Changing your tax residency to save on crypto taxes sounds simple: move to a country with 0% capital gains tax, and boom - your Bitcoin profits are tax-free. But if you think it’s just about packing a suitcase and booking a flight, you’re already behind. By 2026, the game has changed. The IRS is tracking every trade. The OECD is forcing countries to share your crypto data. And the places that once offered easy tax breaks? Many have closed the door.

Why Tax Residency Matters More Than Ever

Your tax bill on crypto isn’t based on where you were born. It’s based on where you’re legally considered a resident. That’s different from citizenship. You can be a U.S. citizen living in Dubai and owe zero crypto taxes - if you meet Dubai’s residency rules. But if you’re a German citizen living in Portugal and still have ties to Germany? You might owe exit taxes on your unrealized gains - even if you never sold a single coin. The IRS started requiring exchanges to report every crypto transaction in 2025. That means Form 1099-DA now includes your purchase date, cost basis, and sale proceeds for every trade you made in 2024. No more hiding behind small exchanges. No more claiming you "forgot" about that ETH-to-SOL swap. The IRS knows. And they’re auditing harder than ever.Where You Can Still Legally Avoid Crypto Capital Gains Tax

Not all countries are the same. Some still let you keep 100% of your crypto gains - if you play by their rules. United Arab Emirates (Dubai) is still the easiest. No personal income tax. No capital gains tax. You only need to spend 30 days a year in the country to qualify for tax residency. You don’t need to buy property. You don’t need to invest. Just show up, get a residency visa, and keep your bank account there. The Virtual Assets Regulatory Authority (VARA) keeps things simple: if you’re not trading like a business, you pay 0%. Singapore also has 0% capital gains tax. But here’s the catch: if you’re trading frequently - say, more than once a week - the tax office may classify you as a professional trader. Then your profits get taxed at up to 24%. You need to be clear: are you investing, or are you running a business? Most people don’t realize this distinction until they get a letter from IRAS. Malta offers 0% for occasional traders. But if you make more than €50,000 a year in crypto gains, you’re taxed as a business - up to 35%. Plus, you need to live there 183 days a year, open a local bank account, and prove you have a place to live. And don’t forget: Malta is in the EU. That means your data will be shared with other EU countries under the Crypto-Asset Reporting Framework (CARF) starting in 2027. Puerto Rico still has Act 22. If you become a bona fide resident - meaning you live there 183 days a year and cut ties with your U.S. state - you pay 0% on crypto gains. But you still pay U.S. federal taxes on other income. And you can’t just rent an Airbnb for six months. You need to prove you’re rooted: a local driver’s license, utility bills, a Puerto Rican bank account, even a local gym membership. The IRS watches this closely.The Places That Used to Be Safe - But Aren’t Anymore

Portugal used to be the dream. No capital gains tax on crypto. No tax residency requirements. Just move in and forget about taxes. But in 2024, they changed the rules. Now, if you’re not a Non-Habitual Resident (NHR), you pay 28% on crypto gains. And the NHR program is shutting down for new applicants. If you didn’t get in before January 2024, you’re out of luck. Switzerland? Still no federal capital gains tax. But if you’re a resident and trade crypto regularly, the cantons (like Zurich or Zug) may treat it as business income. And if you’re a citizen of Germany or France and move to Switzerland? You might owe an exit tax on your unrealized gains before you even leave. Even countries like El Salvador - where Bitcoin is legal tender - don’t offer tax residency benefits. If you’re a U.S. citizen, you still owe U.S. taxes. No matter where you live.

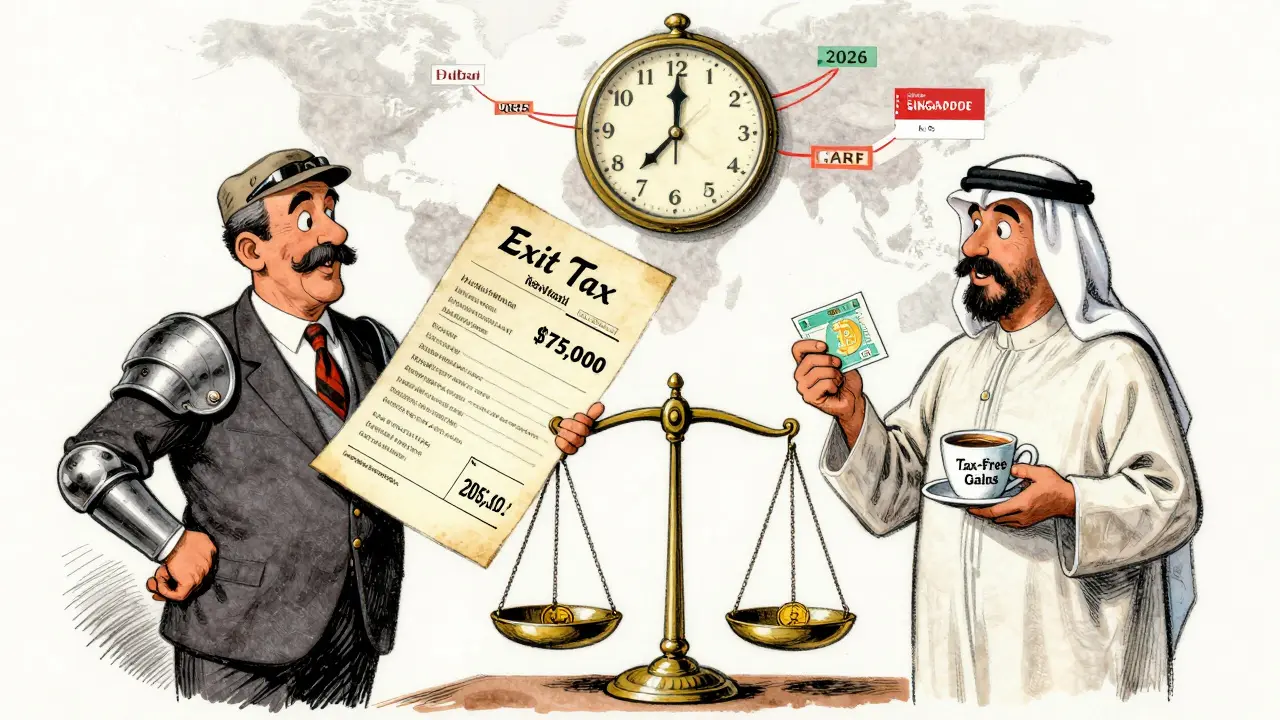

The Hidden Costs of Moving Your Tax Residency

It’s not just about finding a new country. It’s about leaving your old one cleanly. Exit taxes are the silent killer. France, Germany, Italy, and Spain all charge you when you leave. They don’t wait for you to sell your crypto. They tax you on what it’s worth right now. If you hold $300,000 in Bitcoin and move from Germany to Dubai, Germany will tax you on the gain - even if you never touched it. That’s often 25-30% of your unrealized profit. One Reddit user lost €22,000 because his tax advisor didn’t mention the exit tax. He thought he was saving money. He ended up paying more than he would have stayed. Cost of setup isn’t cheap. Hiring a tax lawyer who understands crypto residency? $15,000 to $50,000. Getting a residency visa? Another $5,000 to $20,000. In Portugal, you need to invest €500,000 in real estate. In Malta, you need to prove you have €15,000 in passive income per year. Most people don’t realize these requirements until they’re already halfway through the process. Documentation is everything. You need rental agreements, utility bills, bank statements, medical records, even gym memberships. The IRS and other tax authorities don’t believe your word. They want proof you live there. And if you’re flying back to the U.S. every three months? You’re not a resident. You’re a tourist with crypto.What the Future Looks Like - And Why Time Is Running Out

The biggest threat isn’t the IRS. It’s the OECD’s Crypto-Asset Reporting Framework (CARF). Starting in 2027, over 100 countries will automatically share your crypto transaction data. Your exchange in Dubai will report your trades to Singapore. Singapore will send it to Canada. Canada will send it to the U.S. And the U.S. will cross-check it with your Form 8854 - the form you file when you give up U.S. tax residency. That means the days of hopping between tax havens to avoid reporting are over. If you’re trying to hide your crypto gains by moving your residency, CARF will expose you. The window to act is closing fast. By 2028, most of the current "crypto tax havens" will be under the same reporting rules as the U.S. and EU. The only places that will survive are those with constitutional bans on capital gains taxes - like the UAE and Singapore. Even then, they’ll still tax you if you’re trading like a business. And if you’re a U.S. citizen? You’ll still owe U.S. taxes on worldwide income unless you formally renounce your citizenship - a decision that comes with its own penalties and public disclosure.

What You Should Do Right Now

If you’re thinking about changing your tax residency:- Stop thinking about it as a loophole. It’s a legal, complex, expensive relocation - not a tax hack.

- Check your current country’s exit tax rules. If you’re from Germany, France, or Italy, you might owe more to leave than you’d save.

- Don’t trust Reddit gurus. Real people lost money because they followed advice from someone who didn’t even have a residency visa.

- Get professional help - but only from someone who’s handled crypto residency before. Ask for case studies. Ask for references. Ask how many clients they’ve helped move from your country to your target country.

- Start now. Establishing residency takes 6 to 18 months. You can’t do it in 30 days.

Real Talk: Is It Worth It?

For most people? No. The average crypto holder with $250,000 in gains might save $50,000 in taxes by moving to Dubai. But they’ll spend $40,000 on legal fees, relocation, and compliance. They’ll lose six months of their life managing paperwork. They’ll risk getting flagged by the IRS if they don’t document every day they spend abroad. The only people who benefit are those who:- Have over $1 million in crypto gains

- Are willing to live in their new country for 180+ days a year

- Have no ties to countries with exit taxes

- Can afford $50,000+ in setup costs

- Are prepared to cut ties with their home country permanently

Can I still avoid crypto taxes by moving to Portugal?

No. Portugal eliminated its 0% crypto tax policy in 2024. Now, if you’re not a Non-Habitual Resident (and new applications are closed), you pay 28% on crypto gains. Even if you were a resident before 2024, you must meet strict income and residency requirements to keep the benefit.

Does the IRS know if I move my tax residency?

Yes. If you’re a U.S. citizen or green card holder, you must file Form 8854 to officially renounce U.S. tax residency. The IRS cross-checks this with your crypto transaction data from exchanges, bank records, and now, international data sharing under CARF. If you claim you moved but still live in the U.S. for 200 days a year? You’re at high risk of audit.

What’s the cheapest country to move to for crypto tax savings?

The UAE (Dubai) is the cheapest. You don’t need to invest in property. You don’t need to prove income. You just need to spend 30 days a year there and get a residency visa - which can cost as little as $5,000. But you still need to prove you’re not just visiting. That means a local bank account, rental agreement, and consistent physical presence.

Do I have to sell my crypto to avoid taxes by moving?

No - but your old country might force you to. Countries like Germany and France charge exit taxes on your unrealized gains when you leave. That means you owe tax on what your crypto is worth today, even if you never sell. Selling before you move can help avoid this - but it triggers a taxable event in your current country.

Can I keep my U.S. bank account if I move my tax residency?

You can, but it hurts your case. Tax authorities look for ties to your old country. If you still use your U.S. address, bank account, and phone number, they’ll argue you haven’t truly changed residency. For the strongest case, open a local bank account, get a local phone number, and use your new address for everything.

Is it legal to change my tax residency for crypto?

Yes - if you do it correctly. You must meet the legal residency requirements of your new country and formally sever ties with your old one. Many people get into trouble by pretending to move while still living in their home country. That’s fraud. Legally changing residency is allowed - but it’s complex, expensive, and requires full transparency.

Wayne mutunga

January 30, 2026 AT 23:12Man, I read this whole thing and just felt exhausted. Not because it’s wrong, but because it’s so painfully accurate. I thought moving to Dubai was my ticket out - turns out I’d need a lawyer, a new bank account, and a whole new identity just to avoid paying half my gains. And for what? To save $50k but lose 18 months of my life? I’m just gonna hold and HODL. The IRS can have their cut. I’d rather sleep at night.

Also, no one talks about how weird it feels to cut ties with your home country. Like, you’re not just changing tax status - you’re erasing part of your life. I’m not ready for that.

Rob Duber

February 1, 2026 AT 06:30OMG I JUST MOVED TO PORTUGAL LAST MONTH AND NOW I’M SCREWED?? LIKE WHAT THE ACTUAL F?? I SPENT 6 MONTHS PRETTING MYSELF AS A DIGITAL NOMAD AND NOW I OWE 28%?? I’M OUT HERE WITH A BEACH VIEW AND A $40K TAX BILL?? THIS ISN’T TAX OPTIMIZATION - THIS IS A TAX TRAP WITH SUNSET VIEWS.

Also, why does everyone keep acting like Dubai is magic? I tried getting a visa. They asked for proof I’m not a ‘crypto bro’ who just wants to dodge taxes. I showed them my NFT collection. They laughed. I cried. Then I bought a coconut and moved on.

Also, if you’re a US citizen - you’re already paying taxes. Stop pretending you’re a rebel. You’re just a guy with a better Airbnb.

Joshua Clark

February 2, 2026 AT 00:08There’s a lot of nuance here that’s being ignored - and I think that’s dangerous. The article correctly identifies that tax residency is not about citizenship, but about legal domicile - which is a complex, multi-factor test involving physical presence, economic ties, family connections, and intent. The IRS uses a 183-day rule, but also looks at where your primary home is, where your spouse and children live, where your mail is sent, and even where you vote. Many people think moving for 30 days in Dubai qualifies them - but if you’re still flying back to the U.S. every other week to see your family, using your U.S. credit cards, and keeping your car registered in California - you’re not a resident of Dubai. You’re a tax evader with a passport stamp. And the CARF system will catch you. The real strategy isn’t moving - it’s understanding your current tax profile, calculating your exit liability, and then making a deliberate, documented, long-term relocation - not a vacation with a bank account.

Also, the cost of legal help isn’t $15k - it’s $50k if you want someone who actually understands crypto and international tax law. Most ‘experts’ on Reddit are just guys who read a Medium post.

Dahlia Nurcahya

February 3, 2026 AT 15:08Thank you for writing this. I’ve been thinking about this for months and felt so lost. I didn’t realize how many hidden costs there were - especially the exit taxes. I thought I was being smart by moving. Turns out I was being naive. I’m not rich enough to gamble on this, and I’m not willing to lose my family ties just to save on taxes. I’m going to stick with tax-loss harvesting and long-term holding. It’s boring, but it’s honest. And honestly? That’s worth more than any crypto gain.

To anyone thinking about this: talk to a real tax professional. Not a YouTube guy. Not a Reddit thread. A real person who’s handled this before. And if they don’t ask you about your family, your home, your past tax filings - walk away.