Crypto Risk Assessment Calculator

Risk Assessment Calculator

Assess your crypto business risk level based on key factors to determine appropriate compliance measures.

Customer Risk Factors

Geographic Risk Factors

Product Risk Factors

Risk Assessment Results

Risk Factors Applied

When you run a crypto exchange, wallet service, or DeFi platform, you don’t get to pick and choose which rules to follow. The global financial system is watching. And if you’re not using a risk-based approach to compliance, you’re not just risking fines-you’re risking your entire business.

Why Rules-Based Compliance Fails in Crypto

Ten years ago, banks handled money laundering risks with simple rules: flag any transfer over $10,000. Block transactions to known bad addresses. Run a basic KYC check. It worked for traditional finance because cash flows were predictable, accounts were tied to identities, and the system moved slowly. Crypto doesn’t work like that. A single user can send $500,000 in Bitcoin through a decentralized exchange, then mix it through three privacy protocols, and withdraw it as stablecoins from a wallet with no identity attached-all in under 10 minutes. A rules-based system would flag every single one of those steps. That’s thousands of false alerts per day. Your compliance team spends hours chasing ghosts while real criminals slip through. That’s why the Financial Action Task Force (FATF) pushed for a risk-based approach (RBA) back in 2012-and why it’s now mandatory in 206 countries. RBA says: don’t treat every customer the same. Don’t apply the same controls to a retail investor buying $200 worth of ETH and a high-net-worth trader moving $5 million through cross-chain bridges. Assess the actual risk. Then respond proportionally.The Four Pillars of a Crypto Risk-Based Approach

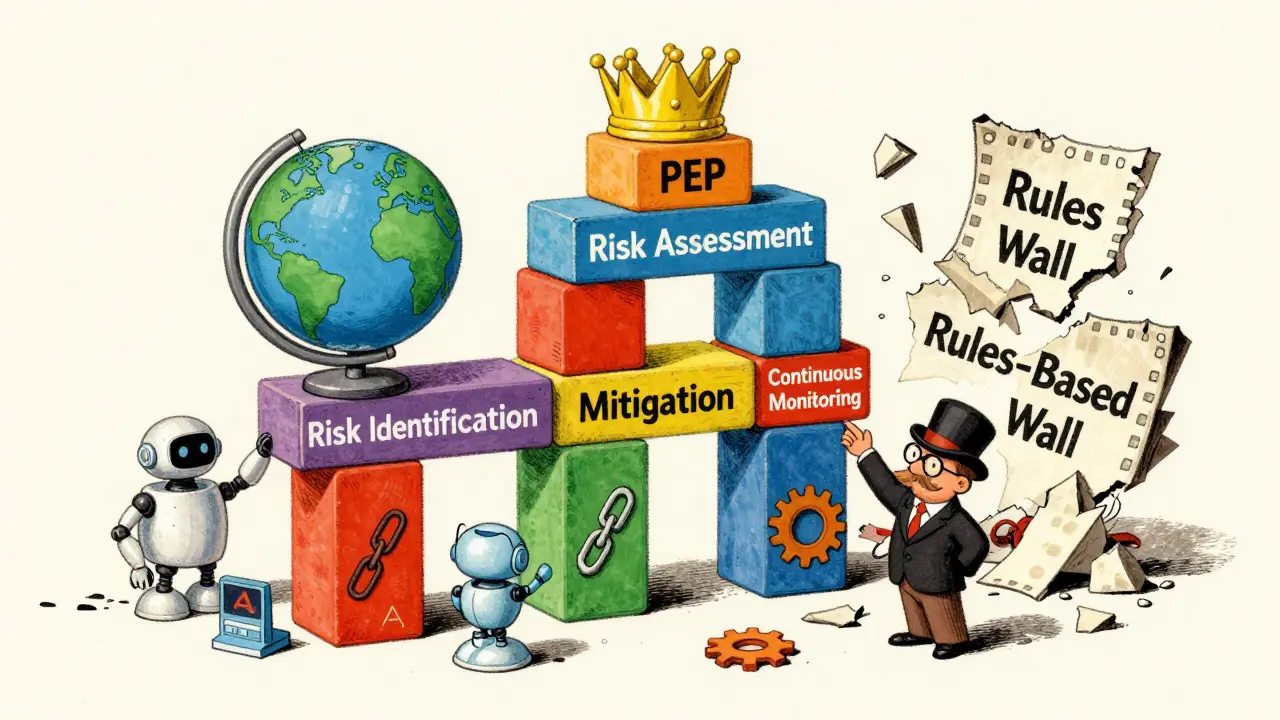

A working RBA framework for crypto isn’t a checklist. It’s a living system built on four pillars.- Risk Identification: Know what you’re dealing with. That means mapping every customer type, product line, transaction channel, and geographic exposure. Are you serving users from Myanmar? That’s high risk. Do you support anonymous mixers? That’s high risk. Do you offer NFT trading with no identity verification? That’s high risk.

- Risk Assessment: Turn those red flags into numbers. Use scoring models. For example, a Politically Exposed Person (PEP) carries a 3.2x higher risk weight than a regular user, according to AUSTRAC’s 2022 matrix. Cross-border transfers? 2.8x more monitoring needed. Transactions over $1,000 to a FATF high-risk jurisdiction? That’s automatic Enhanced Due Diligence (EDD).

- Mitigation Measures: Match your controls to the score. Low-risk users? Simplified Due Diligence-quarterly reviews. Medium-risk? Standard checks every 14 days. High-risk? 72-hour transaction monitoring, source-of-funds verification, and ongoing surveillance. No one-size-fits-all.

- Continuous Monitoring: Crypto changes fast. New DeFi protocols pop up weekly. Privacy tech evolves daily. Your risk model must update every quarter, at minimum. FATF requires it. So do regulators in the EU, Australia, and Singapore.

What Makes a Crypto Risk Different From Traditional Finance?

Crypto doesn’t just add complexity-it rewrites the rules. In banking, you know who’s sending money. In crypto, you might not. A transaction can come from an unhosted wallet-a wallet you don’t control, with no KYC attached. Chainalysis found these require 3.7x more verification steps than hosted wallets. That’s not a glitch. That’s the nature of the system. Then there’s DeFi. Liquidity pools. Governance tokens. Flash loans. Traditional AML tools can’t see these. Kraken fixed that by targeting liquidity pool transactions over $10,000. Their SARs (suspicious activity reports) dropped 68% because they stopped trying to monitor everything and started focusing on what actually mattered. And then there’s privacy tech. Zero-knowledge proofs (ZKPs) hide transaction details entirely. The FATF admits current RBA tools struggle with them. In 2023, the Blockchain Intelligence Group found ZK-based transactions had a 41% higher false negative rate. That’s not a failure of the tech-it’s a failure of the compliance model. If you can’t see the transaction, you can’t assess the risk. So you need new tools: mandatory disclosure protocols, behavioral analysis, and on-chain pattern recognition.

Technology That Makes RBA Work

You can’t do this manually. No compliance team has enough people to manually review 15,000 risk indicators per second. Top VASPs use a stack:- Blockchain analytics: Chainalysis Reactor, Scorechain, Elliptic. These tools trace crypto flows across chains, identify mixing services, and flag wallet clusters linked to known illicit actors. Minimum cost? $85,000/year for mid-sized platforms.

- AI risk engines: These process transaction patterns, user behavior, and network activity to assign dynamic risk scores. Chainalysis’ Risk Model 3.0, launched in September 2023, analyzes over 15,000 indicators with 89.7% accuracy in spotting mixer usage.

- Transaction monitoring systems: These trigger alerts based on your custom rules-e.g., “flag any wallet that receives 5+ ETH from 3 different high-risk jurisdictions within 24 hours.”

Real-World Wins-and Costly Mistakes

Ripple reduced manual reviews by 72% and boosted high-risk detection by 53% using RBA. Their secret? They stopped treating all transactions equally. They focused on cross-chain swaps over $3,000 and wallets linked to darknet markets. That’s precision, not blanket scanning. On the flip side, the Axie Infinity hack in 2022 cost $611 million. Why? The risk model didn’t account for bridge transactions. The system saw normal-looking transfers between two Ethereum-based tokens. It didn’t recognize that the bridge was being exploited. The model was built for traditional exchanges-not DeFi bridges. No one updated the risk parameters. And then there’s Terra/Luna. In 2022, algorithmic stablecoins collapsed. Risk models didn’t flag the systemic risk because they were built on historical price volatility, not tokenomics. Professor Angela Walch called it “regulatory arbitrage”-where smart actors exploit gaps in risk models. That’s the danger of a static approach.

Implementation: What It Really Takes

Don’t think you can flip a switch and go from rules-based to risk-based in a month. The FATF’s 2023 study of 89 VASPs found the average implementation time is 9 to 14 months. Why so long?- You need to train your team-minimum 20 hours of compliance training per year, per EU MiCA rules.

- You need to build or buy the tech stack. Budget $150,000-$500,000 depending on size.

- You need to document everything. FATF’s gold standard? AUSTRAC’s 127-page RBA guide. Most firms don’t have that level of detail.

- You need to test. Run simulations. See how your system handles a PEP transferring crypto from a sanctioned country. Does it catch it? Does it escalate?

The Future: What’s Coming Next

Regulation isn’t slowing down. It’s accelerating. The EU’s MiCA regulation (effective December 2024) makes RBA mandatory for all crypto service providers. The U.S. Treasury’s 2023 AML/CFT strategy says “enhanced risk-based supervision” is a top priority. The World Bank calls RBA the only sustainable path forward. ISO is working on ISO 22739-the first global standard for crypto RBA. Drafts are expected in Q2 2024. That means consistency. That means fewer loopholes. Gartner predicts that by 2026, 75% of crypto compliance budgets will go to dynamic risk assessment tools. In 2023, it was only 42%. The shift is happening. But the biggest challenge remains: privacy tech. Zero-knowledge proofs, confidential transactions, and private DeFi protocols are here to stay. The FATF admits current RBA frameworks can’t fully assess them. The solution? Not banning them. Not ignoring them. Building risk disclosure protocols that force privacy protocols to signal their risk profile-without revealing the transaction itself.Is RBA Perfect? No. Is It the Only Way? Yes.

A risk-based approach isn’t easy. It’s messy. It requires judgment. It demands constant learning. It’s not a plug-and-play solution. But here’s the truth: if you’re still using rules-based compliance in crypto, you’re not protecting your business-you’re just delaying the inevitable. Regulators are watching. Investors are asking. Customers are demanding transparency. The companies thriving in crypto today aren’t the ones with the most features. They’re the ones with the smartest compliance. The ones who understand that risk isn’t something to eliminate. It’s something to manage-intelligently, dynamically, and proportionally. The future of crypto compliance isn’t about more rules. It’s about better risk intelligence.What is a risk-based approach in crypto compliance?

A risk-based approach (RBA) in crypto compliance means assessing the level of money laundering and terrorist financing risk posed by each customer, transaction, or product-and applying controls that match that risk. Instead of treating everyone the same, you focus resources on high-risk users and activities. For example, a retail investor buying $100 of Bitcoin might only need basic KYC, while a trader moving $100,000 from a sanctioned country requires full Enhanced Due Diligence. This method is mandated by FATF and used by all major crypto exchanges.

Why is RBA better than rules-based compliance for crypto?

Rules-based systems flag every transaction over a set amount or to a known address, creating thousands of false alerts. In crypto, where transactions are fast, anonymous, and decentralized, this overwhelms compliance teams. RBA reduces false positives by 63% and increases true positive detection by 47%, according to FATF’s 2022 study. It saves time, cuts costs, and lets teams focus on real threats.

What are the main risk factors in crypto compliance?

Key risk factors include: customer type (e.g., Politically Exposed Persons have 3.2x higher risk), transaction type (cross-border transfers trigger 2.8x more scrutiny), product type (anonymous mixers and privacy coins are high-risk), and geographic exposure (operations in FATF high-risk jurisdictions like Myanmar or South Sudan require full Enhanced Due Diligence). DeFi protocols, NFT marketplaces, and unhosted wallets also add unique risk layers.

Do I need special software for RBA in crypto?

Yes. Manual monitoring won’t work. You need blockchain analytics tools like Chainalysis or Scorechain, AI-powered risk engines, and transaction monitoring systems that can process thousands of data points per second. These tools track wallet clusters, detect mixing services, and flag suspicious patterns. Entry-level systems start at $85,000/year, but smaller platforms can use SaaS providers like Sumsub for as little as $0.75 per verification.

How long does it take to implement RBA in a crypto business?

On average, it takes 9 to 14 months to fully implement a risk-based approach, according to FATF’s 2023 study. This includes training staff, selecting and integrating technology, building risk scoring models, testing systems, and documenting everything. Smaller businesses may take longer if they lack dedicated compliance teams. Rushing the process leads to gaps that regulators will catch.

What happens if I don’t use a risk-based approach?

You risk being grey-listed by FATF, which cuts off access to global banking partners. Regulators can shut you down, freeze assets, or impose massive fines. In 2023, 23 countries were grey-listed for failing to adopt RBA. Major exchanges like Coinbase and Kraken have spent millions to comply-not because they wanted to, but because they had to. Non-compliance isn’t an option for any crypto business that wants to operate legally.

Is RBA enough to stop all crypto crime?

No system stops all crime. But RBA is the most effective tool we have. It doesn’t eliminate risk-it manages it. Privacy technologies like zero-knowledge proofs still challenge current RBA models, and new DeFi exploits emerge regularly. But by continuously updating risk indicators, using AI, and focusing on real threats, RBA makes criminal activity significantly harder and more expensive to execute. It’s not perfect, but it’s the only framework that scales with innovation.

Jerry Perisho

December 5, 2025 AT 05:42Real talk-most crypto compliance teams are still stuck in 2018 thinking. RBA isn’t optional anymore. If you’re still using static rules, you’re just doing paperwork while the real money moves through ZKPs and cross-chain bridges. The tech exists. The frameworks exist. It’s about execution, not theory.

Chainalysis’ Risk Model 3.0 alone cuts false positives by over 60%. That’s not magic. That’s data. Stop treating every $500 transfer like a terrorist financing red flag.

And yes, small VASPs can use Sumsub or Onfido for under $1 per KYC. You don’t need a $500k budget to start. You just need to stop pretending compliance is a cost center.

It’s a competitive advantage. The firms that get this right will outlast the ones still flagging every ETH transfer to a mixer.

Also, training your team isn’t optional. CAM certification matters. Regulators are watching who’s got the credentials, not just the software.

And if you’re still using Excel sheets to track risk scores? You’re already behind.

Jon Visotzky

December 6, 2025 AT 17:20bro i just want to send crypto to my cousin in naija without getting flagged for ‘high-risk jurisdiction’

why does every platform treat me like i’m laundering money just because i live in a country that’s on some list?

also why do i need a $85k/year tool to buy a meme coin?

we’re turning finance into a surveillance state and calling it ‘compliance’

Renelle Wilson

December 7, 2025 AT 17:20It’s important to recognize that risk-based compliance isn’t just about mitigating legal exposure-it’s about fostering trust in an ecosystem that has been historically viewed with suspicion. When we apply disproportionate controls to users from certain geographies or transaction types, we risk alienating legitimate participants who are simply trying to participate in a global financial system.

The FATF’s framework is sound, but its implementation often lacks nuance. A user in Myanmar isn’t inherently risky because of their location-they’re risky because of the infrastructure gaps in their country’s financial oversight. The solution isn’t to block them-it’s to build better, adaptive tools that can assess behavior, not borders.

Moreover, the rise of SaaS compliance platforms like Sumsub and Onfido is democratizing access to compliance infrastructure. This is progress. It allows small operators to meet regulatory expectations without sacrificing innovation or inclusivity.

But we must also acknowledge the human cost. Compliance fatigue is real. Teams are overwhelmed. Algorithms misclassify. False positives erode user trust. We need more empathy in the design of these systems-not just more data points.

Regulators must engage with builders, not just audit them. The future of crypto compliance lies in collaboration, not coercion.

And let’s not forget: the goal isn’t to eliminate all risk. It’s to manage it intelligently. That requires humility, adaptability, and a willingness to learn from failure.

When Terra collapsed, it wasn’t because the risk model was too aggressive-it was because it was too static. We need systems that evolve as fast as the technology they’re meant to govern.

That’s the real challenge. Not the tech. Not the budget. The mindset.

Holly Cute

December 9, 2025 AT 06:56Oh wow, another ‘risk-based approach’ sermon from a compliance consultant who’s never touched a blockchain

Let me guess-you also think ZKPs are ‘the enemy’ and that ‘behavioral analysis’ will magically solve everything?

Newsflash: if you can’t see the transaction, you can’t assess the risk. No amount of AI will change that.

And yet here we are, spending $500k on tools that flag 90% false positives because someone in a boardroom decided ‘transparency’ means surveilling every Satoshi.

Meanwhile, real criminals use non-crypto methods-cash, gold, real estate-and nobody’s asking for a ‘risk-based approach’ to Walmart.

Also, ‘enhanced due diligence’ for someone sending $3k from Nigeria? That’s not compliance. That’s colonialism with a SaaS dashboard.

Stop pretending this is about safety. It’s about control. And the people who benefit? Not the users. Not the innovators. The vendors selling the tools.

Also, I saw a tweet that said ‘RBA is the only way’ and I laughed so hard I cried 😭

It’s not the only way. It’s the most profitable way-for consultants. Not for users.

Tara Marshall

December 10, 2025 AT 13:59Just want to add that the 68% SAR quality improvement at Binance wasn’t just from tech-it was from retraining analysts to focus on patterns, not thresholds.

One team started tagging wallet clusters that reused the same IP across 3 different chains. That caught 12 laundering rings in 3 weeks.

Simple. No AI needed.

Also, compliance isn’t about being perfect. It’s about being defensible. Document everything. Even the bad calls.

Doreen Ochodo

December 12, 2025 AT 02:17Stop making compliance sound like rocket science. It’s just common sense with paperwork.

Know your user. Know their transactions. Know when to dig deeper.

Everything else is just noise.

Yzak victor

December 12, 2025 AT 03:52my buddy runs a small wallet service and he uses sumsub for $1.50 per check and a free trial of scorechain

he got audited last year and passed with zero issues

no one needs to spend $500k

you just gotta not be an idiot

Adam Bosworth

December 14, 2025 AT 02:35you guys are all so naive

this isn’t about compliance

it’s about control

the banks are scared

crypto is the only thing that can break their monopoly

so they’re forcing these ‘risk-based’ systems to make it impossible to use

every flag is a trap

every ‘enhanced due diligence’ is a brick wall

they want you to quit

they don’t want you to win

and you’re all just polishing the chains while they laugh at you

and don’t even get me started on ‘certified anti-money laundering specialist’

that’s just a fancy title for ‘bank shill’

they’ll never let crypto be free

and you’re helping them

Uzoma Jenfrancis

December 14, 2025 AT 17:33why do western companies think they can tell Africa how to run finance?

we’ve had peer-to-peer value transfer for centuries

your ‘high-risk jurisdictions’ are just places you don’t understand

you don’t need AI to detect fraud

you need respect

and maybe a flight to Lagos

Chloe Hayslett

December 16, 2025 AT 08:05so let me get this straight-you want to let people send crypto anonymously, but you’re okay with a $500k compliance budget to track it?

that’s not innovation. that’s corporate extortion.

you’re not protecting users. you’re protecting your investors from being embarrassed.

and don’t give me that ‘FATF says so’ crap.

the FATF is a relic of 20th century banking.

crypto doesn’t need their permission.

we’re not here to make them comfortable.

we’re here to replace them.

Jonathan Sundqvist

December 17, 2025 AT 21:41my cousin runs a crypto shop in ohio

he uses a $200/month tool

he’s never had a problem

he doesn’t care about FATF

he just doesn’t take cash from sketchy dudes

maybe the real problem is overengineering

Roseline Stephen

December 19, 2025 AT 03:03I appreciate the depth here, but I wonder how many of these compliance tools actually consider cultural context.

For example, in some communities, pooling funds for emergencies is normal. That looks like structuring to an algorithm.

Are we building systems that understand human behavior-or just patterns?

Isha Kaur

December 20, 2025 AT 02:14As someone from India, I’ve seen how compliance gets weaponized against small players.

We have millions of people sending crypto to families abroad-remittances, not laundering.

But every platform treats them like criminals because ‘India is high-risk’.

It’s not the users. It’s the labels.

And the tools? They’re built by Americans who’ve never met someone who sends $200 to their sister in Kerala every month.

What if we designed systems around trust networks instead of blacklists?

What if we let communities self-regulate?

Not every risk is financial.

Sometimes it’s exclusion.

ronald dayrit

December 21, 2025 AT 08:10There’s a deeper philosophical tension here that no one is naming.

Compliance, as it’s currently structured, assumes that transparency is the highest good.

But what if privacy is also a good?

What if the right to financial anonymity is not a loophole, but a fundamental liberty?

The FATF framework doesn’t just fail to account for privacy-it actively pathologizes it.

Zero-knowledge proofs aren’t a bug in the system.

They’re a feature of human dignity.

And yet we treat them like weapons.

Are we building a financial system that protects people?

Or one that demands their surrender?

There’s no algorithm that can resolve this.

Only dialogue.

Only humility.

Only the willingness to accept that some risks are worth taking.

Because if we eliminate all risk, we eliminate all freedom.

And if crypto doesn’t stand for freedom, then what does it stand for?

Just another bank.

With better UX.

Krista Hewes

December 22, 2025 AT 06:09i tried to use a new exchange and they asked for my tax return, passport, and a selfie holding a note with the date

then they froze my account for 3 weeks

because i sent 300 usd to a friend who also used the same ip

no one explained why

no one apologized

i just lost my trust

and i’m not even doing anything shady

just sending money

is this what the future looks like?

Nelson Issangya

December 23, 2025 AT 23:42you think this is hard? try being a compliance officer in 2024.

you’ve got regulators breathing down your neck, devs building new chains every week, users screaming about privacy, and investors demanding profits.

no one gives you a manual.

you’re just supposed to ‘get it right’.

so yeah, we use tools.

we spend the money.

we do the training.

because we don’t want to be the one who lets a terrorist fund a bomb.

so don’t come here with your ‘they’re just profiting’ nonsense.

we’re the ones sleeping with one eye open.

and we’re tired.

Mairead Stiùbhart

December 25, 2025 AT 02:57Oh wow, so now we’re calling mass surveillance ‘risk intelligence’?

How cute.

Next they’ll call the NSA a ‘behavioral analytics startup’.

Meanwhile, the real criminals? They’re still using cash, shell companies, and real estate.

But hey, at least your algorithm flagged 12,000 innocent people this week.

Progress!

Also, ‘enhanced due diligence’ for someone who sent $1,000 to a friend in Nigeria? That’s not compliance.

That’s racism with a dashboard.

And you call it innovation?

lol

🫠

Elizabeth Miranda

December 26, 2025 AT 09:31I’ve worked with VASPs across Latin America, Southeast Asia, and Africa.

The most effective compliance teams aren’t the ones with the most tools.

They’re the ones with local knowledge.

A trader in Jakarta who knows which Telegram groups are used for pump-and-dumps?

That’s worth more than any AI model.

Compliance isn’t a tech problem.

It’s a people problem.

And we’re treating it like a spreadsheet.

Manish Yadav

December 28, 2025 AT 07:21why do people think crypto needs rules?

it’s supposed to be free

you want to send money? send it

you want to be anonymous? be anonymous

if the government doesn’t like it they can go jump in a lake

all this compliance is just fear

and fear is not innovation

innovation is not asking for permission

Glenn Jones

December 29, 2025 AT 21:21okay so i read this whole thing and my head hurts

you’re telling me i need to spend $500k to send crypto to my cousin who lives in a country with a 3.2x risk multiplier?

and if i don’t? i get ‘greylisted’ like i’m a terrorist?

but when a bank moves $2 billion through a shell company in the Caymans? they get a bonus

so the real criminals are the ones with suits

and we’re the ones getting scanned like airport luggage

also i just typed ‘risk-based approach’ 17 times and my fingers are cramping

someone please tell me this is satire

because if it’s real… we’re all doomed

and also i think my dog is laundering crypto through his chew toys

he keeps chewing on the same bone and then i get a transaction alert

maybe he’s a PEP

maybe he’s a darknet vendor

maybe he’s just hungry

but no one will tell me

because compliance

and also i have a 98% false positive rate on my wallet

so i just send everything to my mom’s account

she’s 74

she doesn’t even know what crypto is

but she’s ‘low risk’

so i guess that’s the answer

send it to grandma

she’s the new offshore account

and she doesn’t even need a KYC

just cookies and a hug

and maybe a little blockchain

💔