CoinWind cryptocurrency: What it is, why it matters, and what you need to know

When you hear CoinWind cryptocurrency, a blockchain-based reward token designed to incentivize trading and staking on decentralized exchanges. Also known as CWIND, it’s one of many tokens trying to turn user activity into passive income. But unlike flashy meme coins, CoinWind ties rewards directly to real trading behavior—think of it as cashback for using DeFi platforms instead of Amazon.

It’s not a standalone chain. CoinWind runs on existing networks like Binance Smart Chain and Polygon, which means it doesn’t build its own infrastructure. Instead, it plugs into DeFi protocols, decentralized financial systems that let users lend, borrow, and trade without banks to distribute tokens as incentives. This makes it similar to platforms like PancakeSwap or Uniswap, but with a tighter focus on rewarding frequent traders. The token’s value doesn’t come from hype—it’s meant to grow as more people use the exchange it’s tied to. But here’s the catch: if no one trades, the rewards dry up. That’s why many of these tokens fail quietly.

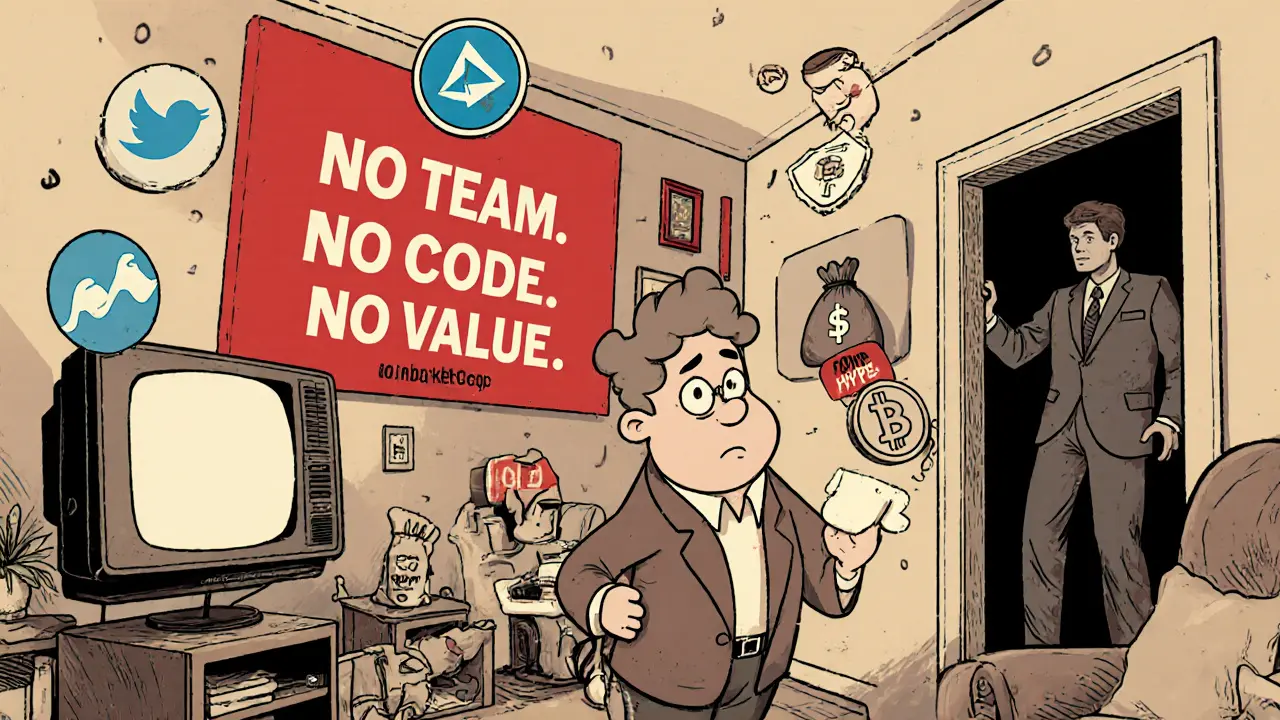

Behind CoinWind is a pattern you’ve seen before: airdrops, referral bonuses, and staking pools that look great on paper but often lack real volume. You’ll find similar setups in tokens like WLBO and CKN—projects that promise rewards but have zero trading activity or no verifiable team. CoinWind could be different, but without clear data on daily users or locked liquidity, it’s hard to say. It’s not a scam by default, but it’s also not proven. Most users who jump in chase short-term gains and leave when the rewards drop. That’s why checking the exchange listing, wallet distribution, and trading volume matters more than the whitepaper.

What you’ll find in the posts below isn’t just a list of CoinWind-related articles. It’s a collection of real cases—tokens that promised big, tokens that vanished, and tokens that actually delivered. You’ll see how crypto airdrops, free token distributions meant to grow a user base work, why some are legit and others are traps, and how to spot the difference before you invest time or money. You’ll also find comparisons with similar reward systems, breakdowns of how exchanges distribute tokens, and warnings about fake campaigns pretending to be associated with CoinWind. This isn’t theory. It’s what happened to real people who got burned—or got lucky.