DeFi Project Health Checker

Evaluate Your DeFi Project

Use this tool to assess whether a DeFi project is likely to succeed or is at high risk of failure. Based on the lessons from projects like Bagels Finance.

Project Health Criteria

Check all criteria that apply to the project:

Projects listed on major exchanges have better liquidity and legitimacy.

Security audits reduce the risk of exploits and scams.

Transparent teams are more likely to deliver on promises.

Active development shows the project is being maintained.

Projects with real users and revenue are more likely to succeed.

Results

Back in early 2025, if you were active in DeFi circles, you probably saw posts promising free BAGEL tokens from Bagels Finance. The hype was real: ‘Earn up to $700 just by signing up,’ ‘Get your slice of the first cross-chain leveraged farming protocol,’ ‘Don’t miss the last chance.’ But today, as of December 2025, the BAGEL token doesn’t trade anywhere. Not on Binance. Not on Coinbase. Not even on small decentralized exchanges. And the airdrop? It ended months ago. Here’s what actually happened.

The Bagels Finance Airdrop Was Real - But It’s Over

The Bagels Finance airdrop wasn’t a scam. It was real. Airdrop.io listed it with clear rules: 103,594 BAGEL tokens were set aside for distribution. Every participant who met the basic requirements - connecting a wallet, following their social channels, and sharing the airdrop - got a share. No lottery. No winners and losers. If you did the steps, you got tokens. The deadline? April 11, 2025. That’s over eight months ago. If you missed it, you missed it. There’s no extension. No second chance. The smart contract has already distributed the tokens. The airdrop isn’t live anymore, and no one’s bringing it back.So Where Are the BAGEL Tokens Now?

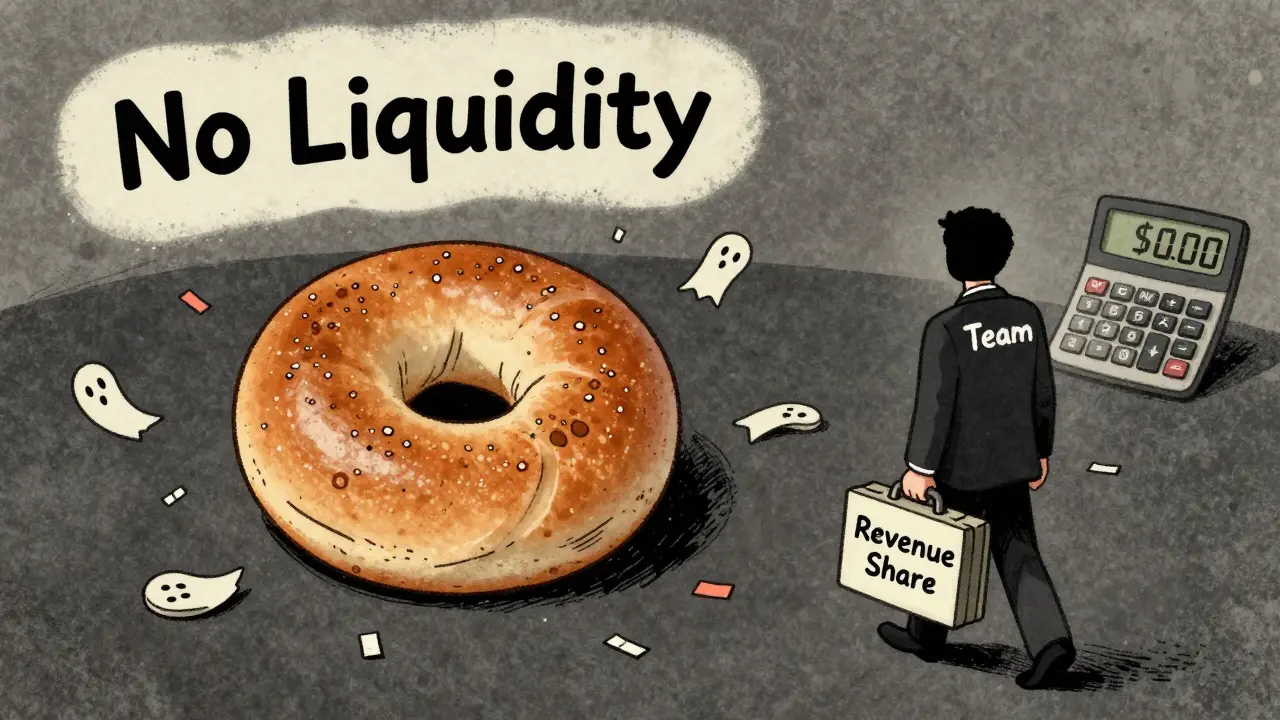

Here’s the big problem: no one can trade them. CoinMarketCap shows a circulating supply of 0 BAGEL. Crypto.com says the price is $0.002047, but with zero 24-hour volume. Binance, which used to list the token, hasn’t updated its data since June 2022 - before the airdrop even launched. That’s not a glitch. That’s a red flag. This isn’t a case of ‘low liquidity.’ This is a case of ‘no liquidity.’ The tokens exist on-chain, but they’re stuck. They’re not listed on any major DEX like Uniswap or PancakeSwap. No market makers are stepping in. No traders are buying. And without buyers, the price doesn’t matter - it’s just a number on a screen.What Was Bagels Finance Supposed to Do?

Bagels Finance pitched itself as the first multi-chain leveraged yield farming protocol. That sounds fancy, but here’s what it meant in plain terms: you could deposit ETH, USDT, DAI, or BNB, and the platform would use leverage - up to 10x - to amplify your farming rewards. So if you normally earned 10% APY on a liquidity pool, Bagels claimed you could earn 100%. The catch? Higher returns meant higher risk. If the price of your deposited asset dropped even a little, your leveraged position could get liquidated. That’s not unique - other platforms like Beefy Finance and Yearn Finance offer similar strategies. But Bagels Finance added one twist: they promised 85% of platform revenue would go back to BAGEL token holders as dividends. That sounds great. Until you realize: if no one’s using the platform, there’s no revenue. And if there’s no revenue, there’s nothing to distribute.

Why Did the Project Stall?

There are a few likely reasons. First, the timing was terrible. The DeFi boom of 2021-2022 was already over by the time Bagels Finance launched. Liquidity was thin. Investors were cautious. New protocols struggled to attract users. Second, they never got listed on major exchanges. Binance, the biggest exchange in the world, never listed BAGEL. Without that, most retail users never even heard of it. And without retail users, there’s no trading volume. Third, the marketing felt amateurish. YouTube videos promised $700 payouts with no proof. Some posts were in broken English. There was no clear roadmap, no team transparency, no audit reports from reputable firms like CertiK or Hacken. In DeFi, trust is everything - and Bagels Finance didn’t build it.What Do the Price Predictions Say?

Some sites still publish price forecasts for BAGEL. CoinDataFlow says it might hit $0.000155 in five years. BeInCrypto says the data is too unreliable to trust. Here’s the truth: you can’t predict the price of a token that doesn’t trade. There’s no order book. No bids. No asks. No volume. Price predictions for BAGEL are just guesswork dressed up as analysis. They’re not data-driven - they’re fantasy.Is BAGEL Still Worth Holding?

If you got tokens in the airdrop, you still hold them. But unless you’re planning to hold them for decades - and believe the project will somehow revive - you’re holding digital paper. You can’t sell them. You can’t stake them (because there’s no active staking contract). You can’t use them in any DeFi app. The governance system? It’s dead. The revenue-sharing model? It never launched. The only value left is sentimental. You participated. You got free tokens. But unless Bagels Finance suddenly gets a major investor, a full audit, and a listing on a top exchange, those tokens are worth nothing.

What Should You Do If You Have BAGEL Tokens?

If you have BAGEL tokens in your wallet:- Don’t panic. Don’t sell them for pennies on a shady DEX - there’s no buyer anyway.

- Don’t send them to anyone claiming they’ll ‘unlock’ them. That’s a scam.

- Keep them in a secure wallet - but don’t expect anything from them.

- Check the official Bagels Finance website (if it’s still up) for any updates. But don’t hold your breath.

What This Teaches Us About Airdrops

The Bagels Finance story isn’t unusual. It’s a textbook example of how most DeFi airdrops fail. Airdrops aren’t free money. They’re marketing tools. Projects use them to build a community. But if they don’t deliver a working product, the community vanishes. The tokens become worthless. And everyone who waited for the ‘big payout’ ends up with nothing. Real airdrops come from projects with:- Active development teams

- Public audits

- Exchange listings

- Real usage - not just hype

Heath OBrien

December 16, 2025 AT 06:35Claire Zapanta

December 17, 2025 AT 20:14Kathleen Sudborough

December 19, 2025 AT 08:58Vidhi Kotak

December 20, 2025 AT 15:24Sue Gallaher

December 20, 2025 AT 18:54Alex Warren

December 21, 2025 AT 04:33Steven Ellis

December 21, 2025 AT 14:46Kim Throne

December 22, 2025 AT 19:31amar zeid

December 24, 2025 AT 11:31Taylor Farano

December 25, 2025 AT 08:11Lois Glavin

December 26, 2025 AT 20:01Jeremy Eugene

December 27, 2025 AT 06:40Toni Marucco

December 28, 2025 AT 04:29Joey Cacace

December 30, 2025 AT 03:53Ike McMahon

December 30, 2025 AT 06:52Taylor Fallon

December 31, 2025 AT 03:05Caroline Fletcher

January 1, 2026 AT 01:24Sarah Luttrell

January 1, 2026 AT 04:14Patricia Whitaker

January 1, 2026 AT 23:55Anselmo Buffet

January 2, 2026 AT 18:56Hari Sarasan

January 4, 2026 AT 06:51Kurt Chambers

January 5, 2026 AT 22:42Ian Norton

January 5, 2026 AT 22:53Kelly Burn

January 6, 2026 AT 13:24JoAnne Geigner

January 6, 2026 AT 22:55Abhishek Bansal

January 8, 2026 AT 04:56Eunice Chook

January 10, 2026 AT 01:49PRECIOUS EGWABOR

January 11, 2026 AT 10:14John Sebastian

January 11, 2026 AT 20:38Kathy Wood

January 12, 2026 AT 09:51