COW Token Price: Real Value, Trading Data, and What You Need to Know

When you hear COW token, the native token of Cow Protocol, a decentralized exchange aggregator built on Ethereum. Also known as COW, it’s designed to help traders get better prices by batching orders and reducing slippage. Unlike most meme coins, COW isn’t just hype—it’s tied to a live protocol used by real DeFi users. But its price doesn’t always reflect its utility, and that’s where things get messy.

What makes COW different is how it’s used inside Cow Protocol, a platform that combines orders from multiple DEXes to give users the best possible trade execution. Instead of buying crypto on Uniswap or SushiSwap directly, users submit their trades to Cow Protocol, which then finds the cheapest path across networks. This process saves money on gas and improves execution—something traders care about. The COW token gives holders voting power in the protocol’s governance and rewards them with fees from trades. But here’s the catch: most people don’t hold COW to vote. They hold it because they think the price will go up. And that’s where the disconnect happens.

Related to this is the idea of decentralized finance, a system where financial services like trading, lending, and earning interest happen without banks. COW sits right in the middle of that. It’s not a stablecoin. It’s not a Layer 2 scaling solution. It’s a governance and incentive token for a specific tool used by advanced DeFi users. That means its demand comes from a small, technical group—not the general public. That’s why you’ll see low trading volume compared to tokens like ETH or SOL. It’s not broken. It’s just niche.

Some people compare COW to other DeFi tokens like UNI or AAVE. But those have bigger ecosystems—lending, borrowing, liquidity mining. COW’s whole job is one thing: better trades. And it does that well. But if you’re looking for a token that’s going to explode in price because everyone’s talking about it, COW isn’t it. If you’re looking for a token that quietly improves your trading costs and gives you a say in how the system evolves, then it’s worth a closer look.

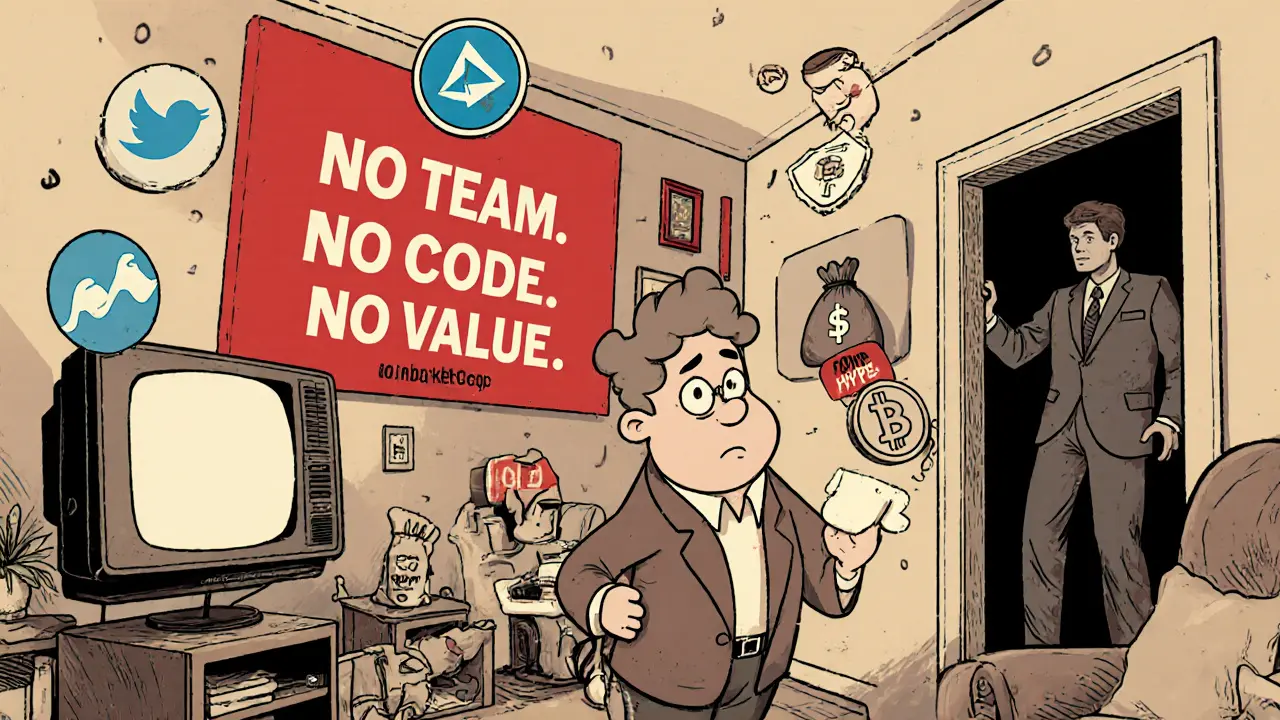

Below you’ll find real posts that dig into what COW actually does, how its price has moved over time, and whether it’s still a player in today’s DeFi landscape. Some of these articles expose empty promises. Others show real data. No fluff. Just what’s happening with the token, who’s using it, and whether it’s still worth your attention in 2025.