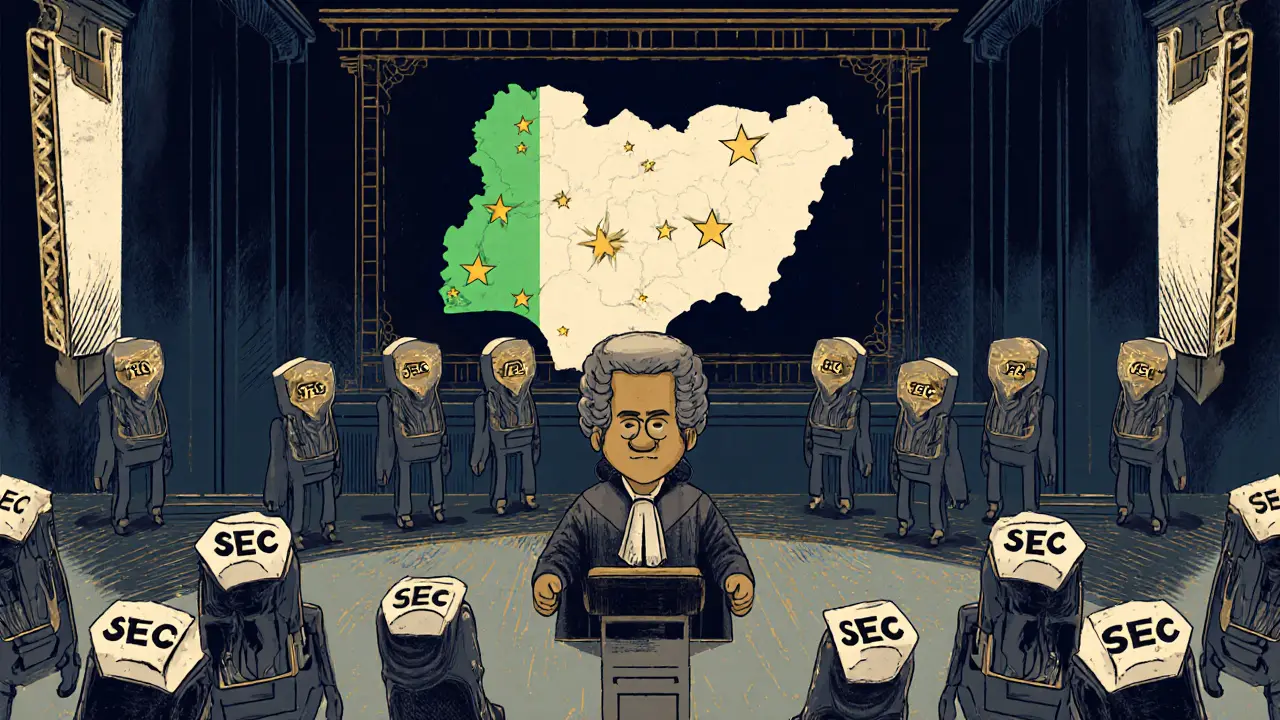

Nigeria Crypto Regulation Timeline

CBN Bans All Crypto Transactions

Central Bank of Nigeria (CBN) issued a circular prohibiting banks from processing cryptocurrency transactions. Governor Godwin Emefiele cited concerns over "opaque activities" threatening financial stability.

Primary Authority: CBN

Market Effect: P2P surge, formal exchanges shut down

Limited Bank-Crypto Partnerships

CBN quietly allowed limited bank-crypto partnerships under "undisclosed conditions," signaling a softening stance on the ban.

Primary Authority: CBN

Market Effect: Early testing of compliance frameworks

Ban Lifted for Licensed Firms

CBN lifted the ban for firms holding a valid license from the SEC. Key parameters included transaction limits and prohibition of cash withdrawals from crypto-related accounts.

Primary Authority: CBN + SEC

Market Effect: Licensed exchanges regain bank access

SEC Issues VASP Guidelines

SEC rolled out detailed Virtual Asset Service Provider (VASP) Guidelines. Major exchanges applied for licenses and partnered with international firms.

Primary Authority: SEC

Market Effect: Market consolidation around licensed players

ISA 2025 Legalizes Digital Assets

The Investments and Securities Act (ISA) 2025 officially recognized digital assets as securities under SEC authority. It mandated strict AML/KYC standards and investor protection mechanisms.

Primary Authority: SEC (with CBN oversight)

Market Effect: Full regulatory certainty; potential foreign investment boost

Key Takeaways

- From 2021 to 2023, Nigeria transitioned from complete prohibition to regulated participation

- 2024 marked a licensing rush as exchanges sought official recognition

- 2025 brought final legal clarity with ISA 2025

Nigeria's cryptocurrency banking ban reversal is the policy shift that moved from a total banking prohibition in February 2021 to a regulated framework by December 2023 and full legal recognition in the Investments and Securities Act 2025 - a four‑year roller coaster that reshaped Africa’s biggest crypto market.

Quick Take

- Feb2021: Central Bank of Nigeria (CBN) bans all crypto transactions through banks.

- Late2022: CBN quietly allows limited bank‑crypto partnerships under undisclosed conditions.

- Dec2023: New CBN directive lifts the ban for licensed firms, introduces transaction limits and cash‑withdrawal prohibitions.

- 2024: Securities and Exchange Commission (SEC) rolls out VASP Guidelines; major exchanges seek licenses.

- 2025: Investments and Securities Act (ISA) 2025 legally recognises digital assets as securities and cements the regulatory regime.

2021: The Ban That Shocked the Market

On 5February2021, the CBN issued a circular that prohibited all banks and financial institutions from processing cryptocurrency transactions. Governor GodwinEmefiele warned that “opaque activities” threatened the safety of Nigeria’s financial system. The move built on a 2017 directive that already barred Bitcoin from the banking sector. The ban forced traders into peer‑to‑peer (P2P) platforms, where transaction volume surged despite the official prohibition.

2021‑2022: Underground Growth and Global Rankings

Even without banking support, Nigeria climbed to second place globally for P2P trading volume by 2022, trailing only the United States. The country also entered the top five worldwide for crypto adoption, according to several industry reports. This grassroots momentum proved that a blanket ban was unsustainable: users simply found work‑arounds, and local exchanges flourished on the fringes.

Late 2022‑Early 2023: First Signs of Softening

Facing persistent foreign‑exchange pressure and a booming informal market, the CBN began a quiet policy shift in late 2022. Banks were allowed to engage with crypto firms under “undisclosed conditions,” a vague phrase that signalled willingness to experiment without fully rescinding the ban. Analysts linked this change to Nigeria’s need for alternative liquidity channels and to global trends where regulators were moving from outright prohibition to calibrated oversight.

December 2023: Full Policy Reversal

When Emefiele’s successor took the helm at the CBN, a decisive announcement came in December2023. The ban was lifted for firms holding a valid licence from the SEC. Key parameters included:

- Prudent transaction limits for crypto‑related accounts.

- Prohibition of cash withdrawals from those accounts.

- Mandatory compliance with the newly issued Virtual Asset Service Provider (VASP) Guidelines.

These rules created a formal pathway for exchanges to operate within the traditional banking system while keeping systemic risk in check.

2024: Licensing Rush and Market Realignment

The SEC stepped up by publishing detailed licensing criteria for VASPs. Major players like Yellow Card announced applications for Nigerian licences and partnered with Coinbase to expand across Africa. However, industry insiders warned that the SEC might not hand out licences liberally; the licensing pipeline remained opaque, creating a bottleneck for new entrants.

Meanwhile, enforcement did not disappear. In March2024, two Binance executives were detained on suspicion of facilitating untraceable funds, reminding the market that compliance failures still attract heavy penalties. By May, the national security advisor hinted at treating crypto trading as a “national security threat,” sparking fears of renewed crackdowns on P2P channels.

2025: Legal Consolidation with ISA 2025

The culmination of the regulatory journey arrived with the passage of the Investments and Securities Act (ISA)2025. The act officially recognises digital assets as securities under SEC authority. Its main provisions are:

- All crypto firms must be licensed VASPs.

- Strict AML/KYC standards aligned with the Financial Action Task Force (FATF) to aid Nigeria’s removal from the FATF Grey List.

- Investor protection mechanisms, including mandatory disclosures and dispute‑resolution processes.

With ISA2025, the legal gray area that existed between 2021 and 2023 disappears - owning crypto is no longer “allowed but unsupported”; it is now a regulated activity.

Market Impact: Winners, Losers, and the Road Ahead

**Winners** - Licensed exchanges can now offer fiat on‑ramps directly via banks, reducing transaction costs and improving user experience. Institutional investors see clearer compliance pathways, encouraging capital inflows.

**Losers** - Unlicensed P2P operators face heightened scrutiny and potential shutdowns. Traders who relied on cash withdrawals must adapt to digital wallets or limit their exposure.

**Uncertainties** - The exact transaction limits still aren’t public, and the SEC’s licensing timeline remains vague. Moreover, enforcement actions like the Binance arrests hint that regulators will continue to police non‑compliant actors aggressively.

Challenges Facing the New Framework

Implementing dual oversight-where the CBN controls banking relationships and the SEC manages VASP licences-creates coordination challenges. Aligning AML/KYC standards across both bodies is essential for removing Nigeria from the FATF Grey List, a goal tied to unlocking development financing.

Another hurdle is education. A 2023 ConsenSys survey showed 50% of Nigerians wanted balanced regulation. Achieving that balance depends on clear public guidance about reporting obligations, transaction caps, and the legal status of different token types.

Regional Perspective and Future Influence

Nigeria’s shift mirrors a broader African trend. South Africa and Kenya have also moved toward regulated crypto environments. Nigeria’s experience, especially the rapid policy reversal, will likely serve as a case study for other emerging markets grappling with the tension between innovation and financial stability.

| Year | Regulatory Action | Primary Authority | Market Effect |

|---|---|---|---|

| Feb2021 | Banking ban on all crypto transactions | CBN | P2P surge, formal exchanges shut down |

| Late2022 | Limited bank‑crypto partnerships (undisclosed conditions) | CBN | Early testing of compliance frameworks |

| Dec2023 | Ban lifted for SEC‑licensed VASPs; transaction caps imposed | CBN + SEC | Licensed exchanges regain bank access |

| 2024 | SEC issues VASP Guidelines; licensing applications flood | SEC | Market consolidation around licensed players |

| 2025 | ISA2025 legalises digital assets as securities | SEC (with CBN oversight) | Full regulatory certainty; potential foreign investment boost |

Next Steps for Stakeholders

- Crypto firms: Submit VASP licence applications promptly; upgrade AML/KYC infrastructure to meet SEC standards.

- Banking institutions: Define internal transaction‑limit policies; train staff on the new VASP partnership rules.

- Individual traders: Shift from cash‑heavy P2P trades to bank‑linked wallets; keep transaction records for possible reporting.

- Policy analysts: Track SEC licensing timelines and CBN limit thresholds; assess impact on Nigeria’s FATF Grey List status.

Frequently Asked Questions

Is cryptocurrency legal in Nigeria now?

Yes. Owning crypto is legal, and licensed crypto firms can operate with banks under the 2023 CBN reversal and the 2025 ISA framework.

Do I need a licence to trade crypto in Nigeria?

Individuals can trade on licensed platforms without a personal licence. However, crypto service providers must obtain a VASP licence from the SEC.

What are the transaction limits introduced in 2023?

The CBN set “prudent” caps that vary by bank and risk profile, typically ranging from ₦1million to ₦5million per month for crypto‑related accounts. Exact figures are disclosed by each bank.

Can I withdraw cash from a crypto‑linked bank account?

No. Cash withdrawals from accounts designated for crypto transactions are prohibited under the 2023 CBN guidelines.

How does the ISA2025 affect AML compliance?

ISA2025 mandates that all VASPs implement FATF‑aligned AML/KYC measures, reporting suspicious transactions to the Financial Intelligence Unit and allowing Nigeria to seek removal from the FATF Grey List.

Andrew McDonald

January 23, 2025 AT 12:05The ban was a textbook case of regulators chasing shadows rather than fostering growth 😊. By 2021 the market was already humming under the radar, and the heavy‑handed approach only pushed activity into the informal sector.

Enya Van der most

January 26, 2025 AT 23:25Look, the ban was an overreaction that smothered innovation, but it also sparked a fierce community spirit! Nigeria’s traders turned adversity into opportunity, flooding P2P platforms and proving resilience is in our DNA. The ban’s reversal was inevitable – the market simply refused to be silenced.

Eugene Myazin

January 30, 2025 AT 10:45It’s amazing how quickly the ecosystem rallied after the ban. From grassroots meet‑ups to cross‑border collaborations, the energy was palpable. This period really showcases the power of a community that believes in decentralised finance.

Latoya Jackman

February 2, 2025 AT 22:05The timeline clearly illustrates a shift from panic to pragmatism. By late‑2022, subtle policy tweaks hinted at a new direction, and the December 2023 lift gave licensed firms a legitimate runway. Such progression is a textbook example of regulatory adaptation.

karyn brown

February 6, 2025 AT 09:25Honestly, the CBN’s original ban was a disaster 😡. It forced users into the shadows while the state lost potential tax revenue. The 2023 reversal is a win for both consumers and the economy – finally some sense!

Megan King

February 9, 2025 AT 20:45Great rundown! The licensing rush in 2024 shows that firms are eager to play by the rules. It’ll be interesting to see how the new AML/KYC standards affect adoption – education will be key.

Rachel Kasdin

February 13, 2025 AT 08:05Finally, Nigeria is getting its act together – we can’t let foreign powers dictate our financial future. This regulatory clarity paves the way for home‑grown tech giants to thrive and keep the wealth inside the country.

karsten wall

February 16, 2025 AT 19:25From a compliance perspective, the dual oversight model creates a fascinating case study in inter‑agency coordination. The integration of FATF‑aligned AML protocols with the SEC’s VASP framework could set a benchmark for emerging markets, provided the CBN and SEC maintain synchronized policy updates.

Keith Cotterill

February 20, 2025 AT 06:45The regulatory evolution in Nigeria reads like a masterclass in adaptive governance, and it warrants a thorough dissection. First, the 2021 ban was predicated on a superficial risk assessment that neglected the burgeoning P2P ecosystem, which had already achieved global significance. Second, the clandestine partnerships of late‑2022 signalled an internal acknowledgment that outright prohibition was unsustainable, yet the authorities chose opacity over transparency, thereby eroding trust. Third, the December 2023 reversal introduced a calibrated framework, but the transaction caps remained nebulous, prompting speculation about the underlying risk tolerance thresholds. Fourth, the 2024 VASP guidelines, while ostensibly comprehensive, suffered from a licencing bottleneck that could stifle competition and inadvertently cement incumbents’ market dominance. Fifth, the enforcement actions in early 2024, exemplified by the Binance arrests, underscore that regulatory compliance is non‑negotiable, even for ostensibly reputable global exchanges. Sixth, the ISA 2025 legislation finally codifies digital assets as securities, aligning Nigeria with international best practices and providing the legal certainty required for institutional capital inflows. Seventh, the dual‑oversight architecture necessitates rigorous inter‑agency data sharing; any lag could resurrect the very systemic risks the reforms aim to mitigate. Eighth, the mandated AML/KYC standards, harmonised with FATF directives, should accelerate Nigeria’s removal from the Grey List, unlocking developmental financing avenues. Ninth, the public’s education gap remains a critical hurdle; without clear guidance, compliance costs may deter small‑scale innovators. Tenth, the broader African context suggests that Nigeria’s experience will serve as a reference model, influencing regulatory trajectories across the continent. Eleventh, the ongoing market consolidation around licensed entities could enhance consumer protection, yet it risks marginalising informal traders who constitute a substantial share of volume. Twelfth, the strategic partnership between local exchanges and global custodians, such as Coinbase, could catalyse technology transfer and bolster operational resilience. Thirteenth, the anticipation of foreign direct investment hinges on the perceived stability of the regulatory environment; any retrograde policy shift would be detrimental. Fourteenth, the interplay between fiat banking restrictions and crypto liquidity channels will continue to shape monetary policy outcomes. Finally, sustained success will depend on the agility of both regulators and market participants to adapt to evolving technological and macro‑economic landscapes.

Jenny Simpson

February 23, 2025 AT 18:05Everyone’s applauding the reversal, but let’s not forget the human cost of the original ban – families lost savings, informal traders were black‑listed, and trust was shattered. The narrative of progress ignores these scars.

mukund gakhreja

February 27, 2025 AT 05:25Oh sure, because the “progress” narrative is always flawless – right, let’s just pretend that every stakeholder is ecstatic. The reality is that many still operate in the shadows, and the new limits feel like a half‑measure.

Michael Ross

March 2, 2025 AT 16:45While the reforms bring clarity, we must remain vigilant that enforcement remains proportionate and inclusive, ensuring that legitimate users are not inadvertently penalised.

Sabrina Qureshi

March 6, 2025 AT 04:05Regulation finally catches up. 🙄

CJ Williams

March 9, 2025 AT 15:25Huge kudos to the community that kept the momentum alive despite the ban – your resilience turned a crisis into a catalyst for growth! Keep sharing knowledge and supporting each other as the ecosystem matures.

Nilesh Parghi

March 13, 2025 AT 02:45The philosophical takeaway here is that regulation, like any social contract, must evolve with the technology it seeks to govern. When it lags, innovation finds a way around, often filling the regulatory vacuum with informal mechanisms that later become formalised. This cycle repeats across sectors, reminding us that flexibility is a virtue in policy design.