Auto-Deleveraging: The Safety Net for Leveraged Traders

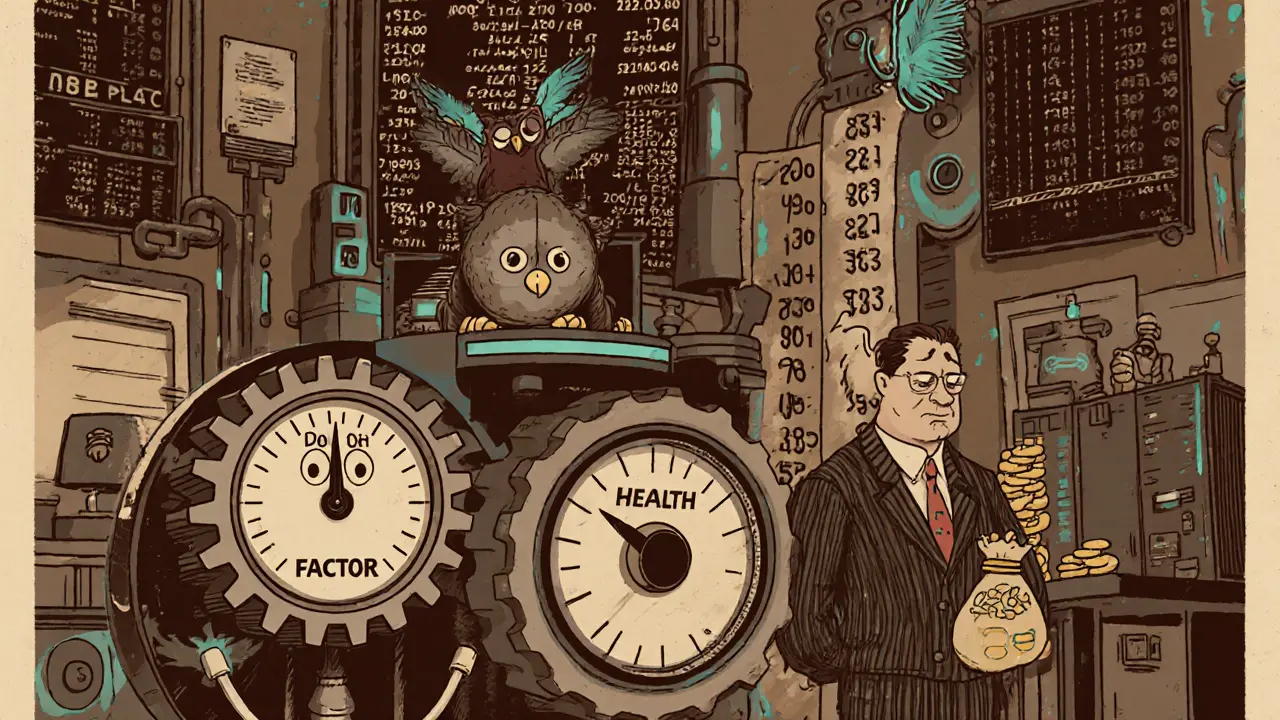

When working with Auto-Deleveraging, a system that automatically trims down large leveraged positions when market stress reaches a critical level, also known as ADL, it helps keep the trading platform from collapsing under a wave of forced liquidations. Auto-deleveraging kicks in after a predefined health metric drops, instantly shrinking or closing positions to protect the exchange’s solvency. In practice, ADL is the last‑resort tool that steps in when normal liquidation queues would otherwise overload the order book and create a cascade of losses.

How ADL Connects with Futures, Margin Trading, and Liquidation Engines

To see why ADL matters, first look at Futures Contracts, standardized agreements to buy or sell an asset at a set price on a future date. These contracts draw huge capital and often allow high leverage, which magnifies both gains and risks. When a trader’s margin ratio falls below the maintenance level, the platform’s Liquidation Engine, the automated process that closes positions to recover lost collateral steps in. However, if many traders hit the breach simultaneously, the engine can’t clear all orders quickly enough, and the market price may tumble further. That’s where Margin Trading, the practice of borrowing funds to increase exposure to price movements meets ADL. The system monitors each margin account in real time, and when the collective risk exceeds a safety threshold, ADL forces a proportional reduction across the most vulnerable positions, preventing a total order‑book collapse.

Think of ADL as a pressure relief valve for the whole ecosystem. It requires accurate data feeds, rapid risk calculations, and clear rules about which positions get trimmed first. Exchanges that deploy ADL usually rank traders by leverage size and health score, then apply the reductions starting with the riskiest accounts. This approach ensures that the platform’s capital stays intact while giving remaining traders a chance to recover. In short, auto‑deleveraging encompasses forced position reduction, requires real‑time margin monitoring, and enables exchanges to mitigate systemic risk. These three connections form the core of why ADL is a non‑negotiable feature for any serious futures or margin‑trading venue.

Below you’ll find a curated set of guides, deep dives, and practical checklists that unpack every angle of auto‑deleveraging. From understanding the math behind health metrics to comparing how major exchanges implement ADL, the articles cover everything you need to navigate leveraged markets safely. Dive in to see real‑world examples, risk‑management tips, and the latest regulatory perspectives that shape ADL rules today.