Every year, millions of dollars vanish from NFT wallets-not because of hacking, but because users clicked the wrong link, approved a malicious contract, or trusted a fake Discord message. The truth is, NFT marketplace security isn’t just about choosing the right platform. It’s about how you think, act, and protect your assets every single day.

Hardware Wallets Are Non-Negotiable for Valuable Collections

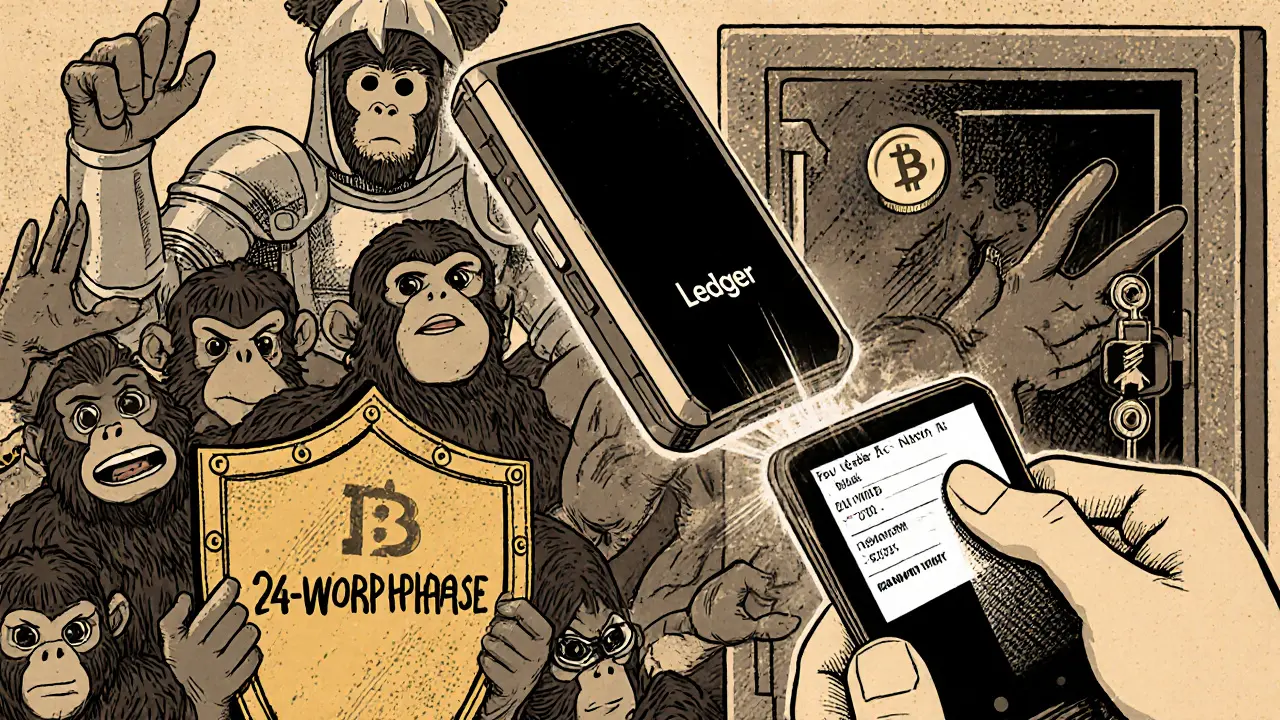

If you own NFTs worth more than $5,000, storing them in a browser wallet like MetaMask is like leaving your house key under the mat. Hardware wallets like Ledger Nano X and Trezor Model T keep your private keys completely offline. According to 101 Blockchains’ April 2025 benchmarking study, properly used hardware wallets reduce theft risk by 98% compared to hot wallets. Ledger’s internal data shows only 0.02% of thefts involved users who kept their assets on these devices. That’s not luck-it’s design. Set up your hardware wallet correctly: generate your 24-word recovery phrase on a metal backup (not a piece of paper), store it in a fireproof safe, and never type it into any app. Never connect your hardware wallet to a public computer or a device you don’t control. Use it only for final approvals, and always double-check the transaction details on the device’s screen before confirming.Stop Blindly Approving Smart Contracts

One of the biggest causes of NFT theft isn’t a stolen password-it’s a forgotten approval. In 2024, 73% of NFT thefts came from dormant smart contract permissions users didn’t even know they’d given. These are the invisible backdoors that let hackers drain your wallet without ever touching your password. Use Etherscan’s Token Approval Checker to see every contract you’ve ever allowed to access your tokens. The average user has 14.3 active approvals they don’t recognize. Revoke everything you don’t actively use. For example, if you bought an NFT on OpenSea six months ago, you don’t need that contract to still have unlimited access to your ETH or tokens. Set permissions to a specific amount (like 0.1 ETH) instead of “unlimited.” Dr. Sarah Jamie Lewis found that 87% of Bored Ape Yacht Club phishing victims approved unlimited allowances-just changing that one setting could have saved $2.1 million.Use the Five-Minute Rule Before Any Transaction

Scammers don’t need to hack your wallet. They just need you to click “approve” on a fake site. That’s why the Five-Minute Rule works: before you sign anything, spend five minutes verifying the source through three independent channels. If someone DMs you on Discord saying “your NFT is about to be delisted-click here to claim it,” pause. Check the official project Twitter. Check the official website URL. Check the project’s verified Discord server. If any of those sources don’t mention the alert, it’s a scam. Check Point Research found this simple habit prevented 63% of phishing losses in a survey of 1,247 collectors. Scammers rely on urgency. Don’t give them the rush.Verify Contracts Before Buying or Selling

Not all NFTs are created equal. A project with an unverified smart contract is a ticking time bomb. Etherscan reports that 78% of fraudulent NFT projects in Q1 2025 used unverified contracts. Legitimate projects pay $15,000-$50,000 for audits from firms like OpenZeppelin. Look for the green “Verified Contract” badge on OpenSea or Rarible. If it’s missing, ask why. If the team can’t or won’t explain, walk away. Even verified projects can be copied. OpenSea’s Collection Verification program gives blue checkmarks to official collections, but only 58% of top projects adopted it. Clone X stayed unverified until January 2025-leaving buyers open to fake versions. Always check the contract address against the official project’s website. A tiny typo in the address means you’re sending your ETH to a scammer.

Secure Your Connection and Devices

You can have the best wallet and the smartest habits, but if you’re on a public Wi-Fi network or using a malware-infected browser, it doesn’t matter. Use WPA3-encrypted home Wi-Fi. Install Cloudflare Gateway ($20/month) to block malicious domains. Use Privacy Badger to stop tracking scripts that steal session cookies. Never use SMS for two-factor authentication. It’s easy to hijack. Use Authy or Google Authenticator instead. Update your wallet apps regularly-MetaMask version 11.19.1 (May 2025) includes critical fixes for transaction preview bugs. And never, ever use the same password across platforms. A 2025 Magnft survey found 41% of users under 25 reused passwords-making them 57% more likely to fall victim to credential-stuffing attacks.Use Transaction Preview Features

OpenSea’s “Preview Transaction” tool shows you exactly what a smart contract will do before you sign. Will it transfer your NFT? Drain your ETH? Grant access to your whole wallet? This feature blocks 89% of malicious contract interactions, according to Check Point. Yet only 22% of users turn it on. If a platform doesn’t offer preview, don’t use it. If the preview looks weird-like a contract asking for “unlimited token access” or “withdraw from any address”-cancel. You don’t need to understand Solidity code to spot red flags. If it feels off, it is.Understand the Trade-Offs of KYC and Centralization

Some platforms like Foundation require KYC (identity verification). That reduces scam listings by 82%, but it also means you’re trusting a central authority with your personal data. Meanwhile, anonymous platforms like OpenSea give you freedom-but you bear full responsibility for security. NBA Top Shot uses custodial wallets. Dapper Labs holds your assets. That means you can’t lose them to a hack, but you also can’t move them freely. If the company goes down, so does your access. Decentralized platforms give you control-but only if you know how to use it. There’s no perfect system. Choose based on your risk tolerance and asset value.

Kathy Alexander

November 23, 2025 AT 19:43Soham Kulkarni

November 25, 2025 AT 02:47Tejas Kansara

November 25, 2025 AT 09:58Sky Sky Report blog

November 26, 2025 AT 15:29asher malik

November 28, 2025 AT 14:14Lisa Hubbard

November 29, 2025 AT 17:41Jennifer MacLeod

December 1, 2025 AT 09:17Julissa Patino

December 2, 2025 AT 23:09Omkar Rane

December 3, 2025 AT 15:16Daryl Chew

December 4, 2025 AT 04:23Jennifer Morton-Riggs

December 5, 2025 AT 09:14Rajesh pattnaik

December 5, 2025 AT 14:44Belle Bormann

December 7, 2025 AT 04:53Jody Veitch

December 7, 2025 AT 18:58Dave Sorrell

December 8, 2025 AT 11:19stuart white

December 10, 2025 AT 11:08Jenny Charland

December 12, 2025 AT 07:29preet kaur

December 13, 2025 AT 00:04Emily Michaelson

December 13, 2025 AT 09:12Amanda Cheyne

December 15, 2025 AT 07:58Anne Jackson

December 16, 2025 AT 16:08John Borwick

December 17, 2025 AT 06:37Matthew Prickett

December 19, 2025 AT 00:40Caren Potgieter

December 19, 2025 AT 10:15Linda English

December 19, 2025 AT 22:16Tyler Boyle

December 20, 2025 AT 19:46Jane A

December 21, 2025 AT 13:25Kathy Alexander

December 22, 2025 AT 00:42