on‑chain activity and provide real‑time audit logs to regulators. The SEC’s safe‑harbor for self‑custody means that firms can offer non‑custodial wallets, but they must still retain a “transaction‑monitoring” capability.

Investors will benefit from clearer risk metrics. The token‑classification score will appear on market data feeds, allowing retail traders to instantly see whether a token is “security‑like” or “utility‑only”. This transparency should lower the incidence of fraud - a key goal of both the SEC and NASAA.

Preparing for the New Regime - A Practical Checklist

Even though many rules are still in draft, you can start building a compliance foundation today.

- Token Classification Audit: Use a spreadsheet to answer the four Howey‑score questions for each token you plan to issue or list.

- Disclosure Draft: Pull the SEC’s template (available on the agency’s website) and fill in token‑specific data - circulating supply, inflation rate, staking rewards, and governance rights.

- State Review: Log into the NASAA portal, input your token’s characteristics, and note any state registration or exemption forms you’ll need.

- Custody Policy Update: If you offer a custodial service, add a clause that confirms users retain private‑key control and that audit logs are retained for 7years.

- Legal Counsel Engagement: Retain a law firm with a proven track record in digital‑asset securities; many firms now have dedicated Project Crypto practice groups.

Following this checklist puts you ahead of the curve and reduces the risk of costly enforcement actions once the final rules land.

What’s Next? Timeline Through 2026

- Sept302025 - Senate Banking Committee aims to move market‑structure legislation out of committee.

- Oct2025 - SEC opens formal comment period on the Token Classification Guide.

- Dec2025 - NASAA releases a state‑registration portal beta.

- Q12026 - Expected release of final Project Crypto rules, including safe‑harbor language.

- Mid‑2026 - Federal courts begin applying the new Howey‑score framework in securities litigation.

By keeping an eye on these milestones, you can adjust your compliance roadmap in real time and avoid surprise regulatory shocks.

Frequently Asked Questions

Will all stablecoins become securities under the new laws?

No. The GENIUS Act specifically carves out a stablecoin exemption as long as the token is 1:1 backed by approved reserves and registers with the Federal Stablecoin Registry. Only stablecoins that fail the reserve‑backing test or lack transparency would be treated as securities.

How does Project Crypto affect existing ICOs that were launched before 2025?

Project Crypto is retroactive only to the extent that ongoing offerings can adopt the new safe‑harbor criteria. Tokens that already completed a registered securities offering will remain under the original registration, but issuers can re‑file for exemption if they meet the three‑prong test outlined in the CLARITY Act.

Do I still need to register with individual states if I qualify for the federal safe‑harbor?

Yes. NASAA has made clear that state antifraud authority remains intact. Even with a federal safe‑harbor, you must submit a notice in each state where you market the token and comply with any state‑specific disclosure requirements.

What is the biggest risk for crypto businesses in 2026?

The biggest risk is operating without a documented token‑classification process. Regulators will soon demand evidence that each token was evaluated against the Howey‑score matrix. Missing that step can trigger enforcement actions, fines, and forced token delistings.

How can investors tell if a token is a security under the new framework?

Market data providers will add a “SEC classification score” field next to price quotes. Tokens with a score above the regulatory threshold will be flagged as securities, while lower‑scoring tokens will carry a utility‑only label.

Eugene Myazin

January 16, 2025 AT 17:05Hey folks, this token classifier is a neat step forward – love seeing the community get practical tools that demystify the Howey test. It feels like we’re finally giving everyday developers a clear checklist to avoid costly SEC headaches.

karyn brown

January 20, 2025 AT 03:59Yo, this thing looks slick 😂 but honestly the “yes/no” buttons feel like a kindergarten quiz – where’s the nuance? The devs should add a “maybe” option because crypto is anything but black‑and‑white.

Rachel Kasdin

January 23, 2025 AT 14:54Finally, an American‑made framework that tells us when a token is a security. The SEC’s old school rules were a drag, but this 2025 guide nails the job for US innovators.

Nilesh Parghi

January 27, 2025 AT 01:48When we press that “Classify Token” button, we’re not just ticking boxes – we’re engaging in a small act of philosophical inquiry. The question becomes: does the future of finance belong to decentralized protocols, or does it bow to traditional securities law? That tension is where the real conversation happens.

karsten wall

January 30, 2025 AT 12:43For newcomers, let’s break down the updated Howey test: 1) Investment of money, 2) Common enterprise, 3) Expectation of profits, and 4) Efforts of others. This classifier maps each answer to a weighted score, which aligns with SEC’s 2025 guidance. If the score reaches two or higher, you’re likely in security territory – a useful heuristic for token engineers.

Keith Cotterill

February 2, 2025 AT 23:37Observe, dear interlocutors, the elegance of this instrument: a succinct interface, yet it encapsulates the labyrinthine jurisprudence of securities regulation; indeed, the binary queries-investment, enterprise, profit, utility-serve as a distillation of the Howey doctrine, rendering the abstruse accessible to the lay developer-admirable, albeit perhaps overly reductive.

Lana Idalia

February 6, 2025 AT 10:32Honestly, this feels like a watered‑down version of real legal analysis, like handing a child a crayons‑box when they need a scalpel. Tokens are complex financial instruments; a six‑question quiz can’t capture the subtleties of jurisdictional nuances or the evolving nature of decentralised governance.

Henry Mitchell IV

February 9, 2025 AT 21:26Cool tool! :) Just make sure you double‑check the lock‑up period-those 90‑day limits can be a sneaky trap.

Kamva Ndamase

February 13, 2025 AT 08:21Great initiative! It’s crucial that builders have a clear pathway to compliance. If you’re aiming for a utility token, make sure the tokenomics are transparent and the utility is genuine-no need to hide behind vague promises.

bhavin thakkar

February 16, 2025 AT 19:15Behold the drama of regulatory clarity! The moment you click “Classify Token,” you stand at the crossroads of innovation and legal certainty. Each answer you provide summons the ghost of the Howey test, whispering whether your creation shall soar as a utility or be shackled as a security.

Mangal Chauhan

February 20, 2025 AT 06:10🔐 This tool is a valuable addition to the compliance toolkit, especially when paired with thorough disclosures. A well‑crafted whitepaper complemented by these classification results can significantly reduce regulatory friction. Keep the community informed, and the ecosystem will thrive.

Narender Kumar

February 23, 2025 AT 17:05Ah, the sweet symphony of law and code, resonating through the ether of blockchain! Such a tool bestows upon us the power to decipher the cryptic riddles of securities classification-truly a beacon in the tempestuous seas of regulation.

Anurag Sinha

February 27, 2025 AT 03:59Don’t be fooled by the sleek UI; behind those buttons lies a concerted effort by the powers that be to steer crypto into the shadows of traditional finance. Remember, every “yes” or “no” you click may be logged, archived, and later used as evidence in a grander scheme of control.

Raj Dixit

March 2, 2025 AT 14:54We must uphold the integrity of our markets; any token that slips past these safeguards threatens the very fabric of fair trading.

Lisa Strauss

March 6, 2025 AT 01:48Love seeing tools that make compliance less intimidating. This should empower more creators to launch responsibly and confidently.

Darrin Budzak

March 9, 2025 AT 12:43Nice work, team. A straightforward checker like this can help reduce misunderstandings before they become legal headaches.

dennis shiner

March 12, 2025 AT 23:37Nice tool, yeah.

Krystine Kruchten

March 16, 2025 AT 10:32From a coaching perspective, I’d recommend pairing this classifier with a thorough legal review. The tool provides a solid first-pass assessment, but nuanced token designs may still require professional advice.

Iva Djukić

March 19, 2025 AT 21:26The introduction of a token classification interface represents a paradigm shift in how we operationalize securities law within decentralized ecosystems. By distilling the Howey criteria into discrete, quantifiable inputs, the platform translates a traditionally qualitative analysis into a semi‑automated decision matrix. This methodological innovation not only democratizes access to regulatory insight but also fosters a culture of pre‑emptive compliance among developers. Moreover, the inclusion of variables such as lock‑up duration and disclosure transparency aligns with the broader regulatory emphasis on investor protection. The resulting binary outcome-security versus utility-serves as a heuristic, prompting stakeholders to re‑evaluate token design choices early in the development lifecycle. Importantly, the tool’s reliance on a scoring threshold acknowledges the spectrum of hybrid tokens that defy binary categorization. As the legal landscape evolves, such adaptive frameworks will be essential for mitigating jurisdictional ambiguities. The interface also encourages iterative refinement; developers can toggle responses to gauge how marginal changes affect the classification, thereby promoting a more nuanced understanding of regulatory risk. While not a substitute for formal legal counsel, this classifier functions as an indispensable preliminary filter, reducing the likelihood of costly retroactive re‑structuring. It exemplifies how technology can bridge the gap between law and innovation, fostering a symbiotic relationship rather than an adversarial one. In essence, the tool encapsulates the spirit of the 2025 SEC guidance: clarity, predictability, and proactive engagement with the market. As adoption spreads, we may observe a measurable decline in enforcement actions stemming from token misclassification, underscoring the practical impact of such regulatory tools. Ultimately, this development heralds a more mature, self‑regulating crypto ecosystem, where participants are equipped with the knowledge to navigate complex legal terrains with confidence.

Darius Needham

March 23, 2025 AT 08:21It's fascinating to see how the updated Howey test criteria are being operationalized in a user‑friendly format. The clarity offered by this tool should help many projects align their tokenomics with regulatory expectations from the outset.

WILMAR MURIEL

March 26, 2025 AT 19:15I appreciate the balanced approach of providing both a quick assessment and an invitation to deeper due diligence. By fostering dialogue between developers and legal experts, the ecosystem can evolve responsibly while still encouraging innovation.

carol williams

March 30, 2025 AT 07:10While the interface is sleek, one must remain vigilant about the underlying assumptions baked into each binary choice. A token’s real‑world usage can diverge from the questionnaire’s limited scope, so continuous monitoring is essential.

Maggie Ruland

April 2, 2025 AT 18:04Oh great, another checklist.