Brazil Crypto Transfer Calculator

Brazil International Transfer Limit Calculator

The Central Bank of Brazil restricts international crypto transfers to $10,000 per month. Exceeding this limit will trigger automatic blocking by exchanges.

Enter your transfer amount to see if it complies with Brazil's regulations.

When you buy Bitcoin or trade stablecoins in Brazil, you’re not just using an app-you’re navigating one of the strictest, most detailed crypto regulatory systems in the world. The Central Bank of Brazil doesn’t ban crypto. It doesn’t ignore it either. Instead, it’s built a complex web of rules that reshapes how crypto works for everyday users, exchanges, and investors. If you’re trading, holding, or sending crypto from Brazil, you need to understand what’s actually allowed-and what’s blocked.

It’s Not a Ban, But It’s Not Free Either

The Central Bank of Brazil (BCB) doesn’t outlaw cryptocurrencies. In fact, since June 2023, they’ve been the official regulator thanks to Federal Law No. 14.478/2022, known as the Brazilian Virtual Assets Law (BVAL). This law forced every crypto platform operating in Brazil to register with the BCB. No registration? No legal operation. That’s it. There are no "crypto licenses" like in some countries. Instead, you get a compliance stamp-if you meet all the rules.What does that mean for you? If you use a Brazilian exchange like Mercado Bitcoin or Binance Brazil, they’ve spent millions upgrading their systems to track every transaction, verify your identity, and report everything to the government. You can’t just sign up with an email anymore. You need ID, proof of address, and sometimes even source-of-funds documentation. It’s not optional. It’s the law.

The $10,000 Cap That Changed Everything

In early 2025, the BCB introduced a rule that stunned the market: no international transfers over $10,000 through crypto platforms. This wasn’t about stopping criminals-it was about controlling capital flight. Brazil’s currency, the real, has been under pressure for years. The central bank feared people would use crypto to move large sums out of the country without oversight.Here’s how it hits users:

- You can’t send $20,000 worth of Bitcoin to a U.S. exchange and cash out in dollars.

- You can send $9,999-but only once every 30 days. Multiple small transfers? The system flags it.

- Exchanges now block transfers above the limit automatically. No exceptions.

That’s forced platforms to rethink their business. Many have stopped offering direct USD withdrawals. Instead, they’re pushing users to trade only in Brazilian reais (BRL). If you want to cash out, you’re likely getting reais deposited into your bank account-not dollars. That’s a big shift for people who used crypto as a hedge against inflation or to access global markets.

Stablecoins Are Everywhere-But Tightly Controlled

About 90% of all crypto transactions in Brazil involve stablecoins like USDT or USDC. People use them because they’re stable, fast, and easy to move. But the BCB sees them as a risk. Why? Because they’re tied to the U.S. dollar-and that’s exactly what the central bank is trying to limit.Since March 2025, stablecoin issuers and exchanges must:

- Hold 100% reserves in approved Brazilian financial institutions

- Submit daily audit reports to the BCB

- Stop offering stablecoin-to-fiat conversions above $1,000 per user per day

That means if you want to cash out $5,000 in USDT, you can’t do it in one go. You need to spread it over five days. And even then, the exchange might ask for extra paperwork. The goal? To slow down large-scale dollar conversions and keep capital inside Brazil’s banking system.

DeCripto: Every Transaction Is Logged

In March 2025, the BCB launched DeCripto-a mandatory reporting system that forces exchanges to send real-time data on every crypto transaction to the government. This isn’t just for tax purposes. It’s for surveillance.Here’s what gets reported:

- Who sent what

- When

- How much

- Which wallet addresses were involved

- Whether it was a swap, withdrawal, or deposit

Exchanges now have to install special compliance modules. If you trade $100 in Bitcoin, the BCB knows. If you send $500 in USDT to a friend, they know. There’s no anonymity. Even peer-to-peer trades on local platforms now require KYC. The system is designed to make crypto as traceable as bank transfers.

Who’s Watching? It’s Not Just the Central Bank

The BCB doesn’t work alone. Three other agencies are deeply involved:- COAF (Financial Activities Control Council): Flags suspicious transactions. If you’re sending crypto to a known risky address, they get notified-and might freeze your account.

- CVM (Securities and Exchange Commission): If your crypto token acts like a stock (you’re promised returns, it’s sold to the public), it’s treated as a security. That means strict rules on how it’s marketed and traded.

- RFB (Brazilian Revenue Service): You pay capital gains tax on crypto profits. They get all your transaction data from exchanges. If you made $5,000 in gains last year and didn’t report it? You’ll get a letter-and a fine.

You’re not just dealing with one regulator. You’re dealing with a system where every move is cross-checked. One missed tax form, one unreported wallet, and you’re in trouble.

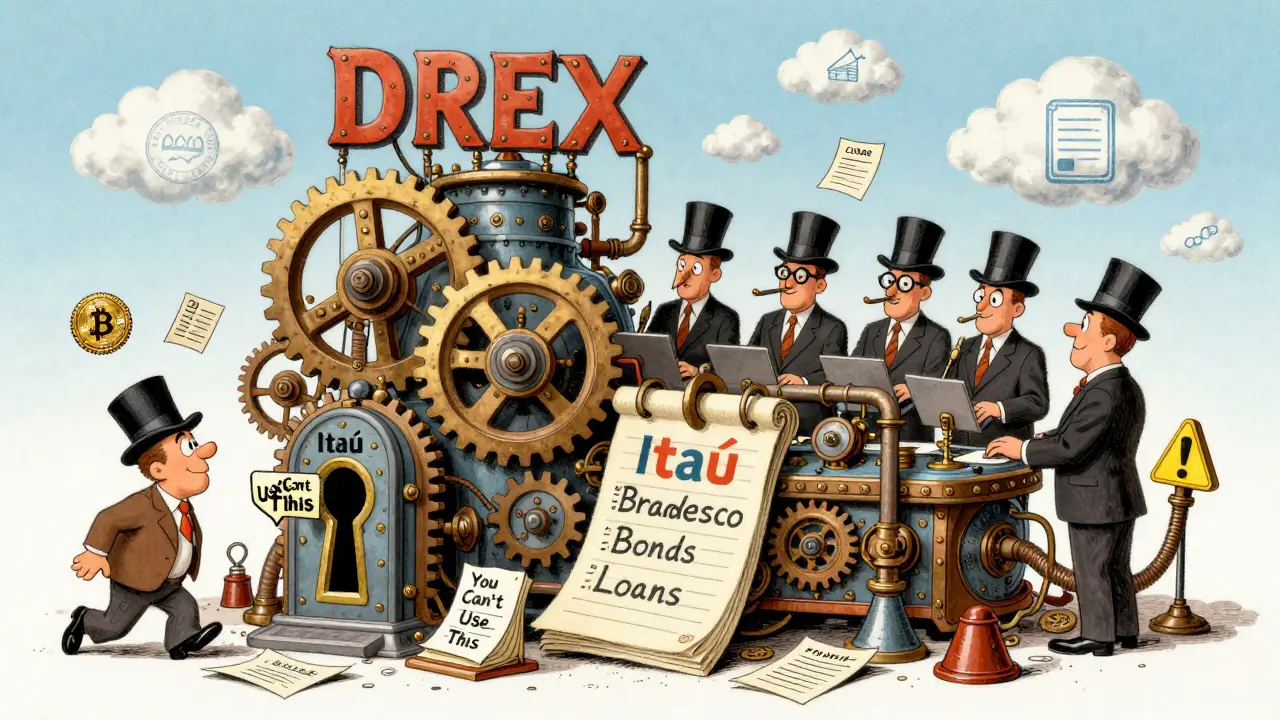

The DREX Platform: What It Really Is

You’ve probably heard rumors about Brazil’s "CBDC"-a digital version of the real. But the BCB is clear: DREX isn’t that. It’s a private-sector blockchain infrastructure for banks to tokenize deposits, loans, and government bonds. Think of it as a secure digital ledger for financial institutions-not a wallet you can download.Right now, only major banks like Itaú and Bradesco are testing DREX. You can’t use it. You can’t hold it. You can’t trade it. But it’s a sign of where the BCB is headed: integrating crypto-like tech into the traditional banking system, not replacing it.

What This Means for You

If you’re a casual user in Brazil:- You can still buy and sell crypto-but only in reais.

- You can’t move large amounts out of the country using crypto.

- You must report all gains to the tax office.

- You can’t use unregistered platforms. Stick to BCB-registered exchanges.

If you’re a trader or investor:

- Stablecoins are useful-but capped. Plan your cash-outs in chunks.

- Long-term holding is safer than frequent trading. Every trade leaves a digital trail.

- Don’t use foreign exchanges. They’re not allowed to serve Brazilian residents directly.

The BCB isn’t trying to kill crypto. It’s trying to tame it. To make it safe, traceable, and tied to Brazil’s economy. The result? A market that’s more regulated than most in Europe-but also more transparent and stable.

What’s Coming Next

By late 2025, the BCB plans to release detailed rules for stablecoins and tokenized assets. Expect:- More limits on stablecoin issuance

- Stricter rules for DeFi platforms that operate in Brazil

- Expanded DREX pilots to include small businesses and government payments

One thing is clear: Brazil isn’t going back. The rules are here to stay. The question isn’t whether crypto will survive here-it’s whether you’ll adapt to the new reality.

Can I still use Binance or Coinbase in Brazil?

Yes-but only if they’re registered with the Central Bank of Brazil. Binance Brazil is registered. The global Binance.com platform is not allowed to serve Brazilian users directly. You must use the local version, which follows all BCB rules, including the $10,000 cap and DeCripto reporting.

Do I have to pay taxes on crypto in Brazil?

Yes. Any profit from selling or trading crypto is taxable. If you made more than R$35,000 in gains in a year, you must file a tax return and pay capital gains tax (15%-22.5%). The Brazilian Revenue Service gets all your transaction data from exchanges, so hiding profits is nearly impossible.

Can I send crypto to someone outside Brazil?

You can, but only if the total value doesn’t exceed $10,000 per month. Exchanges automatically block transfers above that limit. Even if you use a peer-to-peer platform, you still need to pass KYC, and the transaction will be reported to the BCB. There are no legal loopholes.

Are stablecoins banned in Brazil?

No, but they’re heavily restricted. You can still buy and hold USDT or USDC, but exchanges can’t let you convert more than $1,000 per day into reais. They must also hold 100% reserves in Brazilian banks and report daily to the Central Bank. The goal is to prevent dollar outflows, not to eliminate stablecoins.

What happens if I use an unregistered crypto platform?

It’s not illegal for you to use an unregistered platform, but it’s risky. These platforms have no legal protection. If they get shut down, you lose your money. They don’t report to the BCB, so your transactions aren’t tracked-and you can’t prove them for tax purposes. You also can’t file complaints with regulators. Stick to registered exchanges for safety.

Elizabeth Miranda

December 4, 2025 AT 21:17So Brazil’s basically turning crypto into a bank account with extra steps. Not surprising-they’ve always been cautious with money. Still, it’s wild to see a country embrace regulation so thoroughly instead of fighting it.

Manish Yadav

December 4, 2025 AT 21:51This is why crypto is evil. People use it to cheat the system. Brazil is doing the right thing.

Chloe Hayslett

December 5, 2025 AT 05:18Oh wow, a country actually trying to control capital flight? Shocking. Next they’ll ban people from buying too much avocado toast.

Jonathan Sundqvist

December 6, 2025 AT 02:34They’re not banning crypto, just making it boring. Which honestly? Kinda genius. Who wants to gamble when the government’s watching every trade?

Jerry Perisho

December 7, 2025 AT 14:53The $10k cap is smart. It stops laundering without killing utility. And the 100% reserve requirement for stablecoins? Long overdue. Most stablecoins globally are just promises on paper.

Brazil’s model could be the blueprint for other emerging markets. Not perfect, but way better than the Wild West.

Mairead Stiùbhart

December 7, 2025 AT 23:04Oh honey, you think this is heavy-handed? Wait till you see what happens when they start taxing your NFTs like art collections. 😌

Adam Bosworth

December 9, 2025 AT 14:52so like… if i send 9.9k every 29 days… is that a loophole? or just… a very obvious one? 🤡

Annette LeRoux

December 9, 2025 AT 20:40It’s fascinating how Brazil is using tech to protect its economy instead of fighting innovation. 🌱 Maybe this is what responsible adoption looks like? Not hype, not fear-just structure.

Krista Hewes

December 10, 2025 AT 01:36wait so i can only cash out 1k a day in usdt? that’s insane. i just wanted to buy a laptop lol

Noriko Robinson

December 10, 2025 AT 20:41This is actually a model other countries should copy. No chaos, no scams, no tax evasion. Just clear rules. People complain but they don’t want the truth: regulation keeps you safe.

ronald dayrit

December 11, 2025 AT 06:43Let’s zoom out. The BCB isn’t regulating crypto-it’s regulating the flow of capital. Crypto is just the vessel. The real issue is Brazil’s currency instability, and this is a containment strategy. It’s not about control for control’s sake-it’s about survival.

Compare this to the U.S., where regulators are still arguing over whether Bitcoin is a commodity or a security. Brazil’s moving forward while we’re stuck in a philosophy seminar.

The DeCripto system? It’s not surveillance for surveillance’s sake. It’s the same as banks reporting wire transfers. We accept that in fiat. Why not crypto? Because we romanticize anonymity. But anonymity isn’t freedom-it’s a liability.

And the stablecoin cap? It’s not about limiting access. It’s about preventing a bank run on the dollar via crypto. If everyone tries to convert $500B in USDT to BRL overnight, the real collapses. This is macroeconomic triage.

People calling this oppressive don’t understand currency sovereignty. The BCB isn’t trying to kill crypto. It’s trying to keep the country from collapsing while letting crypto live inside its walls. That’s not tyranny. That’s statesmanship.

And DREX? That’s not a CBDC. It’s a settlement layer. Think SWIFT, but blockchain-powered. Banks don’t want to be replaced-they want to be upgraded. Brazil’s building the infrastructure for the next decade, not the next election cycle.

We’re witnessing a quiet revolution. Not in the streets. Not in tweets. In compliance modules and audit reports. And honestly? It’s beautiful.

Tisha Berg

December 12, 2025 AT 07:00As someone who’s seen how crypto scams hurt families in poor communities, I’m glad Brazil’s stepping in. No one should lose their life savings because some app said ‘10x your money’.

Renelle Wilson

December 13, 2025 AT 18:05It’s remarkable how Brazil has managed to balance innovation with responsibility. Most countries either ignore crypto entirely or panic and ban it. Brazil chose to understand it, study it, and then regulate it with precision.

Imagine if every nation treated digital assets this thoughtfully-no more rug pulls, no more untraceable money flows, no more victims of unregulated platforms. Brazil’s approach isn’t just about control-it’s about inclusion. By requiring KYC and reporting, they’re ensuring that even ordinary people can participate safely.

And the stablecoin restrictions? They’re not punishing users; they’re protecting the broader financial system. When 90% of crypto activity revolves around a single asset pegged to a foreign currency, it becomes a vector for economic vulnerability. This isn’t anti-crypto-it’s pro-stability.

The DeCripto system may sound invasive, but it’s no different from how banks report suspicious transactions. If you’re not doing anything illegal, why fear transparency? The real danger is the illusion of anonymity, which empowers criminals and erodes trust.

What’s most impressive is how the BCB collaborated with other agencies-COAF, CVM, RFB-to create a unified front. No jurisdictional gaps. No loopholes. Just accountability. That’s governance done right.

And yes, the $10,000 cap limits freedom-but freedom without responsibility is chaos. This isn’t a prison; it’s a well-lit path. You can still trade, invest, and move value. You just can’t turn crypto into a private offshore bank.

Future historians will look back at this moment and ask: Why did so many countries fear crypto, while Brazil embraced it-with boundaries? The answer will be simple: They understood that technology must serve society, not the other way around.

Billye Nipper

December 14, 2025 AT 22:55Okay, but can we talk about how the tax reporting is basically a nightmare? I mean, I’m not even a trader-I just bought some BTC in 2021 and sold a little last year-and now I have to track every single swap, every tiny gain, every tiny loss… it’s exhausting.

And the fact that exchanges report EVERYTHING? I feel like I’m being watched by a robot accountant with no mercy.

I get it, I get it-taxes are important-but why does it have to feel like a police state? 😩

Doreen Ochodo

December 15, 2025 AT 22:36Brazil’s doing the hard thing. And honestly? That’s leadership.

Uzoma Jenfrancis

December 16, 2025 AT 18:49They say crypto is freedom. But freedom without rules is just noise. Brazil is quieting the noise. Smart.