WELL Token – What It Is and Why It Matters

When working with WELL token, a governance‑focused cryptocurrency that rewards community participation and decision‑making. Also known as WELL, it sits at the crossroads of tokenomics, community voting, and market incentives.

Alongside the WELL token, the broader world of governance token, digital assets that give holders voting power in decentralized protocols shapes how projects evolve. WELL token holders often earn rewards through airdrop, free distribution events that boost token reach and community growth. Meanwhile, crypto regulation, legal frameworks that govern token issuance and trading determines what you can do with these assets in different jurisdictions.

Why Tokenomics and Governance Go Hand in Hand

Understanding the tokenomics of the WELL token is key. Supply caps, inflation rates, and reward schedules dictate price dynamics and user incentives. Pair that with a solid governance model—what proposals can be submitted, how voting weight is calculated, and how decisions are executed through smart contracts—and you have a living ecosystem that responds to its community.

DeFi platforms often integrate governance tokens like WELL to align interests between developers and users. By staking their tokens, participants can earn yield while also influencing protocol upgrades. This dual role creates a feedback loop: better governance attracts more users, which in turn increases token utility and value.

Technical foundations matter, too. The WELL token runs on a blockchain that supports efficient hashing algorithms such as SHA‑256 and Keccak‑256, ensuring transaction integrity. Network topology—whether the chain uses a mesh or star design—affects scalability and security, influencing how quickly governance votes are processed.

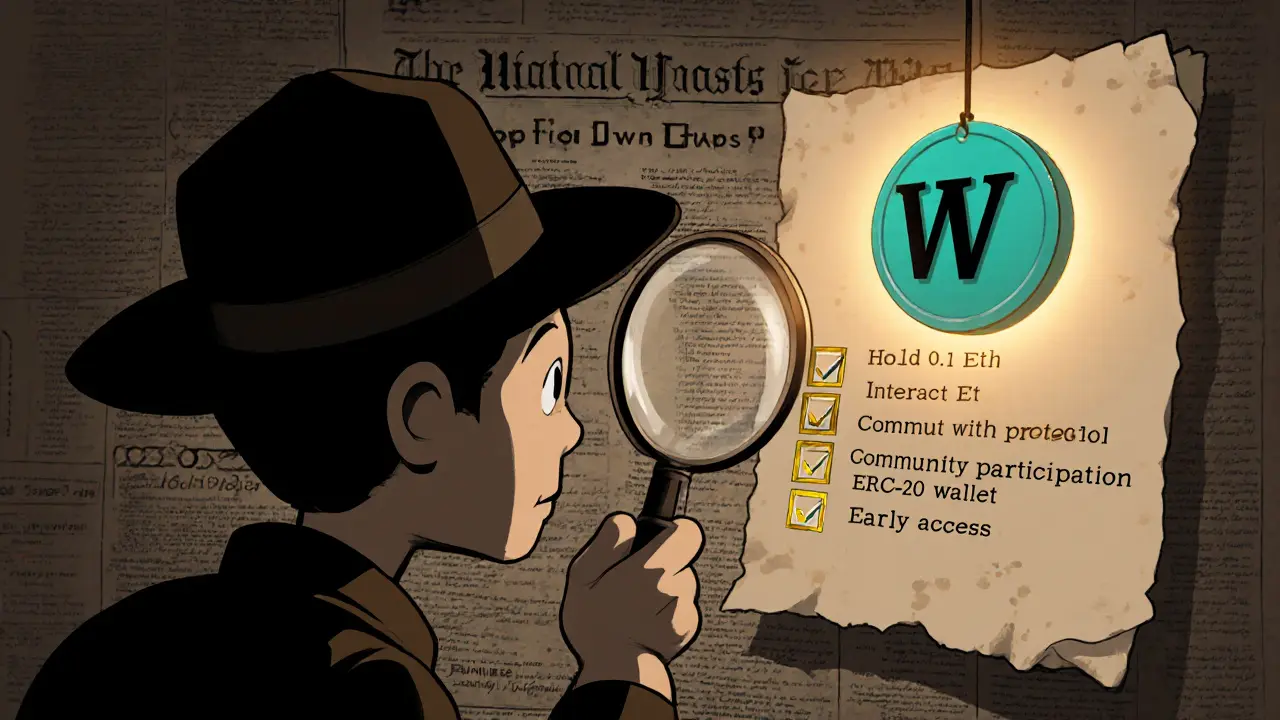

Airdrops are more than giveaways. They serve as marketing tools, community builders, and data collection points. Successful airdrop campaigns often follow a clear eligibility checklist, a secure claim process, and post‑distribution monitoring to prevent fraud. Learning from recent NFT and token airdrops can help you design better distribution strategies for future projects.

Regulatory compliance can’t be ignored. Projects issuing tokens like WELL must navigate licensing tracks, anti‑money‑laundering (AML) rules, and reporting obligations. Knowing the steps to obtain a crypto license, how to file the right paperwork, and where to report suspicious activity protects both the project and its users.

Real‑world use cases illustrate the impact of governance tokens beyond pure finance. In clinical trials, blockchain creates immutable audit trails, while in online voting it ensures transparent, tamper‑proof results. These applications highlight how a token like WELL can power decentralized decision‑making across industries.

Below you’ll find a hand‑picked collection of articles that dive deeper into each of these topics—from detailed airdrop guides and hash algorithm breakdowns to regulatory roadmaps and DAO treasury management. Use them to sharpen your understanding, spot opportunities, and stay ahead in the fast‑moving crypto landscape.