Venezuela Sanctions Risk Calculator

Transaction Risk Assessment

The Venezuela cryptocurrency sanctions evasion phenomenon is one of the most extreme examples of a state turning to digital assets to bypass international restrictions. Since 2018 the Maduro regime has built a parallel financial system that blends national tokens, stablecoins and a network of government‑run exchanges. Below you’ll find a step‑by‑step look at how the whole machinery works, the key players involved, and what it means for compliance professionals worldwide.

Venezuela cryptocurrency sanctions evasion refers to the coordinated use of crypto‑assets by the Venezuelan government and affiliated actors to sidestep U.S., EU and other Western sanctions has evolved from a desperate response to hyperinflation into a systematic economic policy. The regime’s playbook combines three pillars: a state‑issued token (the PETRO), stablecoins pegged to fiat or commodities, and a tightly‑controlled exchange ecosystem.

Why the regime went digital

Traditional banking channels sealed off after 2017, leaving the country with no reliable way to move oil revenue abroad. Crypto offered three immediate benefits:

- Borderless transfers that ignore SWIFT bans.

- Relative anonymity that hampers sanctions‑monitoring tools.

- Speed - transactions settle in minutes instead of weeks.

For ordinary citizens, crypto also became a lifeline against 1,000%+ inflation, allowing them to preserve purchasing power with Bitcoin or stablecoins.

The PETRO: A national token with an oil backstop

Launched in December 2018, the PETRO is a government‑issued cryptocurrency supposedly backed by Venezuela’s oil reserves was pitched as a solution to both economic collapse and sanctions evasion. Unlike Bitcoin, each PETRO token was claimed to represent a barrel of oil, giving the token a tangible asset claim.

Key attributes:

- Backing: Oil reserves (officially 1 PETRO = 1 barrel of oil).

- Issuance: Controlled by the Ministry of Oil and PDVSA.

- Legal framing: Described by officials as a "digital oil contract" to attract foreign investors.

In practice, PETRO never gained traction outside the country because U.S. Treasury’s Office of Foreign Assets Control (OFAC) quickly listed it as a sanctions‑evasion tool, treating any purchase as an extension of credit to the Maduro regime.

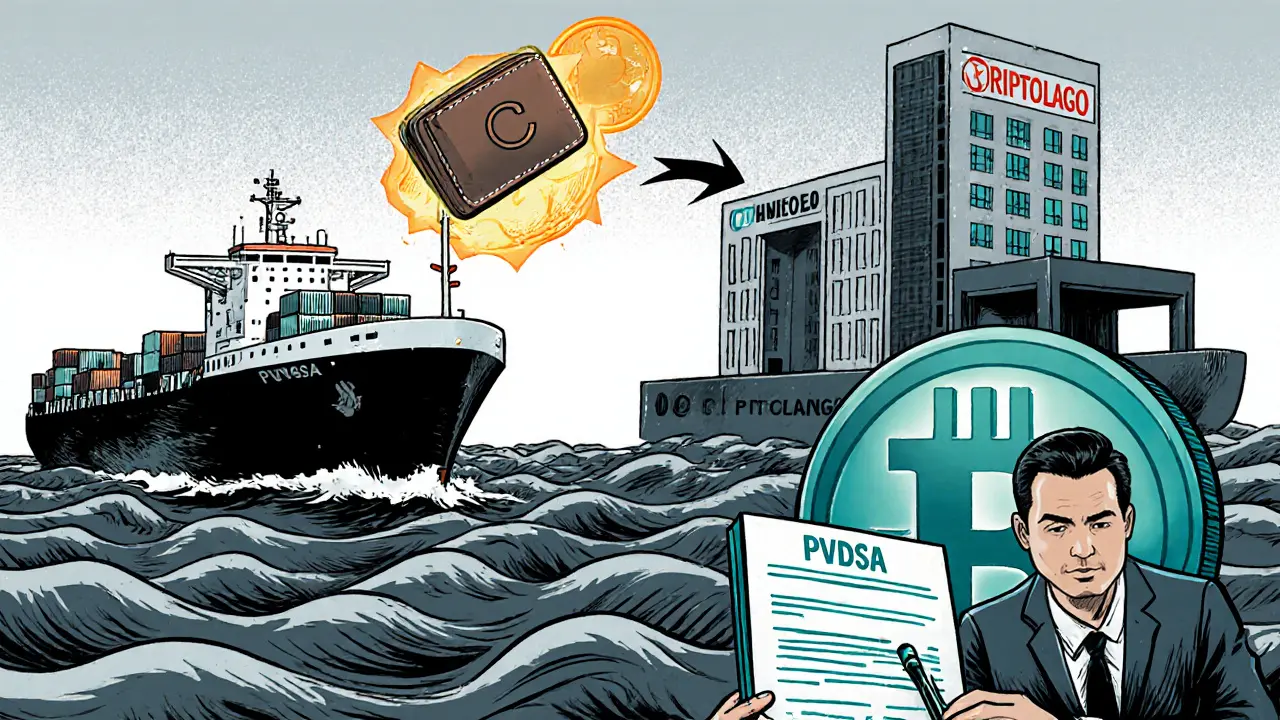

Stablecoins and the PDVSA crypto pipeline

Because PETRO struggled to find buyers, the regime pivoted to existing stablecoins, especially Tether (USDT) a dollar‑pegged stablecoin widely used for cross‑border payments. PDVSA now converts oil sales into USDT through a series of offshore entities, then uses the tokens to pay contractors, purchase equipment, or funnel cash back into the Venezuelan economy.

Operational flow:

- Oil is loaded onto a vessel and transferred to a second ship in international waters - a classic “ship‑to‑ship” maneuver that obscures the cargo’s origin.

- The second vessel’s owner receives payment in USDT via a crypto‑friendly bank in the Caribbean.

- USDT is transferred to a Venezuelan‑registered exchange, then swapped for local crypto or cash through OTC brokers.

Stablecoins reduce price volatility, which is crucial when the token must match the value of large oil shipments.

State‑controlled exchanges: Criptolago and the regulated market

To keep the flow inside national borders, the government authorized seven crypto exchanges. The most visible is Criptolago a state‑run exchange owned by Zulia state and managed by Governor Omar Prieto. All exchanges are required to list PETRO alongside Bitcoin and USDT, effectively turning them into conduits for sanctioned transactions.

Features of these exchanges:

- Mandatory KYC for Venezuelan users, but lax verification for foreign counterparties.

- Direct API hookups with PDVSA’s treasury department.

- Preferential fee structures for oil‑related transfers.

Because the exchanges are government‑owned, they can be swiftly ordered to freeze or release assets in line with political decisions, a flexibility lacking in private platforms.

Legal crackdowns and enforcement actions

International authorities have not turned a blind eye. Major enforcement milestones include:

- October 2022 DOJ indictment of five Russian nationals for helping PDVSA move crypto‑funds, launder money and evade sanctions.

- OFAC’s 2018 designation of PETRO as a “blocked property” under Executive Order 13681.

- U.S. Treasury’s 2023 addition of several Venezuelan crypto exchanges to the Specially Designated Nationals (SDN) list.

These actions have forced some offshore banks to cut ties with PDVSA’s crypto partners, but the regime’s use of privacy‑focused stablecoins and OTC brokers keeps the core pipeline alive.

Comparison of crypto tools used for evasion

| Instrument | Backing / Nature | Primary Use | Sanctions Risk |

|---|---|---|---|

| PETRO | Oil‑backed national token | State‑level oil revenue settlement | High - listed by OFAC |

| Bitcoin (BTC) | Decentralized, proof‑of‑work | Individual wealth preservation, occasional transfers | Medium - can be traced on‑chain |

| Tether (USDT) | Fiat‑pegged stablecoin | Oil‑to‑crypto conversion, bulk payments | Medium‑High - widely used in illicit finance |

| OTC cash‑to‑crypto brokers | Informal, off‑exchange | Last‑mile conversion for locals | High - limited oversight |

The table shows why stablecoins like USDT have eclipsed PETRO for large‑scale evasion: they combine liquidity, low volatility, and a global network of wallets that are harder for regulators to freeze in real time.

Compliance red flags and remediation steps

Financial institutions that encounter Venezuelan crypto exposure should watch for these patterns:

- Large USDT inflows from wallets linked to known PDVSA addresses.

- Transactions that originate from or terminate at Venezuelan‑registered exchanges (e.g., Criptolago).

- Rapid “mixing” of BTC or USDT through privacy mixers shortly after receipt.

- Cash‑to‑crypto conversions performed via unlicensed OTC brokers in Caracas.

Recommended remediation:

- Deploy blockchain analytics tools (Chainalysis, CipherTrace) to tag Venezuela‑related addresses.

- Apply enhanced due‑diligence questionnaires for any counterparties dealing with oil‑sector entities.

- Screen against OFAC’s SDN list for exchange names and corporate officers.

- Consider transaction limits or outright blocking for high‑risk token flows.

Future outlook: What could change?

Two forces will shape the next phase of Venezuela’s crypto‑sanctions game:

- Technological evolution - the regime is already eyeing privacy‑focused coins (e.g., Monero) and DeFi protocols that can hide ownership.

- Regulatory pressure - as blockchain‑forensics improve, more exchanges worldwide are likely to delist Venezuelan wallets, forcing the state to rely on tighter‑controlled OTC networks.

Unless the U.S. and EU agree on a comprehensive sanction‑relief package tied to credible elections, the crypto conduit will remain a core lifeline for the Maduro government.

Frequently Asked Questions

Is the PETRO actually backed by oil?

Officially, each PETRO represents one barrel of oil, but independent audits have never verified the backing. Most analysts view it as a political token rather than a tradable commodity.

Can US businesses legally accept USDT from Venezuelan entities?

If the USDT originates from a wallet linked to PDVSA or a sanctioned exchange, accepting it would violate OFAC regulations. Companies must screen wallet addresses before processing.

What red flags indicate an OTC broker is part of the evasion network?

Typical signs include no KYC, cash‑only deposits, rapid conversion to multiple cryptocurrencies, and the use of disposable phone numbers for contact.

How effective are blockchain analytics tools against Venezuelan crypto flows?

Tools like Chainalysis can tag most PDVSA‑linked addresses, but the regime’s use of mixers and privacy coins reduces coverage to around 70%.

Will Venezuela switch to privacy coins to avoid sanctions?

Experts say the government is testing Monero‑style solutions, but widespread adoption depends on access to local mining hardware and the ability to integrate with existing oil‑sale contracts.

Schuyler Whetstone

October 17, 2025 AT 08:15If you think using crypto to dodge sanctions is clever, you’re just a clueless puppet of a corrupt regime.

Kaitlyn Zimmerman

October 19, 2025 AT 20:53The PETRO token was marketed as a digital oil contract but in practice it never gained real market traction because most exchanges blocked it and investors stayed away

Devi Jaga

October 22, 2025 AT 04:26Oh great, another state‑run token that promises oil‑backed stability while simultaneously providing a sandbox for illicit finance; the absurdity of PETRO is only matched by the regulatory lag that lets these so‑called ‘stablecoins’ become a de‑facto sovereign wealth fund for Maduro.

Hailey M.

October 24, 2025 AT 12:00👏 Wow, Venezuela basically turned crypto into a secret bridge for oil money! 💸 It's like watching a sci‑fi movie where the villains hack the financial system with stablecoins. 🙄

Carolyn Pritchett

October 26, 2025 AT 18:33The whole PETRO charade is a textbook case of regime propaganda masquerading as fintech. It's a vanity project that only serves to launder oil revenue under the radar.

Jason Zila

October 29, 2025 AT 02:06What’s fascinating is how the government integrates state‑run exchanges with PDVSA’s treasury operations, effectively creating an internal crypto pipeline that bypasses traditional banking.

Cecilia Cecilia

October 31, 2025 AT 09:40Regulators must prioritize blockchain analytics to trace PDVSA‑linked wallets.

lida norman

November 2, 2025 AT 17:13I can’t believe they’re even considering Monero now… 😱 this could make sanctions even harder to enforce!

Miguel Terán

November 5, 2025 AT 00:46Venezuela’s foray into crypto began as a desperate measure against crippling hyperinflation, but it quickly transformed into a sophisticated state‑run financial apparatus.

The launch of the PETRO in 2018 was intended to showcase a sovereign digital asset backed by oil, yet it never attracted genuine market interest.

Instead, the regime pivoted to existing stablecoins, primarily USDT, because they offered liquidity without the stigma attached to PETRO.

PDVSA established a covert pipeline where oil shipments are transferred mid‑sea, and payment is settled in USDT through crypto‑friendly banks in the Caribbean.

These tokens are then funneled into Venezuelan‑registered exchanges such as Criptolago, where they can be swapped for local crypto or cash.

The state‑run exchanges enforce lax KYC for foreign counterparties, creating a blind spot for international regulators.

By integrating API hooks directly into the treasury department, the government can instantly freeze or release assets in line with political decisions.

The use of stablecoins also mitigates price volatility, which is crucial when settling large oil‑related invoices.

Moreover, the regime has begun testing privacy‑focused coins like Monero to further obscure transaction trails.

These developments demonstrate a clear understanding of blockchain technology’s potential for sanctions evasion.

International bodies have responded with indictments and sanctions, yet the core pipeline remains resilient due to offshore entities and OTC brokers.

The persistent use of mixers and rapid conversion cycles complicates detection efforts.

As blockchain analytics improve, the regime may shift more heavily toward decentralized finance protocols that lack centralized oversight.

Ultimately, unless a comprehensive diplomatic solution is reached, crypto will remain an essential lifeline for the Maduro government, sustaining its ability to bypass traditional financial channels.

Such a strategy also serves as a political bargaining chip, allowing the regime to signal resilience in the face of external pressure.

Shivani Chauhan

November 7, 2025 AT 08:20The incorporation of stablecoins into oil transactions reduces exposure to fiat volatility, yet it concurrently raises red‑flag concerns for AML compliance.

Deborah de Beurs

November 9, 2025 AT 15:53Your moral lecture is as empty as the PETRO’s oil backing-just hot air and big words that hide the reality of a regime desperate for cash.

Bobby Lind

November 11, 2025 AT 23:26Great summary, Kaitlyn, really helpful, especially the part about how PETRO never got market traction, the fact that most exchanges blocked it, and investors stayed away, well done!

Katharine Sipio

November 14, 2025 AT 07:00While your sarcasm is noted, the factual inaccuracies regarding the PETRO’s legal status should be clarified in a more formal manner.

Shikhar Shukla

November 16, 2025 AT 14:33Madam, your emotive interjection fails to acknowledge the systematic nature of these sanction‑evasion mechanisms, which are meticulously engineered by the state.

Deepak Kumar

November 18, 2025 AT 22:06Indeed, the integration of state‑run exchanges with the oil ministry’s treasury is a clever workaround; compliance teams should adopt a layered monitoring approach to detect such flows.

Matthew Theuma

November 21, 2025 AT 05:40That’s a solid point, Jason-understanding the pipeline is key, but remember the human element: people will always find new loopholes 🧠.

Sara Stewart

November 23, 2025 AT 13:13Absolutely! Regulators need to act fast!!!

Laura Hoch

November 25, 2025 AT 20:46Your dramatic gasp adds nothing to the discussion; the shift to privacy coins is a logical progression for anyone wanting anonymity.

DeAnna Brown

November 28, 2025 AT 04:20Wow, Miguel, that epic saga of Venezuela’s crypto empire reads like a Hollywood blockbuster-only the heroes are corrupt and the villains wear suits!

Chris Morano

November 30, 2025 AT 11:53Nice take Shivani, it’s good to see balanced views on stablecoins and risk.

Ikenna Okonkwo

December 2, 2025 AT 19:26Deborah, while the critique is sharp, we should also recognize that sanctions pressure pushes regimes toward innovation, not just condemnation.

Jessica Cadis

December 5, 2025 AT 03:00Bobby, your punctuation won’t hide the fact that you’re just parroting mainstream narratives without critical thought.

David Moss

December 7, 2025 AT 10:33Katharine, you ignore the hidden networks behind these tokens-there’s a shadow economy pulling strings that mainstream regulators can’t see.

Pierce O'Donnell

December 9, 2025 AT 18:06Shikhar, honestly, this whole crypto talk is overrated; it’s just another buzzword in finance.

Vinoth Raja

December 12, 2025 AT 01:40Deepak, the whole pipeline is basically a thinly veiled money‑laundering operation, and the jargon only masks the simplicity of the scheme.