SSF Airdrop Legitimacy Checker

Verify if a claimed SSF airdrop is legitimate by checking against crypto scam red flags based on SecretSky.finance documentation. This tool helps you identify potential scams before risking your assets.

Enter details and click "Check Legitimacy" to verify if the airdrop is legitimate

If you’ve been scrolling through crypto forums lately, you’ve probably seen the phrase SecretSky finance airdrop pop up more than once. The hype, the mystery, and the promise of massive staking yields can be tempting, but the reality is a bit more nuanced. Below you’ll find a plain‑spoken walkthrough of what SecretSky.finance actually is, how its SSF token is distributed, what an airdrop could look like, and the red flags you should keep an eye on before you click any “claim” button.

What is SecretSky.finance?

SecretSky.finance is a decentralized communication platform built on the BNB Smart Chain that lets users send messages without ever revealing a phone number or email address. The service’s core feature, SSF:Chat, works with plain BEP‑20 addresses, allowing you to control who can contact you - either anyone or only a whitelist of trusted contacts. In short, it aims to be the "Signal of Web3" with extra privacy tricks like anti‑screenshot mode and self‑destructing messages.

Introducing the SSF Token

SSF token is the native governance and utility token of the SecretSky ecosystem. The contract lives at 0x6836…ab7ffa on the BNB Smart Chain and has a fixed supply of 1billion tokens. Holders can stake SSF to earn what the project calls “ultra‑high yields” and vote on roadmap decisions through the built‑in governance module.

Token Distribution at a Glance

Understanding how the supply is allocated helps you gauge how much of the token might ever hit the market - and how an airdrop could fit into that picture. Below is the official breakdown as disclosed by the team:

| Category | Percentage of Total Supply | Purpose |

|---|---|---|

| Presale (via Unicrypt) | 30% | Early fundraising and community seeding |

| Initial Liquidity Pool | 20% | Bootstrap trading on BNB Smart Chain DEXs |

| Staking & Governance Rewards | 25% | Incentivize long‑term holding and participation |

| Team & Advisors | 15% | Compensate developers and strategic partners |

| Reserve & Future Development | 10% | Flexibility for upcoming features or partnerships |

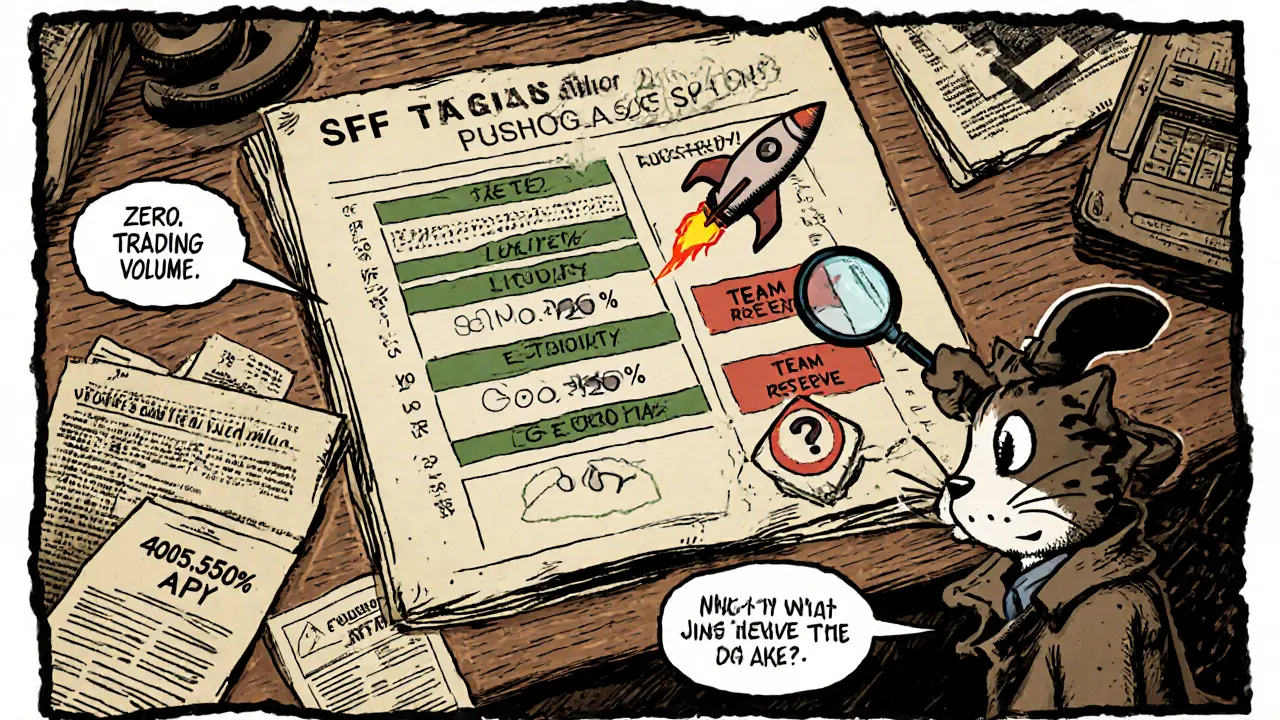

Notice that the circulating supply on major tracking sites still reads zero. That suggests the token has not yet been fully minted or distributed, which is a crucial clue when evaluating any airdrop claim.

Typical Airdrop Mechanics - What to Expect

Legitimate crypto projects usually follow a predictable pattern when they hand out free tokens. While SecretSky.finance has not published an official airdrop roadmap, here’s a template of what you’d normally see:

- Snapshot date: The blockchain state (wallet balances, activity on the platform, etc.) is recorded at a specific block.

- Eligibility criteria: Common requirements include holding a minimum amount of the native token, completing a KYC step, or being an active user of the platform.

- Distribution window: Tokens are sent in a single batch or over a series of weeks.

- Vesting schedule: Many projects lock a portion of the airdropped tokens for 3‑12 months to prevent immediate sell‑off.

Because the SSF token is still largely uncirculated, any claim of an ongoing airdrop should be taken with a grain of salt until the team posts a verifiable announcement on its official Telegram channel, Discord, or the project’s website.

Red Flags - Signals to Walk Away From

Unfortunately, the crypto space is littered with projects that promise sky‑high yields but lack substance. Below are the warning signs that appear around SecretSky.finance:

- Zero trading volume: CoinMarketCap shows SSF at $0 with no 24‑hour trades, meaning the token isn’t listed or is locked.

- Unrealistic APY claims: The advertised 405,555.56% annual percentage yield would require exponential token inflation - a classic red flag for Ponzi‑style reward schemes.

- Lack of audited contracts: No public audit reports have been released for the SSF contract address 0x6836…ab7ffa, making it hard to verify safety.

- Missing documentation: There’s no detailed whitepaper, roadmap, or team bios that can be cross‑checked.

- Vague airdrop details: No snapshot dates, eligibility rules, or distribution mechanics have been disclosed.

If any of these points sound familiar, take extra time to investigate before you sign up for a wallet connection or share private keys.

How to Verify a Legitimate SSF Airdrop

When a genuine airdrop is announced, the project usually follows a transparent communication flow. Here’s a quick checklist you can run against any SSF‑related claim:

- Check the official SecretSky.finance website - the domain should match the one listed in the whitepaper.

- Look for a pinned announcement on the project’s verified Telegram or Discord server.

- Confirm the contract address matches the official SSF token address (0x6836…ab7ffa).

- Search for an audit report from a reputable firm such as CertiK or Quantstamp.

- Verify that the airdrop does not ask for private keys, seed phrases, or any payment to “unlock” the reward.

Only after you’ve ticked all these boxes should you consider interacting with the airdrop smart contract.

Step‑by‑Step: Safely Claiming a Potential SSF Airdrop

Assuming you’ve verified that a legit SSF airdrop is live, follow these steps to keep your assets safe:

- Set up a fresh BNB Smart Chain wallet. Use MetaMask, Trust Wallet, or any hardware wallet that supports BEP‑20 tokens. Do not reuse a wallet that holds large sums of other crypto.

- Add the SSF contract. In the wallet, click “Add Token” and paste the contract address 0x6836…ab7ffa. This will let you see any incoming SSF.

- Take a snapshot of your eligibility. If the airdrop requires holding a certain amount of SSF or another token, make sure the balance is present before the announced snapshot block.

- Interact only with the official claim contract. Copy the contract address from the official announcement, paste it into your wallet’s “Interact with Contract” feature, and execute the “claimAirdrop()” function. Double‑check the gas fee and network (BNB Smart Chain).

- Confirm receipt. After the transaction confirms, you should see the airdropped SSF in your token list. Take a screenshot of the transaction hash for future reference.

- Follow vesting rules. If the airdrop is locked for a period, do not attempt to sell immediately; the contract will reject the transfer until the lock expires.

Remember, if anything feels off - a sudden pop‑up asking for a fee, a request to send BNB to a stranger, or a claim link that redirects to an unknown domain - abort immediately.

Bottom Line: Proceed with Caution but Stay Informed

SecretSky.finance presents an intriguing vision of anonymous, blockchain‑based messaging, and the SSF token could become a useful governance asset if the project launches as promised. However, the current lack of market activity, missing audits, and ultra‑high staking yields are strong indicators that the ecosystem is still in a very early (or possibly speculative) phase.

When it comes to airdrops, the rule of thumb is simple: if you can’t verify the source, don’t trust the claim. Use the checklist above, keep your private keys offline, and only interact with contracts that are openly linked from the official SecretSky channels.

Frequently Asked Questions

Is there an official SSF airdrop right now?

As of October2025, SecretSky.finance has not posted a verified airdrop schedule on its official website, Telegram, or Discord. Any claim circulating on social media should be treated as unverified until the team issues a formal announcement.

Where can I find the SSF contract address?

The SSF token lives at 0x6836…ab7ffa on the BNB Smart Chain. You can view the contract on BscScan by searching that address.

Do I need to pay a fee to claim an airdrop?

Legitimate airdrops only require the standard blockchain transaction (gas) fee. If a portal asks you to send BNB or any other token to "unlock" the reward, it’s a scam.

How risky are the advertised 405,555% APY staking rewards?

Such astronomical APY figures are mathematically unsustainable and typically signal an inflated token supply or a short‑term promotion. Investing large sums to chase those yields can lead to significant losses when the token price collapses.

What should I do if I’ve already interacted with a suspicious SSF airdrop contract?

Immediately move any remaining funds to a new, secure wallet. Monitor the original address for unauthorized withdrawals and report the incident on the SecretSky community channels. Consider contacting a blockchain forensic service if a large amount is involved.

Brian Elliot

October 15, 2025 AT 08:24The SSF airdrop landscape is littered with hype and half‑baked promises.

The before you click any “claim” button, verify the contract address matches 0x6836…ab7ffa on BscScan.

Double‑check that the announcement comes from the official SecretSky Telegram or Discord channel.

Legitimate airdrops never ask you to send BNB or any other token to unlock rewards.

They only require you to pay the standard gas fee for the transaction.

Use a brand‑new wallet for the airdrop and keep it separate from wallets holding large balances.

Add the SSF token to the wallet manually so you can see incoming tokens immediately.

Take a screenshot of the transaction hash as proof in case you need to report an issue.

If the airdrop mentions an astronomical APY, treat it as a red flag and investigate further.

Look for an audit report from a reputable firm such as CertiK or Quantstamp.

Absence of an audit should make you extra cautious.

Check the token’s circulating supply; a zero supply often indicates the token hasn’t been minted yet.

Review the token distribution chart to understand how many tokens are reserved for the team versus the community.

Follow any vesting schedule that’s communicated; early selling can trigger contract restrictions.

In short, stay skeptical, verify every detail, and protect your private keys at all times.

Marques Validus

October 16, 2025 AT 09:24Yo fam the SSF airdrop hype is off the charts it's basically a pump‑and‑dump frenzy with zero vetting the community is buzzing like a hive mind and everyone's shouting about sky‑high APY but guess what the smart contracts are probably a honeypot there’s no audit no official doc just vague whispers on Telegram and Discord the token address might be a placeholder and the gas fees will eat your balance if you’re not careful stay alert keep your private keys locked and never send BNB to claim anything else it’s a classic rug pull scenario

Tayla Williams

October 17, 2025 AT 10:24It is essential to peruse the official documentation prior to quelconque participation. The absent of a verifiable audit raise concerns regarding security. Moreover, the advertised APY of 405,555% appears mathematically implausible. Users should exercise due dilligence and refrain from divulging their seed phrases. In sum, the project lacks transparency.

Jordann Vierii

October 18, 2025 AT 11:24If you’re just getting started with crypto airdrops, keep it simple and safe. Spin up a fresh BNB Smart Chain wallet that holds only a little BNB for gas. Add the SSF token address manually so you can watch for incoming drops. Always double‑check the source of the announcement – official channels only. Never share private keys or seed phrases, no matter how convincing the pitch sounds. Guard your funds like you would guard your passport.

Lesley DeBow

October 19, 2025 AT 12:24When we stare into the abyss of airdrop promises, we find a mirror reflecting our own greed. The paradox of "free" tokens is that freedom always costs something – usually your attention, sometimes your security. Remember, the universe does not owe you a token, but it does reward caution. :-)

Jordan Collins

October 20, 2025 AT 13:24The checklist you provided is comprehensive, yet I would add a step to verify the contract’s source code on BscScan for any hidden backdoors. Additionally, monitoring the token’s liquidity pool can reveal sudden withdrawals, another red flag. It’s also wise to compare the announced APY with realistic staking yields across similar platforms. This methodical approach minimizes exposure to rug pulls.

Andrew Mc Adam

October 21, 2025 AT 14:24Listen up folks – the SSF airdrop circus is in town and the clowns are wearing shiny contracts. If you ignore the red flags you’ll end up like a moth to a burning solor. The apy numbers are so high they defy physics, which tells me the devs are playing with fire. Keep your wallet fresh, keep your keys offline, and don’t let the hype swallow you whole. Typos in the official docs? That’s a sign the whole thing might be a hastily cobbled scam.

Shrey Mishra

October 22, 2025 AT 15:24I totally feel the drama behind this airdrop – the hype is electric, the promises are over‑the‑top, and the community buzz feels like a battlefield of memes. Yet the lack of audit and the demand for BNB payments scream classic rug‑pull vibes. It’s like watching a fireworks show that never actually launches a rocket.

Ken Lumberg

October 23, 2025 AT 16:24The absence of an independent audit is simply unacceptable; it shows a blatant disregard for investor safety. Anyone claiming legitimacy while ignoring basic security protocols must be called out. Demand proof, demand transparency, or walk away.

Blue Delight Consultant

October 24, 2025 AT 17:24In the grand tapestry of decentralized finance, each thread must be examined for strength before it is woven into the collective fabric. An airdrop that lacks verification is a loose strand that can unravel the whole garment.

Shauna Maher

October 25, 2025 AT 18:24They’re hiding something, I’m sure of it. The whole “no payment required” claim is a smokescreen, and the ultra‑high APY is pure bait. Stay away unless you want to fund the next covert operation.

Kyla MacLaren

October 26, 2025 AT 18:24yeah i think it’s best to just keep your keys safe and dont trust random links. i’ve seen too many peoples wallets get drained because they clicked a fake claim button.

Linda Campbell

October 27, 2025 AT 19:24America’s digital frontier should stand as a beacon of security and integrity. Allowing unscrupulous airdrops to flourish undermines the very principles of liberty and innovation that our nation cherishes.

John Beaver

October 28, 2025 AT 20:24Never trust a request for BNB to unlock an airdrop.

EDMOND FAILL

October 29, 2025 AT 21:24Just chill, read the source, and if something feels off, walk away. No rewards are worth losing your wallet.