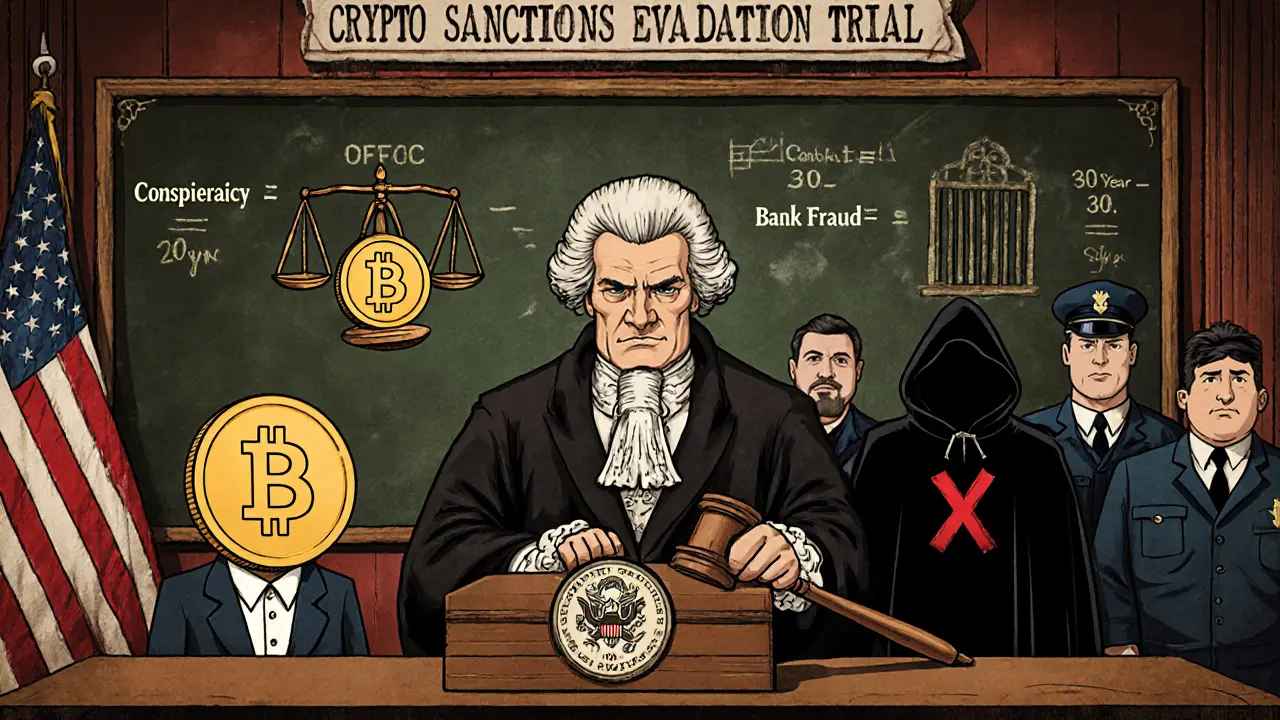

30-year prison and Its Impact on the Crypto World

When talking about 30-year prison, a severe custodial term often handed down for major financial crimes, including high‑profile cryptocurrency fraud, the phrase instantly signals the gravity of illegal activity. It’s not just a number; it represents a warning that regulators, investors, and developers take seriously. In crypto, a 30‑year sentence usually follows cases of massive fraud, money‑laundering schemes, or blatant violations of crypto regulation, the set of rules governing token offerings, exchanges, and licensing requirements worldwide. Understanding how that punishment fits into the broader compliance landscape helps you avoid costly mistakes and spot red flags early.

Why does a lengthy prison term matter for anyone working in blockchain? First, crypto scams, deceptive schemes that lure investors with false promises, often using fake token sales or Ponzi structures are the most common trigger for severe sentences. When authorities prove that a scam led to billions in losses, judges have increasingly imposed 30‑year terms to deter future fraud. Second, legal penalties, monetary fines, asset seizures, and custodial sentences imposed for breaking financial laws shape how exchanges approach compliance, the ongoing process of meeting regulatory standards, reporting requirements, and internal controls. In practice, firms that ignore compliance risk not just fines but also criminal charges that can land their executives in a 30‑year prison cell.

How the Sentence Influences Everyday Crypto Operations

Every day, developers, traders, and service providers make choices that intersect with three core ideas: regulation, risk, and reputation. The sentence acts as a bridge linking these ideas. 30-year prison sentences underscore that regulators view certain violations as existential threats to market integrity. That perception forces exchanges to adopt stricter KYC/AML procedures, pushes token issuers to secure legitimate licensing from bodies like the MFSA in Malta, and nudges investors to demand transparent audit trails. When a high‑profile case lands a founder in prison, the ripple effect is immediate: trading volumes dip, token prices tumble, and the community re‑evaluates trust in similar projects.

From a practical standpoint, the presence of such harsh penalties shapes three actionable steps. One, always verify the licensing status of a platform – a licensed exchange reduces the risk of running afoul of crypto regulation. Two, scrutinize tokenomics and whitepapers for signs of unrealistic returns – red flags often precede scam investigations that end in long sentences. Three, implement robust internal compliance programs, including regular audits and staff training, because the cost of a missed report can be far higher than a fine; it can be a prison term that ends a career.

These connections form a clear pattern: severe custodial terms (30‑year prison) → heightened regulatory scrutiny → stronger compliance measures → lower risk of fraud. The pattern repeats across jurisdictions, from the EU’s MiCA framework to U.S. SEC enforcement actions. As the regulatory environment tightens, the line between a legitimate token launch and a punishable fraud becomes sharper. That’s why staying updated on legal developments isn’t optional—it’s a survival skill.

Below you’ll find a curated list of articles that dive deeper into each piece of the puzzle. Whether you’re hunting for a step‑by‑step licensing guide, learning how to spot a scam before it lands anyone in jail, or wanting a quick rundown of compliance best practices, the collection offers practical insights you can act on today.