Indonesia Crypto Regulation Timeline

Before 2025

Cryptocurrencies were classified as commodities under BAPPEBTI oversight with minimal capital requirements and basic AML measures.

After 2025

Cryptocurrencies are now digital financial assets under OJK supervision with strict capital requirements and comprehensive AML/KYC rules.

- Crypto reclassified from commodity to digital financial asset

- Capital requirement increased to IDR 100 billion

- VAT eliminated on crypto transfers

- Stricter AML/KYC enforcement

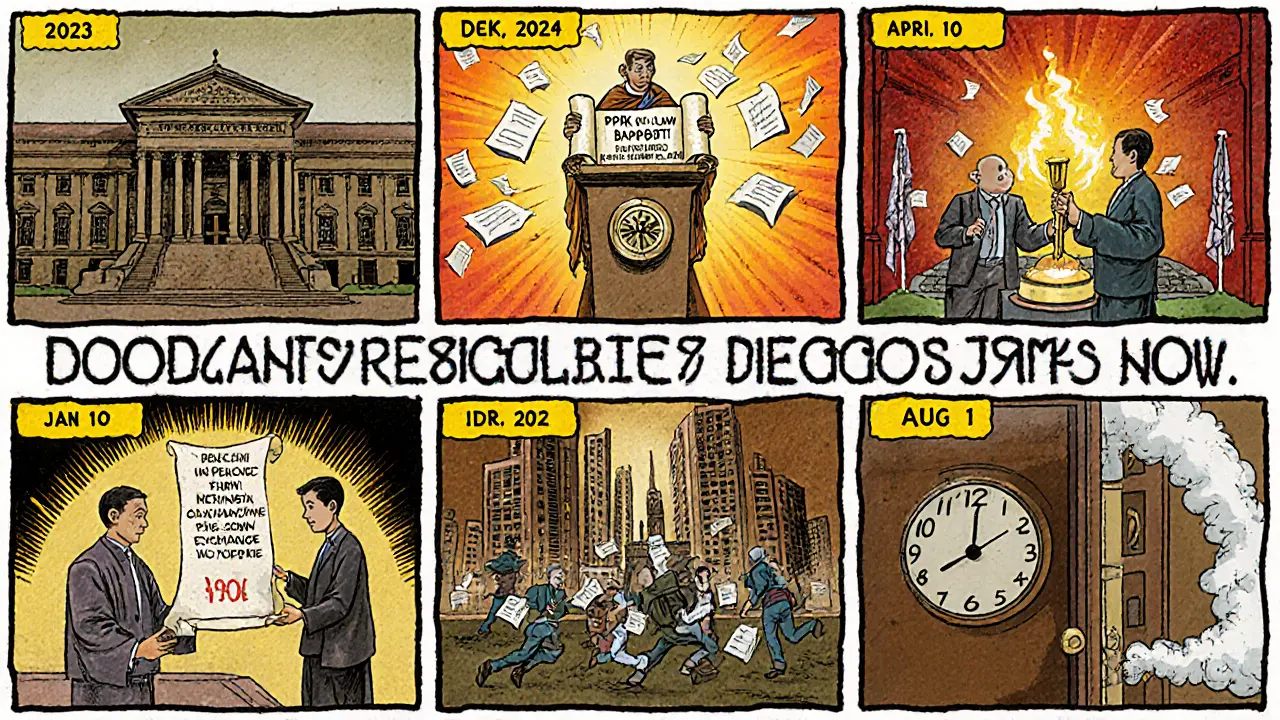

Regulatory Milestones Timeline

Capital Requirements Checker

In early 2025 Indonesia flipped a massive switch on how it treats crypto. What used to be a niche commodity market under the watchful eye of the Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI)the Commodity Futures Trading Regulatory Agency that previously oversaw cryptocurrency as a commodity became a full‑blown digital financial asset sector overseen by the Otoritas Jasa Keuangan (OJK)Indonesia’s Financial Services Authority responsible for supervising banks, insurers and now crypto firms. The change didn’t just move a regulator-it reshaped licensing, capital rules, tax treatment and even the way investors think about crypto in Indonesia.

Quick Summary

- The 2025 transition moved crypto oversight from BAPPEBTI to OJK, reclassifying it as a "digital financial asset".

- Law No. 4 of 2023 provides the legal basis; OJK Regulation No. 27 of 2024 details operational requirements.

- Capital requirements jumped to IDR 100billion paid‑up capital and IDR 50billion equity for crypto traders.

- Minister of Finance Regulation No. 50 of 2025 removed VAT on crypto transfers and aligned income‑tax treatment with financial assets.

- Trading is still illegal for payments, but the new framework promises stronger consumer protection and market stability.

1. Timeline of the Legal Shift

The journey began with Law No. 4 of 2023 (PPSK Lawthe Development and Strengthening of the Financial Sector law enacted on 12January2023). That law authorized the transfer of crypto oversight from BAPPEBTI to OJK. The formal hand‑over occurred on 10January2025, when Government Regulation 49 (GR‑49)the regulation that moved supervisory authority to OJK took effect.

Key milestones:

- 2023 - PPSK Law passed, setting the stage for a regulatory overhaul.

- Dec2024 - OJK issues Regulation No.27, outlining detailed licensing and AML requirements.

- Jan102025 - Oversight officially switches to OJK.

- April2025 - Exchanges must re‑publish a vetted whitelist of crypto assets.

- July2025 - Compliance deadline for existing crypto firms; capital and reporting mandates become enforceable.

- Aug12025 - Minister of Finance Regulation No.50 (PMK50) removes VAT on crypto transfers.

2. Core Legal Framework

Four pillars hold up Indonesia’s new crypto regime:

- Law No.4 of 2023the statutory foundation that authorizes OJK to regulate digital financial assets.

- OJK Regulation No.27 of 2024the detailed rulebook for licensing, capital, AML/KYC and reporting for crypto operators.

- Minister of Finance Regulation No.50 of 2025 (PMK50)the tax regulation that aligns crypto with financial‑asset treatment and eliminates VAT.

- PPATKIndonesia’s Financial Transaction Reports and Analysis Center, the AML watchdog that receives suspicious‑transaction reports from crypto firms.

These instruments work together with Bank Indonesia (BI)the central bank that monitors systemic risk and collaborates with OJK on financial stability to create a multi‑layered supervision model.

3. Licensing, Capital & Operational Requirements

Under OJK Regulation No.27, a crypto business must obtain a "Digital Financial Asset Trading Operator" license. The key numeric thresholds are:

- Minimum paid‑up capital: IDR100billion (≈US$6.7million).

- Minimum equity: IDR50billion.

- Capital must be sourced from legitimate activities; any proceeds of money‑laundering or terrorism financing are prohibited.

Beyond the capital bar, firms must:

- Submit a detailed business plan and risk‑management framework to OJK.

- Implement robust AML measures per SEOJK No.20 of 2024, including transaction monitoring and reporting to PPATK.

- Maintain a secure, auditable IT environment; data‑privacy controls are now a licensing condition.

- Report quarterly performance, suspicious activity, and any material changes to OJK.

Failure to meet any of these obligations can trigger license revocation, heavy fines, or even criminal prosecution.

4. Taxation Overhaul - From VAT to Income‑Tax‑Only

Before August2025, crypto trades were treated as intangible commodities, meaning each transfer attracted Value‑Added Tax (10%) and sellers faced final income tax on capital gains. PMK50 flipped that script:

- Transfers of crypto assets are no longer subject to VAT.

- Income tax is now calculated based on the nature of the transaction-trading profits are taxed like securities gains (currently 20% for individuals, 22% for corporations).

- PMK53 and PMK54 complement PMK50 by clarifying reporting obligations for crypto‑related income.

The net effect is a simpler tax filing process and greater certainty for both domestic and foreign investors.

5. How Exchanges and Fintechs Are Adapting

With stricter capital rules and a mandatory whitelist, many smaller exchanges faced a make‑or‑break moment. Common strategies observed after the July2025 deadline include:

- Joint ventures with larger, well‑capitalized banks to meet the IDR100billion threshold.

- Asset delistings-any crypto not re‑approved by February2025 was removed from trading pairs, tightening the market to roughly 650 vetted assets.

- Automation of AML/KYC-providers adopted AI‑driven monitoring to keep up with the real‑time reporting demands of OJK and PPATK.

These moves have nudged the market toward higher quality listings and better consumer safeguards, albeit at the cost of reduced entry‑level competition.

6. Comparative Snapshot: BAPPEBTI vs. OJK Oversight

| Aspect | BAPPEBTI (Pre‑2025) | OJK (Post‑2025) |

|---|---|---|

| Legal Basis | Commodity Futures Law | Law No.4/2023 + OJK Reg‑27/2024 |

| Asset Classification | Commodity (whitelisted) | Digital Financial Asset |

| Capital Requirement | None specific | IDR100bn paid‑up, IDR50bn equity |

| AML/KYC Duties | Basic AML, limited reporting | Full SEOJK‑20 compliance, PPATK reporting |

| Tax Treatment | VAT + final income tax (PMK68) | No VAT, income tax per PMK50 |

| Enforcement Power | Fines, trading bans | License revocation, criminal charges, real‑time transaction monitoring |

7. Outlook: What’s Next for Crypto in Indonesia?

Even with the 2025 reforms, two big questions linger:

- Payments Ban - Crypto remains illegal as a means of payment. Industry groups are lobbying for stablecoin exemptions, hoping to turn the ban into a regulated payment channel.

- Foreign Investment - OJK’s capital thresholds may deter small foreign entrants unless they partner with local banks or form joint ventures.

If OJK can balance innovation incentives with the heavy‑handed consumer‑protection approach, Indonesia could become a leading, well‑regulated hub for digital assets in Southeast Asia. The next wave of legislation will likely address stablecoin usage and perhaps introduce a sandbox for DeFi projects, but the core framework-digital financial asset status, robust AML, and high capital standards-looks set to stay.

Frequently Asked Questions

Is it legal to buy Bitcoin in Indonesia?

Yes. Buying, holding, and selling Bitcoin on a licensed exchange is legal. Using Bitcoin to pay for goods or services is still prohibited.

What license does a crypto exchange need?

An exchange must obtain a "Digital Financial Asset Trading Operator" license from OJK, meet the IDR100billion paid‑up capital requirement, and follow OJK Regulation No.27/2024.

Do crypto transactions attract VAT in Indonesia?

No. Since Minister of Finance Regulation No.50/2025, transfers of crypto assets are exempt from VAT.

How does OJK monitor AML compliance?

Crypto firms must implement transaction monitoring, conduct customer due‑diligence, and file suspicious‑activity reports to PPATK in line with SEOJK No.20/2024.

Can foreign investors participate in Indonesian crypto markets?

Yes, but they must work through a locally licensed entity that meets OJK’s capital and compliance standards.

Indonesia cryptocurrency regulation has moved from a loose commodity‑centric model to a tightly supervised digital financial‑asset framework. The shift brings clearer rules, higher barriers to entry, and a tax regime that treats crypto more like traditional securities. While the payment ban remains, the overall environment is now geared toward safe, institutional‑grade participation.

Maggie Ruland

March 5, 2025 AT 06:14Oh great, another crypto rule, just what we needed.

Raj Dixit

March 12, 2025 AT 04:54Indonesia finally got its act together. The OJK takeover is long overdue, and anyone who thought BAPPEBTI could handle digital assets was just dreaming. Capital requirements? Yeah, they’re finally realistic.

C Brown

March 19, 2025 AT 03:34Wow, Indonesia’s crypto crackdown is totally groundbreaking-because what the world really needed was more bureaucracy. Sure, slap a billion‑rupiah capital requirement on exchanges and watch innovation sparkle. 🙄

Noel Lees

March 26, 2025 AT 02:14Honestly, this could be the boost the market needed! Higher standards mean safer trading for everyone 😊. If smaller players team up with big banks, we’ll still see a vibrant scene.

Joyce Welu Johnson

April 2, 2025 AT 01:54The new Indonesian rules mark a huge turning point for crypto in the region.

The moving from a commodity label to a digital financial asset shows the government is finally listening to the market.

Investors will now have clearer guidelines on what is allowed and what is not.

The jump to a IDR 100 billion paid‑up capital may seem steep, but it also filters out shaky operators.

This protection can help ordinary people feel more confident when they trade.

The removal of VAT on transfers cuts a big cost that many users complained about.

Aligning income tax with traditional securities makes filing taxes far simpler.

The mandatory whitelist forces exchanges to list only vetted assets, reducing scams.

Strong AML/KYC requirements mean that money‑laundering will be harder to hide.

Although payments with crypto remain banned, the new framework still lets people buy, hold and sell legally.

Smaller exchanges can survive by partnering with well‑capitalized banks or forming joint ventures.

The focus on consumer protection is a positive sign for long‑term stability.

If OJK continues to balance enforcement with innovation, Indonesia could become a regional leader.

Future legislation may open doors for stablecoins and DeFi sandboxes, which would be exciting.

Overall, this overhaul brings much‑needed clarity and confidence to the Indonesian crypto space.

Ron Hunsberger

April 9, 2025 AT 00:34Great summary, Joyce! The clarity you provided will help many newcomers understand the practical impacts of the new rules.

Thiago Rafael

April 15, 2025 AT 23:14While the overview is comprehensive, it’s worth noting that the enforcement mechanisms will rely heavily on real‑time transaction monitoring, which could create additional compliance burdens for firms.

Adeoye Emmanuel

April 22, 2025 AT 21:54Raj, you raise solid points about the need for stricter oversight. It reminds me of the age‑old balance between freedom and responsibility-without proper guards, markets can become chaotic, but with too many shackles, innovation stalls.

Raphael Tomasetti

April 29, 2025 AT 20:34From a fintech perspective, the shift to OJK governance aligns the crypto sector with Basel‑III style capital adequacy frameworks, ensuring systemic risk is better managed.

Rahul Dixit

May 6, 2025 AT 19:14They say this is to protect investors, but I can’t help wondering if foreign powers are pushing these caps to keep Indonesian crypto out of the global arena.

Deepak Chauhan

May 13, 2025 AT 17:54Esteemed colleagues, the recent regulatory amendments signify a commendable stride towards market integrity-though one must remain vigilant of over‑regulation. 😊

Aman Wasade

May 20, 2025 AT 16:34Deepak, your formal tone is appreciated, but perhaps a little less rigidity would foster collaboration rather than intimidation.

Krystine Kruchten

May 27, 2025 AT 15:14Honestly, this new regime is a big step forward-let’s keep an eye on how it shapes the ecosystem and be ready to guide newcomers through any rough patches.

Mangal Chauhan

June 3, 2025 AT 13:54Thank you, Aman, for highlighting the tone issue. A balanced approach will indeed nurture growth while maintaining standards. 👍