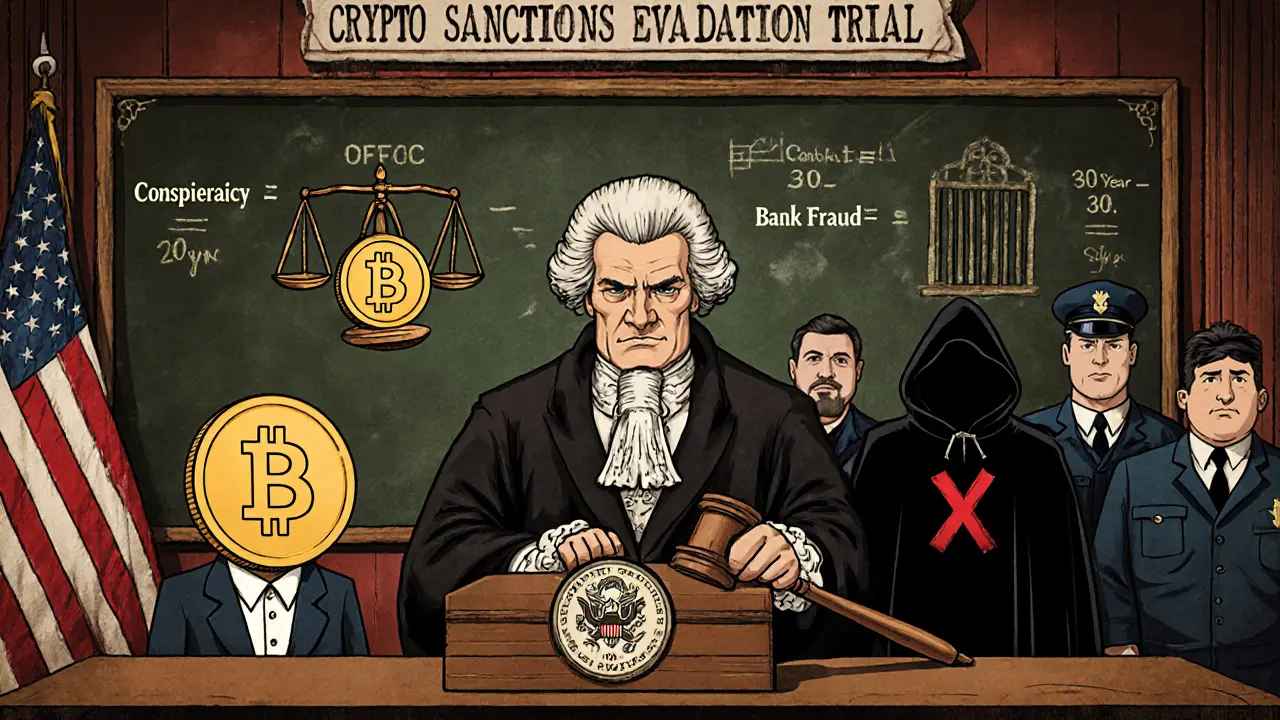

Crypto Sanctions Evasion: What It Means and How to Stay Safe

When dealing with crypto sanctions evasion, the act of bypassing government sanctions by moving digital assets through obscure channels. Also known as sanction circumvention, it puts traders, exchanges, and developers on the radar of regulators worldwide. Understanding the mechanics is the first step to protecting your portfolio and avoiding costly penalties.

Effective sanctions compliance, a framework that ensures all crypto activities respect international embargoes and blacklists depends on two key pillars. First, blockchain analytics, tools that trace token flows, flag suspicious addresses, and map complex transaction networks give investigators the visibility they need to spot evasion patterns. Second, strict AML/KYC, Know‑Your‑Customer and Anti‑Money‑Laundering procedures create a verifiable identity layer that deters bad actors. Together they form a safety net: crypto sanctions evasion requires robust AML/KYC processes, and blockchain analytics helps detect crypto sanctions evasion. The U.S. Office of Foreign Assets Control (OFAC, the agency that enforces economic and trade sanctions) regularly updates its Specially Designated Nationals (SDN) list, meaning anyone handling crypto must stay current with those entries.

Why This Matters for Every Crypto Participant

Regulatory frameworks shape everyday decisions on crypto exchanges, DeFi platforms, and even NFT projects. When sanctions compliance influences crypto exchange licensing, jurisdictions may deny licences to firms that can’t prove they screen transactions against OFAC lists. That ripple effect forces the whole ecosystem to adopt stricter monitoring, which in turn drives demand for better blockchain analytics solutions. For an individual trader, the takeaway is simple: use platforms that publicly disclose their compliance measures, run your own address checks, and keep an eye on whistle‑blowing forums where evasion tactics surface. Below you’ll find a curated set of articles that dive deeper into Malta’s crypto regulation, how to report scams, the future of crypto securities law, and practical guides on hash algorithms and airdrops—all of which touch on the broader compliance landscape that underpins sanctions enforcement. Armed with this knowledge, you’ll be better positioned to navigate the complex world of crypto sanctions evasion without falling into legal traps.