Buying or selling cryptocurrency in Taiwan isn’t just a tech move-it’s a tax event. If you’re trading Bitcoin, Ethereum, or any digital asset on BitoPro, MaiCoin, or Binance, the Taiwanese government expects you to report it. But here’s the catch: there’s no single law that says exactly how. Instead, you’re stuck navigating a patchwork of old tax rules, unclear court rulings, and new regulations still being written. As of 2025, the rules are in flux, but the penalties for getting it wrong are real.

Is cryptocurrency legal in Taiwan?

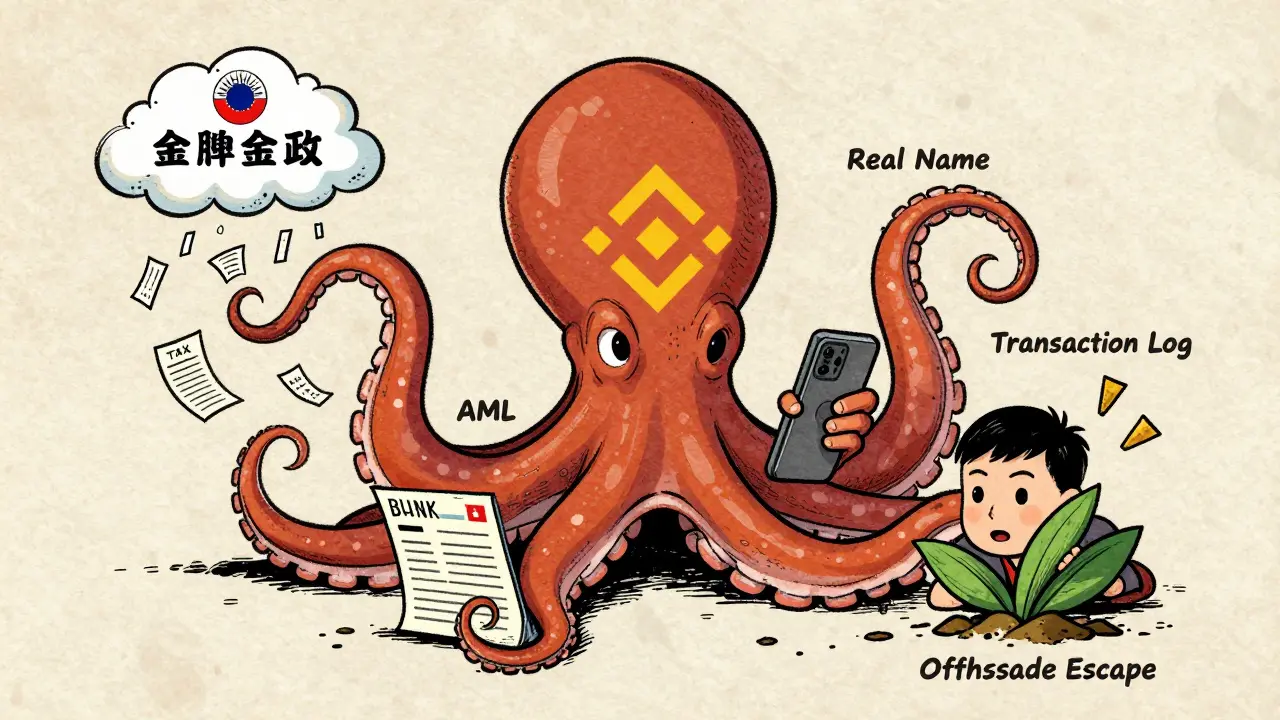

Yes, but not as money. Taiwan doesn’t recognize Bitcoin or any other crypto as legal tender. The Central Bank and Financial Supervisory Commission (FSC) have said since 2014 that digital assets are “virtual commodities.” That label matters. It means you can’t use crypto to pay for coffee, but you can trade it-and when you do, taxes kick in.The FSC doesn’t ban crypto. In fact, they’ve pushed hard to bring exchanges under control. By 2024, 24 platforms had passed strict anti-money laundering (AML) checks and were officially registered as Virtual Asset Service Providers (VASPs). That’s a big shift from 2014, when banks were told to block Bitcoin transactions entirely. Now, exchanges like BitoPro and MaiCoin are regulated, monitored, and required to collect real-name user data. And that’s the key to taxation.

How does Taiwan tax crypto trading?

There are two main taxes: business tax (VAT) and income tax. Neither was written for crypto. Both are stretched to fit.Business tax (5% VAT) applies if you’re selling crypto as part of a business. That includes individuals who trade regularly. If your monthly sales exceed NT$40,000 (about US$1,300), you must register for a business tax number and charge 5% VAT on every sale. This rule applies whether you’re a local or a foreigner selling to Taiwanese buyers. If you’re a foreign company with no office in Taiwan, you only pay VAT if you’re selling to individual Taiwanese users. If you sell only to businesses, the buyer pays the tax.

But here’s where it gets messy: many traders don’t register. The tax office doesn’t have a centralized crypto tracking system yet. That’s changing. As exchanges complete real-name verification, they’ll start reporting transaction data to the Ministry of Finance. Once that happens, unreported sales won’t fly.

Income tax (up to 20%) is the bigger concern. When you sell crypto for a profit, that gain is treated as business income or miscellaneous income, depending on how often you trade. If you’re a casual holder who sells once a year, you might pay 10-20% income tax. If you’re day-trading five times a week, you’re likely running a business-and taxed at the higher end.

The real problem? No one keeps records. Most people buy crypto on Binance or BitoPro and sell it months later. They don’t save the original purchase price. Without that, the tax office can’t calculate your profit. So they assume the entire sale amount is profit. That’s dangerous. You could owe 20% on your full $10,000 sale-even if you only made $1,000 profit. That’s a $2,000 tax bill on $1,000 gain.

What counts as a taxable event?

Not every crypto action triggers tax. But many do:- Selling crypto for New Taiwan Dollars (NTD)? Taxable.

- Trading one crypto for another (BTC for ETH)? Taxable. Even if you didn’t cash out, the IRS and Taiwan treat this as a sale.

- Receiving crypto as payment for goods or services? Taxable. Value at receipt = income.

- Buying crypto with NTD? Not taxable. You’re just exchanging one asset for another.

- Holding crypto without selling? No tax.

- Gifts or inheritances? Still unclear. No official guidance yet, but the tax office may treat it as a transfer of property.

Here’s a real example: You bought 0.5 BTC for NT$150,000 in 2021. In 2025, you sell it for NT$500,000. Your profit is NT$350,000. You owe 5% VAT on the full NT$500,000 (NT$25,000) plus income tax on NT$350,000 (up to NT$70,000). Total tax? Around NT$95,000. If you didn’t save your 2021 purchase receipt? The tax office assumes you bought it for NT$0. Your profit? NT$500,000. Your tax bill? NT$125,000 in VAT plus NT$100,000 in income tax. That’s NT$225,000. One missing receipt. Double your tax.

What about crypto mining or staking?

Mining and staking rewards are treated as income. When you get paid in crypto for validating transactions, that’s taxable the moment you receive it. The value is based on the market price at that exact time.Let’s say you mine 0.1 ETH on January 15, 2025, and it’s worth NT$45,000. You owe income tax on NT$45,000. Later, you sell it for NT$50,000. You now owe another tax on the NT$5,000 gain. You’re taxed twice: once on receipt, once on sale.

Staking rewards work the same. No special rules. No exemptions. If you earn crypto, it’s income. Save your transaction timestamps and prices.

Are crypto exchanges reporting to the tax office?

Yes. And it’s accelerating.Since July 2024, all VASPs in Taiwan must register with the FSC and comply with AML rules. That includes collecting ID, phone numbers, addresses, and bank details. More importantly, they’re required to track and store transaction histories. The Ministry of Finance has made it clear: once platforms complete full real-name verification, they’ll be forced to share data with the tax authority.

Binance, BitoPro, and MaiCoin are already upgrading their systems. In 2025, if you’ve traded more than NT$100,000 in a year, your exchange may send your info to the tax office automatically. You won’t get a warning. You’ll get a notice.

Some traders think they’re safe using overseas platforms. Not anymore. If you’re a Taiwan resident, the tax office doesn’t care where the exchange is based. They care where you live. If you file taxes in Taiwan, your crypto activity is fair game.

What’s changing in 2025?

On November 18, 2024, Taiwan’s Ministry of Finance announced it was reviewing crypto tax rules. Why? Prices surged after the U.S. election. More people traded. More profits were made. And the current system-based on 20-year-old laws-isn’t keeping up.Expect new rules in 2025 or early 2026. Possible changes:

- Formal crypto tax declaration forms

- Clear rules on cost basis calculation

- Penalties for unreported gains

- Exemptions for small traders (under NT$200,000 annual profit)

- Integration with existing income tax software

Don’t wait for the new rules to file. The tax office can audit you for up to seven years. If you didn’t report gains from 2023, you’re still at risk.

What happens if you don’t pay?

The government isn’t going to jail you for unpaid crypto tax. But they will hit you hard.Penalties include:

- Back taxes with interest (up to 15% per year)

- Fines up to 2x the unpaid amount

- Freezing bank accounts linked to unreported crypto activity

- Public listing of tax evaders on government portals

And here’s the kicker: some people have been prosecuted under the Banking Act for “illegal deposit-taking” when they accepted crypto as payment. Courts have ruled Bitcoin isn’t “funds” under the law-but prosecutors keep trying. The legal gray zone is shrinking fast.

How to stay compliant in 2025

You don’t need a CPA to get this right. Just do these five things:- Track every transaction. Use a free tool like Koinly or CoinTracker. Record date, amount, currency, value in NTD, and purpose.

- Save your purchase receipts. Screenshot the trade confirmation. Keep wallet addresses. Don’t rely on exchange statements-they can disappear.

- Register for VAT if you sell over NT$40,000/month. Go to the Ministry of Finance’s online portal. It takes 10 minutes.

- Report crypto income on your annual tax return. Use the “miscellaneous income” section. If you’re a trader, file as a business.

- Don’t ignore offshore exchanges. If you trade on Binance or Kraken and live in Taiwan, you’re still taxed.

Most people think crypto is anonymous. It’s not. The tax office has your name, your phone, your bank account. And soon, they’ll have your entire trading history.

Final thought: The clock is ticking

Taiwan’s crypto tax system isn’t perfect. But it’s getting real. The days of flying under the radar are ending. If you’ve made gains since 2020, you owe taxes. If you’re still trading, you’ll owe more.Waiting for the government to make it easy won’t work. They’re not coming to help. They’re coming to collect. The best time to get compliant was yesterday. The second-best time is now.

Do I have to pay tax if I only hold crypto and never sell?

No. Holding crypto without selling, trading, or receiving it as payment doesn’t trigger a tax event in Taiwan. Tax is only due when you realize a gain-by selling, trading, or using it to buy something. Simply owning Bitcoin or Ethereum is not taxable.

What if I bought crypto on Binance, which is based overseas?

It doesn’t matter where the exchange is located. If you’re a Taiwan resident and you trade crypto, you’re subject to Taiwan’s tax laws. Binance doesn’t pay your taxes for you. You must report all gains on your personal tax return, regardless of the platform.

Can I use the cost of buying crypto as a deduction?

Yes, but only if you can prove it. You must show the original purchase price in NTD, including fees. Without receipts, transaction history, or wallet records, the tax office will assume your cost was NT$0. That means you pay tax on the full sale amount-not just your profit.

Are crypto gifts taxable?

There’s no official rule yet, but receiving crypto as a gift is likely treated as a transfer of property. The recipient may owe tax when they later sell it, based on the original cost basis. Giving crypto as a gift doesn’t trigger tax for the giver, unless it’s part of a business transaction.

What happens if I don’t report my crypto gains?

If the tax office finds out, you’ll owe back taxes plus interest and penalties-up to twice the amount you should have paid. In serious cases, your bank accounts may be frozen. With exchanges now required to report to authorities, hiding crypto gains is becoming impossible.

Do I need to register as a business to trade crypto?

Only if your monthly crypto sales exceed NT$40,000. At that point, you must register for a business tax number and charge 5% VAT on all sales. Casual traders below that threshold don’t need to register-but they still owe income tax on profits.

Emily L

December 26, 2025 AT 06:48Bro i just sold my ETH last week and didn’t think twice. Now i’m sweating bullets thinking the tax office has my email. I’m not even rich, just trying to get by. Why does everything have to be taxed??

surendra meena

December 26, 2025 AT 08:03OMG!!! You guys are PANICKING over TAXES??? 😱 When I bought my first BTC in 2020 it was like $8k… now it’s 70k!!! And you’re worried about 20%?? I mean… come ON!!! This is FREE MONEY!!! Just pay the tax and move on!!!

Kevin Gilchrist

December 27, 2025 AT 18:30Y’all act like the tax man’s gonna show up at your door with a clipboard 😂 I’ve been trading since 2017 and never filed a single crypto form. I use Binance, I’m in the US, I live in Taiwan… who’s gonna track me? 😏 The blockchain’s public but the tax office? Nah. They’re still using Excel sheets from 2003. I’m good.

Also… who even remembers their 2021 purchase price? I screenshot my trades but I lost the folder. So what? I just say I bought it for $0. They can’t prove otherwise. 😎

Khaitlynn Ashworth

December 28, 2025 AT 23:37Oh wow. So the government wants you to track every single micro-transaction like you’re some kind of crypto accountant? 🤡

Let me guess-you also have to log how many times you blinked while holding BTC? And if you forget to save a screenshot of your wallet on a Tuesday in 2022, you owe 200k in taxes? Sweet. I’ll just sell my whole portfolio and move to Portugal. Or Mars. Either way, less paperwork.

NIKHIL CHHOKAR

December 29, 2025 AT 03:14Actually, this is quite reasonable. Taiwan has always been careful with financial regulation, and crypto is just another asset class now. If you’re making profits, you should pay your share. It’s not about control-it’s about fairness. Everyone else pays income tax, why should crypto traders be exempt? The system isn’t perfect, but it’s moving in the right direction. Just keep records, use tools like Koinly, and you’ll be fine.

Mike Pontillo

December 30, 2025 AT 20:18So if I buy BTC for $30k and sell for $35k, I owe tax on $35k? Wait no-only if I don’t have a receipt? So the government assumes I’m a liar unless I prove I’m not? That’s not tax law, that’s guilt until proven innocent. And they wonder why people hate taxes.

Joydeep Malati Das

January 1, 2026 AT 11:27The regulatory clarity in Taiwan is actually impressive compared to many other jurisdictions. The phased approach-starting with VASP registration, then data sharing-is methodical and avoids sudden disruption. While the burden on individuals is real, the infrastructure being built will ultimately benefit honest participants. It’s not perfect, but it’s one of the more pragmatic frameworks in Asia.

rachael deal

January 3, 2026 AT 07:27Y’all are stressing too hard! 😊 I’ve been using Koinly for 2 years and it’s been a lifesaver. Just connect your wallets, let it do the math, and boom-your tax report is ready. It’s not about being perfect, it’s about being consistent. Start small, track one trade a week, and you’ll be ahead of 90% of people. You got this!! 💪

Elisabeth Rigo Andrews

January 5, 2026 AT 06:17From a compliance standpoint, the lack of cost basis documentation is a systemic risk vector. The tax authority’s assumption of zero basis creates a perverse incentive structure where non-compliance is economically rational for low-information actors. This is not a tax policy-it’s a behavioral nudge toward institutionalization of digital asset accounting.

Adam Hull

January 5, 2026 AT 11:23Let’s be honest: the entire crypto tax framework is a farce. You’re being asked to calculate gains on assets traded across 17 different platforms, some of which don’t even provide API access. And the government expects you to know the exact USD value of a Satoshi in 2019? This isn’t taxation. It’s bureaucratic performance art. The real goal? To scare people out of crypto. And honestly? I’m fine with that.

Mandy McDonald Hodge

January 6, 2026 AT 03:28ok so i just realized i forgot to log 3 trades from last year 😅 but i saved all my emails so i think i can still find them! i’m using cointracker now and it’s kinda fun to see my whole history? like a little crypto diary 🥺 anyone else do this? also hi from texas!!

Shawn Roberts

January 6, 2026 AT 07:27Just pay the tax and stop crying. If you made money, you owe it. Simple. No one’s forcing you to trade. You chose this. Now own it. 🤝

Abhisekh Chakraborty

January 6, 2026 AT 15:25Bro I traded 50 times last month and made $12k profit. I didn’t file anything. I’m chill. The government doesn’t even know I exist. They’re too busy arguing about TikTok bans to notice me. 😎

dina amanda

January 6, 2026 AT 17:44They’re using crypto taxes to track us. This is the beginning of the digital surveillance state. Mark my words. Next they’ll tax your sleep. Or your breath. They already know where you are, what you bought, and who you talked to. This isn’t about money. It’s about control.

Gavin Hill

January 7, 2026 AT 22:48It’s interesting how we treat money differently based on its form. A dollar bill is neutral. A Bitcoin is a threat. A stock certificate is legal. A token on a blockchain is suspect. Maybe the real issue isn’t tax evasion-it’s our discomfort with decentralization. We built a system that can’t handle autonomy. So we punish it instead of adapting.

SUMIT RAI

January 8, 2026 AT 21:23Wait so buying ETH with BTC is taxable but buying ETH with USD isn’t? 😂 That’s like saying eating pizza with your hands is a crime but eating it with a fork is fine. Who designed this? A robot with a law degree? 🤖

Also 🚀

Andrea Stewart

January 10, 2026 AT 05:16If you’re unsure about your tax situation, start by exporting your transaction history from all exchanges and uploading it to Koinly or CoinTracker. They’ll auto-calculate your gains/losses in NTD and generate a report you can give to your accountant. Most people don’t realize how easy it is once you start. Don’t wait until the audit letter arrives.

Josh Seeto

January 12, 2026 AT 00:41Oh wow, so now I need to be a forensic accountant to trade crypto? Cool. I’ll just stick to holding. And maybe buying gold. At least gold doesn’t require a spreadsheet with 37 columns.

Bruce Morrison

January 13, 2026 AT 21:36Everyone’s scared of taxes. But this isn’t about punishment. It’s about inclusion. Crypto isn’t going away. So let’s bring it into the system where it can be protected, regulated, and taxed fairly. You don’t need to be perfect. Just start. One trade at a time.

Andrew Prince

January 15, 2026 AT 09:41The current regulatory architecture exhibits a fundamental misalignment between the decentralized nature of blockchain technology and the centralized, fiat-based fiscal apparatus of the modern nation-state. The imposition of VAT and income tax upon peer-to-peer asset transfers-predicated upon archaic concepts of 'realization' and 'cost basis'-is not merely inefficient; it is ontologically incoherent. One cannot tax a protocol. One can only tax the human actors who interface with it. And yet, the state persists in its epistemological arrogance, assuming jurisdiction over immutable ledger entries. This is not taxation. This is epistemic violence.

Jordan Fowles

January 17, 2026 AT 00:23I think the real question isn’t whether you owe taxes. It’s whether the system is designed to help you comply-or to trap you. Right now, it feels like the latter. But if we push for clearer rules, better tools, and grace periods for small traders, it could become something that actually works. For everyone.