When you're trading stablecoins like USDC, DAI, or USDT, every penny of slippage and every cent in gas fees matters. That’s where Curve (Optimism) comes in - not as a flashy new exchange, but as the quiet workhorse that keeps DeFi’s most stable trades running smoothly. If you’re swapping USDC for DAI or moving between different dollar-pegged assets, Curve on Optimism isn’t just an option - it’s often the best one.

Curve Finance started in 2020 with one clear goal: make swapping stablecoins feel like moving money between bank accounts. No weird price jumps. No surprise fees. Just fast, cheap, and predictable trades. By 2025, its Optimism deployment had become the go-to layer-2 version of the protocol, cutting gas costs to nearly nothing while keeping slippage under 0.04% - far lower than Uniswap’s 0.3% on the same trades.

How Curve (Optimism) Works - No Fluff

Curve isn’t a traditional exchange. It doesn’t use order books. Instead, it uses an automated market maker (AMM) built specifically for assets that are meant to stay at $1. Most AMMs, like Uniswap, treat all tokens the same. Curve doesn’t. It knows that USDC and DAI don’t swing like Bitcoin. So it adjusts its pricing curve in real time to minimize price impact. This is called adaptive curve technology, and it launched in Q1 2025. The result? A 0.04% slippage average on stablecoin pairs. Compare that to Uniswap’s 0.3%, and you’re saving 87% in lost value on every trade.

Curve runs on Optimism, an Ethereum Layer-2 chain that bundles hundreds of transactions into one single proof submitted to Ethereum mainnet. This cuts costs and speeds things up. On Ethereum mainnet, a typical swap costs around $1.27. On Curve (Optimism)? About $0.0004. That’s not a typo. You can do over 3,000 trades for the price of one Ethereum transaction.

Performance Numbers That Matter

As of January 2025, Curve’s Optimism deployment had a Total Value Locked (TVL) of $842 million - over 21% of Curve’s total $4 billion+ across all chains. Daily transactions? Around 18,400. Average settlement time? Two seconds. Ethereum mainnet averages 15 seconds. That’s not just faster - it’s game-changing for arbitrage traders and yield farmers who need to move money fast.

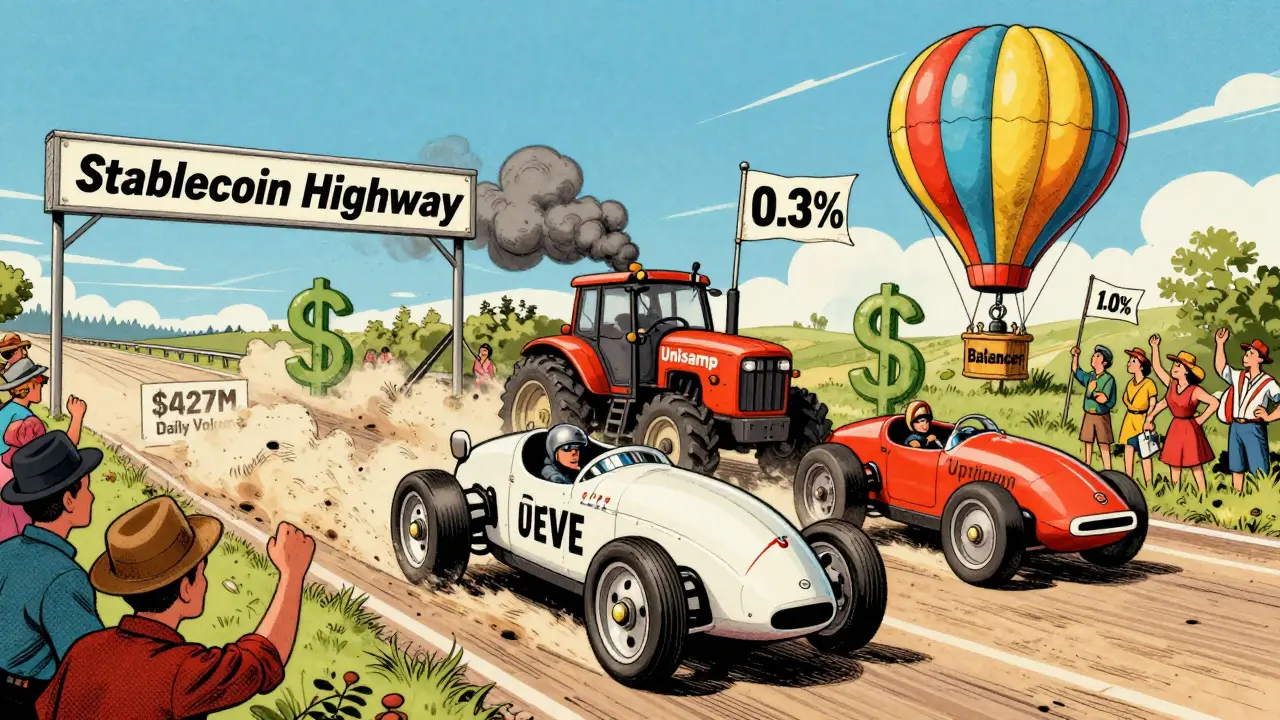

Trading volume on Curve (Optimism) hit $427 million in a single day in January 2025. That’s 38.2% of Curve’s total cross-chain volume. And here’s the kicker: Curve controls 67.3% of all stablecoin swaps across DeFi, according to DeFi Llama. Uniswap may have more total liquidity, but when it comes to stablecoins, Curve owns the market.

What You Get - And What You Don’t

Curve (Optimism) is laser-focused. It supports 12 stablecoin pools: USDC/DAI, USDT/USDC, FRAX/DAI, and so on. If you want to swap ETH for WBTC or SOL for AVAX, you’re out of luck. This isn’t a general-purpose DEX. It’s a precision tool for stable assets.

That’s its strength - and its weakness. If you’re trading volatile tokens, Curve’s algorithm becomes inefficient. You’ll get worse prices than on Uniswap or Balancer. But if you’re only moving between USD-pegged coins? No one beats it.

Security is handled by Optimism’s 7-day fraud proof window. If someone tries to cheat the system, there’s a full week to challenge it. Curve adds its own layer: governance changes require 4 out of 7 signers to approve. That’s not perfect, but it’s more secure than most DeFi protocols.

The CRV Token - More Than Just a Coin

CRV is the governance token of Curve. As of January 2025, it trades at $0.8596 with a $1.08 billion market cap. It’s down 98% from its all-time high of $60.50 in 2020 - but that’s not the full story. CRV isn’t meant to be a speculative asset. It’s a voting key.

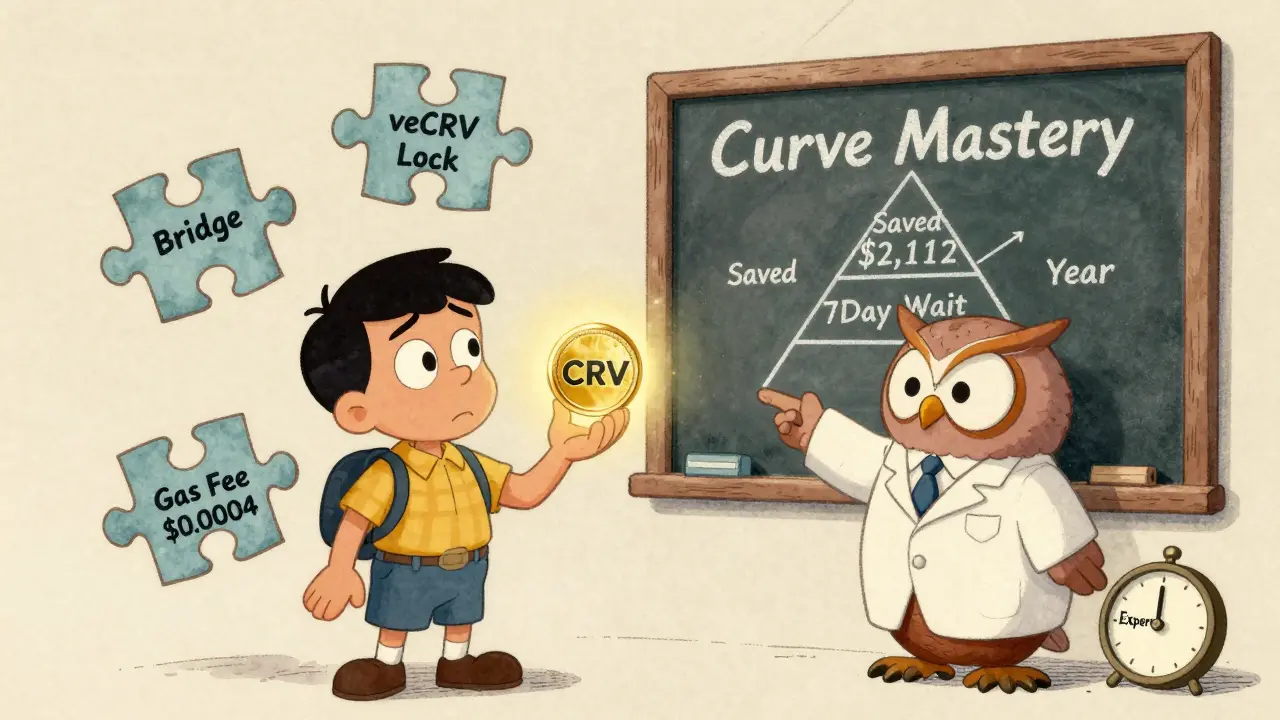

To earn rewards or vote on protocol changes, you need to lock CRV into veCRV (vote-escrowed CRV). Locking for four years gives you the maximum voting power and fee rewards. Locking for just a week? You get almost nothing. This system, called veTokenomics, rewards long-term commitment - but it’s confusing for new users.

On Reddit, one trader said, “Curve on Optimism saved me $2,300 in gas fees last month.” On CryptoCompare, another user complained, “I lost 20% of my rewards because I didn’t lock long enough.” The learning curve is real. 37% of new users make suboptimal locking choices, according to Curve’s own analytics.

Who Is This For?

Curve (Optimism) isn’t for beginners. You need to understand:

- How to connect a wallet (MetaMask, Ledger, etc.)

- How to bridge assets from Ethereum to Optimism (takes 1-2 hours)

- What veCRV is and how locking affects your rewards

- That withdrawing funds back to Ethereum takes 7 days

It’s not hard - but it’s not plug-and-play. Koinly estimates it takes 8-12 hours to get comfortable. If you’re trading stablecoins daily, the time investment pays off fast. A single user doing $100,000 in monthly swaps could save over $1,000 in fees alone.

Enterprise adoption is low - only 3.2% of volume comes from institutions. This is a tool for individual traders, arbitrage bots, and yield optimizers.

How It Compares

| Feature | Curve (Optimism) | Uniswap V3 | Balancer |

|---|---|---|---|

| Slippage on stablecoin pairs | 0.04% | 0.3% | 0.5-1.0% |

| Average gas fee (USD) | $0.0004 | $1.27 (on Ethereum) | $1.50+ (on Ethereum) |

| Settlement time | 2 seconds | 15+ seconds | 15+ seconds |

| Stablecoin pools | 12 | 50+ (but not optimized) | 15+ |

| Market share in stablecoin swaps | 67.3% | 18.1% | 7.4% |

| Best for | Stablecoin-only traders | General swapping | Custom pools, volatile assets |

Uniswap is the giant - but it’s like using a sledgehammer to crack a nut. Balancer lets you build custom pools, but that’s overkill if you just want to swap USDC for DAI. Curve? It’s the scalpel.

Future Roadmap

Curve isn’t standing still. In January 2025, crvUSD v2.1 launched on Optimism and hit $120 million in circulation. The next big thing? “Curve Warp,” a cross-chain settlement layer scheduled for Q3 2025. It aims to cut bridging times from hours to minutes.

Gartner predicts Curve’s TVL will hit $6.2 billion by 2026, with Optimism making up 35% of that. But regulatory clouds loom. The SEC classified CRV as a security in some jurisdictions in October 2024. That could block listings on centralized exchanges like Coinbase or Binance - which might actually help Curve stay decentralized.

Real User Experience

Trustpilot gives Curve a 4.1/5 rating based on over 1,200 reviews. The most common praise? “Low slippage.” The most common complaint? “Too hard to understand veCRV.”

On Twitter, 62% of mentions about Curve (Optimism) are positive. On Reddit, users with active arbitrage strategies call it “the only DEX I use for stablecoins.” But if you’re new to DeFi and just want to swap ETH for USDC? Start with Uniswap. Curve isn’t the entry point - it’s the upgrade.

Final Verdict

Curve (Optimism) is not for everyone. But if you’re trading stablecoins regularly - whether you’re doing yield farming, arbitrage, or just moving funds between platforms - it’s the most efficient tool on the market. The fees are dirt cheap. The slippage is near zero. The speed is unmatched.

The downside? The learning curve. The veCRV system is opaque. The governance is complex. But if you’re willing to spend a few hours learning how it works, the savings are real. One trader on Reddit calculated that switching to Curve (Optimism) cut his monthly gas costs from $180 to $4. That’s $2,112 saved in a year.

For stablecoin traders, Curve (Optimism) isn’t just good - it’s essential. Everything else is just noise.