El Salvador’s Bitcoin Experiment: A Bold Move That Fell Apart

On September 7, 2021, El Salvador became the first country in the world to make Bitcoin legal tender. The move was bold, flashy, and widely covered. President Nayib Bukele promised it would help the poor, cut remittance fees, and bring in tech investment. But by May 1, 2025, the law had been gutted. Businesses no longer had to accept Bitcoin. Taxes couldn’t be paid in it. The government quietly stepped back. And the world watched as the first real-world test of a national cryptocurrency failed.

How It Started: The Bitcoin Law of 2021

The Bitcoin Law wasn’t just a policy change-it was a national rebranding effort. The government wanted to position El Salvador as a crypto hub. To kick things off, every citizen got $30 in Bitcoin loaded into the new Chivo wallet. Gas stations gave 20 cents off per gallon for Bitcoin payments. The idea was simple: force adoption by making it easy and rewarding.

The rollout was chaotic. On day one, the Chivo wallet crashed under the weight of 3 million downloads. That’s nearly half the country trying to use it at once. Bitcoin’s price dropped $3 million in paper losses for the government’s initial buy-in. Protesters gathered outside the Supreme Court. Critics warned about volatility, lack of infrastructure, and digital illiteracy. But the government pushed ahead.

Adoption Numbers: High Downloads, Low Usage

At first glance, adoption looked impressive. Three million Chivo wallets in a month? That’s more than the number of Salvadorans with bank accounts in 2017. But appearances lied. Only 12% of people actually used Bitcoin to buy anything in the first month. Over 90% of businesses reported receiving zero Bitcoin payments. By 2024, 92% of Salvadorans still didn’t use Bitcoin for daily transactions.

Even government services barely used it. Only 5% of citizens paid taxes with Bitcoin. Just 20% of large companies accepted it. The Chivo wallet became a novelty, not a tool. People downloaded it for the free $30, then deleted it. The promise of financial inclusion didn’t materialize. The poor didn’t suddenly gain access to banking-they just got a one-time cash bonus.

The Chivo Wallet: A Technical and Trust Disaster

The Chivo wallet was supposed to be the bridge between Bitcoin and everyday life. Instead, it became a symbol of failure. It was hacked multiple times. Users lost funds. The app was slow, glitchy, and confusing. Many merchants didn’t know how to use it. Some didn’t trust it at all.

And the government didn’t help. It pushed the wallet as mandatory, even though the law technically only required businesses to accept Bitcoin-not to use Chivo. But the app was the only easy way to convert Bitcoin to dollars. That created a monopoly. People felt trapped. When the wallet failed, so did trust.

Why the IMF Stepped In

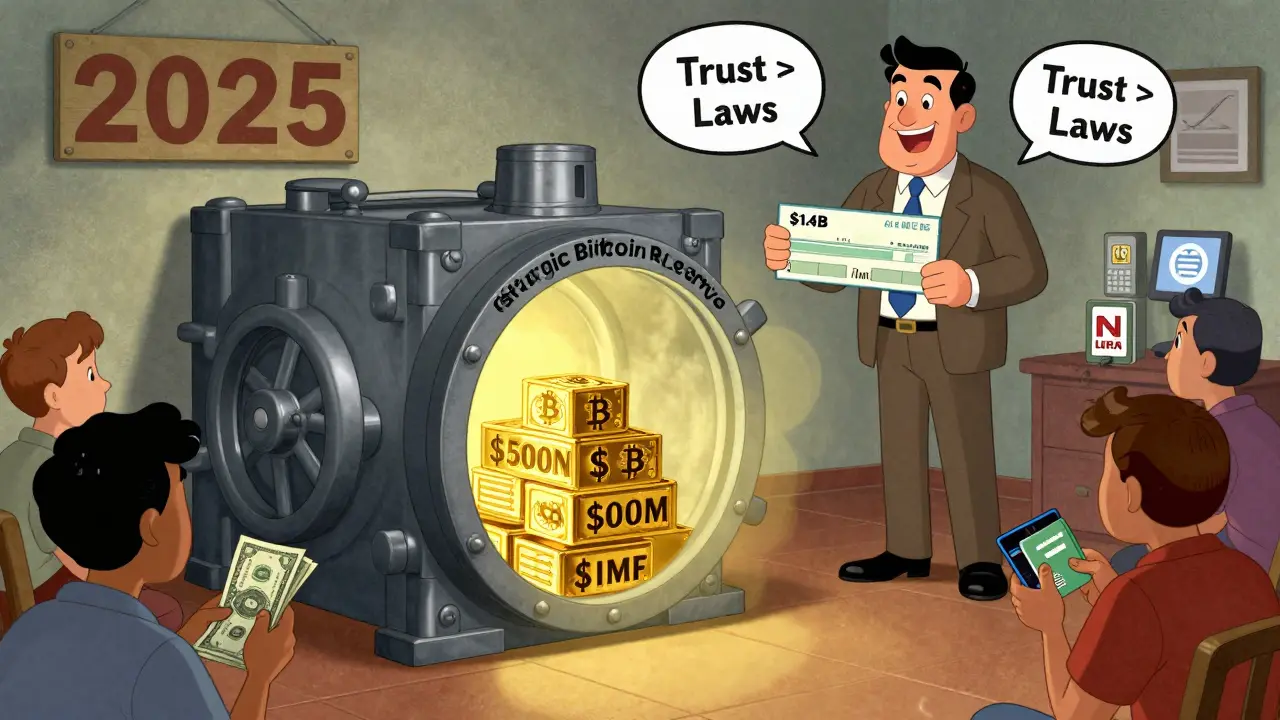

By late 2024, El Salvador’s economy was struggling. Debt was rising. Inflation was creeping up. The government needed cash. In January 2025, it agreed to a $1.4 billion loan from the International Monetary Fund. The catch? Stop forcing Bitcoin on the public.

The IMF didn’t say Bitcoin was bad. It said forcing it as legal tender created uncertainty. Banks wouldn’t lend. Investors were nervous. The volatility made budgeting impossible. The government agreed. On January 29, 2025, lawmakers voted 55-2 to change the law. By May 1, Bitcoin was no longer required to be accepted by businesses. Taxes couldn’t be paid in it. The word “currency” was removed from its legal status.

Economist Rafael Lemus put it simply: “Bitcoin no longer has the strength of legal tender. It should have always been that way.”

What Changed After the Reversal

The change wasn’t a full retreat-it was a pivot. The government stopped pushing Bitcoin on citizens. But it didn’t sell its Bitcoin. In fact, it kept buying.

As of early 2025, El Salvador held 6,102 Bitcoin, worth about $500 million. That’s up from 688 coins in 2021. The government’s Strategic Bitcoin Reserve Fund is now a long-term investment play, not a daily payment system. It’s betting Bitcoin will go up over time, like gold. And so far, it’s working: the country has made roughly $287 million in profit on its holdings.

El Salvador still hosts crypto events like the PLANB Forum 2025. It still courts tech investors. But now, it’s doing so without forcing people to use Bitcoin. The shift was from mandate to market.

Why It Failed: The Real Lesson

El Salvador didn’t fail because Bitcoin was too volatile. It failed because it tried to force a technology into a society that wasn’t ready for it.

Most Salvadorans use the US dollar. It’s stable. It’s familiar. It’s trusted. Bitcoin’s price swings made it useless for buying groceries or paying rent. People didn’t reject Bitcoin because they didn’t understand it-they rejected it because it didn’t solve their problems.

The real issue wasn’t technology. It was trust. People didn’t trust the government to manage Bitcoin. They didn’t trust the Chivo app. They didn’t trust that Bitcoin would be worth anything tomorrow. And no law could fix that.

As The Economist wrote in March 2025: “The Bitcoin experiment brought more costs than benefits.”

What Other Countries Can Learn

El Salvador’s experiment was the first of its kind. That made it valuable-even if it failed. It showed that:

- You can’t mandate adoption. People choose what works for them.

- Volatility kills everyday use. Bitcoin isn’t ready to replace dollars for daily spending.

- Infrastructure matters more than laws. No wallet, no adoption.

- Trust is the real currency. No government can create it with a press release.

Other countries looking at crypto won’t copy El Salvador’s model. They’ll watch it and do the opposite: let markets decide. Let businesses lead. Let users choose. That’s the real lesson.

Where El Salvador Stands Today

El Salvador didn’t give up on Bitcoin. It just gave up on forcing it.

Today, Bitcoin is still legal tender-but only in name. No business has to accept it. No citizen has to use it. The government still holds hundreds of millions in Bitcoin, betting it will rise. Tourists can still pay in Bitcoin at some hotels and restaurants. Tech startups still move there for the friendly regulations.

But for the average Salvadoran? They still use cash. Or their bank account. Or a mobile payment app tied to the US dollar.

El Salvador’s Bitcoin experiment didn’t revolutionize finance. But it did prove one thing: you can’t legislate trust. And without it, even the most powerful technology won’t change how people live.

Is Bitcoin still legal tender in El Salvador?

Yes, but only technically. As of May 1, 2025, Bitcoin is no longer required to be accepted by businesses or used for paying taxes. The government removed the legal obligation to use it, effectively ending its role as a practical currency. It remains on the books as legal tender, but only as a voluntary option.

Did the Chivo wallet succeed?

No. While it hit 3 million downloads quickly, most users deleted it after claiming the $30 bonus. Technical problems, security breaches, and poor usability led to low trust and minimal ongoing use. By 2024, fewer than 1 in 10 Salvadorans used it regularly. The government has since scaled back its promotion.

Why did the IMF demand changes to El Salvador’s Bitcoin law?

The IMF was concerned that Bitcoin’s volatility made economic planning impossible and scared off foreign investment. Businesses couldn’t price goods reliably, banks hesitated to lend, and the government’s own budgeting became risky. To secure a $1.4 billion loan, El Salvador agreed to remove mandatory Bitcoin use as a condition.

How much Bitcoin does El Salvador still own?

As of early 2025, El Salvador holds 6,102 Bitcoin, worth roughly $500 million. This is up from 688 coins in 2021. The government continues to buy Bitcoin as a long-term reserve asset, not as a currency for daily use. It has made about $287 million in profit so far.

Did Bitcoin help reduce remittance fees in El Salvador?

Not significantly. While Bitcoin could have lowered fees, most Salvadorans didn’t use it for remittances. Traditional services like Western Union and MoneyGram remained dominant. The Chivo wallet offered fee-free transfers, but adoption was too low to make a real difference. Remittance costs stayed high because people didn’t switch.

Can you pay taxes with Bitcoin in El Salvador now?

No. Since the law changed in May 2025, Bitcoin cannot be used to pay taxes or any government fees. All public payments must be made in US dollars. This was one of the key conditions of the IMF loan agreement.

Is El Salvador still a crypto-friendly country?

Yes, but only for private investment, not public use. The government still holds Bitcoin as a reserve asset, hosts crypto conferences, and offers tax incentives to tech companies. But it no longer pushes citizens to use Bitcoin. The country is now seen as a hub for crypto businesses, not a nation using crypto as money.

Rajappa Manohar

December 29, 2025 AT 22:04Phil McGinnis

December 31, 2025 AT 09:06Andy Reynolds

January 1, 2026 AT 10:25Alex Strachan

January 1, 2026 AT 10:38Rick Hengehold

January 3, 2026 AT 04:51Brandon Woodard

January 3, 2026 AT 12:41Antonio Snoddy

January 5, 2026 AT 09:13Ryan Husain

January 5, 2026 AT 15:21Daniel Verreault

January 7, 2026 AT 06:47Jacky Baltes

January 8, 2026 AT 01:37prashant choudhari

January 9, 2026 AT 00:20Willis Shane

January 10, 2026 AT 21:32Abhisekh Chakraborty

January 12, 2026 AT 09:16Gavin Hill

January 13, 2026 AT 23:39SUMIT RAI

January 14, 2026 AT 06:14nayan keshari

January 15, 2026 AT 10:51Johnny Delirious

January 17, 2026 AT 00:02Kenneth Mclaren

January 17, 2026 AT 03:08Raja Oleholeh

January 18, 2026 AT 23:00Prateek Chitransh

January 20, 2026 AT 05:45Michelle Slayden

January 20, 2026 AT 20:50christopher charles

January 20, 2026 AT 22:15Vernon Hughes

January 21, 2026 AT 16:02Alison Hall

January 21, 2026 AT 17:41Ian Koerich Maciel

January 23, 2026 AT 06:37