Crypto Compliance Cost Calculator

Calculate Your Thailand Compliance Costs

Based on Thailand's new regulations effective April 13, 2025

Your Estimated Compliance Costs

Annual Compliance Cost:

Minimum required costs for legal operation in Thailand

Penalty Risk

If you're trading cryptocurrency in Thailand or targeting Thai users with a crypto platform, you're playing in one of the toughest regulatory environments in Southeast Asia. As of April 13, 2025, Thailand's new rules don't just ask for compliance-they demand it, with fines, jail time, and blocked access as real consequences for getting it wrong.

What Happens If You Don't Follow the Rules?

Thailand’s Securities and Exchange Commission (SEC) doesn't issue warnings anymore. If you're running a crypto exchange, wallet service, or even a simple trading bot that accepts Thai users, and you're not licensed, you're already breaking the law. The Royal Decree on the Digital Asset Businesses (No. 2) B.E. 2568 (2025) turned up the pressure hard.Unlicensed platforms don't get a chance to fix things. The Ministry of Digital Economy and Society (MDES) can block their websites and apps without a court order. On June 28, 2025, five major foreign platforms were shut down overnight. Thai users lost access to their funds unless they moved them to licensed exchanges before the deadline. No refunds. No appeals. Just gone.

It's not just platforms that are at risk. Individuals using so-called "mule accounts"-crypto wallets or bank accounts knowingly used to receive stolen or scam funds-can face up to three years in prison and fines of up to 300,000 THB ($8,400 USD). That applies even if you didn't start the scam. If your wallet received money from a phishing attack and you didn't report it, you could be charged.

Foreign Platforms Must Localize or Leave

If you're outside Thailand but your platform supports Thai language, accepts THB payments, or runs ads targeting Thai users, you're legally considered to be operating in Thailand. That means you must set up a local company, hire a Thai director, open a Thai bank account, and register with the SEC-all before you can even start serving customers.It's not optional. The SEC doesn't care if you're based in Singapore, the U.S., or Estonia. If you're doing business with Thai citizens, you're subject to Thai law. And the compliance checklist is brutal:

- Full KYC verification for every user

- Real-time transaction monitoring using FATF-compliant algorithms

- Blacklisting wallets linked to fraud or money laundering

- Automatic freezing of suspicious accounts

- Direct data sharing with Thailand’s Anti-Money Laundering Office (AMLO)

- Commitment to refund victims of fraud-even if your platform wasn’t hacked

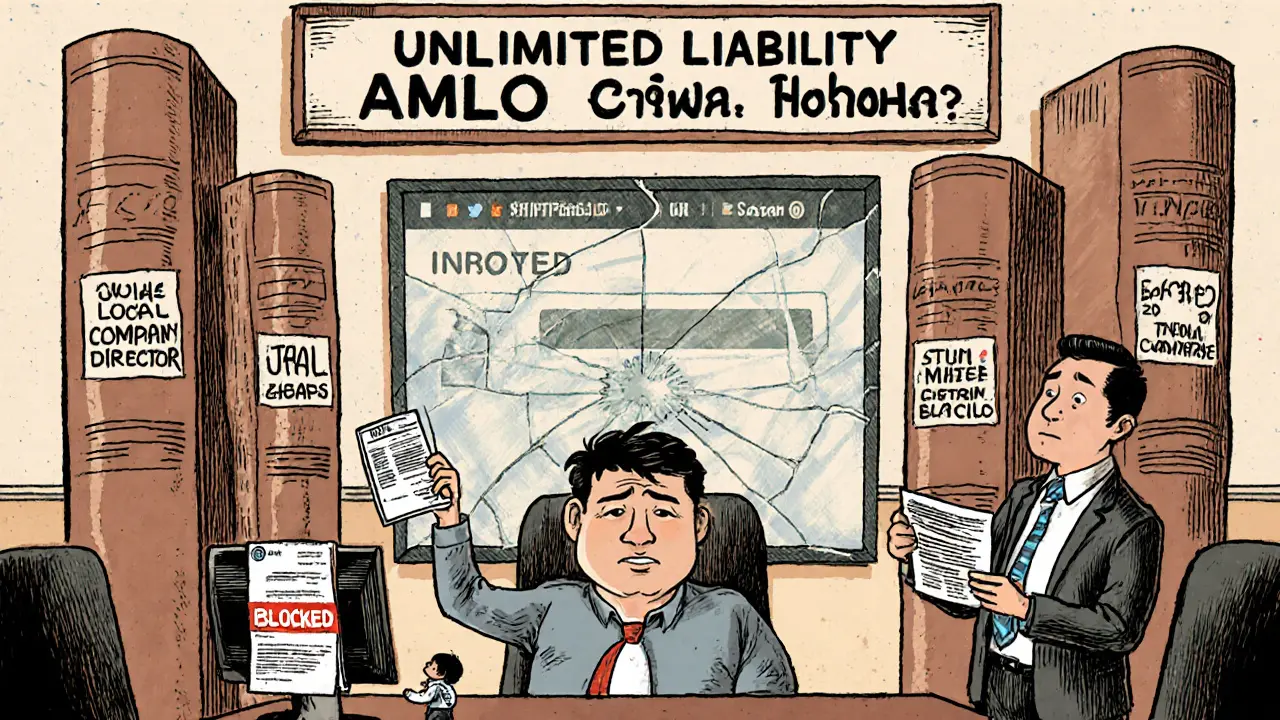

That last one is the most shocking. Unlike in most countries, Thai platforms can be held liable for losses caused by scams that pass through their systems. If a user gets tricked into sending crypto to a scammer, and that crypto went through your exchange, you might be legally required to pay them back. No insurance. No limit. Unlimited liability.

Licensed Platforms Are Under Heavy Scrutiny Too

Even if you’re licensed, you’re not safe. The SEC conducts random audits and demands proof of every compliance step. Platforms that fail to block blacklisted addresses, miss reporting suspicious transactions, or skip KYC checks risk having their license revoked. Operators can be criminally prosecuted.One licensed exchange in Bangkok had its license suspended in May 2025 after a user reported a scam that went undetected for 72 hours. The SEC fined them 5 million THB ($140,000 USD) and forced them to refund 12 victims out of their own reserves-even though the scam originated outside the platform. That’s the new standard.

And the cost to get licensed? Legal firms in Bangkok charge between 500,000 and 2 million THB ($14,000-$56,000 USD) just to help foreign companies navigate the paperwork, corporate setup, and regulatory sandbox process. Most small operators can’t afford it. That’s why the number of licensed platforms dropped from 12 to 7 in the first six months of 2025.

What About Thai Traders?

For Thai users, the changes have been mixed. On one hand, there’s more protection. Licensed platforms now have to verify identities, monitor for fraud, and help recover stolen funds. Reports of scams through regulated exchanges have dropped by 40% since January 2025.On the other hand, the experience is slower and more invasive. KYC now requires government ID, facial recognition, proof of address, and sometimes even a video call with a compliance officer. Withdrawals can take 2-5 days instead of minutes. Some users complain that the system feels like a bank-except you’re paying higher fees for fewer choices.

Trading volumes on licensed platforms rose 23% in 2025, not because more people started trading, but because the unlicensed ones vanished. Users had no choice but to move to the few remaining compliant exchanges. That lack of competition has pushed trading fees up by 15-30% on average.

Tax Incentives and Stablecoin Loopholes

To encourage people to stay on licensed platforms, the Thai government gave a sweetener: a five-year tax holiday. From January 1, 2025, to December 31, 2029, Thai residents don’t pay capital gains tax on crypto profits made through SEC-approved exchanges. That’s a big deal. Most people trading crypto in Thailand now make sure their trades go through licensed platforms just to avoid taxes.Stablecoins like USDT and USDC are now allowed-but only under strict conditions. You can use them to trade or hold, but you can’t pay for coffee, rent, or groceries with them. The Bank of Thailand still bans crypto as payment. The only exception is TouristDigiPay, a pilot program that lets foreign visitors use stablecoins for short-term spending. But even that’s limited to hotels, tours, and airport shops.

What’s Next for Thailand’s Crypto Market?

The SEC has signaled it’s just getting started. They’re already looking at DeFi protocols, NFT marketplaces, and crypto lending platforms for future regulation. The message is clear: if you touch Thai users, you play by Thai rules.Analysts predict that by late 2026, unlicensed crypto activity in Thailand will be nearly extinct. The penalties are too high, the enforcement too fast, and the legal risks too unpredictable. The market will shrink-but it will also become more stable.

That stability comes at a cost. Fewer platforms mean less innovation. Higher fees mean less access for small traders. And the unlimited liability rule could scare away even the biggest global exchanges. Thailand is betting that safety and control outweigh freedom and competition. So far, it’s working.

What Should You Do?

If you’re a Thai trader: use only SEC-licensed exchanges. Keep records of all trades. Don’t use wallets or accounts you don’t fully control. Avoid sending crypto to unknown addresses.If you’re a foreign platform operator: stop assuming you’re invisible. If you have Thai users, you’re regulated. Hire a Thai legal advisor. Budget at least $20,000 USD for compliance. Apply for the regulatory sandbox if you’re a startup. Don’t wait until you’re blocked.

If you’re running a business that accepts crypto: don’t use unlicensed platforms to settle payments. Even if it’s convenient, you’re exposing yourself to legal risk. Thailand doesn’t care how small you are. If you’re involved, you’re responsible.

Can I still trade crypto in Thailand legally?

Yes-but only through platforms licensed by Thailand’s SEC. Unlicensed exchanges are blocked, and using them puts your funds at risk. If you’re a Thai resident, you must use a licensed platform to avoid tax penalties and legal exposure. The SEC publishes a current list of approved exchanges on its official website.

What happens if I used an unlicensed exchange before June 2025?

If you didn’t withdraw your funds before the June 28, 2025 deadline, you likely lost access permanently. The SEC does not require licensed platforms to recover funds from blocked services. Your only option is to contact the unlicensed platform directly-but many have disappeared or are overseas with no legal accountability.

Can I be jailed for owning cryptocurrency in Thailand?

No, owning crypto is not illegal. But using your wallet to receive funds from scams, money laundering, or fraud can lead to criminal charges. The law targets the misuse of crypto, not possession. If you’re holding Bitcoin or Ethereum in a personal wallet and didn’t engage in illegal activity, you’re not at risk.

Why does Thailand require foreign platforms to set up local companies?

It’s about jurisdiction and accountability. If a platform is based overseas, Thai authorities can’t easily fine them, arrest their operators, or force them to refund victims. By requiring a local legal entity, Thailand ensures that someone inside the country can be held responsible for compliance, security, and customer protection.

Are stablecoins like USDT legal in Thailand?

Yes, but only for trading and holding on licensed platforms. You cannot use them to pay for goods or services. The Bank of Thailand still bans crypto as payment. Even USDT and USDC must go through SEC-approved exchanges and are subject to full KYC and transaction monitoring.

Is there a tax on crypto profits in Thailand?

Currently, no-up until December 31, 2029. The government has waived capital gains tax for trades made on SEC-licensed exchanges. After that, tax rules may change. Traders should assume taxes will return and plan accordingly. Profits from unlicensed platforms are not protected and may still be taxable.

Can I use a VPN to access blocked crypto sites in Thailand?

Technically yes, but it’s risky. Using a blocked platform still violates Thai law. If you’re caught, you could face penalties if you’re found to be actively trading or receiving funds from the platform. The SEC doesn’t typically target individual users-but they can and will act if you’re involved in large-scale activity or fraud.

Mike Calwell

November 15, 2025 AT 18:22bro just use binance and vpn lol

Sean Pollock

November 16, 2025 AT 08:59thailand's basically turning into a crypto police state 😂

they want you to be a bank but without the safety net. classic.

also why am i paying for a platform that refunds scam victims?? that's not my problem!!

also i used a vpn to check the blocked sites... they're still up... sooo... 😏

Ryan Hansen

November 17, 2025 AT 17:10the more i read this, the more i realize thai regulators aren't trying to stop crypto-they're trying to control the entire flow of digital value like it's water in a pipe.

they're not banning crypto, they're making it so expensive and slow to use that only the ultra-compliant survive.

and honestly? it's working. trading volumes are up because the wild west got bulldozed. but innovation? dead. startups? gone. the few left are either backed by banks or have lawyers on retainer.

the unlimited liability clause is the real game-changer. no other country makes exchanges pay for user stupidity. that’s a massive deterrent. even coinbase wouldn't survive that.

but here’s the irony: if you’re a thai trader who just wants to buy solana and chill, you’re now stuck with 3 platforms charging 30% more because there’s no competition. that’s not safety, that’s monopoly by regulation.

and the tax holiday? genius move. it’s not about fairness-it’s about forcing behavior. people aren’t switching to licensed exchanges because they trust them-they’re switching because they don’t want to pay 15% tax next year.

the stablecoin ban for payments? hilarious. you can trade usdt but not buy coffee with it? so it’s a digital asset, not a currency. okay, fine. but then why not just call it ‘crypto tokens for trading only’? the semantics are getting ridiculous.

the real question is: what happens when a thai user gets scammed on an unlicensed platform, then tries to use a licensed one to recover funds? do they get denied? do they get sued? do they just cry into their thai iced coffee?

Nataly Soares da Mota

November 18, 2025 AT 22:44the regulatory architecture here is a masterpiece of authoritarian pragmatism.

they’ve weaponized compliance as a barrier to entry-not to protect consumers, but to consolidate power. the 500k–2m thb legal fees? that’s not a cost of doing business-it’s a tax on disruption.

the fact that platforms must refund scam victims even if they weren’t hacked? that’s a paradigm shift. it’s not about trust-it’s about institutional liability as a social contract. you’re not just a service provider-you’re a guarantor of financial morality.

and the local entity requirement? brilliant. it transforms abstract jurisdiction into concrete accountability. no more offshore shell companies hiding behind cloud servers. if you want thai users, you pay thai blood, sweat, and legal fees.

the 40% drop in scams on licensed platforms? proof that regulation, when enforced, works. but at what cost? innovation? liquidity? user autonomy? all sacrificed on the altar of control.

thailand isn’t regulating crypto. it’s domesticating it.

Teresa Duffy

November 19, 2025 AT 04:39so if i’m a thai user and i got scammed on an unlicensed site before june 2025, i’m just screwed? no recourse? no hope? that’s brutal.

i know i shouldn’t have used unlicensed ones, but come on-everyone was doing it. now they just vanish? no warning? no grace period? just… poof?

and the kyc? i get it, security matters, but video calls with compliance officers?? that’s more invasive than my ex checking my phone.

i miss when crypto felt free. now it feels like a bank with extra steps and higher fees.

Carol Wyss

November 19, 2025 AT 07:53i just want to buy dogecoin without getting interrogated by a robot lawyer.

why does everything have to be so complicated??

also, i used a vpn once and felt guilty for a week. i’m not even a criminal!!

Ninad Mulay

November 20, 2025 AT 15:08as an indian, i’ve seen this before-remember the demonetization? same energy.

they’re not trying to kill crypto, they’re trying to make it boring.

and honestly? it’s working. the chaos is gone. the scams are down. the fees? yeah, they’re high. but at least my money isn’t disappearing into the void anymore.

thailand’s playing 4d chess while the rest of us are still trying to figure out checkers.

Shanell Nelly

November 22, 2025 AT 02:11if you’re a foreign dev thinking of targeting thailand: don’t wing it.

hire a thai lawyer. budget $20k minimum. don’t wait for a shutdown.

the regulatory sandbox is your friend. use it. it’s not a suggestion-it’s your lifeline.

also, stop thinking ‘but i’m small!’-they don’t care. if you have thai users, you’re big enough to be targeted.

Darren Jones

November 23, 2025 AT 14:12the unlimited liability rule is insane… but also kind of fair?

if your platform is the gateway for scammers to reach thai users, shouldn’t you bear some responsibility?

it’s not about punishing platforms-it’s about forcing them to build real security, not just marketing buzzwords.

the fact that one exchange got fined 5m thb for missing a scam for 72 hours? that’s a wake-up call.

if you’re building a crypto product, you’re not just coding-you’re building a financial institution.

and if you can’t handle that? then you shouldn’t be in the game.

Aryan Juned

November 25, 2025 AT 02:21thailand = crypto police state 🚨👮♂️💸

they got the kyc, the fines, the jail, the blocking, the refunds, the video calls, the thai directors…

what’s next? mandatory crypto meditation?

also i’m still using binance with vpn 😎

they can’t catch me 😈

Bruce Murray

November 25, 2025 AT 17:05i don’t hate this. i’m actually kind of impressed.

it’s not perfect, but it’s the first time i’ve seen a country actually enforce rules that protect users instead of just pretending to.

the tax holiday? smart. the local entity rule? necessary. the liability? scary, but fair.

maybe the future of crypto isn’t freedom-it’s responsibility.

Grace Craig

November 27, 2025 AT 15:08the legal framework presented herein constitutes a paradigmatic shift in the governance of digital asset ecosystems within sovereign jurisdictions.

by mandating domiciliary incorporation and imposing ex post facto fiduciary obligations upon intermediaries, the thai regulatory apparatus effectively redefines the nature of market participation.

the absence of capital gains taxation, coupled with stringent anti-money laundering protocols, suggests a strategic alignment of fiscal policy with financial stability objectives.

furthermore, the unilateral revocation of access to unlicensed platforms without judicial oversight raises profound questions regarding due process and extraterritorial jurisdiction.

in sum, thailand has not merely regulated cryptocurrency-it has reconstituted its role as a sovereign arbiter of digital economic behavior.

Carol Rice

November 29, 2025 AT 05:10THEY’RE NOT JUST REGULATING-THEY’RE REINVENTING THE WHOLE GAME!!!

UNLIMITED LIABILITY? YES. FINES? YES. JAIL? YES. VIDEO KYC? YES.

THIS ISN’T A COUNTRY-IT’S A CRYPTO LAB. AND WE’RE THE SUBJECTS.

THEY’RE BUILDING A FUTURE WHERE CRYPTO IS SAFE… BUT ONLY IF YOU PLAY BY THEIR RULES.

AND I’M HERE FOR IT. NO MORE SCAMS. NO MORE HIDDEN PLATFORMS. NO MORE ‘I DIDN’T KNOW’.

IF YOU’RE A THAI TRADER, USE THE LICENSED ONES. IF YOU’RE A FOREIGNER, GET YOUR LEGAL TEAM ON SPEED DIAL.

THIS ISN’T THE END OF CRYPTO-IT’S THE BEGINNING OF THE REAL ONE.

Student Teacher

November 30, 2025 AT 07:49so if i’m a thai student and i bought some btc in 2023 and forgot about it… now i have to do full kyc and prove i didn’t use it for scams?

what if i just held it and never traded? do i still need to report it?

and what if i inherited a wallet from a relative who used an unlicensed exchange?

the rules are clear for big players… but what about regular people who just wanted to learn?

Jay Davies

December 1, 2025 AT 20:50the 23% volume increase is misleading. it’s not growth-it’s consolidation.

the number of users hasn’t changed. the number of platforms has dropped from 12 to 7.

this isn’t adoption. it’s monopoly.

and the tax holiday? a temporary bribe to keep people compliant until the government decides to tax them anyway.

thailand’s model works, but it’s not sustainable long-term. it’s a walled garden, not a market.

Astor Digital

December 3, 2025 AT 15:17as someone who’s lived in both thailand and the u.s., this feels… familiar.

in the u.s., we have freedom but chaos. here, they have order but control.

you can’t blame them. scams were destroying lives. people were losing life savings to fake exchanges.

sure, it’s a pain. sure, the fees are high. sure, you need a thai director.

but if you want to sleep at night knowing your money isn’t gonna vanish into a russian server? this is the price.

thailand didn’t kill crypto. it just made it responsible.

Derayne Stegall

December 4, 2025 AT 03:05thailand just turned crypto into a bank with extra steps and zero chill 😅

but hey… at least my funds are safe now 💪

still using vpn though. shhh 😎

Barbara Kiss

December 4, 2025 AT 17:58what’s interesting is how this mirrors the evolution of banking in the 19th century.

back then, banks were wild, unregulated, and often collapsed. people lost everything.

then came regulation. capital requirements. audits. deposit insurance.

it wasn’t glamorous. it wasn’t free. but it created stability.

thailand is doing the same thing-with crypto.

they’re not trying to be cool. they’re trying to be safe.

and maybe, just maybe, that’s the real innovation.

Shanell Nelly

December 5, 2025 AT 15:57to the guy asking about inherited wallets: you’re in a gray zone.

the law targets active misuse, not passive ownership.

but if you ever move that crypto through a licensed exchange, you’ll have to prove its origin.

keep records. document everything. even if it’s just a text message from your relative saying ‘this is my btc, don’t touch it’.

in thailand, paperwork is your shield.