2025/10 Crypto Insights: Airdrops, Nodes, Scams, and Regulations

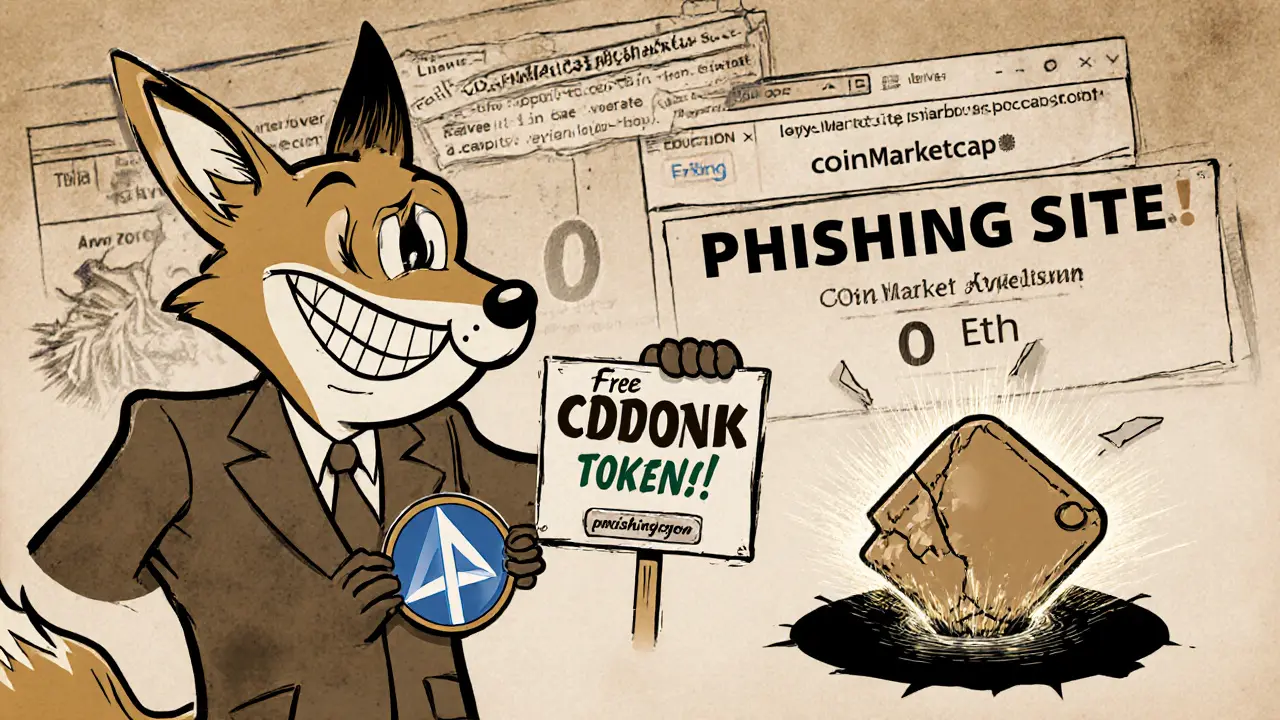

When it comes to crypto airdrop, a free distribution of tokens or NFTs to wallet holders, often used to launch new projects or reward community members. Also known as token giveaway, it's one of the most common ways users get into new blockchain projects—but also one of the easiest ways to get scammed. In October 2025, the mix of real and fake airdrops was sharper than ever. Projects like AceStarter and TopGoal ran legitimate, limited NFT drops tied to CoinMarketCap, while scams like CDONK and Crypto Bank Coin (CKN) pretended to be official, using fake logos and cloned websites to steal wallets. You don’t need to be a tech expert to spot the difference: real airdrops never ask for your private key, and they’re announced through official channels—not random DMs or shady Telegram groups.

validator node, a blockchain participant that validates transactions and creates new blocks in Proof of Stake systems like Ethereum, earning rewards in return. Also known as staking node, it’s a core piece of modern blockchain infrastructure. Unlike a full node, which just checks rules without earning anything, a validator actively secures the network. But running one costs money—hardware, electricity, and technical know-how. In this month’s posts, we broke down who should run one, who shouldn’t, and what happens if you get slashed. Meanwhile, crypto scam, a deceptive scheme designed to trick users into sending crypto or revealing private keys. Also known as rug pull, it’s evolved from fake airdrops to rigged crypto ATMs that stole $246 million in 2024 alone. These scams don’t just target beginners; even experienced users fall for convincing fakes like fake CoinMarketCap pages or cloned NFT claim portals. And behind many of these scams? Weak or nonexistent regulation. That’s where blockchain regulation, government rules that govern how crypto exchanges, tokens, and users operate to protect consumers and prevent fraud. Also known as crypto compliance, it’s becoming the backbone of trust in digital finance. Japan’s 2025 update forced exchanges to offer fast refunds and clear reporting. Malta’s MFSA licensing rules made it harder for fly-by-night platforms to operate. And in Venezuela, crypto isn’t just a tool for speculation—it’s a lifeline to bypass sanctions, using stablecoins to buy food and medicine when the local currency collapses.

Stablecoins, meanwhile, moved beyond trading. They’re now used in cross-border payroll, e-commerce settlements, and even government aid programs. The posts this month showed you how to actually use them—not just hold them. You’ll find guides on claiming real airdrops like Swash and GeoCash, deep dives into meme coins that are dead (COOL, HARAMBE), and clear breakdowns of tokenomics for tokens like AWE, STITCH, and UPDOG. Whether you’re trying to avoid a scam, understand how nodes work, or figure out if a new token has any real value, this archive gives you the facts—no hype, no fluff, just what you need to know.