Blockchain was supposed to connect the world - not split it into isolated islands. But that’s exactly what happened. Each chain - Ethereum, Solana, Binance Smart Chain, Polygon - became its own walled garden. Assets couldn’t move. Data couldn’t talk. Users had to choose: stick with one chain, or jump through hoops to get where they needed to go. That’s where cross-chain technology came in. It promised seamless transfers, unified liquidity, and a future where DeFi apps could work across every network. But the reality? It’s messier, riskier, and far more complicated than anyone expected.

Security Risks: Bridges Are the Weakest Link

Cross-chain bridges are the glue holding multi-chain ecosystems together. But they’re also the most targeted part of the whole system. In 2022 alone, over $1.2 billion was stolen from cross-chain protocols. The Wormhole bridge lost $320 million in one attack. The bZx exploit in 2021 saw hackers move $55 million across four different blockchains, using bridges to vanish into thin air. Why? Because bridges are complex. They rely on smart contracts, validators, or centralized relayers - and if one part breaks, the whole system collapses.Trustless bridges, like those using Hashed Time-Lock Contracts, sound safer because they don’t need intermediaries. But they’re harder to build, slower to process, and prone to timing errors. Trusted bridges - run by exchanges or centralized teams - are faster and more reliable, but they become single points of failure. If the operator gets hacked, or goes rogue, your funds vanish. And there’s no insurance. No FDIC. No recourse. According to Merkle Science’s 2025 analysis, 87% of all major blockchain exploits in the last four years involved cross-chain bridges. That’s not a coincidence. It’s a pattern.

Tracking Illicit Activity: The Blind Spot in Crypto Enforcement

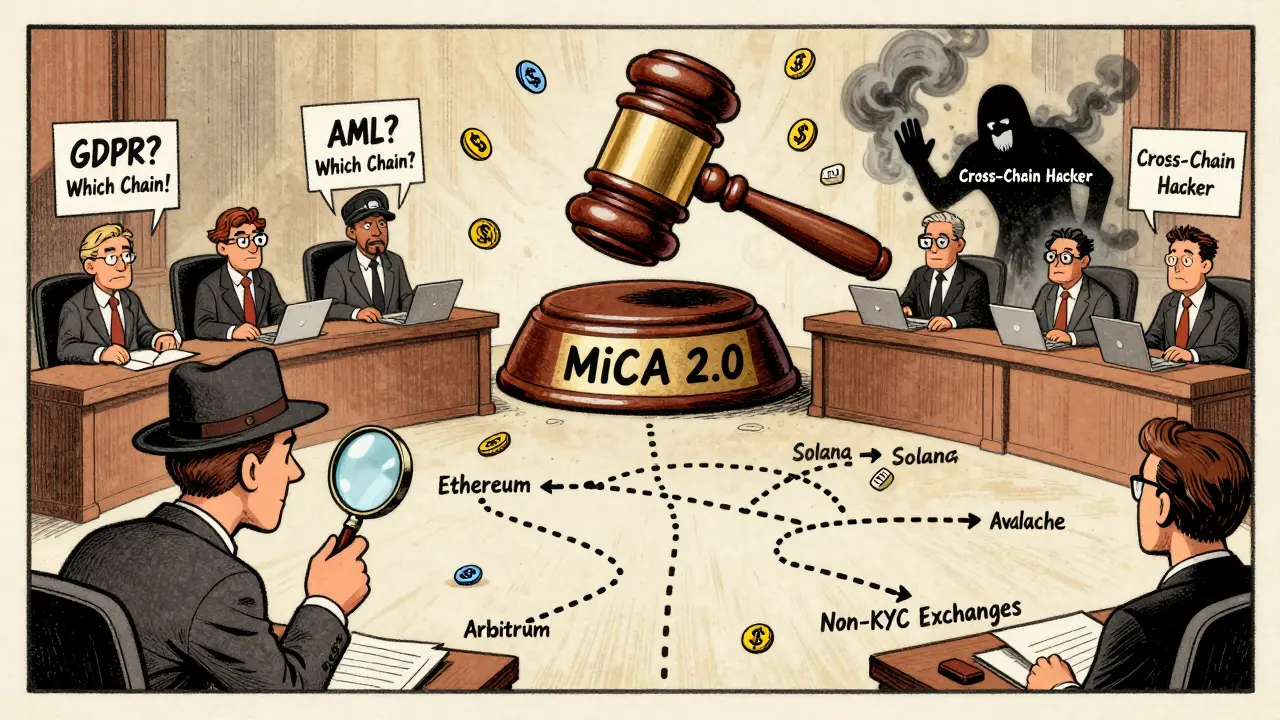

Law enforcement agencies are losing the war on crypto crime - and cross-chain tech is why. Before bridges, tracing stolen funds meant following a single chain. Now? A hacker steals $10 million on Ethereum, swaps it to Solana, moves it to Arbitrum, then to Avalanche, and finally cashes out on a non-KYC exchange. Each hop hides the trail. Traditional blockchain analytics tools were built for one chain. They can’t follow the money across five.That’s why $21.8 billion in illicit crypto was laundered through cross-chain services in 2025 - up from $4.3 billion in 2022. The same data from KYC-Chain shows that 63% of darknet market vendors now operate across multiple chains, avoiding centralized platforms that are easier to shut down. Global regulators are scrambling. The EU’s upcoming MiCA 2.0 framework is one of the first attempts to force cross-chain transparency. But until every bridge is required to log and report every transfer in real time - and until those logs are standardized - enforcement will remain reactive, not proactive.

Technical Fragmentation: No Standard, No Simplicity

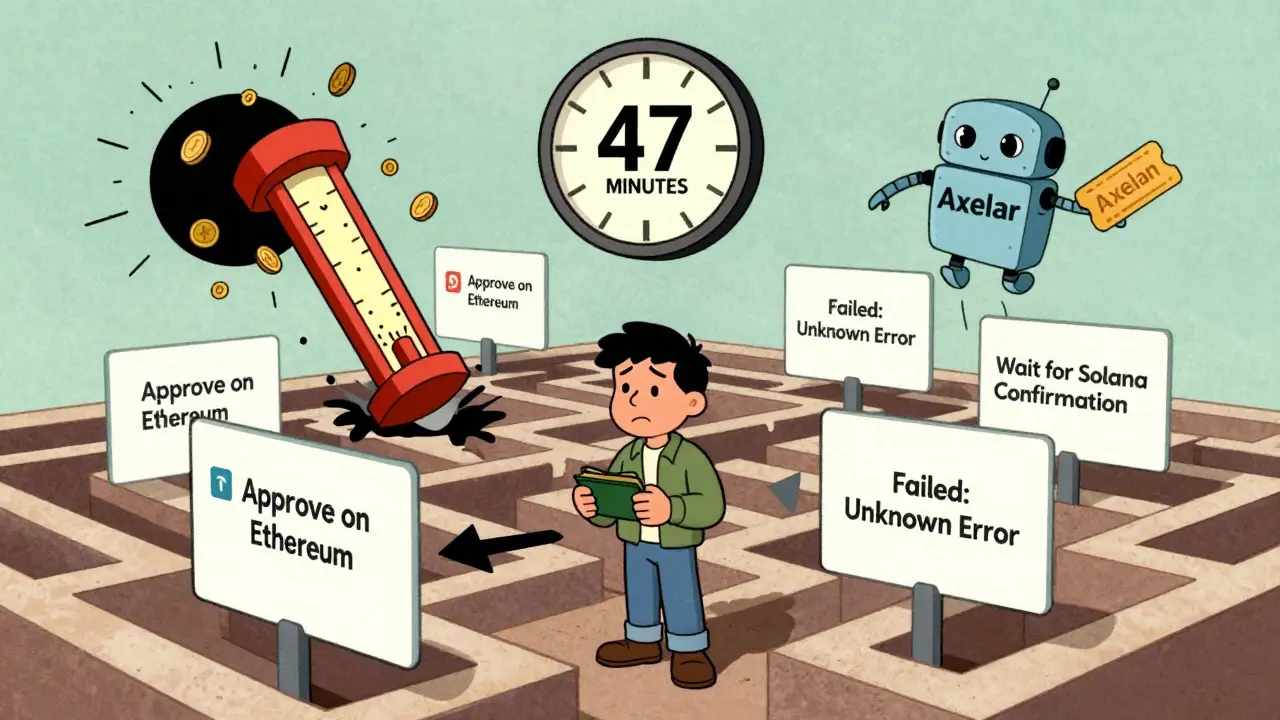

There are over 127 cross-chain protocols in use today. Each one works differently. Some use atomic swaps. Others rely on oracle networks. A few use centralized relayers. There’s no universal standard. That means every new blockchain project has to rebuild interoperability from scratch. It’s like every car manufacturer using a different fuel type - and no gas station can serve them all.As a result, only 25% of cross-chain bridges support liquid assets like USDC or DAI. Most only handle native tokens, forcing users to convert twice - paying fees each time. Transaction delays are common. One Reddit user in January 2025 spent 47 minutes and $28.73 in gas fees to move $150 from Ethereum to Polygon. Three failed attempts. That’s not innovation. That’s frustration.

Enterprise adoption is stuck because of this. According to Gartner’s 2025 survey, 70% of companies cite ‘unclear technical integration paths’ as a blocker. Even if a business wants to use cross-chain, the documentation is inconsistent. Wormhole’s docs got 3.2 out of 5 stars. Axelar’s? 4.5 out of 5. But that’s still not enough. Most teams need 3 to 6 months just to deploy a single bridge. And that’s before they even worry about key management across chains - a problem 78% of implementers report.

User Experience: Too Many Clicks, Too Many Failures

The average user doesn’t care about validators, oracles, or consensus mechanisms. They just want to send their crypto from one place to another - fast, cheap, and without errors. But today’s cross-chain interfaces are clunky. Apps ask for approval on three different chains. They show vague error messages like ‘transaction failed’ with no explanation. Customer support? Often nonexistent. Trustpilot reviews across 1,247 verified users show an average rating of 2.8 out of 5. The top complaints? Unexpected failures (63%) and no help when things go wrong (58%).There are exceptions. DeFiWhale88 moved $2.3 million across five chains in February 2025 using Axelar. Only 0.87% slippage. Zero failures. But that’s the exception. Most users aren’t whales. They’re everyday people trying to earn yield or swap tokens. For them, cross-chain tech feels like a lottery - sometimes it works, often it doesn’t. And when it fails, they lose money and trust.

Regulatory Uncertainty: The Silent Killer

No one is regulating cross-chain technology. Not really. The U.S. SEC hasn’t defined what a cross-chain bridge is legally. The EU is moving with MiCA 2.0, but it won’t be fully enforced until late 2025. Meanwhile, companies are stuck in limbo. Can they comply with GDPR if user data flows across five blockchains? Can they report cross-chain transactions under AML rules if they can’t trace them? The answer? Nobody knows.That’s why only 18% of Fortune 500 companies have implemented cross-chain solutions. The rest are waiting. Not because they don’t see the value - they do. But because the legal risk is too high. One misstep could mean fines, lawsuits, or even criminal liability. And regulators aren’t just asking for compliance - they’re asking for real-time visibility into every transaction. That’s a tall order when bridges are designed to be permissionless and decentralized.

The Future: Consolidation or Collapse?

The market is already shifting. The top five protocols - Axelar, LayerZero, Chainlink CCIP, Wormhole, and Multichain - control 68% of the total value locked. Smaller players are fading. That’s a sign of consolidation. But it’s not enough. Without standards, without regulation, and without better user tools, cross-chain tech risks becoming a luxury for the few.Some experts predict only 15 to 20 major protocols will survive by 2027. Others warn that without global standards, fragmentation will deepen, making cross-chain tech unusable for mainstream adoption. The truth? It’s not about more bridges. It’s about smarter ones. One that’s secure. One that’s traceable. One that’s simple.

Right now, we have none of those.

Why are cross-chain bridges so vulnerable to hacks?

Cross-chain bridges are complex systems that connect two or more blockchains, often using smart contracts, relayers, or validators. If any part of that system has a flaw - like a poorly audited contract or a centralized operator - attackers can exploit it. Many bridges rely on a small number of validators, making them easy targets. Over 87% of major blockchain exploits in the last four years involved cross-chain bridges, according to Merkle Science’s 2025 analysis. The more moving parts, the more ways something can break.

Can regulators track money moved across chains?

Traditionally, no. Most blockchain analytics tools were built to follow transactions on a single chain. Once funds cross over - say, from Ethereum to Solana - they disappear from those tools. That’s why over $21.8 billion in illicit crypto was laundered via cross-chain services in 2025. New tools like Elliptic’s holistic screening and KYC-Chain’s 2025 AML tracer are starting to close the gap, but they’re not universal. Until every bridge is required to log and share data in a standardized format, tracking remains incomplete and delayed.

Why don’t all cross-chain bridges support stablecoins?

Stablecoins like USDC and DAI require extra layers of security because they’re pegged to real-world assets. Many bridges weren’t designed to handle that complexity. Some can’t verify the origin of the stablecoin on the source chain. Others lack the liquidity pools to back the transfer. Only 25% of bridges support them today, forcing users to convert to native tokens first - adding cost and risk. This limits their usefulness in DeFi, where stablecoins make up over 60% of liquidity.

How long does it take to implement a cross-chain solution?

For enterprises, it typically takes 3 to 6 months. That includes auditing the bridge, integrating with internal systems, training staff, and testing transaction finality across chains. Common hurdles include managing private keys across multiple networks (reported by 78% of teams) and handling mismatched block confirmation times (65%). Smaller businesses often can’t afford the time or expertise - which is why adoption is mostly limited to large firms with dedicated blockchain teams.

Is cross-chain technology worth the risk for average users?

It depends. If you’re moving small amounts and understand the risks - yes. But if you’re transferring large sums or relying on it for DeFi yields, the risk may outweigh the reward. User reports show 63% of cross-chain transfers fail unexpectedly. Gas fees can spike. Support is often nonexistent. For most people, the convenience isn’t worth the chance of losing funds. Only use trusted, high-liquidity bridges like Axelar or LayerZero, and never send more than you can afford to lose.

What’s the biggest barrier to enterprise adoption?

Regulatory uncertainty. Companies don’t fear the technology - they fear the legal exposure. Can they comply with GDPR if user data crosses chains? Can they prove AML compliance if they can’t track every hop? With no global standards and evolving laws like MiCA 2.0, most enterprises are waiting. Only 18% of Fortune 500 companies have implemented cross-chain tech, according to Gartner’s 2025 survey. Until regulators provide clear rules, adoption will stay low.