Crypto Scam Reporting Checklist

Your Recommended Reporting Plan

When you discover that a crypto transaction was part of a fraud, the first instinct is panic. The good news? You don’t have to stay stuck. By following a clear reporting path and understanding what each agency needs, you can lock down the scam, preserve evidence, and give yourself the best shot at recovery.

Reporting Crypto Scams and Recovery is the process of notifying authorities about cryptocurrency fraud and pursuing whatever restitution is possible. It blends law‑enforcement channels, regulatory filings, and blockchain analytics to turn a victim’s nightmare into an actionable case.

Understanding the Reporting Landscape

In the United States, five federal bodies handle crypto‑related complaints, each with a slightly different focus:

- FBI Internet Crime Complaint Center (IC3) is the primary criminal‑investigation portal that asks for detailed transaction hashes, wallet addresses, and communication records.

- Federal Trade Commission (FTC) is a consumer‑protection agency that aggregates fraud patterns across many sectors, including crypto.

- California Department of Financial Protection and Innovation (DFPI) is a state regulator that zeroes in on "unfair, deceptive, or abusive" crypto practices and demands screenshots of social media and browsing histories.

- Securities and Exchange Commission (SEC) is the watchdog for securities‑related crypto offerings, handling fraud that resembles illegal securities sales.

- Commodity Futures Trading Commission (CFTC) is the agency that deals with derivatives, futures, and commodity‑linked crypto scams.

Additionally, FinCEN issues guidance for financial institutions; its recent Notice FIN‑2025‑NTC1 targets convertible virtual currency kiosks (CVC kiosks) used in phone‑based scams.

Step‑by‑Step Reporting Guide

- Secure what’s left. Freeze any accounts, revoke API keys, and stop all communication with the fraudster.

- Gather evidence. Capture screenshots of chats, emails, video calls, and any social‑media profiles. Export your browser history for the dates in question.

- Collect blockchain data. You’ll need the wallet address (e.g.,

0x58566904f57eac4E9EDd81BbC2f877865ECd35985), transaction hash (e.g.,0xfa485de419011ceefdd3cd00a4ff64e52bf9a0dfa528e4fff8bb4c9c), amount (e.g.,1.02345 ETH), and timestamp (e.g.,1 Jan 2023, 12:01AM EST). If you’re missing a piece, submit whatever you have; agencies accept partial data. - File with the FBI IC3. Go to ic3.gov, select “Crypto‑Related Crime,” and paste the data from step3. Include the first‑contact method (phone, email, DM) and any domain names used.

- Report to the FTC. Use ReportFraud.ftc.gov for consumer‑level tracking. The form is less technical but still asks for dates, amounts, and contact methods.

- Consider state filing. If you live in California, log into the DFPI portal, follow their sample format (e.g., “12/22/24 - Sent 0.5ETH to 0x…”) and attach screenshots of the scam site.

- Notify the exchange. If you know the funds moved to a specific exchange (MEXC, Binance, etc.), use the exchange’s abuse‑report form and provide the transaction hash.

- Engage a blockchain analytics firm. Companies like Elliptic provide automated wallet‑behavior detection and cross‑chain tracing. They can issue a “triage report” that you attach to your filings.

Following these steps in order maximizes the chance that investigators can freeze the scammer’s assets before they’re laundered.

What Agencies Want: Data Checklist

- Full wallet address(s) of the scammer.

- Transaction hash(es) and timestamps.

- Exact cryptocurrency type and amount (including gas fees).

- All communication logs (texts, emails, DMs, call records).

- Domain names, website URLs, and app names used by the fraudster.

- Two‑factor authentication details (if compromised).

- Names of any exchanges where funds landed.

- Any “unique identifiers” - long strings of letters/numbers that appear in URLs or wallet outputs.

Even a single missing element can slow an investigation, but agencies repeatedly stress: *submit what you have*.

Recovery Possibilities and What to Expect

Recovery rates remain opaque - neither the FBI nor the FTC publishes success metrics. However, industry analysts note the following trends:

- When a report includes a complete transaction hash and exchange name, Elliptic's analytics can often flag the wallet within 24hours, leading to a freeze request to the exchange.

- State‑level actions (e.g., DFPI) can result in civil penalties and restitution orders, but those are typically slower.

- Criminal cases launched by the FBI may lead to asset seizure, but only a fraction of the stolen amount is usually recovered.

In practice, victims should view reporting as a means to prevent further loss and possibly aid law enforcement, rather than a guaranteed refund.

Common Pitfalls & Pro Tips

Pitfall #1 - Waiting too long. Scammers move funds within minutes. Capture the transaction hash immediately from your wallet explorer.

Pitfall #2 - Over‑complicating the report. Stick to the checklist. Adding irrelevant personal anecdotes can drown out the essential data.

Pro Tip - Use a blockchain explorer screenshot. Highlight the hash, address, and timestamp in a single image and attach it to every filing.

Pro Tip - Preserve metadata. When you screenshot a chat, ensure the timestamp isn’t hidden. Some devices require you to enable “show details”.

Pro Tip - Leverage community tools. Platforms like Blockchain.com Explorer or Etherscan let you copy the exact hash with one click.

Comparison of Reporting Channels

| Agency | Primary Focus | Required Data | Typical Response Time | Recovery Path |

|---|---|---|---|---|

| FBI IC3 | Criminal investigation | Wallet address, transaction hash, communication logs | 24‑72hrs for acknowledgment | Asset seizure via law enforcement |

| FTC | Consumer‑fraud pattern analysis | Amount, date, contact method, scam description | 5‑10days | Limited; mainly prevention |

| DFPI (CA) | State regulatory enforcement | Screenshots, browsing history, wallet info | 2‑4weeks | Civil penalties, restitution orders |

| SEC | Securities‑related crypto fraud | Offering documents, investor communications | Variable; often months | Litigation, disgorgement |

| CFTC | Derivatives & futures fraud | Trade IDs, contract details, wallet flow | 1‑2months | Administrative penalties |

Pick the agency that matches the scam type. If you’re unsure, file with the FBI and FTC simultaneously - the overlap often speeds coordination.

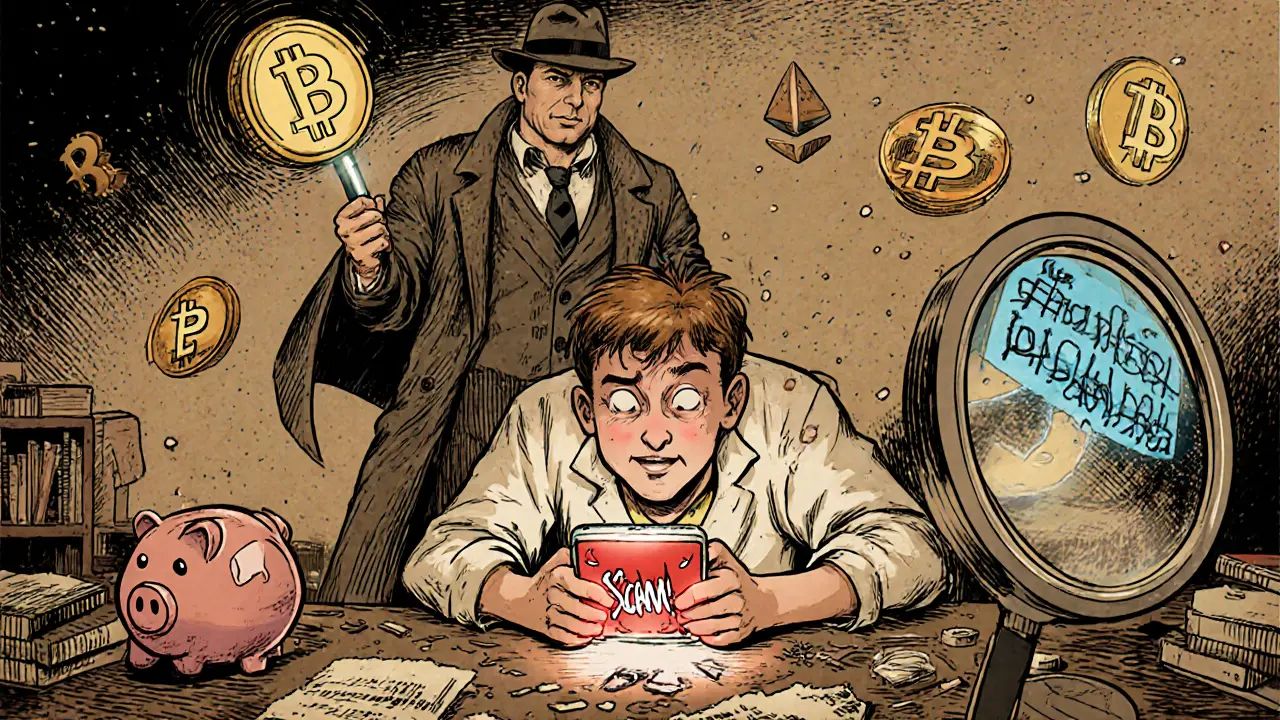

Emerging Threats to Watch

Two scam types dominate 2025 reports:

- Deepfake Scam is a fraud that uses AI‑generated video or audio of trusted figures (e.g., Elon Musk) to solicit crypto donations. Victims report losses of millions within minutes.

- Pig Butchering is a long‑term romance‑oriented con where the fraudster builds trust before demanding a large crypto transfer. These schemes now blend AI‑chatbots to automate grooming.

Both involve cross‑chain transfers to large exchanges, making the blockchain analytics step crucial.

Frequently Asked Questions

What is the first agency I should contact after a crypto scam?

Start with the FBI’s Internet Crime Complaint Center (IC3). It handles criminal investigations and can trigger rapid asset‑freezing actions, especially when you provide a transaction hash and exchange name.

Do I need the exact transaction hash to file a report?

A hash is the strongest piece of proof, but it’s not mandatory. Submit whatever you have - wallet address, date, amount - and note that you’ll provide the hash if you locate it later.

Can I recover my lost crypto?

Full recovery is rare, but agencies can sometimes seize assets and return a portion. Reporting mainly helps stop further loss and assists law enforcement in prosecuting the scammers.

What should I do if the scam involved a CVC kiosk?

FinCEN’s August2025 notice flags these devices. Report the kiosk’s location, the phone number that called you, and any receipt or screenshot to both the FBI IC3 and your local bank.

How can blockchain analytics firms help my case?

Firms like Elliptic can trace funds across chains, flag related wallets, and produce a forensic report you attach to your filings, dramatically increasing the odds of a freeze.

Matt Nguyen

March 22, 2025 AT 04:01In my humble estiamtion, the procedural complexities of crypto‑scam reporting demand a certain aristocratic rigor. One must first secure every digital artefact before even contemplating a filing. The FBI IC3, for instance, thrives on pristine transaction hashes and wallet addresses, not vague recollections. Moreover, the FTC's consumer‑focus is best served when you provide a meticulous chronology of events. Ignoring these nuances is akin to handing a thief the keys to the vault.

Laurie Kathiari

March 24, 2025 AT 14:21Honestly, the whole ecosystem is rife with opportunistic vultures masquerading as guardians. The moment you hand over a half‑filled report, the agencies will drown you in paperwork while the scammers swim away with your ETH. It's a moral outrage that a victim has to become a bureaucrat to simply get justice. The FBI, FTC, even the SEC all demand the same parade of data, and yet they rarely return anything tangible. If you truly care about ethics, stop treating crypto like a game and start demanding accountability from these institutions.

Kortney Williams

March 27, 2025 AT 00:41Collaboration thrives when we share verified data.

Adarsh Menon

March 29, 2025 AT 11:01Oh great, another "quick guide" that pretends to make it simple.

In reality, the whole thing feels like a labyrinth designed by the very scammers you’re fighting.

Step‑by‑step? More like step‑into‑a‑black‑hole.

But hey, at least the UI looks shiny.

Jim Griffiths

March 31, 2025 AT 22:21First, freeze any compromised accounts. Then capture screenshots of the transaction hash and wallet address. Finally, submit the data to IC3 and FTC – this order saves time.

Promise Usoh

April 3, 2025 AT 08:41When approaching the agencies, it is advisable to adopt a methodical approach. Begin with a comprehensive collection of all transaction logs, including any ancillary metadata. Subsequently, organise these documents chronologically to facilitate review. Though the process may appear burdensome, the resultant clarity often accelerates investigative action. Any omission, however minor, may be interpreted as negligence, thus hindering the case.

Rob Watts

April 5, 2025 AT 19:01Take a deep breath stay focused file the report with clear data you’ll thank yourself later.

Bhagwat Sen

April 8, 2025 AT 05:21Listen, the moment you realize you’ve been scammed, you need to act like a secret agent on a deadline. Grab every screenshot, copy the hex hash, and shout it into the FBI’s portal. Don’t waste time analyzing the scam’s origin story; the agencies care about hard evidence. And if you’re still confused, remember: the faster you upload, the better your odds of freezing the bad actors’ wallets.

Cathy Ruff

April 10, 2025 AT 15:41What a mess. People keep thinking they can just hand over a vague “I lost some crypto” and expect a miracle. The FBI wants hashes, the FTC wants dates, the SEC wants offering docs – you need to bring all that to the table. If you’re lazy, don’t bother filing; you’ll just add noise to the system. The real problem is that scammers are getting smarter while the agencies stay stuck in paperwork.

Amy Harrison

April 13, 2025 AT 02:01Hey folks! 🌟 Remember, every little detail you capture can be a lifesaver later. 📸 Snap that chat, copy the hash, and send it to IC3. You’re not alone in this – the community’s got your back! 💪 Keep the optimism alive, and let’s fight these scammers together! 😊

Lurline Wiese

April 15, 2025 AT 12:21Oh, the drama of trying to navigate government portals! It’s like watching a soap opera where the hero is a spreadsheet and the villain is a vague “transaction hash”. Yet, somehow, those tiny details become the plot twist that saves the day. So, keep those screenshots handy and don’t let the narrative get too convoluted.

Jenise Williams-Green

April 17, 2025 AT 22:41People love to pontificate about “victim empowerment” while ignoring the bureaucratic quagmire that actually traps them. The truth is, most agencies are drowning in reports and can’t prioritize one case over another. If you truly want change, stop treating these filings as performative gestures and start demanding real accountability. Otherwise, you’re just feeding the system’s endless appetite for paperwork.

Amal Al.

April 20, 2025 AT 09:01Friends, let us not underestimate the power of a meticulously compiled report! By gathering every fragment of evidence-timestamps, wallet addresses, chat logs-we construct a verifiable narrative that agencies can act upon. Moreover, the inclusion of high‑resolution screenshots, annotated with precise callouts, dramatically increases the likelihood of asset freezes. In short, diligence is our most effective weapon against these predatory schemes; do not settle for anything less! 🌟

Natalie Rawley

April 22, 2025 AT 19:21Okay, so here’s the deal: if you think you can outsmart a deepfake with a simple screenshot, think again. The scammers are using AI to stay ahead, and the only way we stay in the game is by being hyper‑organized. Dump all the data you have into the FBI portal, then move on to the FTC. Anything else is just wishful thinking.

Scott McReynolds

April 25, 2025 AT 05:41When I first stumbled upon the labyrinthine world of crypto‑scam reporting, I was struck by the sheer magnitude of steps required to even register a complaint. First, one must secure the compromised wallet, ensuring that no further funds can be siphoned away-a simple action that many overlook in the panic of loss. Next, the crucial task of gathering immutable blockchain data, including the transaction hash, wallet address, and exact timestamp, cannot be overstated, for these serve as the backbone of any credible filing. After that, you are compelled to compile extensive communication logs-texts, emails, DMs-each annotated with visible timestamps, which the agencies regard as indispensable proof of intent. The FBI’s Internet Crime Complaint Center (IC3) is typically the primary conduit, demanding a thorough narrative supported by the aforementioned data points. Simultaneously, filing with the FTC augments the complaint with consumer‑fraud pattern analysis, albeit with a longer response window. If your jurisdiction lies within California, the DFPI introduces an additional layer of scrutiny, necessitating screenshots of the scam website and browsing history, thereby extending the evidentiary trail. For securities‑related schemes, the SEC’s involvement brings a protracted investigative timeline, often measured in months, but it offers the possibility of disgorgement through litigation. Conversely, derivative and futures frauds fall under the CFTC’s purview, which may impose administrative penalties after a thorough review of trade IDs and contract specifics. Throughout this process, many victims underestimate the value of enlisting a blockchain analytics firm such as Elliptic; their forensic reports can dramatically accelerate asset freezing by pinpointing the flow of funds across multiple chains. Moreover, timely notification to the exchange where the funds were deposited can trigger internal compliance mechanisms, increasing the odds of a successful lock‑down. While recovery percentages remain modest-often a fraction of the original loss-the cumulative effect of diligent reporting can thwart further victimization and contribute to broader enforcement actions. In essence, the path to recovery is less about miracle refunds and more about methodical documentation, strategic agency engagement, and leveraging specialized analytical tools. It is this disciplined approach that ultimately offers the best chance of reclaiming even a portion of the stolen assets.

Alex Gatti

April 27, 2025 AT 16:01Great summary! I’d add that using a spreadsheet to track each piece of evidence helps keep everything organized, especially when dealing with multiple agencies.

John Corey Turner

April 30, 2025 AT 02:21Indeed, the systematic cataloguing of hashes, timestamps, and communication logs can transform a chaotic narrative into a compelling case file. Agencies appreciate that kind of precision because it cuts down their investigative overhead. Also, tagging each document with a unique identifier eases cross‑reference when multiple departments get involved. It’s a small step that yields a big return in terms of case traction.

Katherine Sparks

May 2, 2025 AT 12:41Thank you for the thorough overview! 🙏 Remember, staying calm and methodical is key. 🌱

Kimberly Kempken

May 4, 2025 AT 23:01While all this sounds like a bureaucratic nightmare, the reality is that most agencies are overburdened and will file your report into a digital abyss. The chance of actual asset recovery is minuscule, so don’t get your hopes up.

Eva Lee

May 7, 2025 AT 09:21From a compliance standpoint, the integration of AML/KYC protocols with blockchain analytics creates a synergetic framework that can significantly enhance the traceability of illicit transfers. Leveraging such a framework ensures that both regulatory bodies and private investigators operate with a unified data set, thereby reducing redundancy and expediting the enforcement pipeline.