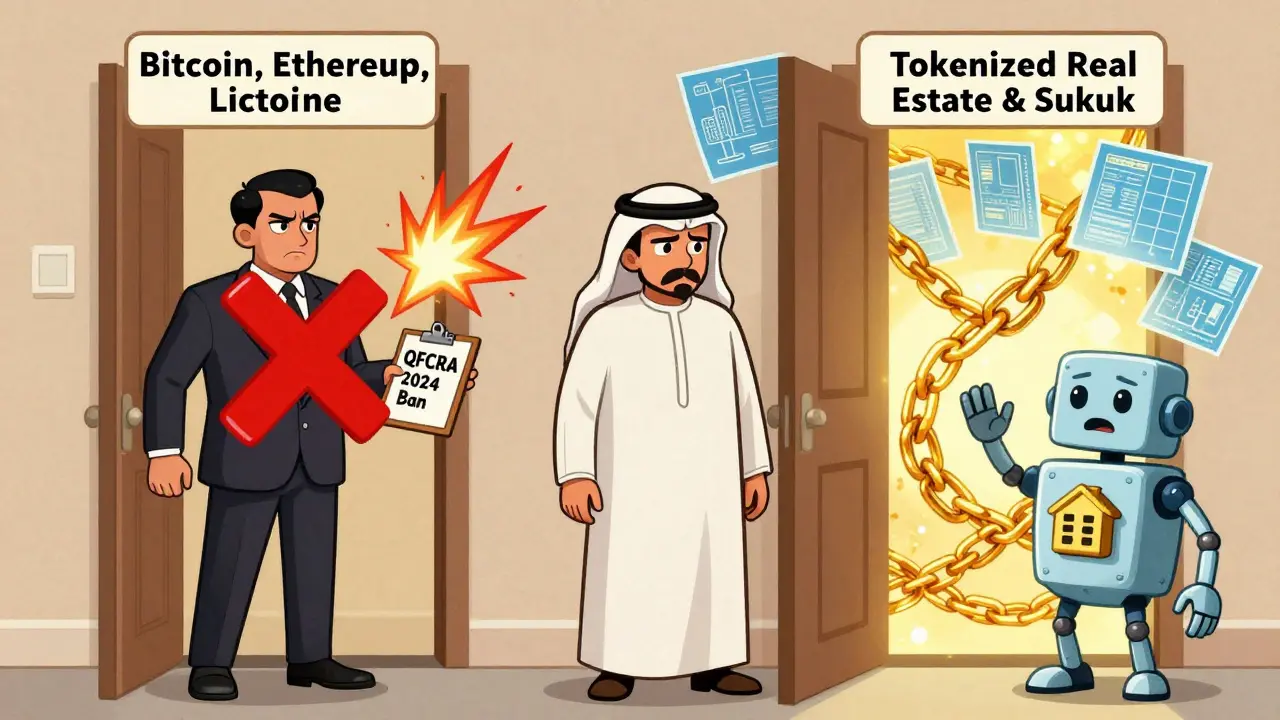

Qatar doesn’t just discourage cryptocurrency-it actively blocks it. If you're a resident trying to buy Bitcoin, trade Ethereum, or use a crypto wallet, you’re walking a legal tightrope. Since 2018, the Central Bank of Qatar has banned banks from handling crypto transactions. By 2020, that ban expanded to cover all virtual asset services inside the Qatar Financial Centre. And in September 2024, the rules got even clearer: cryptocurrencies are officially banned, but not everything digital is off-limits.

What’s Completely Illegal?

Under the new Digital Assets Regulations 2024, three types of digital assets are classified as "Excluded Tokens" and are strictly forbidden:- Cryptocurrencies like Bitcoin, Ethereum, and Litecoin

- Stablecoins such as USDT and USDC

- Central Bank Digital Currencies (CBDCs)

That means no local crypto exchanges. No Qatari banks offering crypto wallets. No ATMs that cash out Bitcoin. No peer-to-peer apps like Paxful or LocalBitcoins operating legally inside the country. The infrastructure simply doesn’t exist-and if someone tries to build it, they’ll be shut down.

What’s Actually Allowed?

Here’s where things get interesting. Qatar isn’t rejecting blockchain technology. It’s rejecting speculation. The same 2024 regulations that ban Bitcoin open the door to something else: tokenized real-world assets.Permitted Tokens are digital representations of actual, tangible value. Think of them as digital receipts backed by real property, shares, or commodities. Examples include:

- Tokenized real estate (a share of a Doha apartment building)

- Tokenized sukuk (Islamic bonds)

- Tokenized gold or oil contracts

- Tokenized company shares

To make one of these tokens legal, you need a three-step process:

- Validation: A licensed validator confirms the asset exists and belongs to the owner.

- Request: The owner formally asks for the asset to be tokenized.

- Generation: A licensed token generator creates the digital token on approved infrastructure.

This isn’t gambling. It’s asset management with blockchain tech. You’re not betting on price swings-you’re owning a piece of something physical. And because it’s tied to a real asset, it’s regulated, traceable, and legal.

Why This Split Exists

Qatar’s approach isn’t random. It’s strategic. The country has massive wealth tied up in real estate, oil, and sovereign investments. By allowing tokenization, they’re opening those assets to global investors without letting in the volatility of crypto markets.Compare this to the UAE or Saudi Arabia, where crypto exchanges are licensed and trading is encouraged. Qatar chose a different path: control the tech, not the speculation. They want blockchain for efficiency, not for day trading.

Experts say this reflects a deeper cultural and economic mindset. In Qatar, wealth is tied to stability-oil reserves, state-backed funds, long-term infrastructure. Crypto’s wild swings don’t fit. But a digital bond that pays dividends? That’s a natural fit.

What Happens If You Break the Rules?

There’s no public record of individuals being prosecuted for personal crypto use. But that doesn’t mean it’s safe.Law No. 20 of 2019 on Combating Money Laundering and Terrorism Financing defines "funds" broadly to include any asset transferred digitally. That means even if you buy Bitcoin on Binance from outside Qatar, you could still be flagged under AML rules. The government doesn’t need to prove you’re funding terrorism-just that you moved value through an unregulated digital system.

For businesses, the penalties are severe. Any company offering crypto services-wallets, exchanges, trading platforms-faces immediate shutdown, fines, and possible criminal charges. The QFCRA has made it clear: no gray area.

Can You Use Crypto Outside Qatar?

Technically, yes. If you travel abroad, you can buy crypto on international platforms. You can store it in a hardware wallet. You can even send it to someone overseas.But here’s the catch: bringing crypto back into Qatar-especially converting it to Qatari Riyal or using it to pay for goods or services locally-is a violation. If you deposit crypto into a Qatari bank account, even accidentally, the bank will freeze the transaction. If you try to pay for a car with Bitcoin in Doha, the seller could face legal trouble for accepting it.

Most residents who hold crypto do so as a long-term, offshore investment-like holding gold in a safe deposit box abroad. They don’t trade it. They don’t use it. They just keep it.

How to Invest Legally in Digital Assets

If you want to participate in Qatar’s digital asset future, here’s how:- Work with a QFC-licensed token service provider

- Look for tokenized real estate projects in Lusail or Doha

- Invest in tokenized sukuk issued by government-linked entities

- Use only platforms that show clear QFCRA licensing

Some firms like QFC-registered asset managers now offer tokenized portfolios of commercial properties. Others are launching tokenized commodities tied to Qatar’s LNG exports. These aren’t speculative. They’re structured investments with legal ownership rights.

Always ask: "Is this asset backed by something real?" If the answer is yes, and the provider is licensed, you’re on safe ground. If it’s just a coin with no underlying asset, walk away.

The Bigger Picture

Qatar’s crypto ban isn’t about fear of technology. It’s about control. The country has spent decades building a financial system based on stability, transparency, and state oversight. Crypto’s anonymity and decentralization clash with that model.At the same time, Qatar isn’t ignoring innovation. The 2024 framework gives legal recognition to smart contracts and digital ownership rights-something most countries still struggle with. They’re not rejecting blockchain. They’re redirecting it.

For residents, this means one thing: don’t chase Bitcoin. Chase tokenized assets. The future of digital finance in Qatar isn’t in wallets-it’s in deeds, contracts, and shares made digital.

What’s Next?

Don’t expect the ban on Bitcoin to lift anytime soon. The QFCRA has called cryptocurrencies "Excluded Tokens"-a permanent label. But the permitted token market is just starting. Expect more real estate, more commodities, and possibly tokenized government bonds in the next two years.Qatar’s Third Financial Sector Strategic Plan aims to make the country a hub for regulated digital assets. That’s not hype. It’s policy. And if you want to play in this space, you need to play by their rules.

Josh V

January 17, 2026 AT 05:15Qatar’s banning crypto but letting tokenized real estate? That’s not control that’s just capitalism with a veil

CHISOM UCHE

January 18, 2026 AT 18:28Excluded Tokens vs Permitted Tokens - this is regulatory arbitrage dressed as innovation. The QFCRA isn’t anti-blockchain, they’re anti-decentralization. They want the ledger without the liberty.

Pramod Sharma

January 20, 2026 AT 18:09Smart move. Crypto’s volatility kills long-term planning. Tokenized assets? That’s finance with discipline.

Ashlea Zirk

January 21, 2026 AT 12:06It’s important to note that the distinction between Excluded and Permitted Tokens isn’t arbitrary - it reflects a deliberate policy alignment with Islamic finance principles and sovereign wealth preservation. Tokenized sukuk, for example, are Sharia-compliant by design.

Lauren Bontje

January 22, 2026 AT 12:26Oh please. They’re just scared their oil money can’t compete with decentralized finance. If Qatar wanted real innovation, they’d let people trade Bitcoin. Instead they’re building a digital gilded cage for the elite. Tokenized real estate? That’s just Wall Street with blockchain glitter.

Shaun Beckford

January 23, 2026 AT 17:51Qatar’s strategy is a masterclass in authoritarian capitalism. They’re not banning tech - they’re banning freedom. You can own a digital slice of a Doha skyscraper but not a single Bitcoin? That’s not regulation, that’s psychological control wrapped in legal jargon.

Alexandra Heller

January 24, 2026 AT 18:24People don’t realize this isn’t about finance - it’s about morality. Crypto enables anonymity, speculation, and chaos. Tokenized assets? They’re transparent, traceable, and tied to real value. One is sin. The other is stewardship.

Liza Tait-Bailey

January 25, 2026 AT 10:40i mean… i get it? like why gamble on something no one owns vs owning a piece of something that actually exists? 🤷♀️ but also… why can’t i just hodl btc in my cold wallet? 😔

Deb Svanefelt

January 26, 2026 AT 07:07What’s fascinating here isn’t the ban - it’s the quiet revolution in asset ownership. Qatar isn’t rejecting blockchain; it’s redefining it. They’ve taken a technology born in rebellion and turned it into an instrument of institutional permanence. The digital deed, the tokenized sukuk - these aren’t just financial tools, they’re new forms of social contract. In a world where value is increasingly abstract, Qatar is anchoring it to the physical, the tangible, the enduring. This isn’t conservatism - it’s a profound reimagining of capital.

Dustin Secrest

January 26, 2026 AT 08:03There’s a philosophical elegance here. Crypto is about decentralization - but decentralization without accountability is chaos. Tokenized assets are about digitized sovereignty - where ownership is preserved, but power remains centralized. It’s not a contradiction. It’s a refinement.

myrna stovel

January 27, 2026 AT 13:01I know some people feel frustrated by the restrictions, but if you’re living in Qatar, it’s worth respecting the system. There are legal, secure ways to participate in digital assets here - and they’re actually safer than chasing volatile coins. You don’t have to love the rules to benefit from the structure.

Haley Hebert

January 28, 2026 AT 02:09Honestly? I think this is the most mature approach I’ve seen anywhere. Everyone’s screaming about Bitcoin this and DeFi that, but no one’s talking about how unstable and reckless it all is. Tokenizing real estate? That’s like giving people the power of ownership without the gambling. I’m not saying crypto is evil - I’m saying Qatar’s just grown up while the rest of us are still in high school.

Rod Petrik

January 29, 2026 AT 04:47Pat G

January 30, 2026 AT 17:45Of course the U.S. media calls this "oppressive" - they can’t stand that a country actually has the guts to protect its economy from Wall Street’s casino. Bitcoin is a Ponzi scheme wrapped in libertarian fantasy. Qatar gets it. We should be copying them, not mocking them.

Chris Evans

February 1, 2026 AT 15:02This isn’t regulation - it’s metaphysics. Crypto represents the illusion of freedom: infinite supply, no borders, no authority. Tokenized assets represent the truth: value is bound to land, to labor, to legacy. Qatar is choosing ontology over speculation. They’re not banning innovation - they’re demanding that innovation serve reality, not replace it. The future belongs to those who understand that digital ownership must be anchored - not floating, not abstract, not free.

Stephanie BASILIEN

February 1, 2026 AT 23:03One must consider the epistemological implications of this regulatory architecture: the state, by permitting only asset-backed tokens, effectively reifies capital as a tangible, measurable, and verifiable entity - thereby reinstating a Cartesian certainty into financial ontology, which had been eroded by the ontological vagueness of cryptographic tokens. One might argue this is not merely economic policy, but a philosophical reassertion of substance over signal.