Airdrop Value Calculator

Airdrop Value Calculator

Results

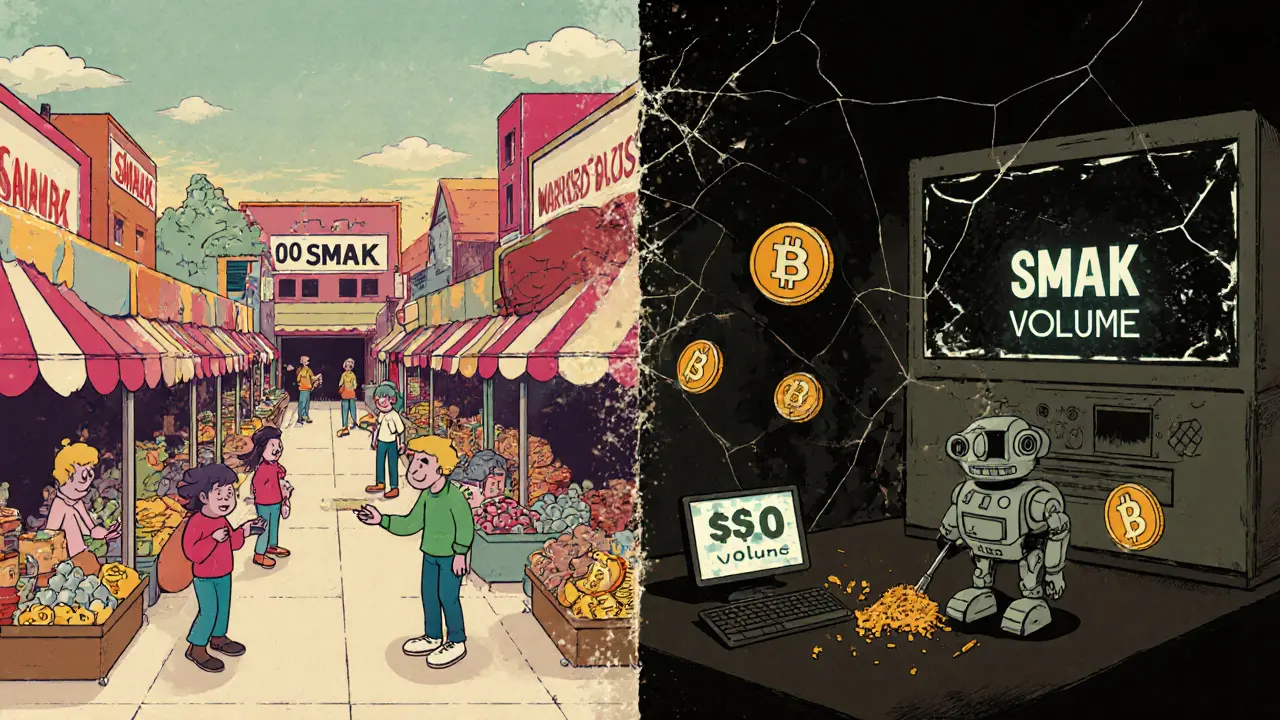

Back in September 2021, thousands of crypto users signed up for a free token drop called the SMAK X CoinMarketCap airdrop. It promised $20,000 worth of SMAK tokens to participants who followed simple steps on CoinMarketCap. At the time, it felt like just another opportunity to grab free crypto. But today, that same token trades for less than a penny - and most people have forgotten it ever existed.

What Was the SMAK Airdrop?

The SMAK airdrop was run by Smartlink, a project trying to build a decentralized escrow service for Web 3.0. Think of it like a digital middleman for online deals - if you’re buying something from a stranger on a blockchain platform, Smartlink would hold the payment until you both confirmed the transaction was complete. No need to trust the other person. No chargebacks. Just code doing the work. The airdrop ran from September 13 to September 23, 2021. To qualify, users had to create a CoinMarketCap account, verify their email, and complete a few basic tasks like following Smartlink’s social media. That’s it. No wallet deposits. No KYC. No fees. Around 10,000 people claimed tokens, and each got a small slice of the $20,000 pie. CoinMarketCap was the perfect place to run this. Back then, it was (and still is) the go-to site for crypto prices, charts, and news. Millions of people visited daily. If you wanted exposure, this was one of the easiest ways to get it.Why Tezos? The Tech Behind Smartlink

Smartlink didn’t build on Ethereum or BSC. It chose Tezos, a blockchain known for low fees and energy efficiency. Tezos uses a proof-of-stake system called Liquid Proof of Stake (LPoS), which lets token holders vote on upgrades without needing to sell their coins. That made it a good fit for Smartlink’s long-term vision. The SMAK token was meant to power everything:- Pay for escrow services - holders got discounts

- Earn rewards - users who locked SMAK got paid in tokens

- Vote on future changes - governance rights

What Happened After the Airdrop?

Right after the airdrop, SMAK hit a high of around $0.01. That’s 100 times more than its current price. Early holders saw quick gains. Some sold. Others held, hoping the platform would take off. But the platform never gained traction. The Smartlink website still exists, but updates stopped in 2022. No new features. No major partnerships. No marketing. The decentralized marketplace? Still listed on the site, but zero active listings. The payment processor? Not used by any known businesses. By 2023, trading volume dropped to almost nothing. Today, SMAK trades only on Gate.io - one of the smaller exchanges. The 24-hour volume? $0. That means no one is buying or selling. The token is essentially frozen in time.

The Price Crash: From The Price Crash: From $0.01 to $0.00013

.01 to The Price Crash: From $0.01 to $0.00013

.00013

Here’s the reality check:

- September 2021: SMAK price peaked at $0.01

- November 2024: SMAK was at $0.0024

- November 2025: SMAK is at $0.00013

Supply Confusion: Who Even Has SMAK?

There’s another red flag: the token supply doesn’t add up. CoinMarketCap says 305 million SMAK tokens are in circulation. But other trackers show 0. How is that possible? One theory: many tokens were sent to wallets that were never claimed. Or maybe the team locked them. Or maybe the data was never updated. Whatever the case, this kind of inconsistency erodes trust. If you can’t even agree on how many tokens exist, why would you trust the project?Was the Airdrop a Success?

In the short term? Yes. Smartlink got exposure. Thousands of people signed up. Social media buzzed. CoinMarketCap gave them legitimacy. But in the long term? No. Airdrops don’t build products. They build lists. And lists don’t pay bills. The team focused on getting users to claim tokens - not on getting users to use the platform. That’s a fatal mistake. Compare this to projects like Uniswap or Compound. They ran airdrops too. But they also built real tools. People used them. Tokens had purpose. SMAK had no such foundation.

What Can You Learn From This?

If you’re thinking about joining an airdrop today, here’s what to ask:- Does the project solve a real problem? Or is it just another token with a fancy website?

- Is there actual usage? Check GitHub commits, active users, transaction volume.

- Who’s behind it? Are the team members real? Do they have a track record?

- Is the token utility clear? Or is it just “for governance” with no voting history?

Where Is SMAK Today?

As of November 2025, SMAK is still listed on CoinMarketCap and CoinGecko. But the data tells a silent story:- Price: $0.000113-$0.000137

- 24h Volume: $0

- Exchanges: Only Gate.io

- Market Cap: $35,000 (down from over $1 million at peak)

- 7-Day Change: -47%

- 30-Day Change: -60%

Final Thoughts

The SMAK X CoinMarketCap airdrop wasn’t a scam. It was a missed opportunity. The idea had potential. The timing was right. The platform was built on a solid blockchain. But without real adoption, no token survives. This isn’t just a story about one failed project. It’s a warning for anyone chasing free crypto. Airdrops are fun. But they’re not investments. Unless the underlying project has real users, real utility, and real progress - your free tokens will end up worth less than the gas fee it took to claim them. If you still hold SMAK? You’re holding a digital artifact of a 2021 crypto trend. A relic. A lesson. Not an asset.Was the SMAK airdrop a scam?

No, the SMAK airdrop wasn’t a scam. It was a legitimate distribution campaign run through CoinMarketCap. Participants received tokens as promised. But the project behind the token failed to deliver real usage or long-term value. The scam wasn’t in the airdrop - it was in the false promise that the token would grow.

Can I still claim SMAK tokens from the 2021 airdrop?

No. The airdrop campaign ended on September 23, 2021. The claiming period is long closed. Any website or social media post claiming you can still claim SMAK tokens is likely a phishing attempt or scam. Only use official sources like CoinMarketCap or the Smartlink website - and even those no longer offer active claiming.

Is SMAK still tradable today?

Yes, but barely. SMAK trades only on Gate.io as of 2025. The 24-hour trading volume is $0, meaning there are no active buyers or sellers. You can technically sell your tokens, but you’ll likely get almost nothing for them. Liquidity is non-existent.

Why did SMAK’s price crash so hard?

SMAK’s price crashed because no one used the platform. The token had no real utility - escrow services weren’t adopted, the marketplace had zero listings, and the payment system wasn’t integrated anywhere. Without usage, demand vanished. And without demand, the price collapsed. Airdrops create hype, but only real products create value.

Should I buy SMAK tokens now?

No. Buying SMAK today is gambling, not investing. The project is inactive, the team is gone, and the token has no trading volume. Even if the price drops further, there’s no catalyst for recovery. Save your money for projects with active development, real users, and transparent teams.

What happened to the Smartlink team?

The Smartlink team stopped updating their website and social media after 2022. Their Twitter account hasn’t posted since 2023. No announcements, no roadmap updates, no responses to community questions. They effectively disappeared. This is a common pattern in failed crypto projects - hype first, silence later.

Can I use SMAK tokens for anything today?

No. The Smartlink escrow service, marketplace, and payment tools are inactive. Even if you hold SMAK, you can’t use it to pay for services, earn rewards, or vote on governance. The token’s utility was never activated in practice. It’s just a number in a wallet.

Douglas Tofoli

November 13, 2025 AT 13:40William Moylan

November 13, 2025 AT 17:18Michael Faggard

November 13, 2025 AT 21:44Johanna Lesmayoux lamare

November 14, 2025 AT 20:21ty ty

November 16, 2025 AT 01:22BRYAN CHAGUA

November 16, 2025 AT 21:16Debraj Dutta

November 17, 2025 AT 18:51tom west

November 19, 2025 AT 17:01Michael Brooks

November 19, 2025 AT 23:33David Billesbach

November 20, 2025 AT 04:36Andy Purvis

November 21, 2025 AT 09:34FRANCIS JOHNSON

November 23, 2025 AT 09:22Ruby Gilmartin

November 24, 2025 AT 04:11Elizabeth Stavitzke

November 25, 2025 AT 21:25Ainsley Ross

November 26, 2025 AT 20:09Brian Gillespie

November 28, 2025 AT 11:53Wayne Dave Arceo

November 28, 2025 AT 23:58Joanne Lee

November 29, 2025 AT 02:20Laura Hall

November 29, 2025 AT 23:14Arthur Crone

November 30, 2025 AT 14:41Michael Heitzer

December 1, 2025 AT 19:48Rebecca Saffle

December 2, 2025 AT 16:26