Crypto Meme Tokens: What They Are, Why They Surge, and How to Avoid the Scams

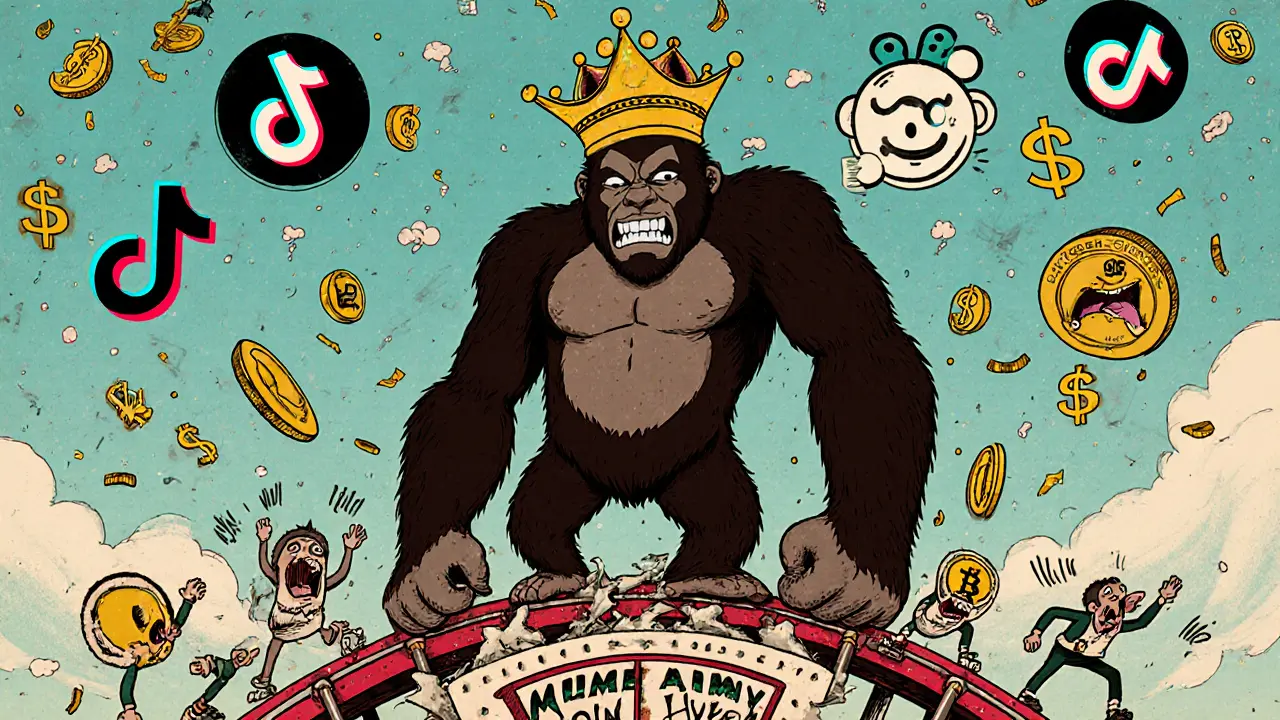

When you hear crypto meme tokens, digital assets built on humor, internet culture, and viral momentum rather than technical innovation. Also known as meme coins, they often start as jokes but can explode in value overnight—until they vanish just as fast. Unlike Bitcoin or Ethereum, these tokens don’t fix problems. They ride waves of TikTok trends, Reddit hype, and Elon Musk tweets. Some, like UPDOG, were launched as pure satire on Solana. Others, like LOFI or COOL, pretend to be real projects while having zero code, no team, and zero trading volume.

What makes meme coins, a category of cryptocurrency driven by community sentiment and social media virality. Also known as crypto meme tokens, they so dangerous isn’t just the price swings—it’s the fake airdrops. Look at CDONK X CoinMarketCap or Crypto Bank Coin (CKN). Neither existed. Scammers created fake websites, fake Twitter accounts, and fake ‘claim now’ buttons to steal wallet keys. These aren’t bugs—they’re features of the scam. Real airdrops, like Swash or GeoCash, have clear rules, official partners, and public blockchain records. Fake ones ask for your private key, send you to sketchy sites, or promise impossible returns.

Behind every big meme coin surge is a story: a Discord group that turned into a movement, a creator who posted a meme and got 10 million views, a token that got listed on a tiny exchange and suddenly had liquidity. But most of these tokens have no utility. No roadmap. No team you can find. Just a supply of billions, a price that jumps 500% in a day, and then crashes 90% by morning. That’s not investing. That’s gambling with a blockchain label.

Some meme tokens survive because their communities stick around—like FC Barcelona’s BAR token, which gives fans voting rights on merch and events. That’s not a meme. That’s a fan economy. But tokens like WTEC or STITCH? They’re ghost coins. One exchange. Tiny liquidity. No updates. Zero transparency. If you see a token with no website, no whitepaper, and a name that sounds like a joke, it probably is.

And here’s the truth: if you’re chasing the next Dogecoin, you’re already too late. The real opportunity isn’t in buying the hype—it’s in learning how to spot the traps. That’s why this collection dives into the scams, the dead coins, the fake airdrops, and the few meme tokens that actually built something. You’ll see how Japan and Malta regulate these tokens, how crypto ATMs get exploited, and why some tokens with zero volume still trick people into thinking they’re worth something. You won’t find fluff here. Just facts, patterns, and red flags you can use tomorrow.