Crypto Bank Coin: What It Is, Why It Matters, and What You Should Know

When people search for Crypto Bank Coin, a term often used to describe cryptocurrencies that aim to replace traditional banking services. Also known as banking tokens, it usually refers to projects trying to combine crypto with financial services like lending, savings, or payments—not a single coin called Crypto Bank Coin. There’s no official token by that name. Instead, you’ll find real projects like Chiliz (CHZ), a blockchain platform enabling fan tokens for sports teams, or Saros Finance (SAROS), a decentralized exchange built on Solana with advanced trading features, that actually deliver banking-like functions without needing a bank license.

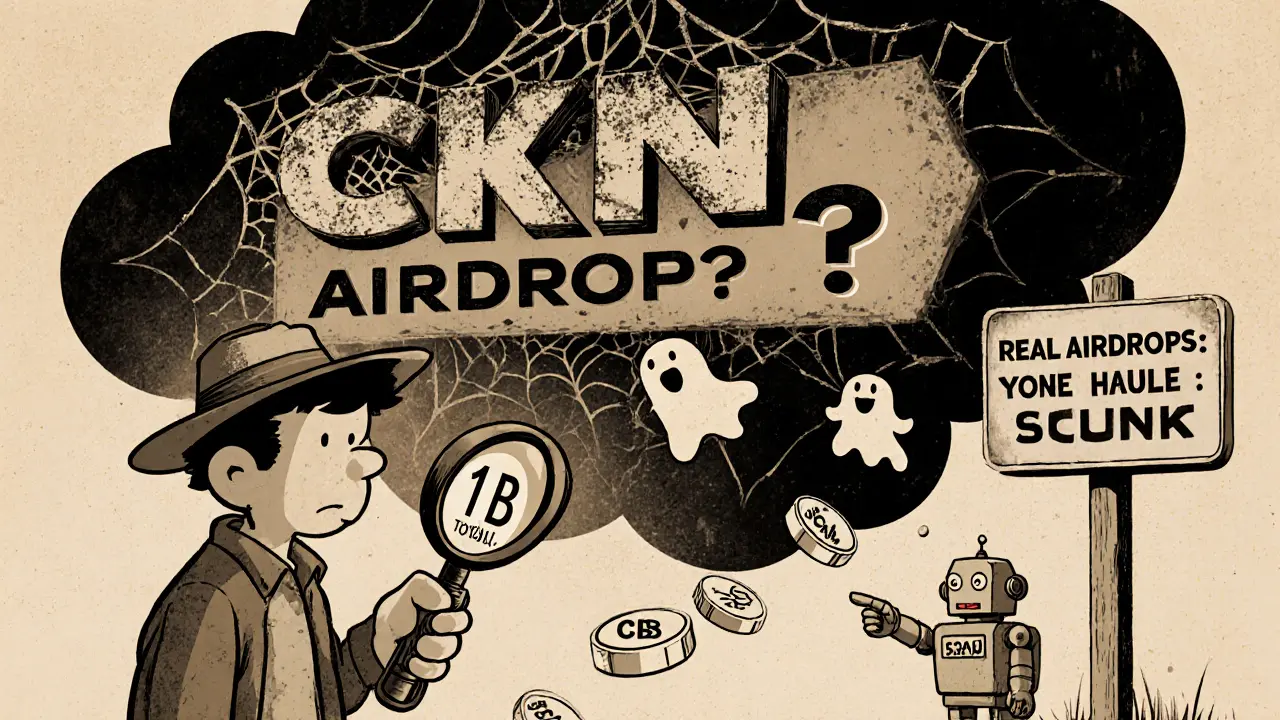

Why does this matter? Because scammers love the phrase "Crypto Bank Coin" to trick people into buying fake tokens with no value, no team, and no roadmap. Look at Coolcat (COOL), a dead token with zero trading volume and no website, or WTEC, a BEP-20 token with tiny liquidity and just one exchange listing. These aren’t banks. They’re ghosts. Real crypto banking tools—like stablecoins for cross-border payments, governance tokens for community control, or DeFi platforms for earning interest—actually move money. They don’t just sit on a chart with no activity.

What you’ll find in the posts below isn’t a list of fake "Crypto Bank Coin" projects. It’s a clean breakdown of real crypto finance tools: how fan tokens work, why airdrops get abused, how stablecoins are used outside trading, and what makes a token actually useful. You’ll see how Japan and Malta regulate these systems, how Venezuela uses crypto to bypass sanctions, and why some "earn while you watch" tokens are just noise. No fluff. No hype. Just what’s real, what’s risky, and what to avoid.