Oly Sport (OLY) Token Distribution Calculator

Project Overview

Oly Sport's native token OLY has a maximum supply of 500 million tokens. As of October 2025, no tokens have been distributed yet.

The token distribution follows two tiers with different vesting schedules:

- Tier 1: 25% of total supply at TGE with 1-month cliff and linear vesting over 3 months

- Tier 2: 7% of total supply at TGE with 18-month linear vesting

The public sale is scheduled for November 6, 2025.

Calculate Your Allocation

Allocation Results

Enter your investment details and click "Calculate Allocation" to see results.

Vesting Schedule

No data available

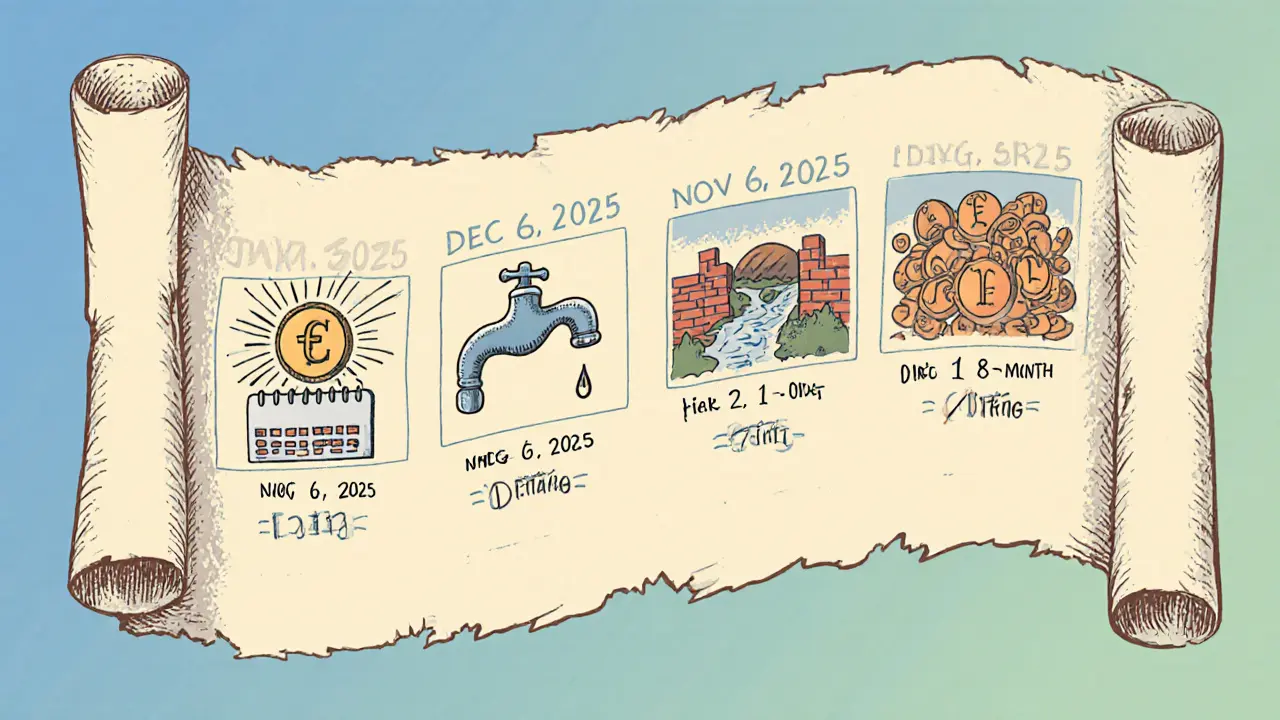

Token Distribution Timeline

| Date | Description | Token Allocation |

|---|---|---|

| Nov 6, 2025 | Token Generation Event (TGE) | 25% (Tier 1) / 7% (Tier 2) |

| Dec 6, 2025 | 1-Month Cliff | Release begins for Tier 1 |

| Dec 6, 2025 - Mar 6, 2026 | Linear Vesting (Tier 1) | Full release over 3 months |

| Nov 6, 2025 - May 6, 2027 | Linear Vesting (Tier 2) | Full release over 18 months |

If you’re wondering about the Oly Sport airdrop, you’re not alone. The hype around NFT‑based gaming projects often brings a flood of “free token” promises, yet many of those campaigns never materialize. This article untangles the reality behind Oly Sport’s token distribution, explains why an official airdrop isn’t live in October 2025, and shows how the project’s upcoming public sale fits into the broader crypto‑airdrop landscape.

Quick Take

- Oly Sport is an NFT horse‑racing platform that blends virtual land with real‑world property.

- The native token, OLY, has a max supply of 500million but zero circulating supply as of Oct2025.

- No verified Oly Sport airdrop is running now; the team focuses on a public sale set for 6Nov2025.

- Token Generation Event (TGE) releases 25% of tokens, then a 1‑month cliff and linear vesting over 3months for one tier; another tier gets 7% at TGE and 18‑month vesting.

- Compare Oly Sport’s status with active October 2025 airdrops like Arena Two ($ATWO) and Play AI Network ($PLAI) in the table below.

What is Oly Sport?

Oly Sport describes itself as the world’s first game that lets players own virtual land backed by real‑world property. The core gameplay revolves around NFT horse racing: each horse, track, and piece of land is tokenized as a non‑fungible token, enabling true ownership, trade, and royalty streams.

The platform aims to disrupt three massive markets-gaming, finance, and real estate-by letting users invest in virtual assets that have a tether to physical land. In theory, that creates a safety net for investors who fear “plain‑vanilla” crypto volatility.

Tokenomics and Sale Schedule

The project’s native utility token is OLY. Key attributes:

- Max supply: 500million OLY

- Circ. supply (Oct2025): 0OLY (tokens haven’t been released yet)

- Distribution: Two primary allocation tiers

- Tier1 - 25% at Token Generation Event (TGE), 1‑month cliff, then linear daily vesting over 3months.

- Tier2 - 7% at TGE, 18‑month linear daily vesting.

The public sale is scheduled for 6November2025 and will be conducted via the GameFi platform. Interested investors must complete KYC, pass a basic questionnaire, and be ready for the phased release schedule. The smart contract that will manage token minting is 0x74c1…1a7296, already listed on CoinMarketCap’s preview page.

Current Airdrop Status

Despite many rumors, there is no verified Oly Sport airdrop listed on major tracking sites like AirdropAlert, CoinMarketCap’s airdrop page, or ICODrops as of 3Oct2025. The project’s communication channels-official Telegram, Discord, and Twitter-focus exclusively on the upcoming ICO, tokenomics, and partnership announcements.

Why no airdrop? The team appears to prioritize a structured token sale over community giveaways. This strategy aligns with projects that want to lock in early investors, ensure compliance, and avoid diluting the token’s perceived value before the TGE.

That said, some crypto projects tease “point‑based” reward systems that later convert into token allocations. Oly Sport has hinted at a “Land‑Owner Loyalty Program” that could distribute future OLY rewards to early land‑buyers, but no concrete timeline or percentages have been disclosed.

How Oly Sport Stacks Up Against Active October 2025 Airdrops

| Project | Token | Chain | Airdrop Status (Oct2025) | Distribution Method | Key Date(s) |

|---|---|---|---|---|---|

| Oly Sport | OLY | EVM (Ethereum‑compatible) | No official airdrop | Public Sale + TGE vesting | Public Sale 6Nov2025 |

| Arena Two | ATWO | BNB Chain | Live airdrop - 1M ATWO | Complete sports‑quiz & share social post | Ends 15Oct2025 |

| Play AI Network | PLAI | Polygon | Active - Aura point system | Earn Aura points on PlayHub, convert after TGE | Q42025 TGE |

| Lurky | LURK | Solana | Closed - 5M LURK (Jan2025) | Referral‑based claim | Ended 31Jan2025 |

The table makes clear that Oly Sport’s distribution model is fundamentally different: it relies on a traditional token sale and vesting schedule rather than an open‑to‑anyone airdrop. For investors chasing “free tokens,” the current opportunity is to secure a spot in the upcoming public sale, not to hunt for an airdrop.

Risks & Things to Watch

- Regulatory compliance: The upcoming ICO will undergo KYC and AML checks. Expect a thorough vetting process that could exclude some participants.

- Vesting dilution: Even after the TGE, a large portion of OLY will be locked for up to 18months. Early buyers may face selling pressure when vesting cliffs lift.

- Market perception: The lack of a free airdrop could limit community buzz, especially compared to projects like Arena Two that generate viral hype.

- Real‑land linkage: The claim of real‑world property backing is still unverified. Investors should demand clear documentation on land ownership and legal framework.

- Smart‑contract security: The token contract (0x74c1…1a7296) has not yet been audited by a top‑tier firm. Await a formal audit report before committing large sums.

How to Stay Updated & Next Steps

- Join Oly Sport’s official Telegram and Discord. The team posts sale updates, KYC windows, and any surprise token‑distribution announcements there.

- Bookmark the Project’s page on CoinMarketCap. When the token moves from “preview” to “listed,” the site will publish the official contract address, market cap, and price.

- Set Google Alerts for “Oly Sport airdrop” and “OLY token sale.” This catches any last‑minute airdrop experiments the team might launch close to the public sale.

- Review the public sale whitepaper thoroughly. Look for details on fund allocation, use‑of‑proceeds, and the governance model for future token holders.

- If you’re interested in the “Land‑Owner Loyalty Program,” monitor the platform’s beta launch. Early land purchases could earn reward points that later translate into OLY allocations.

By following these steps, you’ll avoid falling for bogus airdrop scams and position yourself to participate in the real, upcoming token event.

Frequently Asked Questions

Is there an Oly Sport airdrop happening right now?

No. As of October2025, Oly Sport has not announced any official airdrop. The project’s focus is on the public token sale scheduled for 6November2025.

What is the OLY token’s supply and vesting schedule?

The maximum supply is 500million OLY. Tier1 investors receive 25% at the Token Generation Event, followed by a 1‑month cliff and linear daily vesting over three months. Tier2 gets 7% at TGE and 18months of linear vesting.

How does Oly Sport differ from other October 2025 airdrops?

Unlike Arena Two or Play AI Network, which distribute free tokens through quizzes or point systems, Oly Sport distributes tokens only through a structured sale and vesting plan. No free‑for‑all airdrop is currently on the table.

Can I earn OLY tokens without buying in the public sale?

The only confirmed path right now is the public sale. However, Oly Sport has mentioned a future loyalty program that could reward early land owners with OLY, but details and timelines are still pending.

Is the OLY smart contract safe?

The contract address (0x74c1…1a7296) is public, but as of now it has not undergone a third‑party audit. Wait for a formal security audit report before allocating large funds.

Maggie Ruland

June 23, 2025 AT 13:34Oh great, another airdrop that never lands.

Joyce Welu Johnson

June 23, 2025 AT 15:23If you’re trying to make sense of the OLY token schedule, start with the fact that the token generation event is set for Nov 6 2025.

The first tranche releases 25 % of the supply at TGE, but it’s locked behind a one‑month cliff.

That means nothing actually reaches investors until Dec 6 2025, when the linear vesting for Tier 1 kicks in.

From Dec 6 2025 to Mar 6 2026 the remaining 75 % of the Tier 1 allocation drips out month by month.

Tier 2 is a different beast, with only 7 % released at TGE and then a straight‑line vesting for the next 18 months.

Those 18 months run from Nov 6 2025 all the way to May 6 2027, so you won’t see the full amount until mid‑2027.

If you’re planning to invest, remember that the public sale is slated for Nov 6 2025, so you need to have your funds ready before that date.

The calculator on the site only works after you input an investment amount and select a tier, but the underlying math is simple: multiply your USD amount by the allocation percentage, then apply the vesting curve.

Because Tier 1 is front‑loaded, early investors see a quicker return of tokens compared to the slower‑moving Tier 2.

However, the higher upfront percentage also means more market pressure once the cliff lifts, potentially driving the price down temporarily.

On the other hand, Tier 2’s long vesting can help stabilize the token’s supply, reducing the likelihood of a massive dump.

From a risk standpoint, treat the OLY token like any other early‑stage crypto project: conduct thorough due diligence, check the team’s track record, and assess whether the tokenomics align with your investment horizon.

Do not get swayed by the hype of a “free airdrop” when, in reality, nothing has been airdropped yet.

The phrase “no airdrop yet” in the title is a clear warning that you’re still in the speculation phase.

In short, if you can tolerate the volatility and understand the vesting schedule, the token could be a speculative play; otherwise, it might be safer to wait for a more mature project.

Keep an eye on official announcements for any changes to the timeline, as crypto projects often shift dates without much notice.

Raj Dixit

June 23, 2025 AT 16:46This looks like another pump‑and‑dump scheme; don’t fall for the hype.

Raphael Tomasetti

June 23, 2025 AT 18:10From a tokenomics perspective, the linear vesting model mitigates immediate supply shock but still raises concerns about liquidity provision post‑cliff.

Rahul Dixit

June 23, 2025 AT 19:33Obviously the whole thing is a staged release to manipulate market sentiment, and nobody wants to be the sucker buying at the top.

Deepak Chauhan

June 23, 2025 AT 20:56One might ponder the epistemic foundations of token distribution: does the prescribed vesting truly reflect a fair allocation of value, or is it merely a veneer of legitimacy? 😊

Aman Wasade

June 23, 2025 AT 22:20Nice to see a project finally caring about “fair” distribution-right after they’ve sold the whole thing.

Ron Hunsberger

June 23, 2025 AT 23:43Actually, the project does provide detailed lock‑up terms, and the vesting schedule is publicly documented, which can help investors plan their exit strategy.

Thiago Rafael

June 24, 2025 AT 01:06While the linear vesting does address supply shock, the real issue lies in the limited utility of OLY tokens beyond speculative trading, which diminishes long‑term value.

Krystine Kruchten

June 24, 2025 AT 02:30Great breakdown! Just remember to diversify your portfolio; relying heavily on a single token can expose you to unnecessary risk.

Mangal Chauhan

June 24, 2025 AT 03:53Indeed, thorough due diligence is paramount. 📊 Evaluating the team’s background and the token’s use‑case will provide clearer insight into its potential.

Iva Djukić

June 24, 2025 AT 05:16The delineation between Tier 1 and Tier 2 allocations underscores the project's strategic liquidity management, yet the relatively modest 7 % Tier 2 tranche may limit broader community participation, potentially stifling decentralized adoption.

Darius Needham

June 24, 2025 AT 06:40While skepticism is healthy, it’s worth noting that many projects undergo phased releases without malicious intent; evaluating actual on‑chain activity can clarify intent.

C Brown

June 24, 2025 AT 08:03Oh absolutely, because “fair” always means they hand out free money after the fact, right?

Noel Lees

June 24, 2025 AT 09:26Deepak, you sound like a philosopher quoting a whitepaper while the market’s already moving on the next hype.

Adeoye Emmanuel

June 24, 2025 AT 10:50Even if the airdrop hasn't materialized, the community can still rally around the project's vision and push for transparency.

Lisa Strauss

June 24, 2025 AT 12:13Let’s stay hopeful-maybe the airdrop is just delayed, not cancelled.