North Korean Crypto Theft Calculator

Impact Analysis

saw significant cyber theft activities:

- in total stolen assets

- major incidents reported

- Signature operation:

This analysis reflects data from the United Nations and blockchain analytics firms. The ByBit hack alone represents of North Korea's total crypto thefts over the past three years.

Quick Summary

- ByBit hack stole roughly $1.5billion in Ethereum on Feb212025.

- The attack is linked to the North Korean unit “TraderTraitor,” part of the Lazarus Group.

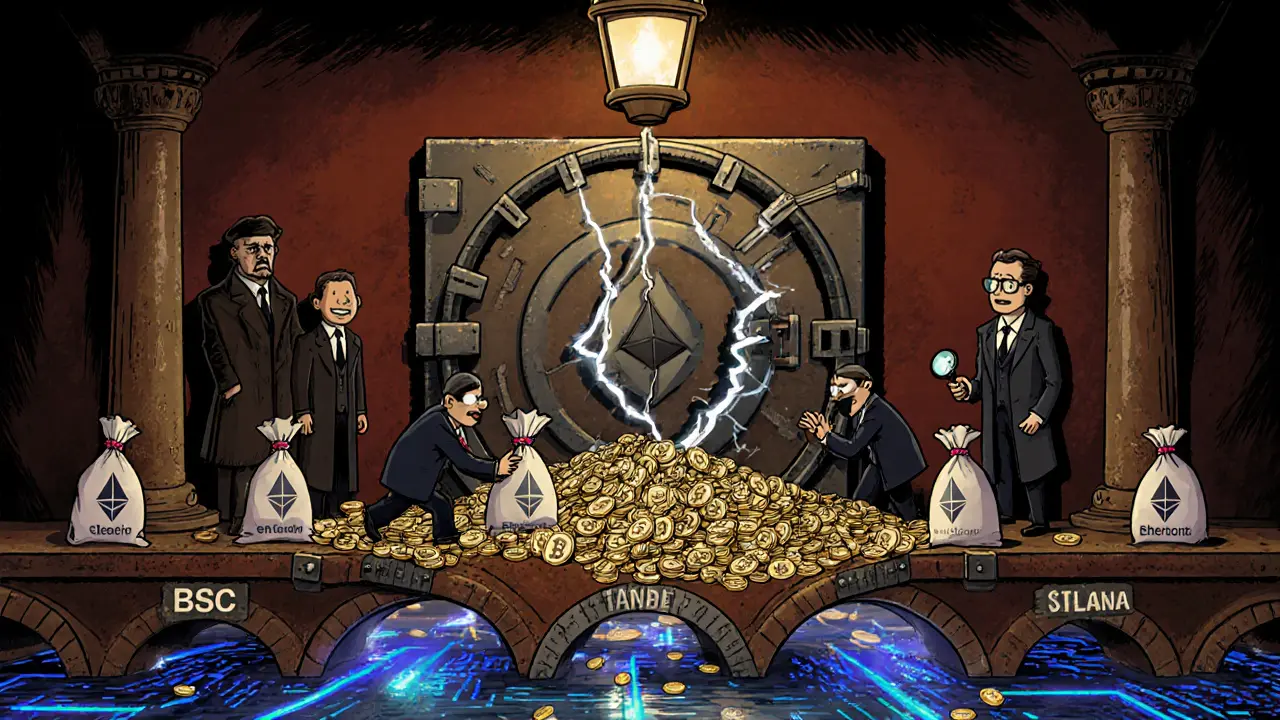

- Hackers breached a cold‑wallet, bypassed multi‑signature controls, and moved funds across Ethereum, BSC, Solana and finally Bitcoin.

- FBI, TRM Labs and the broader crypto ecosystem responded with address blocklists and real‑time tracking.

- The theft reshapes how exchanges think about state‑sponsored threats and cold‑wallet security.

When you hear the phrase ByBit hack is the February2025 theft of about $1.5billion worth of Ethereum from the ByBit exchange, attributed to a North Korean hacking unit called TraderTraitor, you instantly picture a massive breach of something that was supposed to be “offline‑only.” In reality, the incident exposed the limits of even the most hardened crypto storage methods and gave the world a front‑row seat to a state actor that now treats cryptocurrency like a regular line‑item on a military budget.

How the attack unfolded

The timeline is short but brutal. On February212025, traders at ByBit noticed a sudden drop in the balance of one of the platform’s cold‑storage wallets. Within minutes, the exchange’s security team identified that roughly 4.3million ETH-valued at $1.5billion at the time-had left the vault. The movement began with a single transaction that transferred the ETH to an address later flagged by TRM Labs as Bybit Exploiter Feb 2025.

Analysis by the blockchain‑analytics firm showed three possible breach vectors:

- A supply‑chain compromise of a software component that managed key generation.

- An insider with privileged access who leaked private keys.

- A direct private‑key extraction that sidestepped the exchange’s multi‑signature checks.

While the exact method remains classified, the fact that a “cold” wallet-normally kept offline and signed by multiple parties-was emptied suggests the attackers either held the keys long enough to craft a legitimate multi‑sig transaction or they exploited a flaw that allowed them to fake additional signatures.

After the initial siphon, the stolen ETH was quickly split across several blockchains. Within an hour, portions landed on Binance Smart Chain (BSC) and Solana, likely using cross‑chain bridges to hide the trail. The bulk of the value was then swapped for Bitcoin via decentralized exchanges, ending up in a cluster of addresses that have stayed mostly dormant, hinting at an upcoming large‑scale liquidation.

Who is TraderTraitor?

The FBI labeled the operation “TraderTraitor,” tying it to a sub‑unit of the DPRK’s Reconnaissance General Bureau (RGB). This unit lives under the broader umbrella of the Lazarus Group, which has been active since at least 2009. Within the RGB’s 3rd Bureau, TraderTraitor specializes in high‑value digital‑asset thefts, a shift from older “phishing‑only” tactics to sophisticated, supply‑chain and insider‑based attacks.

TraderTraitor first appeared on the radar in 2022, linked to the JumpCloud supply‑chain breach. Since then, the group has refined its “flood the zone” approach-spamming multiple blockchains with high‑frequency, cross‑chain transactions to overwhelm monitoring tools. This technique replaces older mixer‑based anonymity methods (e.g., Tornado Cash) with speed and automation, making it harder for analysts to keep up.

Technical tactics that broke the cold wallet

Cold‑wallet security hinges on two pillars: isolation (offline storage) and multi‑signature enforcement. The ByBit breach showed that both can be subverted:

- Private‑key compromise: Whether via malware, a compromised hardware security module, or an insider, the attackers obtained the raw signing key.

- Multi‑sig bypass: By replaying a legitimate transaction or exploiting a flaw in the signature aggregation algorithm, the thieves convinced the wallet that the required number of signers had approved the move.

- Supply‑chain injection: A malicious update to a wallet‑management tool could have injected code that harvested keys at the moment of a routine backup.

Once in possession of the keys, the actors used automated scripts to split the ETH into thousands of micro‑transactions, each below typical AML thresholds, before crossing into other ecosystems via bridges like Wormhole and AnySwap.

Financial fallout and global implications

The $1.5billion loss dwarfs the entire 2023 North Korean crypto theft total of $660million. According to a United Nations report, roughly half of North Korea’s foreign‑currency earnings now come from cyber‑crime, with the proceeds funneled into sanctions‑evasion projects and weapons programs. The ByBit hack therefore isn’t just a private‑sector loss; it directly fuels a regime’s strategic capabilities.

For the market, the sudden removal of such a large ETH supply caused a brief dip in Ethereum’s price, though the effect was muted by the broader bull market of 2025. More importantly, the event forced exchanges worldwide to reevaluate their cold‑wallet architectures. Many are now considering hardware‑security‑module (HSM) upgrades, threshold‑signature schemes (e.g., Schnorr), and continuous key‑rotation policies.

Lessons for exchanges: hardening against state‑sponsored APTs

Three practical takeaways emerged from the post‑mortem reports:

- Zero‑trust key management: Treat every component-software updates, CI/CD pipelines, and even internal admin tools-as potential attack surfaces. Implement hardware‑based isolation for key generation and signing.

- Multi‑layer monitoring: Pair on‑chain analytics (TRM Labs style) with off‑chain SIEM alerts that watch for abnormal outbound traffic from internal networks.

- Rapid address blacklisting: Adopt an industry‑wide protocol for disseminating malicious address lists in real time, similar to the FBI’s public advisory for the TraderTraitor addresses.

Exchanges that already use threshold signatures (e.g., 2‑of‑3 with distinct geographic separation) fared better, but the ByBit case proves that even those mechanisms can be outmaneuvered by a determined nation‑state.

Industry response: FBI, TRM Labs, and the wider crypto community

Within hours of the breach, the FBI released a set of Ethereum addresses tied to the operation and urged all virtual‑asset service providers to block them. TRM Labs created a live‑tracking entity named Bybit Exploiter Feb 2025, tagging every movement as “Stolen Funds.” Major exchanges such as Binance, Kraken, and Coinbase added the addresses to their deny‑list tables, effectively cutting off many OTC liquidation routes.

Meanwhile, DeFi protocols tightened their bridge monitoring, adding extra verification steps for large cross‑chain swaps. The rapid, coordinated reaction showcases a new era where public‑private partnerships can blunt even state‑sponsored thefts, provided the information flow stays swift.

| Year | Total Stolen (USD) | Number of Incidents | Signature Operation |

|---|---|---|---|

| 2023 | $660million | 20 | Various phishing & ransomware attacks |

| 2024 | $800million | 47 | Supply‑chain compromises (e.g., JumpCloud) |

| 2025 | $1.5billion | 1 (ByBit) | TraderTraitor - cold‑wallet breach & cross‑chain laundering |

What’s next? Ongoing risks and future scenarios

Analysts warn that the ByBit incident may be the tip of the iceberg. As sanctions tighten, North Korea is likely to double down on high‑value, low‑frequency attacks that bypass traditional AML thresholds. Future scenarios include:

- Targeting decentralized finance aggregators that hold large pools of assets in smart contracts.

- Compromising bridge validators to trigger mass token swaps without user consent.

- Leveraging quantum‑resistant key‑extraction methods as research matures.

For investors and users, the takeaway is simple: never assume any platform’s “cold storage” is impervious. Diversify across custodians, use hardware wallets for personal holdings, and stay alert to public advisories from law‑enforcement and analytics firms.

Frequently Asked Questions

What exactly was stolen in the ByBit hack?

Approximately 4.3million ETH, valued at about $1.5billion at the time, were transferred out of ByBit’s cold‑wallet and later converted into Bitcoin through multiple cross‑chain hops.

Who is responsible for the attack?

The FBI attributes the operation to a North Korean state‑sponsored unit called TraderTraitor, which operates under the Reconnaissance General Bureau and is part of the broader Lazarus Group.

How did the hackers bypass ByBit’s cold‑wallet protections?

Investigations point to a private‑key compromise-either via a supply‑chain injection, insider leak, or a sophisticated attack on the multi‑signature logic-that let the thieves generate a valid transaction without the usual quorum of signatures.

What steps are exchanges taking to prevent a repeat?

Many are moving to hardware security modules, implementing threshold signatures with geographic separation, and adopting real‑time address blacklisting protocols shared across the industry.

Can users protect their own crypto from similar attacks?

Yes-store personal holdings in hardware wallets, avoid keeping large sums on centralized exchanges, and stay updated on security advisories from reputable firms like TRM Labs and government agencies.

Eugene Myazin

September 1, 2025 AT 03:29Kudos to the community for staying vigilant after the ByBit breach!

karyn brown

September 1, 2025 AT 06:15Wow, this heist is like a crypto‑pirate saga 🙈💥. North Korea pulling off a $1.5B loot? That's insane, like stealing the whole vault of a bank in one night! People need to lock their digital doors tighter, otherwise it’s just a playground for these cyber‑pirates. 🚀

Nilesh Parghi

September 1, 2025 AT 10:25Reading the details feels like staring into a digital abyss, where borders blur and code becomes the new battlefield. It reminds us that trust is a fragile construct, especially when sovereign actors wield it as a weapon. Still, the resilience of the community shines through.

karsten wall

September 1, 2025 AT 13:45From a systems‑engineering perspective, the multi‑sig bypass illustrates a failure mode in threshold crypto‑auth protocols. The attacker essentially performed a nonce replay within the wallet's consensus layer, subverting the quorum requirement. This underscores the need for hardware‑rooted key escrow.

Lana Idalia

September 1, 2025 AT 17:22If you think the world is safe because you store crypto in a cold wallet, think again. The ByBit episode proves that even offline keys can be yank‑ed out by a state‑sponsored hacker crew. Money talks, but in this case, it shouted louder than ever.

Henry Mitchell IV

September 1, 2025 AT 20:25😅 Yeah, those emojis kinda sum it up – it's a wild ride and we’re all just strapped in!

Kamva Ndamase

September 1, 2025 AT 23:12Exactly! If the tech isn’t airtight, it’s just a ticking time bomb. Let’s push the industry to adopt hardware security modules RE‑NOW!

bhavin thakkar

September 2, 2025 AT 03:22The sheer audacity of TraderTraitor is reminiscent of Cold War espionage, only now the loot is digital ether. This isn’t just a hack; it’s a statement of geopolitical power in code.

WILMAR MURIEL

September 2, 2025 AT 08:55The ByBit incident is a stark reminder that the line between traditional finance and the crypto frontier is increasingly porous.

When a nation‑state like North Korea can orchestrate a $1.5 billion extraction, it forces us to rethink the very architecture of digital asset custody.

Cold wallets, once hailed as the gold standard, have now been shown to possess exploitable weaknesses when the key management pipeline is compromised.

Supply‑chain attacks, insider threats, and sophisticated multi‑signature bypasses form a trifecta that can dismantle even the most hardened defenses.

For exchanges, this translates into an urgent mandate to audit every component of their hardware security modules and software update mechanisms.

Implementing threshold signatures with geographic distribution can mitigate the risk, yet the ByBit breach demonstrates that attackers may still find ways to simulate quorum.

Moreover, the rapid cross‑chain laundering underscores the necessity for integrated on‑chain analytics that can track assets across Ethereum, BSC, Solana, and Bitcoin in real time.

Organizations like TRM Labs and the FBI have set a precedent by sharing malicious address lists promptly, but the speed of the attack often outpaces these defensive measures.

Investors, too, must internalise the lesson that diversification of custodial options is no longer a luxury but a survival strategy.

Storing personal holdings in hardware wallets, while still prudent, should be complemented by multi‑factor authentication and regular key rotation.

The geopolitical angle cannot be ignored; sanctions‑evading crypto proceeds fund missile development and other illicit programs, amplifying global security concerns.

As regulators tighten oversight, we may see mandatory reporting standards for large transfers, similar to the FATF recommendations.

However, enforcement remains a challenge given the anonymity and speed of blockchain transactions.

The crypto community’s coordinated response to this hack – from blacklisting addresses to tightening bridge verification – is a hopeful sign.

It shows that collaborative defense, even against a state‑backed adversary, can blunt the impact of such massive thefts.

Ultimately, the ByBit hack should serve as a catalyst for industry‑wide reforms that prioritize resilience over convenience.

carol williams

September 2, 2025 AT 12:15Indeed, the cascade of insights you’ve laid out reads like a manifesto for the next era of crypto security; let’s heed it before the next storm hits.

jit salcedo

September 2, 2025 AT 15:52Some say this whole saga is a staged diversion, a smoke screen to distract from even larger covert operations hidden in the blockchain’s shadows.

Ally Woods

September 2, 2025 AT 18:55Maybe, but until we see proof, we’re just speculating over data that’s already public.

Kristen Rws

September 2, 2025 AT 23:05Don’t lose hope – every breach pushes the tech forward, and we’ll get stronger together!

Fionnbharr Davies

September 3, 2025 AT 02:25Let’s keep the conversation constructive and share best practices so newcomers aren’t left in the dark.

Narender Kumar

September 3, 2025 AT 06:02In summation, the ByBit exploitation epitomises the inexorable rise of cyber‑warfare as a sovereign instrument; vigilance must henceforth be our perpetual creed.