Wrapped assets were never meant to be the endgame. They were the bridge - a temporary fix to connect Bitcoin to Ethereum’s booming DeFi world. In 2019, when WBTC launched, no one thought it would become a $11 billion pillar of decentralized finance. But here we are in early 2026, and wrapped tokens still dominate cross-chain liquidity. The question isn’t whether they work - it’s whether they’ll survive.

How Wrapped Assets Actually Work

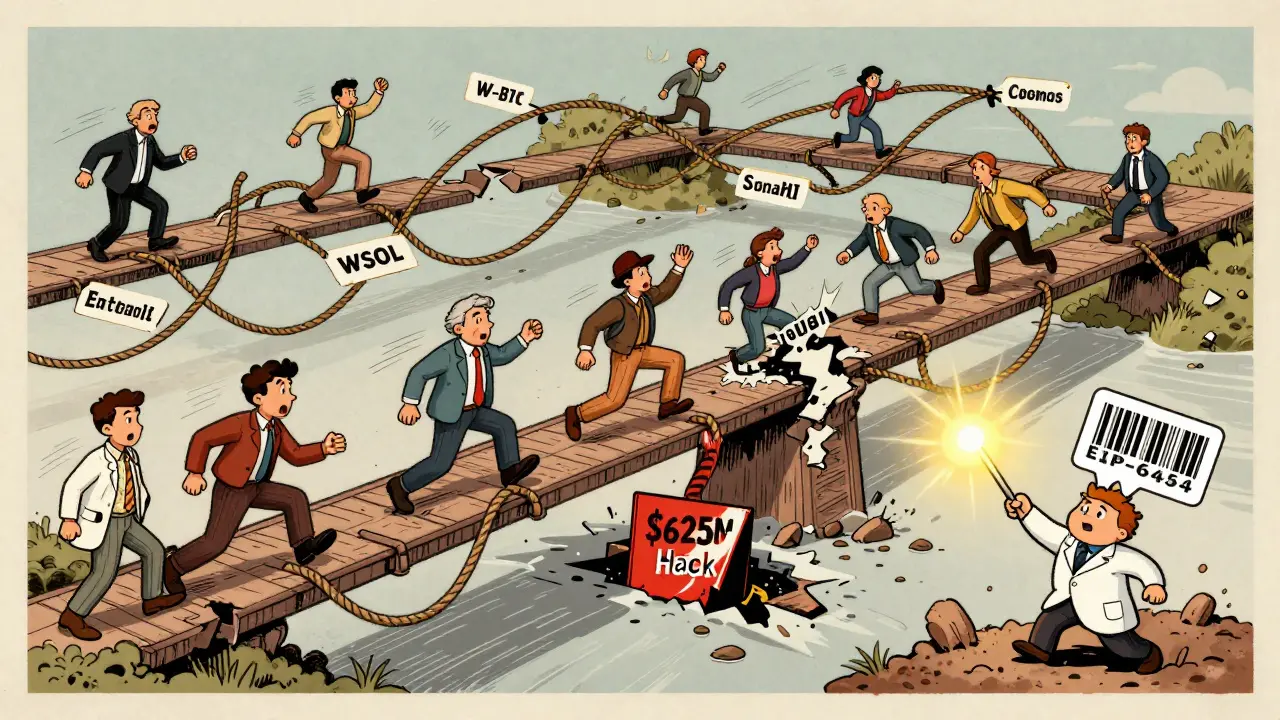

At its core, a wrapped asset is a token that stands in for something else. Want to use Bitcoin in a DeFi protocol on Ethereum? You don’t move your BTC. You lock it in a vault, and get an equivalent amount of WBTC - a token that looks and acts like ERC-20, but represents real Bitcoin on the other side. The same goes for Wrapped Solana (WSOL), Wrapped Ethereum (WETH), even Wrapped Filecoin. Each one is a digital IOU backed 1:1 by the original asset.

This lock-and-mint system sounds simple, but it’s full of hidden complexity. The vaults? Most are still controlled by centralized custodians - companies like BitGo or Coincover. You’re trusting them not to disappear with your Bitcoin. And if you think that’s safe, remember: $2.1 billion has been lost in wrapped asset hacks since 2020. The Wormhole exploit in 2022 alone wiped out $625 million in wrapped ETH.

The Dominance of WBTC and the Fragmentation Problem

WBTC still owns 92% of the wrapped Bitcoin market. It’s the gold standard - literally. It’s integrated into Aave, Uniswap, Curve, and over 65 other DeFi apps. But that dominance hides a deeper flaw: fragmentation.

On Ethereum, you use ERC-20 wrapped tokens. On Solana, you use SPL tokens. On Cosmos, you use IBC-based bridges. Each chain has its own rules, its own custodians, its own redemption processes. Trying to move a wrapped asset from Ethereum to Solana isn’t a single click. It’s a multi-step journey across three different bridges, each with its own fees, delays, and failure points. The success rate drops from 99.8% on a single chain to just 87.3% when crossing chains.

And the number of standards? Over 87 different wrapped token implementations exist today. That’s not innovation - it’s chaos. Wallets don’t know how to display them consistently. Exchanges struggle to list them. Regulators can’t classify them. You end up with users who don’t know if their wrapped token is a security, a commodity, or just a glorified receipt.

Why Everyone Still Uses Them

Despite the risks, wrapped assets are everywhere because they solve a real problem: access. Bitcoin holders want yield. They don’t want to sell their BTC to buy ETH and stake it. With WBTC, they can lend it on Aave and earn 4.7% APY - without ever touching their original coins. In Q2 2023, WBTC generated $89 million in lending interest alone.

Institutions love it too. Fidelity, Coinbase, and Grayscale use wrapped assets to bring Bitcoin into DeFi without breaking compliance. 67% of enterprises using DeFi rely on wrapped Bitcoin as their main gateway. Why? Because it’s the only way to plug legacy crypto into modern protocols without rebuilding everything from scratch.

For retail users, the barrier is low. Getting WETH on Uniswap takes under two minutes. MetaMask recognizes it. Gas fees are predictable. The user experience is smooth - until it isn’t. That’s the trap. It works until the custodian goes down, the bridge gets hacked, or the redemption process fails. Reddit user u/BridgeVictim lost $4,678 trying to unwrap ETH after a failed transaction. Their story isn’t rare.

The Push Toward Decentralization

The early days of wrapped assets were all about trust. You had to trust a few companies to hold your Bitcoin. But that model is crumbling under pressure. The WBTC DAO now includes 15 independent entities managing the system - not one central company. Newer wrapped token projects like Wormhole’s WETH use 13-of-19 multisig validators. That’s a huge step up from the old 3-of-5 setups.

Ethereum’s EIP-6454 proposal, released in August 2023, is trying to standardize metadata so wallets can recognize wrapped tokens automatically. No more confusion between WBTC, renBTC, and sBTC. Think of it like a universal barcode for wrapped assets. If it catches on, it’ll cut down user errors by 40%.

And then there’s MultiChain DAO - a new protocol launched in September 2023 that lets wrapped assets move across 25+ chains without needing a custom bridge for each pair. It’s not perfect yet, but it’s the first real attempt to replace the patchwork of bridges with one unified messaging layer.

Regulation Is the Wild Card

Here’s the quiet crisis no one talks about: no one knows what wrapped assets are legally.

The FASB said in 2023 that if a wrapped token gives you enforceable rights to the underlying asset, it’s not a crypto asset - it’s a security. That’s huge. If regulators in the EU, US, or Singapore decide WBTC is a security, exchanges will have to delist it. Custodians will need licenses. The whole model could collapse overnight.

Chainalysis found that 63% of wrapped token volume flows through jurisdictions with no clear rules. MiCA in Europe is the first real attempt to regulate this space, but even it doesn’t clearly define wrapped assets. The World Economic Forum warned in October 2023 that regulatory uncertainty could trigger a $9.3 billion market correction if rules come down hard.

Deloitte’s report is blunt: institutions must evaluate each wrapped token on a case-by-case basis. There’s no blanket rule. That’s a nightmare for compliance teams.

What Comes Next? The End of Wrapped Assets?

The smart money says wrapped assets won’t disappear - they’ll evolve. By 2028, most will be native interoperability layers, not custodial bridges. Projects like LayerZero are already eating into their market share, capturing 18% of cross-chain volume since 2022. Instead of wrapping Bitcoin, LayerZero lets Bitcoin itself move across chains using smart contracts - no vaults, no custodians.

Galaxy Digital’s 2023 report predicts current wrapped standards will be seen as transitional tech - a 3-to-5-year stopgap. The future is atomic swaps, shared state machines, and chain-agnostic asset representation. Wrapped tokens are the training wheels. We’re not done with them yet, but we’re getting close to taking them off.

For now, they’re still the most practical way to move value between chains. But the risk-reward balance is shifting. Every time you wrap an asset, you’re trading control for convenience. And as DeFi matures, users are starting to ask: is convenience worth giving up ownership?

What You Should Do Today

If you’re using wrapped assets:

- Stick to WBTC or WETH - they’re the most audited, the most liquid, and the most likely to survive regulation.

- Avoid obscure wrapped tokens. If it’s not on Uniswap or Aave, it’s probably not worth the risk.

- Check the backing ratio. WBTC’s dashboard shows 99.87% backing as of late 2023. If a token’s backing is below 98%, walk away.

- Understand the redemption process. Test it with a small amount first. Many users lose funds because they don’t know how to unwrap.

- Don’t assume your wrapped asset is safe just because it’s on Ethereum. The bridge is the weak link, not the chain.

If you’re building something on DeFi: support EIP-6454. Push for standardized metadata. Build with interoperability in mind, not just wrapped tokens. The future isn’t about wrapping assets - it’s about letting them move freely.

Are wrapped assets safe to use?

Wrapped assets are functional but carry real risks. The biggest danger isn’t price volatility - it’s custodial failure. Over 78% of wrapped tokens still rely on centralized custodians, and $2.1 billion has been lost to hacks since 2020. WBTC and WETH are the safest options due to heavy auditing and multi-signature custody. Avoid lesser-known wrapped tokens with weak backing or unclear redemption processes.

Can I lose my original asset when I wrap it?

You don’t lose your original asset - it’s locked in a vault. But you can lose access to your wrapped token if the bridge fails, the custodian goes offline, or the redemption contract has a bug. In 37% of GitHub-reported issues, users couldn’t unwrap their tokens due to reconciliation errors. Always test with a small amount first, and keep records of your lock transactions.

Is WBTC the only wrapped Bitcoin I should use?

WBTC is the most trusted and widely adopted wrapped Bitcoin standard, with $11.2 billion in TVL and 92% market share. Alternatives like renBTC and sBTC have much smaller liquidity and less developer support. If you’re using it for DeFi, WBTC is the default choice. Only consider alternatives if you’re specifically using a platform that supports them and you understand the trade-offs.

Why do wrapped assets have different names on different chains?

Each blockchain has its own token standard - ERC-20 on Ethereum, SPL on Solana, BEP-20 on BSC. A wrapped asset must conform to the target chain’s rules, so it gets a new token name. WBTC is ERC-20 on Ethereum, but on Solana, it becomes WSOL if it’s wrapped Solana, or W-BTC if it’s a custom bridge. This fragmentation makes it harder for wallets and exchanges to recognize them consistently, which is why EIP-6454 is trying to standardize metadata.

Will wrapped assets be banned by regulators?

They won’t be banned outright, but they could be heavily restricted. Regulators in the EU (MiCA), US (SEC), and elsewhere are still figuring out how to classify wrapped assets. If they’re deemed securities because they give holders enforceable claims on underlying assets, exchanges will need licenses to list them. That could force many small wrapped tokens off platforms. WBTC is more likely to survive due to institutional backing and transparency.

What’s the difference between wrapped assets and cross-chain bridges?

Wrapped assets are tokens that represent another asset on a different chain - like WBTC on Ethereum. Cross-chain bridges are the systems that move assets between chains. Some bridges create wrapped tokens as part of their process. Others, like LayerZero, use message-passing protocols to move assets natively without wrapping. Wrapped assets are one method; bridges are the infrastructure. The trend is moving toward bridge protocols that don’t require wrapping at all.

Can I use wrapped assets on mobile wallets?

Yes - but only if the wallet supports the token’s standard. MetaMask, Trust Wallet, and Phantom all recognize WBTC, WETH, and WSOL. But many mobile wallets don’t auto-detect lesser-known wrapped tokens. You may need to manually add the contract address. Always verify the token symbol and contract before sending funds. Mistaking one wrapped token for another has cost users millions.

Freddy Wiryadi

February 1, 2026 AT 22:06Brandon Vaidyanathan

February 2, 2026 AT 04:24Jeremy Dayde

February 3, 2026 AT 11:50