Before Taproot, every Bitcoin transaction using multiple signatures looked like a mess on the blockchain. If you sent money with two friends, the network saw three separate signatures, three public keys, and a clunky script that screamed "multisig." That changed in November 2021. With Taproot, Bitcoin quietly swapped out its 12-year-old signature system for something simpler, smaller, and more private: Schnorr signatures. But why swap at all? And what did ECDSA - the old workhorse - actually do wrong?

Why ECDSA Was the Default for Over a Decade

ECDSA wasn’t chosen because it was perfect. It was chosen because it was available. When Bitcoin launched in 2009, the Schnorr signature patent was still active. Claus-Peter Schnorr had filed it in the 1980s, and until it expired in the 2010s, using his algorithm legally in software meant paying royalties. So Bitcoin developers used ECDSA - a variant of the older DSA algorithm - because it was patent-free and already well-studied. It worked. It secured billions in value. But it had flaws built into its design.

ECDSA signatures in Bitcoin are 70-72 bytes long. That’s not huge, but multiply that by thousands of transactions per block, and you’re wasting space. Public keys? 33 bytes each. The encoding? DER/BER - a bloated, complex format designed for general-purpose cryptography, not blockchain efficiency. And worst of all, ECDSA signatures are malleable. A third party could tweak a valid signature slightly and make it look different without breaking its validity. That broke things like the Lightning Network’s payment channels, forcing developers to build workarounds just to keep the system stable.

What Makes Schnorr Signatures Different

Schnorr signatures are mathematically cleaner. Instead of the non-linear, two-part structure of ECDSA, Schnorr uses a single linear equation. That simplicity has real-world consequences. First, size: Schnorr signatures are always 64 bytes. Public keys? Just 32 bytes. That’s a 10% reduction in data per signature - and in a system where every byte costs money, that adds up fast.

But the real game-changer is how Schnorr handles multiple signatures. With ECDSA, if three people need to sign a transaction, you need three separate signatures and three public keys listed in the blockchain. It’s obvious. It’s bulky. It’s private information leaking out. Schnorr, through MuSig (a multi-signature protocol built on top of it), lets those same three people combine their keys into one single public key. They produce one single signature. To the blockchain, it looks exactly like a normal, single-owner transaction.

That’s not just a technical win - it’s a privacy revolution. Before Taproot, blockchain analysts could spot multisig wallets from a mile away. Now? You can’t tell the difference between a solo wallet and a corporate treasury holding funds with 5-of-7 approval. That’s huge for institutional adoption, for privacy-focused users, and for anyone who doesn’t want their financial patterns tracked.

Performance: Speed, Size, and Batch Verification

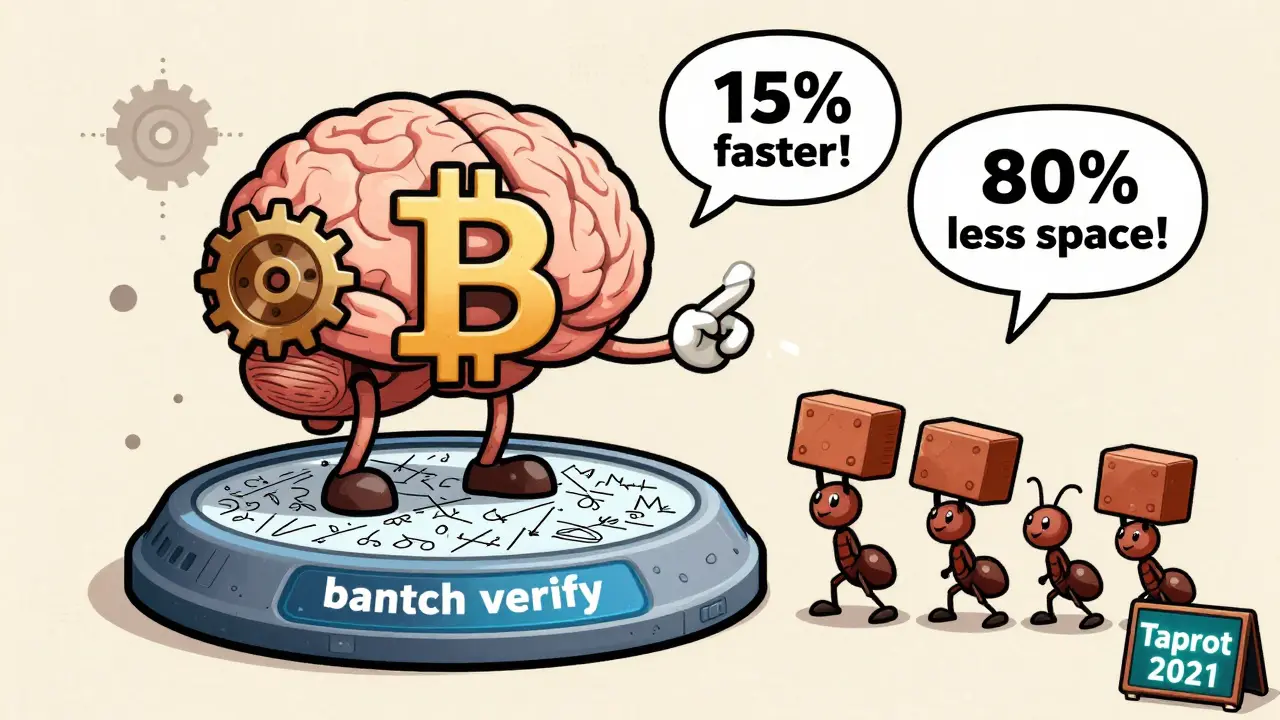

Verification speed isn’t just about user experience - it’s about network scalability. Schnorr signatures verify about 15% faster than ECDSA on average. That might not sound like much, but when you’re processing 3,000 transactions per block, that adds up to seconds saved across the entire network. Memory usage is lower too. Less strain on nodes means more people can run full nodes, which strengthens decentralization.

But the biggest performance boost comes from batch verification. With ECDSA, you verify each signature one by one. With Schnorr, you can verify dozens or even hundreds of signatures in a single mathematical operation. That’s because Schnorr’s linearity allows signatures to be combined mathematically before verification. In a blockchain where miners and full nodes validate every transaction, this cuts down CPU load dramatically. It’s like comparing checking 100 receipts one at a time versus adding them all up and checking the total once.

Security: Simpler Proofs, Fewer Bugs

Security isn’t just about being unbreakable - it’s about being hard to mess up when implementing. ECDSA is notoriously tricky to code correctly. The nonce (a random number used once in signing) must be truly random. If reused - even once - an attacker can steal the private key. There have been real-world breaches caused by nonce reuse in poorly implemented wallets.

Schnorr doesn’t eliminate the need for good randomness, but its simpler structure reduces the number of ways things can go wrong. There’s no need for the complex curve arithmetic ECDSA requires. No DER encoding headaches. No signature malleability. Schnorr signatures are inherently non-malleable - once signed, they can’t be altered without breaking the signature entirely. That’s a built-in fix for a problem that plagued Bitcoin for over a decade.

Also, ECDSA needed extra steps like key prefixing to avoid certain attacks. Schnorr doesn’t. Fewer moving parts. Fewer attack surfaces. That’s why developers who’ve worked with both say Schnorr is simply easier to implement correctly.

Privacy: The Silent Winner

Privacy in Bitcoin has always been an afterthought. But Schnorr changes that. With key aggregation, any multisig setup - whether it’s 2-of-3, 5-of-7, or even 10-of-15 - collapses into a single public key and a single signature. To an observer, it looks identical to a regular wallet. No more patterns. No more footprints. No more telling which wallets are corporate, which are family accounts, and which are cold storage.

This isn’t theoretical. It’s already being used. Lightning Network channels that use Schnorr-based multisig are now indistinguishable from single-signature on-chain transactions. That means less data for chain analysts, fewer targets for surveillance, and more freedom for users. Even exchanges and custody providers are adopting Schnorr to hide their internal multi-signature structures from public view.

Scalability: More Transactions, Lower Fees

Block space is limited. Every byte you save means more transactions fit in a block. With Schnorr, you’re saving 6-9 bytes per signature. But with key aggregation, you’re saving hundreds of bytes per multisig transaction. A 3-of-5 multisig that used to take 500+ bytes now fits in under 100. That’s a 80% reduction in on-chain footprint.

That directly translates to lower fees. If you’re running a business that pays 10 employees every week with a multisig wallet, you’re now paying 80% less in fees. For high-volume users, that’s hundreds of dollars saved per year. And because batch verification is faster, nodes can process more transactions per second without upgrading hardware. That’s scalability without hard forks.

Adoption Today: Still a Work in Progress

Taproot activated in November 2021. But adoption didn’t happen overnight. Wallets had to update. Exchanges had to adjust. Developers had to learn. As of early 2026, about 45% of Bitcoin transactions now use Schnorr signatures - mostly from wallets like Sparrow, BlueWallet, and Ledger. Major exchanges like Coinbase and Kraken support it for internal custody. But many older wallets still default to ECDSA.

The transition is slow because Bitcoin moves cautiously. No one wants to break the network. But the trend is clear: new wallets are built with Schnorr as the default. Old ones are being phased out. The future is Schnorr. ECDSA isn’t going away tomorrow - but it’s becoming legacy tech.

What’s Next? Threshold Signatures and Beyond

Schnorr isn’t just about better signatures - it’s a foundation for advanced crypto. Researchers are already building threshold signature schemes using Schnorr, where you need, say, 3 out of 5 signers to approve a transaction - but no one knows who the others are. That’s ideal for enterprise custody, DAOs, and decentralized finance.

Future upgrades could let you aggregate signatures across multiple transactions - imagine 100 payments signed by one user, verified as one unit. That could reduce block space usage even further. Or, combine Schnorr with zero-knowledge proofs for even stronger privacy. The math is there. The infrastructure is growing. The potential is massive.

Bottom Line: Why It Matters

ECDSA kept Bitcoin alive for 12 years. But it was holding it back. Schnorr signatures fix the flaws without compromising security. They make Bitcoin faster, cheaper, more private, and more scalable - all while staying backward compatible. You don’t need to upgrade your wallet to benefit. But if you use multisig, or care about fees, or want privacy, you’re already using Schnorr without realizing it.

This isn’t just a technical upgrade. It’s a quiet revolution in how Bitcoin works under the hood. And it’s the clearest sign yet that Bitcoin’s development isn’t stuck - it’s evolving, deliberately, and for the long term.

Are Schnorr signatures more secure than ECDSA?

Yes, in practice. Both rely on the same elliptic curve cryptography, so their theoretical security is equal. But Schnorr signatures are non-malleable by design, have simpler security proofs, and are harder to implement incorrectly. ECDSA has had real-world exploits due to nonce reuse and encoding bugs. Schnorr reduces those risks.

Do I need to do anything to use Schnorr signatures?

No, if you’re just sending or receiving Bitcoin. But if you use multisig wallets, you’ll get better privacy and lower fees automatically when you send from a Schnorr-enabled wallet. Most modern wallets like Sparrow, BlueWallet, and Ledger now support it by default. Older wallets may still use ECDSA.

Can Schnorr signatures be used on other blockchains?

Yes. Many newer blockchains like Litecoin, Elements, and even Ethereum L2s are adopting Schnorr signatures for their efficiency and privacy benefits. Bitcoin’s Taproot implementation proved the concept works at scale, and others are following suit.

Why didn’t Bitcoin use Schnorr from the start?

Because the original Schnorr patent was still active when Bitcoin was created in 2009. Developers avoided it to prevent legal risk. ECDSA was a patent-free alternative. The patent expired in the 2010s, making Schnorr legally usable - which is why it was finally added via Taproot in 2021.

Is ECDSA being removed from Bitcoin?

No. ECDSA is still fully supported and will remain valid for existing transactions. Schnorr is an addition, not a replacement. But new transactions, especially multisig ones, are increasingly using Schnorr because it’s better in every way. Over time, ECDSA will fade into legacy use.

Jacob Clark

January 12, 2026 AT 07:44Jon Martín

January 12, 2026 AT 18:17Mujibur Rahman

January 12, 2026 AT 19:07Danyelle Ostrye

January 14, 2026 AT 12:41Jennah Grant

January 15, 2026 AT 01:01Dennis Mbuthia

January 15, 2026 AT 13:29Dave Lite

January 15, 2026 AT 17:26Becky Chenier

January 17, 2026 AT 01:55Staci Armezzani

January 18, 2026 AT 17:52Don Grissett

January 19, 2026 AT 17:28Veronica Mead

January 20, 2026 AT 21:11Mollie Williams

January 21, 2026 AT 08:12Surendra Chopde

January 21, 2026 AT 13:17Tiffani Frey

January 22, 2026 AT 10:06kris serafin

January 23, 2026 AT 13:13Valencia Adell

January 24, 2026 AT 16:00Paul Johnson

January 24, 2026 AT 21:58Kelley Ramsey

January 25, 2026 AT 05:53Tre Smith

January 26, 2026 AT 03:43Ritu Singh

January 27, 2026 AT 03:30Tracey Grammer-Porter

January 27, 2026 AT 09:39sathish kumar

January 28, 2026 AT 00:04