Platform Token Potential Calculator

Token Evaluation Parameters

Enter metrics to evaluate a platform token's investment potential based on real usage and utility.

Evaluation Results

Usage Metrics

Tokenomics

Platform tokens aren’t just another crypto fad. They’re the keys to digital ecosystems - the tickets you need to use apps, services, and decentralized platforms. Unlike Bitcoin, which sits like digital gold, or Ethereum, which powers smart contracts, platform tokens have one job: make something work. And that’s where their investment potential comes from - not speculation, but utility.

What Exactly Are Platform Tokens?

Platform tokens are digital assets built on existing blockchains - mostly Ethereum using the ERC-20 standard - that give users access to a specific service. Think of them like arcade tokens. You don’t buy them to hoard; you buy them to ride the rollercoaster. In the digital world, that rollercoaster could be a decentralized exchange like Uniswap, a cloud storage network like Filecoin, or a gaming platform like Axie Infinity. These tokens are fungible, meaning one is exactly like another. That’s different from NFTs, which are one-of-a-kind. Fungibility makes them easy to trade, use in payments, and stack up in wallets. But it also means their value is tied entirely to how much people actually use the platform. No usage? No demand. No demand? The token price drops - fast.Why They’re Different from Bitcoin or Ethereum

Bitcoin’s value comes from scarcity and perception. Ethereum’s comes from being the backbone of DeFi and smart contracts. But platform tokens? Their value is built into the product. If you want to stake your tokens to earn rewards on a DeFi protocol, you need the platform’s native token. If you want to pay for AI-powered data queries on a decentralized network, you need that token. If you want to vote on governance changes in a DAO, you need the token. This creates a feedback loop: more users → more token usage → higher demand → higher price. It’s not just hype. It’s economics. And that’s why some platform tokens have outperformed Bitcoin over multi-year periods - not because they’re “better money,” but because they’re essential to a working system.Where Platform Tokens Are Making Real Impact

You won’t find platform tokens just in crypto circles. They’re already embedded in real industries:- Energy: PowerLedger lets households trade solar energy using tokens. Users earn tokens for surplus power, then spend them to buy electricity from neighbors.

- Healthcare: MedRec uses tokens to give patients control over their medical records. Doctors access data only with token-based permission.

- Logistics: TradeLens (IBM + Maersk) uses tokens to track shipping containers and automate customs clearance across 100+ ports.

- Entertainment: Audius lets artists upload music and get paid directly in tokens - no record label needed.

How to Evaluate a Platform Token’s Investment Potential

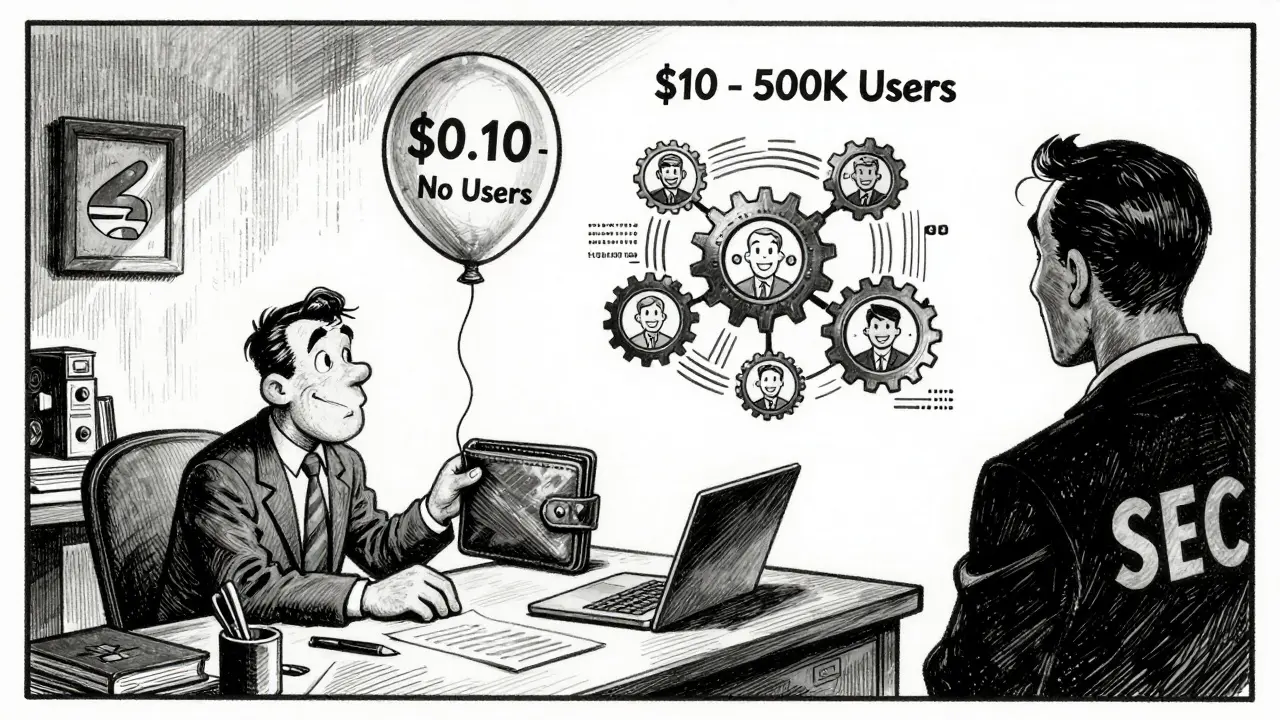

Not all platform tokens are worth buying. Most fail. Here’s what actually matters:- Real usage, not whitepapers: Check daily active users, transaction volume, and token burn rates. If the platform has 500 users and 10 million tokens floating around, that’s a red flag.

- Tokenomics that align incentives: Does the token get burned when used? Is it used for staking rewards? Is there a cap on supply? Tokens with deflationary mechanics (like Binance’s BNB) often perform better long-term.

- Team and roadmap: Who’s behind it? Have they shipped before? Are they transparent about development? A team with a track record in tech or finance is a better bet than anonymous devs.

- Competitive moat: Is this the only platform doing this? Or are there 20 others with the same idea? The winner takes most in crypto - and the loser disappears.

- Regulatory exposure: Is the token classified as a security in the U.S. or EU? That could shut down trading on major exchanges overnight.

The Risks You Can’t Ignore

Platform tokens are high-risk, high-reward. Here’s what can go wrong:- Platform failure: If the app shuts down, the token becomes worthless. Look at hundreds of ICO tokens from 2017-2018 - most are dead.

- Regulatory crackdown: The SEC has already targeted several tokens as unregistered securities. If your token gets labeled that way, exchanges delist it. Game over.

- Competition: A better, cheaper, faster platform can replace yours overnight. Ethereum’s dominance isn’t guaranteed forever.

- Liquidity crunch: Some tokens trade on obscure exchanges with thin order books. You might not be able to sell when you need to.

- Token inflation: If the team keeps minting new tokens to pay developers or reward users, your holdings get diluted. Check the emission schedule.

How to Start Investing - Without Getting Burned

Start small. Focus on platforms you understand. Don’t chase hype. Here’s a practical approach:- Identify a problem you care about: Is it data privacy? Decentralized AI? Peer-to-peer energy? Pick a niche.

- Find the top 3 platforms solving it: Look at CoinGecko, DappRadar, or DefiLlama. Check real usage data, not just market cap.

- Read their tokenomics document: Not the marketing page. The technical whitepaper or GitHub repo. Look for token supply, burn mechanisms, vesting schedules.

- Check if the team is doxxed: Anonymous teams = higher risk. Names, LinkedIn profiles, past projects - they matter.

- Invest only what you can afford to lose: Even the best platform tokens can drop 80% in a bear market. Don’t bet your rent money.

The Future: From Niche to Mainstream

Platform tokens are moving beyond crypto natives. Big companies like Walmart, Siemens, and Deutsche Bank are testing token-based supply chains, loyalty programs, and digital identity systems. When a Fortune 500 company starts using a platform token to automate payments between suppliers, that’s not speculation - that’s adoption. Regulators are still catching up, but clarity is coming. The EU’s MiCA regulation, effective in 2025, is creating a legal framework for utility tokens. The U.S. is slowly following. That means safer, more transparent markets - and fewer scams. The next five years will separate the platforms that solve real problems from the ones that just raised money on Twitter. The tokens tied to the winners will be the ones that matter. And if you’re looking for long-term growth in crypto, that’s where the real opportunity lies.Are platform tokens the same as cryptocurrencies?

No. Cryptocurrencies like Bitcoin and Ethereum are primarily digital money or network fuels. Platform tokens are utility assets tied to a specific app or service. You use them to access features, not just to store value or send payments.

Can platform tokens be traded on major exchanges?

Yes - if they’re well-established and compliant. Tokens like Chainlink (LINK), Uniswap (UNI), and Polygon (MATIC) trade on Coinbase, Binance, and Kraken. But many smaller platform tokens only exist on decentralized exchanges or obscure platforms, making them harder to buy and sell.

What’s the biggest risk when investing in platform tokens?

The biggest risk is platform failure. If the underlying app shuts down, loses users, or gets banned, the token becomes useless. Many tokens from 2017-2018 are now worthless because their projects never gained traction. Always prioritize real usage over hype.

How do I know if a platform token has real demand?

Look at on-chain data: daily active addresses, transaction volume, token transfer frequency, and staking rates. Tools like Dune Analytics and Nansen show this. If the token is being used constantly inside the platform - not just sitting in wallets - that’s real demand.

Should I invest in new platform tokens during their launch?

Only if you’ve done deep research. Early launches can offer big returns, but they’re also the riskiest. Many ICOs fail to deliver. Look for teams with proven experience, clear roadmaps, and real product usage - not just a slick website and a Discord channel.

Lois Glavin

December 15, 2025 AT 15:15Bridget Suhr

December 16, 2025 AT 09:43Jessica Petry

December 17, 2025 AT 16:24Scot Sorenson

December 19, 2025 AT 08:47Ike McMahon

December 21, 2025 AT 04:51JoAnne Geigner

December 21, 2025 AT 15:13Patricia Whitaker

December 22, 2025 AT 04:16Joey Cacace

December 22, 2025 AT 21:01Taylor Fallon

December 22, 2025 AT 23:40PRECIOUS EGWABOR

December 23, 2025 AT 01:19Kim Throne

December 24, 2025 AT 17:05Caroline Fletcher

December 25, 2025 AT 08:29Taylor Farano

December 27, 2025 AT 01:00Kathryn Flanagan

December 28, 2025 AT 01:26Ian Norton

December 28, 2025 AT 04:31Jeremy Eugene

December 29, 2025 AT 07:38Nicholas Ethan

December 30, 2025 AT 09:46Rakesh Bhamu

January 1, 2026 AT 05:06Hari Sarasan

January 2, 2026 AT 08:29Stanley Machuki

January 2, 2026 AT 13:41Kelly Burn

January 4, 2026 AT 07:31Abhishek Bansal

January 5, 2026 AT 14:12Anselmo Buffet

January 6, 2026 AT 16:35Scot Sorenson

January 7, 2026 AT 12:48