Quanto (QTO) Token Value Calculator

Token Information

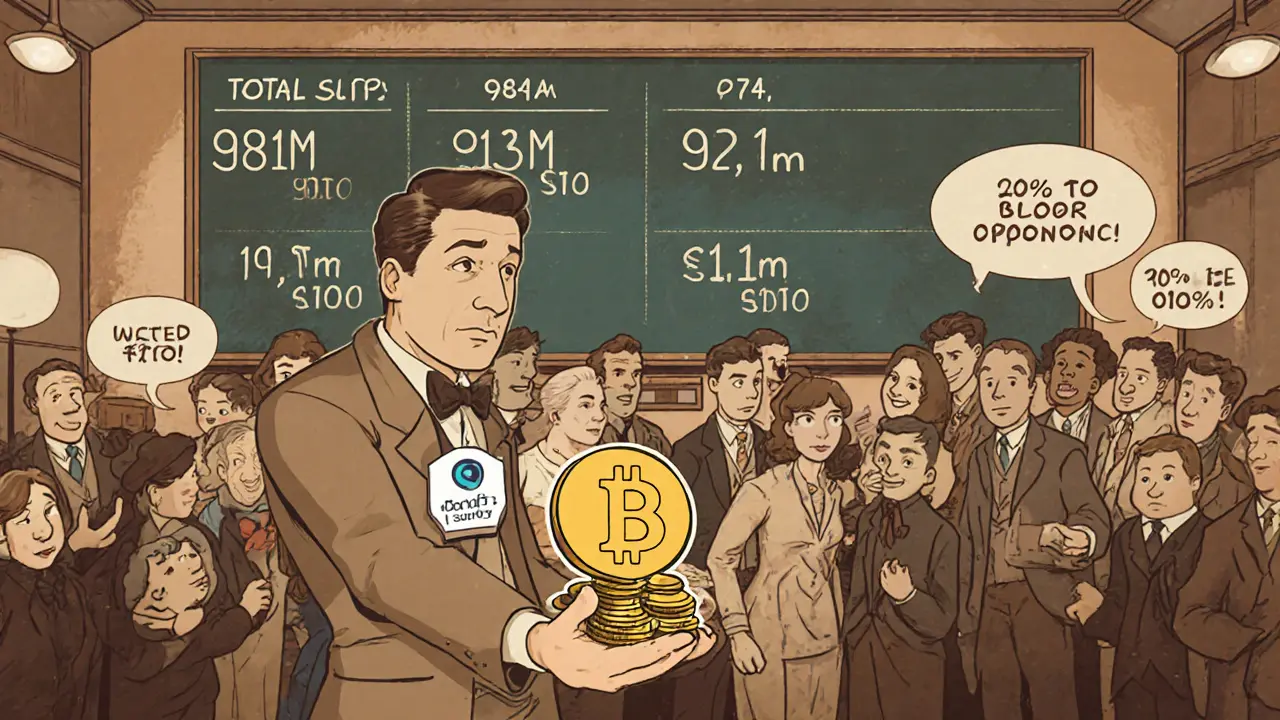

Total Supply: 981 million QTO

Circulating Supply: ~974 million QTO

Current Price: $0.012 per QTO

Fee Burn Rate: 1-2% of trade fees

Governance & Fee Discount: 10% off trading fees for QTO stakers

Trading Parameters

Results

Enter values and click "Calculate Impact" to see how QTO benefits you.

Key Features Summary

- Max Leverage 100×

- Collateral Model Any-asset

- Governance Rights Yes

- Fee Burn Mechanism Active

Quick facts

- Quanto (QTO) is a Solana‑based token that powers a perpetual decentralized exchange.

- The DEX lets traders use any asset they hold as collateral, removing the need for stablecoin conversion.

- Leverage options go up to 100×, with grid and hidden‑order tools for advanced strategies.

- QTO holders earn fee discounts and participate in protocol governance.

- A built‑in fee‑burn mechanism creates deflationary pressure on the token supply.

When you hear the name Quanto (QTO), think of a crypto token that does more than just sit in a wallet. It’s the engine behind a next‑generation perpetual exchange built on the Solana is a high‑performance blockchain known for low fees and sub‑second finality. Solana’s fast block times and cheap transaction costs make it an ideal home for high‑frequency trading applications, and Quanto leverages those strengths to offer traders a seamless experience. The exchange itself is a perpetual DEX is a decentralized trading venue that offers futures‑style contracts with no expiry date, enabling continuous leverage positions. Unlike traditional futures that settle on a set date, perpetual contracts keep traders exposed to price movements indefinitely, as long as they maintain enough margin. By staying fully on‑chain, the protocol avoids centralized order books and custody risks, while still delivering the speed that Solana can provide. QTO functions as both a governance token is a digital asset that lets holders vote on protocol upgrades, fee structures, and treasury allocations and a utility token that grants fee discounts - typically 10% off trading fees for holders staking a minimum amount. Every trade also triggers a fee‑burn mechanism is an automatic process where a portion of collected fees is permanently removed from circulation, reducing total supply over time. The burn rate scales with volume, meaning that periods of high activity accelerate the deflationary effect. The standout feature is the any‑collateral model is a design that accepts any supported asset as margin, eliminating the need to convert holdings into a base stablecoin before opening a leveraged position. Users can lock BTC, SOL, ETH, USDT, USDC, or even volatile tokens like “Fartcoin” and still trade perpetual contracts against those assets. This flexibility reduces capital friction and lets traders keep exposure to their preferred assets while still earning leverage profits. Leverage on the platform tops out at 100×, putting it on par with the most aggressive centralized futures markets. For power traders, the DEX adds grid trading is a strategy that places a series of buy and sell orders at predefined price intervals to capture market oscillations automatically and hidden orders is orders that do not appear on the public order book, offering privacy similar to dark pool trades in traditional finance. Both tools are designed for seasoned users who want to automate strategies or protect large positions from front‑running. All of these features run on audited smart contracts is self‑executing code on the blockchain that enforces trade rules without a central intermediary. The contracts handle liquidation, fee distribution, and the burn process, ensuring transparency and tamper‑proof execution. Regular security audits have been published, but as with any DeFi protocol, users should stay aware of upgrade proposals and community feedback. As of early October2025, QTO trades around $0.012, down from its all‑time high of roughly $0.075 in 2022. Daily volume fluctuates widely; CoinMarketCap reports about $15million in 24‑hour trades, while smaller aggregators show nearer $1million, hinting at fragmented liquidity across exchanges. The token’s price swing over the past week exceeds 68%, reflecting both market‑wide corrections and profit‑taking after earlier bullish runs. Token supply-wise, QTO’s total issuance caps at just under 981million tokens. As of the latest snapshot, about 974million are already circulating, leaving only a small reserve for ecosystem incentives, treasury operations, and future airdrops. The aggressive burn policy-removing roughly 1‑2% of every trade fee-means the circulating supply could shrink by several hundred thousand tokens each month if trading volume stays robust. This deflationary pressure is a core part of the project’s value proposition. Looking ahead, the success of Quanto hinges on three factors: adoption of Solana’s high‑throughput network, the ability to attract deep liquidity, and the delivery of promised roadmap items such as cross‑chain asset support. If trading volume ramps up, the burn mechanism could turn scarcity into price upside, echoing patterns seen with other deflationary tokens. Conversely, persistent network congestion or stronger competition from entrenched platforms like Hyperliquid could stall growth and keep the token under pressure.

| Platform | Chain | Max Leverage | Collateral Model | Fee Discount for Token Holders |

|---|---|---|---|---|

| Quanto | Solana | 100× | Any‑collateral (any supported asset) | 10% |

| Hyperliquid | BNB Chain | 50× | Stablecoin‑only | 5% |

| Aster | BNB Chain | 100× | Stablecoin‑only | 7% |

- Set up a Solana‑compatible wallet (e.g., Phantom or Solflare) and fund it with a small amount of SOL to cover transaction fees.

- Buy QTO on a listed exchange such as MEXC, Binance (via token bridge), or a trustworthy DEX aggregator.

- Connect the wallet to the Quanto DEX UI, approve the QTO contract for use as collateral, and select the assets you want to trade.

- Choose your leverage level (up to 100×), enable grid or hidden‑order features if desired, and place the trade.

- Monitor your position closely; high leverage means liquidations can happen quickly if the market moves against you.

Frequently Asked Questions

What does the QTO token actually do?

QTO powers the Quanto perpetual exchange. It grants governance rights, reduces trading fees for stakers, and participates in the fee‑burn process that slowly shrinks the token supply.

Can I trade on Quanto without holding QTO?

Yes. Trading is open to anyone with a Solana wallet, but only QTO holders enjoy fee discounts and voting power.

Is the any‑collateral model safe?

The model is audited, but using volatile assets as margin can increase liquidation risk. Users should understand the asset’s price dynamics before locking it as collateral.

How often are QTO tokens burned?

A portion of every trade fee (typically 1-2%) is sent to a burn address instantly, creating a continuous deflationary effect.

Where can I buy QTO?

QTO is listed on MEXC, CoinGecko’s market data page, and a handful of other mid‑size exchanges. Always verify the contract address on the official site before depositing.

Thiago Rafael

May 8, 2025 AT 16:53Let's break down the mechanics of Quanto (QTO) in a methodical way. The token operates as the native utility and governance layer for the Solana‑based perpetual DEX, which inherently ties its value proposition to on‑chain trading activity. Every trade executed on the platform incurs a fee, a fraction of which-typically between one and two percent-is deliberately sent to a burn address, creating a deflationary pressure on the total supply. Because the burn rate is volume‑scaled, periods of heightened market participation accelerate token scarcity, which should theoretically support price appreciation if demand remains constant or rises. Moreover, the token confers a ten‑percent discount on trading fees for participants who stake a minimum amount of QTO, effectively lowering their marginal cost of trading and incentivizing longer‑term holding. Governance rights are also embedded; token holders can vote on protocol upgrades, fee structures, and treasury allocations, meaning that active community involvement can directly shape the platform’s evolution. The any‑collateral model distinguishes Quanto from many competitors, allowing traders to post assets such as BTC, SOL, or even volatile altcoins as margin without first converting to a stablecoin, thereby reducing capital friction and preserving exposure to preferred assets. However, this flexibility introduces additional risk, as using volatile collateral can increase liquidation probability during market turbulence. The platform's leverage caps at 100×, matching the most aggressive centralized futures exchanges, but it also offers advanced order types like grid and hidden orders, which are valuable tools for seasoned traders looking to automate strategies or conceal large positions. Audited smart contracts underpin these features, handling liquidation, fee distribution, and the burn mechanism in a transparent, tamper‑proof manner, yet the ever‑present risk of code exploits mandates continuous vigilance. Liquidity remains a critical factor; while the DEX reports daily volumes in the low tens of millions, fragmentation across aggregators can impede depth, potentially leading to slippage for sizable orders. Lastly, the token's market performance reflects broader crypto cycles-its price has fallen from a peak of roughly $0.075 to around $0.012, a decline compounded by macro‑economic pressures and competition from platforms like Hyperliquid. In summary, QTO's value is a composite of fee discount benefits, governance influence, deflationary tokenomics, and the underlying Solana infrastructure's performance, all of which must be weighed against liquidity, volatility, and competitive dynamics.

Krystine Kruchten

May 8, 2025 AT 18:33Appreciate the thorough breakdown, though I think it's worth noting that the community vibe around QTO is pretty supportive. Even if the price dipped, people keep sharing strategies and educational resources, which helps newcomers navigate the any‑collateral model without feeling overwhelmed. Deflationary mechanics can be a double‑edged sword, but the shared knowledge often mitigates fear. Keep the optimism alive, fam! :)

Lisa Strauss

May 8, 2025 AT 20:13Wow, this token has a lot of moving parts! The fee‑burn feature alone makes me feel like I'm part of a growing ecosystem. If the DEX can pull in more volume, the scarcity could really drive the price up. I'm excited to watch how the governance proposals shape the future.

Darrin Budzak

May 8, 2025 AT 21:53Totally feel you on the excitement. I’ve been testing the grid feature on a small account and it’s surprisingly smooth. Just remember to keep an eye on liquidations when you crank up that 100× leverage.

C Brown

May 8, 2025 AT 23:33Ah, another “revolutionary” token trying to catch the wave. Sure, a 100× lever and any‑collateral sounds fancy, but remember the last time anyone promised deflation without a catch? Spoiler: we all got burned. The Solana outages alone make this a high‑risk playground for anyone not ready to lose half their position in a flash.

Noel Lees

May 9, 2025 AT 01:13😂 Seriously, the drama is real but the tech behind the any‑collateral is pretty slick. If the network stabilizes, there’s legit potential. Just don’t go all‑in on the 100× without proper risk management! 🚀

Adeoye Emmanuel

May 9, 2025 AT 02:53From a philosophical standpoint, Quanto represents a microcosm of decentralized finance's ambition: to democratize access while embedding self‑regulating scarcity. The burn mechanism, though simple in code, carries profound implications for tokenomics, inviting us to ponder how perpetual incentive structures can sustain community value over time. Moreover, the any‑collateral paradigm challenges traditional notions of liquidity, urging participants to reconcile volatility with leverage. It is a bold experiment that, if executed flawlessly, could reshape our perception of margin trading on blockchains.

Raphael Tomasetti

May 9, 2025 AT 04:33Spot on. The protocol’s architecture leverages Solana’s high‑throughput lanes, decoupling collateral orthogonal to stablecoins-pure jargon for “we let you stake whatever you’ve got”. It’s concise, effective, and cuts transaction costs to the bone.

Rahul Dixit

May 9, 2025 AT 06:13Honestly, I suspect there’s a hidden agenda. The burn rate claims to be 1‑2% of fees, but who audits the actual burn logs? If the team can manipulate volume numbers, the whole scarcity narrative is just a smokescreen. Stay vigilant.

Deepak Chauhan

May 9, 2025 AT 07:53One might argue that the existential risk posed by centralized exchanges is mitigated by platforms such as Quanto, yet the paradox remains: decentralization in name only, while the underlying governance may be concentrated among a few token holders. The philosophical implications of this power distribution merit rigorous discourse, lest we accept a veneer of liberty while ceding substantive control.

Aman Wasade

May 9, 2025 AT 09:33Well, if we’re being all high‑falutin about power dynamics, let’s not forget the practical side: the UI is still clunky, and the community support is... limited. A bit of sarcasm here, but truly, patience is a virtue.

Ron Hunsberger

May 9, 2025 AT 11:13For anyone looking to dip their toes in, start small and focus on understanding the fee‑discount mechanics. Staking a modest amount of QTO can lower your trading costs, which over time adds up, especially if you’re a frequent trader. Also, keep an eye on governance proposals; they can directly influence fee structures and burn rates. Remember, the any‑collateral model is powerful, but it also means you need to monitor the volatility of whatever asset you lock up as margin. Use the platform’s testnet if you’re unsure, and always set stop‑loss orders to protect against sudden market moves.

Lana Idalia

May 9, 2025 AT 12:53Yo, just a heads‑up: the token’s contract address on some sites is a phishing trap. Double‑check the official link before you send any SOL or QTO. Trust me, you don’t want to be the next victim of a copy‑paste scam.

Henry Mitchell IV

May 9, 2025 AT 14:33Cool token, worth a look! 😊